Blockchain technology is an emerging and potentially disruptive technology especially in the financial world. It redefines and reshapes how we think about money. They are digitizing, dematerializing, and democratizing money in ways that no one has ever done before.

So what actually is disruptive technology?

Disruptive innovation occurs when a new business sees a gap in the market that has been missed, or a part of the population that has been overlooked. Few examples of disruptive technology are ride-sharing apps like your Uber and Grab, e-commerce sites to GPS systems.

I value the importance of disruptive technology as a avenue of human progression. Without it, we might still be riding on horses when we move from one place to another. So with every progression that we embrace, my belief is that crypto is the next big thing.

Here are the five ways crypto will shake up the finance industry:

1. International payments

Traditionally, when you want to make a transfer of money to an overseas account, it would take “1 to 5 working days” for the transaction to complete. Some may be able to wait, but for others, it may be too long.

With every traditional finance company, there are strict procedures and multiple layers of confirmation needed to ensure none of the steps are breached. These could be due to fraud prevention methods, incorrect payment details, different time zones etc which contributes to the slow international transfers.

Don’t get me started on how banks are closed during holidays and the weekend.

Blockchains are ledgers that are not bound by borders and do not require the use of intermediaries. Transactions are processed more quickly and at lower costs in the most transparent manner.

Typically it will take 10 to 20 minutes regardless of the transaction being a domestic or an international one. With this speed, imagine the increase in business transactions bolstering companies to even mjor economies.

2. Blockchain in equities trading

Trading transactions based on the blockchain minimize information redundancy and hence improve speed. reduces huge costs levied on users in terms of commission while speeding up the process for fast transaction settlements.

They significantly eliminate the need for intermediaries. In the absence of a third party, rules and regulations would be in-built within smart contracts and enforced with each trade in order to register transactions with the blockchain network acting as a regulator for all transactions.

3. Lending and borrowing on blockchain

Blockchain-enabled lending provides a more secure approach for providing personal loans to a bigger pool of customers, as well as making the loan process more affordable, faster, and safer.

Traditional banks and lenders issue loans based on an individual’s credit score. Without the intermediaries, blockchain opens up the possibility of peer-to-peer (P2P) loans. This offers a cheaper, more efficient, and more secure way of making personal loans to a broader pool of consumers.

While blockchain projects in the lending space are still in their infancy, there are a couple of interesting projects out there around P2P loans, credit, and infrastructure. They even open up arbitrage and other practices such as spot and futures trading within the space.

Read More: All You Need To Know About Hundred Finance: The DApp For Lending And Borrowing Crypto

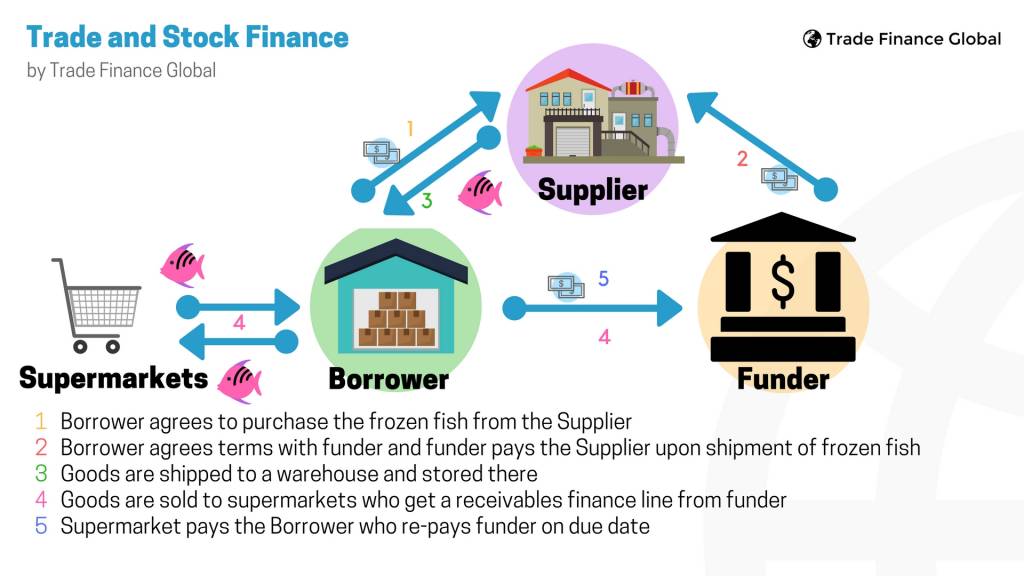

4. Trade finance

The use of blockchain and distributed ledger technology can support cross-border trade transactions that would otherwise be uneconomical because of costs related to trade and documentation processes. It would also shorten delivery times and reduce paper use.

Many trade finance activities, even in today’s disruptive age of technology, still include a lot of paperwork. Every middleman in an international trade prepares all documents on their own to keep their ledger up to date.

A single ledger with blockchain technology may be maintained and viewed by all parties engaged in a transaction, and it can be updated in real-time. By eliminating time-consuming paperwork and bureaucracy, blockchain-based trade finance can streamline the entire trading process.

With approximately 80-90% of world trade relying on trade finance, the influence of blockchain on the market would be felt globally throughout all industries that use cross-border trading.

Read More: VeChain: How It Disrupts Supply Chains with Blockchain Technology

5. Accounting and audit

By design, blockchains are inherently resistant to modification of any stored data.

They serve as an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. Even so serving as a source of verification for reported transactions.

Standardization using blockchain would enable auditors to automatically validate the most critical data in financial accounts, lowering costs and saving time. Blockchain technology also makes it simple to prove the integrity of the files.

Closing thoughts

Although blockchain promises highly secure transactions fraud instances cannot be fully eradicated. In recent times, we hear of hacks happening on bridges to even centralize exchanges.

Hackers stole over 173,600ETH, $25.5 million $USDC from the blockchain behind Axie Infinity accounting to one the largest crypto heists. The root cause of this fraud was not related to deficiencies in the blockchain technology but, rather, due to a vulnerability within the software.

This may be where institutions draw the line, manging millions in their funds, it would be of great difficulty to put all that up in a game of “chance”. The likely tendency is them resorting in traditional methods, which has been working for them on a consistent basis, without any FUD.

There is no doubt there is great resolve in how blockchain and crypto is here to disrupt then finance industry. With blockchain technology still at its infancy stage, there are still much more to come, eventually robust enough for global adoption.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief