Diffusion Finance has recently gained traction thanks to news of its latest airdrop and the EVM on the Cosmos Ecosystem.

Furthermore, they were featured on Delphi Insights for airdrops to delegators staked on the Osmosis Network.

With snapshots being constantly taken, let’s take a look at all you need to know about this exciting new protocol.

Introducing Diffusion Finance

Diffusion Finance is a Uniswap V2 fork, one of the first AMMs for Evmos — an EVM that leverages the Cosmos SDK enabling use cases around composability, interoperability and fast finality.

Also Read: Evmos: All You Need To Know About Ethereum Virtual Machine (EVM) Hub On Cosmos

While still in test-net phase, the use cases it presents around combining smart-contract applications is extremely exciting.

Uniswap V2 is coming to the EVM on Cosmos, @EvmosOrg

— Diffusion Finance (@diffusion_fi) January 11, 2022

We want to be the place to trade erc20 tokens on Evmos and help projects bootstrap their liquidity.

Join our telegram to follow announcements:https://t.co/8XNu9pTqlQ pic.twitter.com/v3HJbqzZcw

Benefits of building an Automatic Market Maker on Evmos

- Interoperability is a key factor, and Diffusion Finance believes that an interchain future is essential for blockchain applications to communicate seamlessly. The ecosystem allows dApps to make use of interchain rather than relying on expensive or complex ways of communicating with other blockchains.

- As an EVM, this allows rapid deployment of well-known DeFi works which will help fuel new DeFi use cases. The ecosystem would hence be in a better position to attract other DeFi projects and unlock new value by interacting seamlessly with other chains.

- In addition, there are balanced economies for all stakeholders. Evmos’ token model article outlines how the protocol’s token distribution wants to help in determining future economic outcomes for the entire ecosystem, mainly developers, users and validators.

- There are also the right incentives provided for developers. Fees on Evmos are calculated based on EIP 1559 and base fees are redistributed to developers and network operators instead of getting burned. To date, Uniswap V2 has burned almost 120,000 Ethereum. Evmos’s approach and incentives will help to derive better products and a fairer network value distribution.

Interestingly, contracts eligible for rewards are subjected to governance approval, so developers are rewarded based on the value and impact, rather than hype and distribution.

Diffusion Finance airdrop

Diffusion Finance is airdropping a total of 25 million tokens to four different groups.

The first group it would like to appreciate is the Uniswap Community. Being a Uniswap v2 fork, it wants to bring the Uniswap community to Evmos and will hence airdrop tokens to UNI holders and addresses that have spent exorbitant amounts on gas fees.

The snapshot for this was taken on 31 December 2021. Users must hold at least 401 UNI, or must have paid at least 1 ETH in gas.

Additionally, it is airdropping to $OSMO stakers on either @binaryholdings or @frensvalidator, as they have helped with Diffusion Finance continuously.

These snapshots have been continuously taken from 17 to 28 February, and potentially beyond, with the last one taken on 3 March.

As the Evmos community is essential for its success, Diffusion will airdrop to all stakers on Evmos and related liquidity pools on osmosis.

Early adopters will also be rewards more, with snapshot details being released with the official airdrop announcement soon.

🪂 AIRDROP UPDATE 🪂 – Here are some more details on the Diffusion Airdrop 🌀 👇 (All of this whale-capped).

— Diffusion Finance (@diffusion_fi) March 2, 2022

The latest announcement also notes that JUNO Network stakers will also be airdropped tokens, coming directly from the team.

Also Read: Juno: The Layer 1 Solution Building An Interoperable Future In The Cosmos Ecosystem

For those participating, the tokens will have a linear vesting with a deadline for claiming. Tokens not claimed by the stipulated date will be transferred to the community pool with more specific details being announced next week.

Strategic reserve allocation

There is an initial allocation of 25 million tokens, controlled by a multi-sig DAO comprised of the team and select core contributors in the Cosmos community.

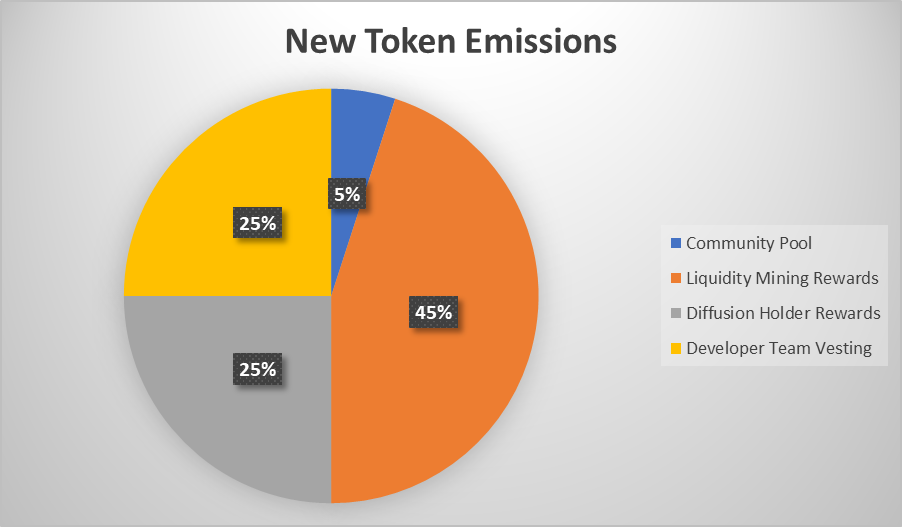

Part of this will be allocated to partners who invest or provide liquidity for Diffusion. Any funding generated is completely transparent and is subject to vesting periods. Newly released tokens are also distributed in the following allocations:

Community Pool — This pool is spent by Diffusion governance and used to improve the value generated by the community. These funds also help community members discuss, provide suggestions, and brainstorm ideas on new areas for Diffusion’s success.

Liquidity Mining Rewards — These are mainly generated for the benefit of liquidity providers and increase with time staked. In addition, governance will also be used to decide whether liquidity mining incentives should be increased, decreased, or redirected elsewhere.

Diffusion Holder Rewards — This will be released via a single-sided staking mechanism similar to xSUSHI. Governance will also play a big part in the launch of this mechanism.

Dev Team — Lastly, the DEV rewards are locked, and the development team cannot stake or transfer it until vested. This means the team get 0% at genesis and will have to work to get their tokens released.

Notable feature: gas fee incentives

Diffusion Finance has an interesting proposition as Evmos is incentivizing developers by redistributing the base fee of all transactions generated by interactions with the smart contracts.

With large adoption, the Diffusion Finance router will burn a substantial amount of gas, generating good rewards for Diffusion, subject to governance votes.

Diffusion Finance strongly believes that this may be a catalyst to expand their Uniswap v2 fork and tailor Diffusion to Evmos unique ecosystem.

Closing thoughts

Diffusion Finance will be an interesting protocol to watch, especially with Cosmos’ recent explosion in the ecosystem.

Diffusion’s goal is to become the #1 AMM on Evmos and play a key role in the development of the Cosmos ecosystem.

To achieve this, it has an ambitious plan to ensure that liquidity providers are well incentivised. It also has various other incentives such as community-driven airdrops and single-sided staking.

It strongly believes in the community being proactive to propose other mechanisms, and plan to introduce proposals to help them better achieve this goal.

Diffusion Finance also recently launched a partnership with nomad, increasing blockchain interoperability via utilizing an optimistic mechanism.

This would allow assets to be transferred easily to bring a better user experience to Evmos, and hence, Diffusion Finance.