“Bitcoin has no value because it is not backed by anything!” I hear this all the time from Bitcoin skeptics.

The funny thing is, fiat currency (or cash) that we know today is likewise not backed by anything other than the government’s trust and belief that the piece of paper is of any value at all.

Ever since the collapse of the Bretton Woods system where USD was backed by Gold, fiat currencies have been experiencing a rapid decline thanks to the unlimited money printing going on which effectively devalues the dollar and every other paper currency around the world and that includes SGD.

While today’s topic is about how to value crypto assets, it is important to understand what is money in the first place.

Now, to say that Bitcoin has no value simply because it is not backed by anything, is the same way as saying how USD is not backed by any hard asset at all.

Before you go on and say that the USD is backed by the US government, let’s ask why things like the Mona Lisa painting or diamonds have “value” even though they don’t produce any value and likewise not backed by any hard assets.

Scarcity

What makes something valuable? That has to do with the fundamental economic concept of scarcity.

When something is said to be scarce, it means that the supply of the items are limited.

If there is demand for the item with limited supply, and assuming that the demand goes higher, that will only mean that the price or “value” of the item will go higher.

There is only 1 authentic Mona Lisa painting that is hand painted by Leonardo Da Vinci himself, who is one of the most prominent inventor, artist, scientist and human to ever lived in the history of mankind.

So what gives Mona Lisa such prestigious value? Isn’t it just paint and paper?The simple answer is scarcity. There is only ONE such painting in the whole world.

Coupled with the fact that famous Kings and Queens used to own them, it is no wonder the painting became so precious and of immense value because there is only one such painting in the whole world and it can never be replicated ever again.

Now let’s talk about diamonds. There is literally no utility in diamonds other than the fact that it is a highly sought after jewellery item worn for special occasions such as a proposal ring.

Diamonds and Charcoal are literally made of the same element (Carbon) but what makes diamond so much more valuable than carbon is the fact that it is very difficult to extract diamonds since they only form under high pressure which gives it a different structure than charcoal and the hardest object on Earth.

Now, let’s go on to talk about Bitcoin. The reason why Bitcoin is valuable is because there will only ever be 21 million Bitcoin in circulation.

That makes Bitcoin a perfectly scarce asset as we can track the total supply of Bitcoin and as Bitcoin supply continues to decrease while assuming demand for Bitcoin to remain constant, simple economics will tell you that the price of Bitcoin will continue to go higher.

Enter the Stock-To-Flow Model

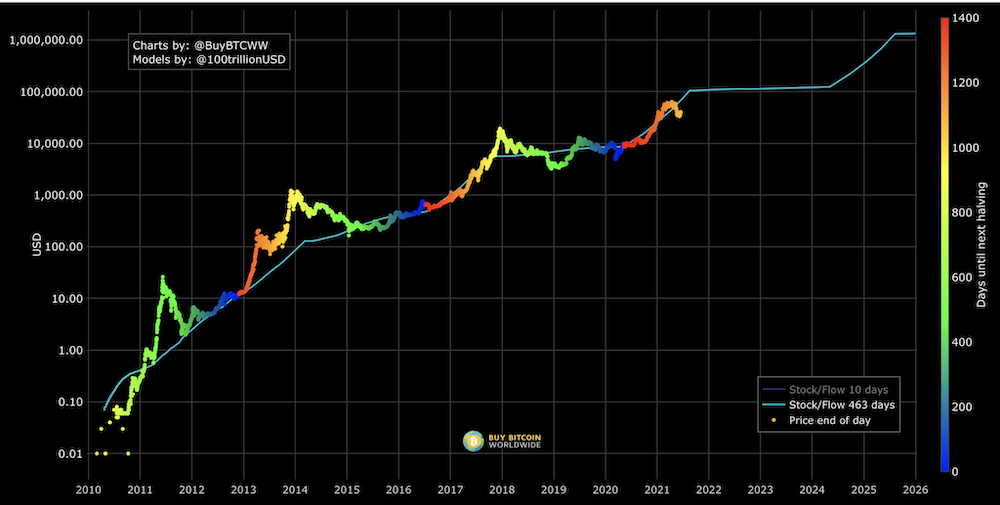

The above image is one the most famous valuation method used to measure the price of Bitcoin. It was pioneered by a pseudonymous individual known as PlanB who is a retired institutional investor and currently runs a Bitcoin node himself.

The Stock-To-Flow Model is not new at all. It is commonly used to value the price of scarce commodities such as Gold, Silver and Platinum.

The model shows how many years, at the current production rate, are required to achieve the current stock. The higher the number, the higher the price.

Stock to flow is defined as a relationship between production and current stock that is out there.

Why is it important?

One key feature of Bitcoin is the halvings which happens every 4 years. This gives Bitcoin and the crypto market the unique 4 year cycles that we see today where we see a period of bull market and a period of bear market until the next halving occurs.

Halving events will continue taking place until the reward for miners reaches 0 BTC.

The last Bitcoin to be mined into existence will be mined in the year 2140. It will be the 21 million’th Bitcoin to come into existence, and last, after which point it will be impossible to create anymore Bitcoin.

From then on, Bitcoin will become truly deflationary, since printing/minting or mining new coins will no longer be possible, and if owners keep on losing their private keys, as they currently are, then the supply would further deflate by that lost-keys ratio.

All of these points towards Bitcoin’s scarcity. As of the time of writing, there are currently around 18.7 million Bitcoin already in circulation, couple that with millions of lost Bitcoins in zombie wallets, you can do the math and see how high Bitcoin still can grow based on how many Bitcoin is left.

Metcalfe’s Law (Network Effect)

Another metric we can look at when discussing how to value crypto assets is Metcalfe’s Law, which is a method for us to gauge the network effects of a blockchain network.

Originally used to describe communicative devices like telephones, the theory was later refined in 1993.

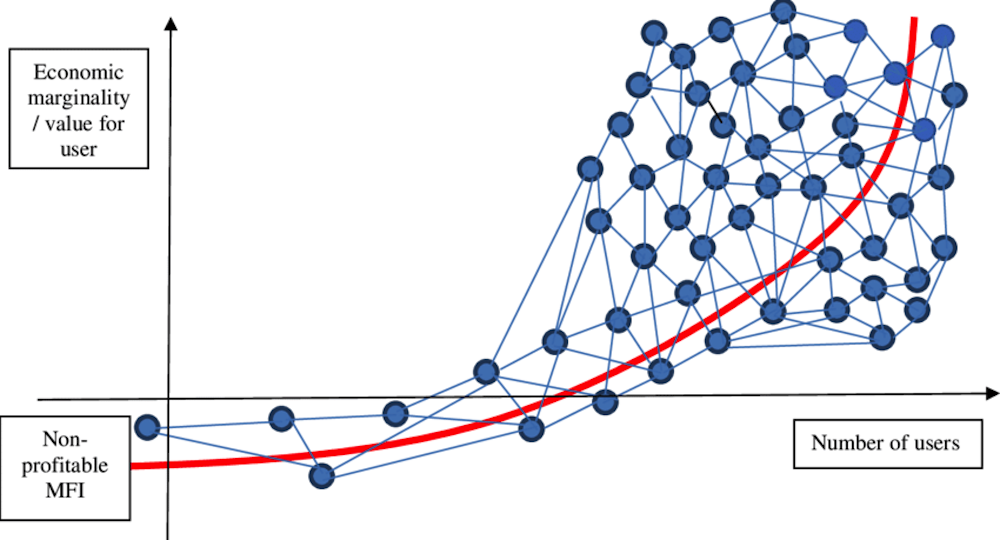

In its simple form, Metcalfe’s Law states that the value of a network is proportional to the square of the number of participants in the network.

What this valuation tells us is that the growth of a network will be exponential over the long run as the network effects deepen.

As seen from the chart above, as the number of users increase significantly, the economic margin per value for the user will increase exponentially. This is also why we often see crypto prices going parabolic and follows an exponential graph simply because of Metcalfe’s Law.

Metcalfe Ratio

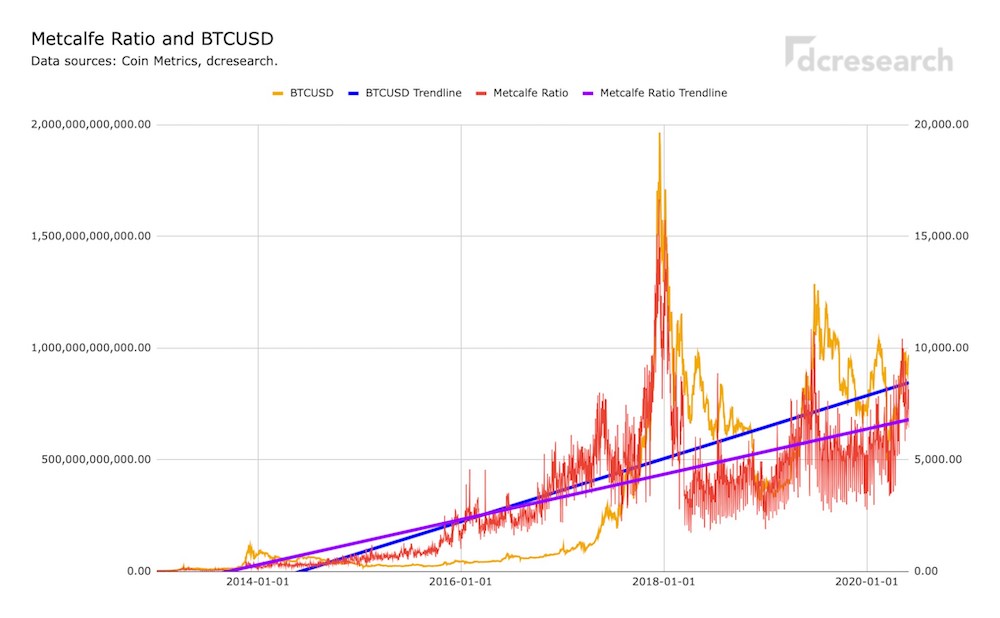

The chart below features the Metcalfe Ratio, which is the amount of active addresses of network and Bitcoin’s price.

Metcalfe Ratio shows both indicators rising in close correlation, and also shows that as the number of active addresses in Bitcoin holding increases, so does the price of Bitcoin subsequently.

This likewise applies to other crypto such as Ethereum, Polkadot, Binance Coin and more. Depending on the tokenomics of each crypto, the Metcalfe Ratio may or may not make sense.

If you use the ratio to evaluate an inflationary token such as Pancake Swap (CAKE), it might not accurately determine the price in the long run given that the token is not meant for long term holding unless deflationary mechanics are introduced through subsequent governance voting.

Bitcoin NVT

Network Value to Transactions Ratio (NVT)is a metric for identifying when the USD price of a digital asset has exceeded or fallen below the value suggested by its underlying daily USD transaction volume.

Bitcoin’s NVT is calculated by dividing the Network Value (market cap) by the the daily USD volume transmitted through the blockchain.

In essence, the correlation between NVT and Bitcoin’s price were close during the recent rallies and dumps which helps us determine the “fair value” of Bitcoin but do note that is is simply an estimate and should not be used as a form of guranteed price gain for Bitcoin.

Total Addressable Market (TAM)

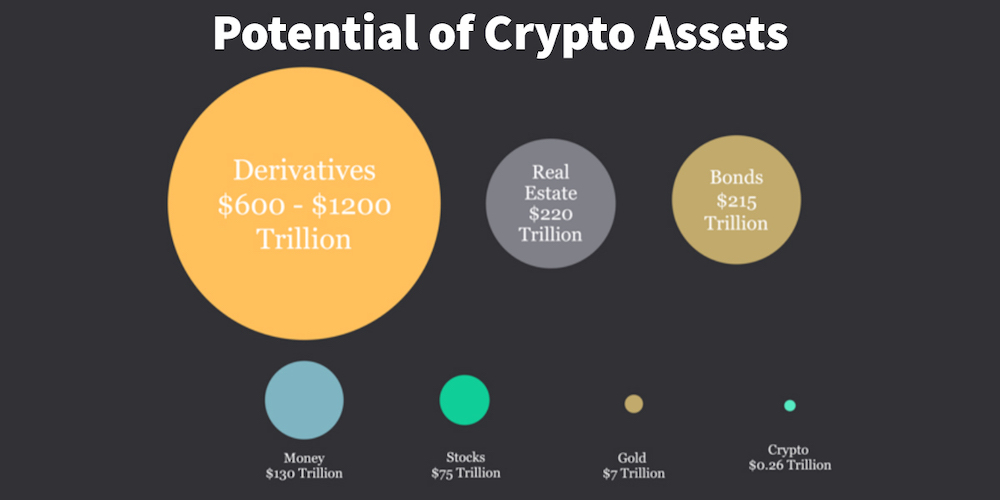

Another way you can evaluate the value of a crypto is by determining what is the potential Total Addressable Market of the ecosystem.

Bitcoin as Gold 2.0

We can take Bitcoin for example. By being digital Gold, Bitcoin should at least be equal to the market capitalisation (Market Cap) of Gold, which is currently around 10 trillion USD.

With a total addressable market of 10 trillion USD or more, if Bitcoin were to reach the market cap of Gold, that would imply a price of approximately $500,000 USD per Bitcoin, making Bitcoin a 10 trillion USD asset.

Ethereum as the New Internet (Web 3.0)

As for Ethereum, if we were to see the potential TAM of Ethereum, that would be the entire financial system which includes the stock market, lending/borrowing, pension funds, money markets, insurance and many more.

As for the TAM potential, it will be way beyond our imagination and it will probably be way beyond the market cap of Bitcoin thanks to the development of Decentralised Finance and laying the foundation of the new internet.

Bitcoin does very well at doing ONE thing

The reason why Bitcoin is the King of Crypto and might always remain so is because it does ONE thing very well, and that is to be a durable, honest and perfectly scarce store of value that is transparent and cannot be stopped or replaced.

The fact that there will only ever be 21 million Bitcoins, generated by the Proof-Of-Work consensus and every transactions being fully traceable and immutable, makes Bitcoin the perfect Store-Of-Value and a way to hedge against currency debasement.

Fiat currencies like USD or Euros on the other hand, are meant to be used as a medium of exchange for goods and services.

Governments have to print more fiat currencies to keep their economies competitive and to incentivise spending in the economy.

Fiat currency will continue to lose its value over the long run and the only way to protect your monetary value or wealth in the long run is by holding assets like Bitcoin.

Forget the short term volatility of Bitcoin because that is the entrance ticket to the best in class Store of Value that will remain rightfully so because of Bitcoin’s characteristics.

Cash is meant to be spent and not held long term, while Bitcoin is meant to be held long term and not meant to be spent. The faster people understand this concept, the faster we see mass adoption take place.

With El Salvador being the first country to declare Bitcoin as legal tender, I expect to see a “Domino Effect” play out over the next few years and as more people understand the significance of Bitcoin and its purpose to hedge individual’s wealth over the long term, there is still more work to be done to educate the masses and spreading awareness of what Bitcoin is all about.

Lightning Network and Strike App

I just want to bring up an important development that is going on with Bitcoin. Currently, because Bitcoin transactions take 10 minutes to go through, there have been developments to improve Bitcoin’s utility as a medium of exchange through a layer-2 solution known as the Lightning Network.

Lightning Network allows individuals to form a separate channel to transact Bitcoin within seconds, allowing smaller transactions such as buying groceries or paying for a meal. Transaction literally takes 0 seconds and transaction fees are also non-existent.

This is also the reason why El Salvador adopted Bitcoin, as they were able to transact Bitcoin easily through the Strike App which has built in function to access the Lightning Network and allow Bitcoin transactions to be instantaneous and zero fee.

Only time will tell when Bitcoin Standard start to hit the shores of sunny Singapore and I am extremely excited about the future.

There are more valuation methods out there

The valuation methods I talked about in this post is not exhaustive and there are more ways to value different crypto assets, but the moral of the story here is that traditional valuation methods that analyst and investment bankers used to evaluate businesses such as DCF, EV/Sales, SOP Analysis does not apply to crypto as crypto assets are not companies that generate income.

It is the same analogy as saying you are valuing the price of a pancake by comparing it to the price of a sports car. They are 2 completely different things. You can’t evaluate them the same way.

Traditional Finance has a misunderstanding of Crypto

The challenges for new investors and how we know if crypto is here to stay is by first understanding and identifying this nascent asset class that is still in its infancy with exponential room for growth in the future.

Traditional finance folks who grew up understanding finance and economics are having a hard time understanding this new asset class and often think of crypto as similar to stocks.

They are 2 very different things! Stop thinking of them the same way!

Most People Just Don’t Bother

Couple this misunderstanding with the fact that 99% of crypto skeptics have probably not read a single line of the Bitcoin Whitepaper before, or the fact that their research is based upon old mathematical models and old valuation concepts.

Most individuals despise Bitcoin (or crypto for the matter) when they don’t understand or even bother to understand more about it or worse, dismiss the idea without even spending the time to try and understand this new asset.

It is very easy to criticise something you don’t understand, but not easy to understand something you criticise.

So before you go on and accuse Bitcoin of being a scam again, I implore you to at least read the Bitcoin Whitepaper and build some understanding before starting an argument.

What happens in the future?

Opinions will change as more people understand. As more and more individuals become aware of the problem Bitcoin or crypto is trying to solve, more skeptics will turn into investors for sure.

Just look at Bitcoin skeptics like Michael Saylor, Mark Cuban, Howard Marks, Ray Dalio or Paul Tudor Jones, as they understand more about Bitcoin, their initial opinion that Bitcoin is nothing but a scam has changed over time.

Always keep an open mind and question everything around you. Why do fund managers hold Gold? Why don’t rich people hold most of their allocation to cash? What will inflation do to my money?

The more you ask these questions, the more you will understand crypto and the things they are trying to solve.

Conclusion

Bitcoin, Ethereum, Doge… The list goes on. Cryptocurrency is only 12 years old. It is still early. Do your own research, question everything that is going on and understand how crypto work.

Even if you feel that crypto is a high risk asset to invest in due to volatility, zoom out, and think like an early Amazon or Apple investor: With so much uncertainty (competiton from incumbents like Book stores and Nokia respectively), how did they held through years of volatility and manage to 10X or 30X their initial capital?

The answer lies in: Conviction. The early investors understood what Amazon or Apple does, they understood the risk, they understood its potential, and they understood having an investor’s mindset.

They held through thick and thin, through bad news after bad news, market crash after market crash.

That is the price to pay for a multi-bagger. If those sound too scary for you, at least invest into an S&P 500 ETF and get market returns.

Inflation only goes up, and the only way to hedge against inflation is by owning assets that appreciate over time.

This article originally appeared on Investing Beanstalk and is republished here with permission.

Also Read: How To Get Started With Decentralised Finance (DeFi) For Beginners