Key Takeaways

- 3AC Fund Most Heavily Hit By STeth, GBTC, LUNA Trades

- Su and Kyle Acknowledge Foolishness, Deny Showing Off Wealth

- The Pair Is Currently Headed To The UAE

_____________________________________________________________________________________________________

By now, everyone knows of the 3AC saga.

Despite ongoing pursuit from creditors and a slew of liquidity crunches thanks to their defaults, the disgraced founders have seemingly gone missing. Su Zhu and Kyle Davies have since come forward to Bloomberg to issue some statements.

Also Read: The 3AC Contagion Effect Just Got Worse, As Holdings May Be Worth Significantly Less Than Reported

The Three Arrows: STeth, GBTC, LUNA

To date, creditors are owed more than $3.5 Billion by the now defunct firm.

Su claims that this stemmed from not realizing “that Luna was capable of falling to effective zero in a matter of days”. Describing it as a miscalculation, they were blinded by Do Kwon and failed to effect proper risk management.

Didn't read the whitepaper tisk tisk tisk. pic.twitter.com/cX2Ubs5aQG

— Arthur Hayes (@CryptoHayes) July 22, 2022

The failure of that trade led to widespread fear in the market, as participants feared liquidity crunches. This caused the STeth/ETH under backing, despite its sound fundamentals.

“So the whole industry kind of effectively hunted these positions”, says Zhu.

However, 3AC were able to stay afloat as creditors were still comfortable with their positions. The kicker was when $BTC crashed from $30,000 to $20,000 – which many have since described as poetic.

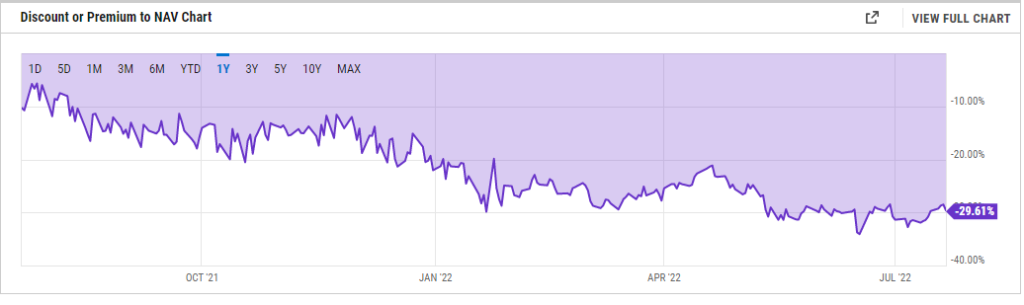

One of their largest trades, a GBTC arbitrage opportunity, came crashing in their face as well. This could be done by exchanging $BTC for $GBTC shares, then selling them on the open market at a premium.

However, $GBTC shares required a 6-month unlock period, and as the premium flipped into a discount, holders lost money.

As other funds tried to mirror the trade, it worsened the liquidity crisis and may have resulted in some non-3AC affiliated firms going bust.

Blind Leading The Blind

“It’s not a surprise that Celsius, ourselves, these kind of firms, all have problems at the same time” says Zhu.

When the market experienced problems in May, they “met all margin calls”, instilling confidence in creditors. However, the herd mentality that grew around them and risk management took a step back.

Those who do not manage their risk will have the market manage it for them

— Zhu Su 🔺 (@zhusu) November 26, 2021

Su and Davies also denies rumors of extravagant spending and trying to hide assets from creditors.

They claim the $50 Million Yacht that they purchased “was bought over a year ago” and “has a full money trail”. Zhu also mentions that he “only has two homes in Singapore” and biked to work everyday.

“When funds blow up… these are kind of the headlines that people like to play.”

While the pair currently refuses to disclose their location, a lawyer with them mentioned that their ultimate destination is the United Arab Emirates.

“We Feel that it’s just the interest for everyone if we can be physically secured and keep a low profile.”

Also Read: 3AC Still Holds 11 CryptoPunks – What Will Happen To Their NFTs?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief