With the Shanghai upgrade around the corner, a new narrative has risen. Liquid staking derivatives on Ethereum have caught eyeballs among the crypto masses, but why? Today we look into why the unlock of Ethereum withdrawals has pushed this narrative into one which cannot be missed.

Before diving into the protocols leading the charge for this Narrative on Ethereum, we got to understand what liquid staking is. To do that, you must understand one of the most fundamental cornerstones of DeFi, staking.

What is liquid staking?

To stake something, you put up something you own to say you are dedicated to the “cause”. Staking is a consensus mechanic that allows users to secure the network.

By dedicating native tokens you have/bought, you are simply making the network stronger, helping to protect the blockchain. In exchange, the network rewards your contribution by letting you earn staking rewards.

By staking, you are essentially adding computational power to the network.

While there are many benefits to staking, such as earning passive income and, in some cases, allowing you to have governance rights in voting, the most significant risk with staking is capital inefficiency.

Networks impose a lock-up period to ensure stability and security. If people were to unstake their crypto whenever they wanted, it could make the network less secure, arguably prone to more hacks.

This means people who stake their tokens will not be able to unstake their crypto immediately, making staking capital inefficient.

But that is what liquid staking solves.

Liquid staking is a way to keep the benefits of normal staking while maintaining flexibility to use your assets.

Stakers receive liquid staking derivatives in exchange for staking their assets; it represents their claim on the underlying stake pool and its yield.

In contrast to traditional staking, LS improves capital efficiency; stakers can now use staked assets in the ecosystem for lending, trading and as collateral, thereby lowering the opportunity cost of locking up assets for staking.

LSD tokens allow investors to earn a staking yields while being able to use the underlying token elsewhere in DeFi.

At last, the Ethereum unlock

You must have heard of Ethereum’s ShangHai upgrade. It is an upgrade where users who dedicated and staked their Ethereum 2 years ago for the Merge will be able to unstake their ETH. This would mean more liquid ETH in the market, and when there is an increase in supply, prices…

In case you missed it: ETH staking withdrawals are currently scheduled for March and are of utmost priority to the devs. This is much earlier than most people expect https://t.co/JgGa9Y8Jnq

— Westie 🟪 (@WestieCapital) November 29, 2022

This has led to increased staking activity, the highest record monthly volume since April 2022, but it has many implications for stakers.

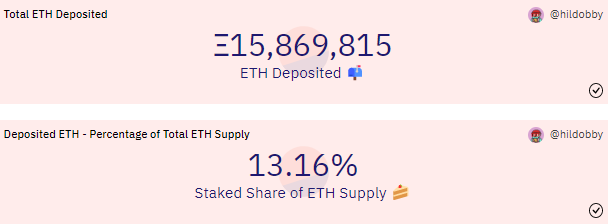

Looking at the cumulative deposits for ETH, “One key implication is that the overwhelming majority of deposits occurred ahead of the FTX collapse: over 14.7M of the total 15.8M staked $ETH was deposited before November 2022. So most deposits occurred when $ETH was trading between $1500 – $3500 (and even above $4,000).”

In fact, two of the largest monthly deposits occurred in March and April, when ETH was trading above the $3K mark.

With liquidity at a premium and various funds, institutions, and retail investors unable to recoup their locked capital, there will be considerable withdrawal activity once it goes live.

Furthermore, ETH liquid staking protocols allow users to participate in ETH staking without having 32 ETH and running a validator. These protocols accept ETH deposits and distribute liquid staking derivative tokens (LSDs) to depositors.

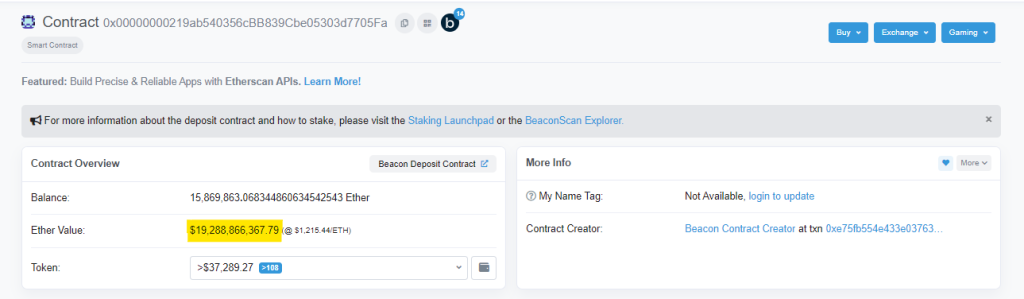

With over $19B in Eth locked up in the Beacon Deposit Contract, there will be $19B entering the supply, creating extra selling pressure; it may not be significant, but incremental. (These 19B will not enter the market all at once, instead they will enter epoch by epoch)

With all that entering the market, eyeballs on liquid staking derivatives are growing popular and a viable alternative to just users dumping their ETH. But why would more people LS their ETH?

If you stake your ETH with a liquid staking derivative (LSD), you will get an LS token back. But, as we saw with the collapse of 3AC with the use of leverage, a large part of the growth of LSD is attributed to leverage. So whenever there is a mass liquidation event, these staking derivatives could trade below the ETH peg, essentially liquidity risk.

The Shanghai upgrade would de-risk LSD significantly, leading to a mass influx of people going to various LSD protocols.

i expect a ton of withdrawals once enabled

— 찌 G 跻 じ MBA, CFA, FRM, CFP, NGMI, HFSP, HENTAI (@DegenSpartan) December 3, 2022

will be initially percieved as bearish

but it will be (1) rotation out of self hosted validators to liquid staking derivatives, and (2) testing withdrawals

and if works (why wouldnt it?) massive amounts of ETH will begin PERMA staking

Liquid staking on Ethereum

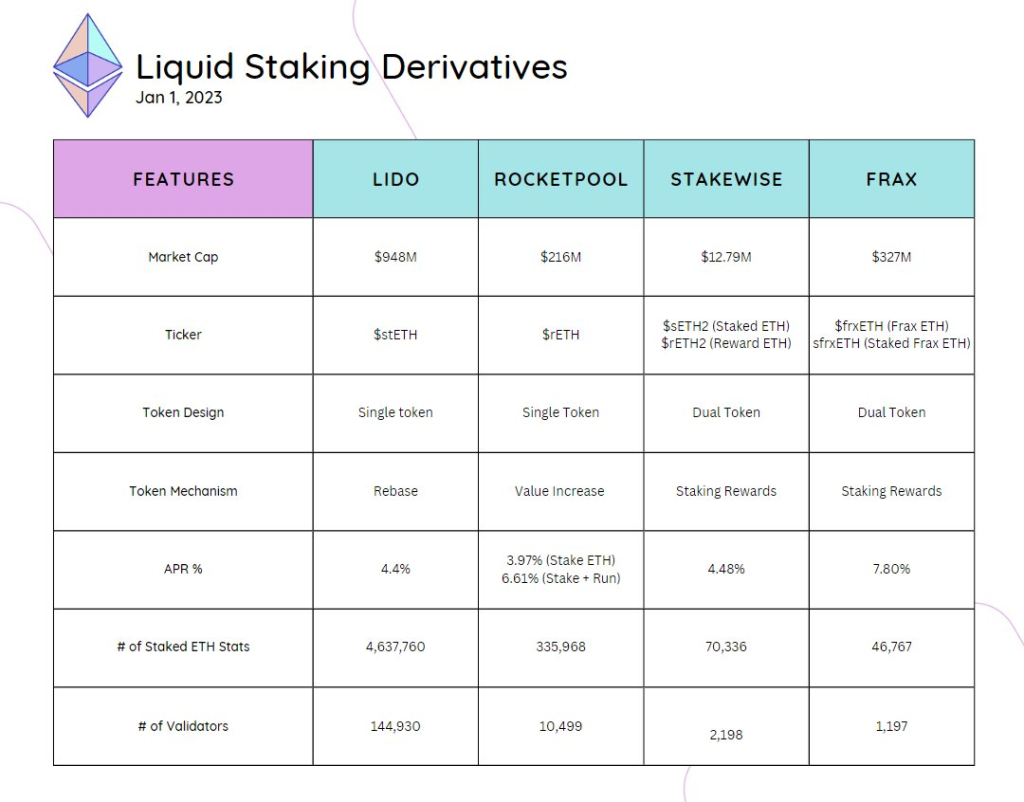

There are many liquid staking derivatives on Ethereum, some more prominent than others. Today we look into the top four platforms on Ethereum ahead of the Shanghai upgrade.

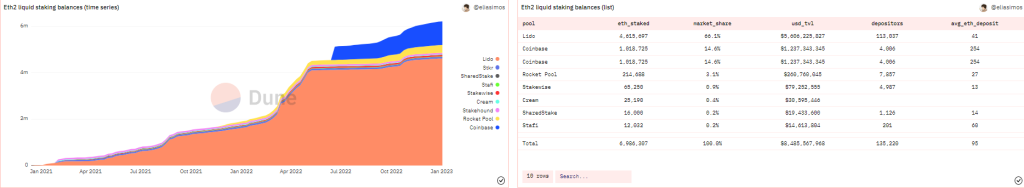

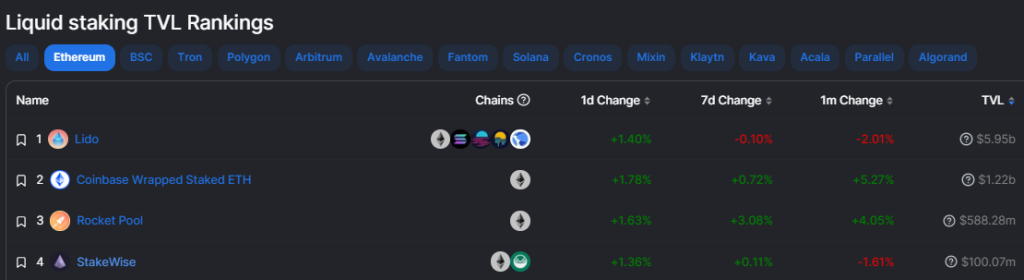

Apart from the abovementioned statistics, @Karl_0x on twitter provided with us the most important information regarding every ETH LSD. Currently, Lido is in the lead with a 65.72% market share with Rocket pool and Stakewise at 3.1% and 0.9% respectively trailing behind.

1/ The Shangai Upgrade is coming, and with it there's an emerging LSD narrative (Liquid Staking Derivatives)

— Karl (@karl_0x) January 2, 2023

here's the most important info regarding every ETH LSD: pic.twitter.com/gcLaDao3hM

Wait, but the calculation does not seem to add up, where are the missing pieces? They reside in Coinbase’s Eth liquid staking pool.

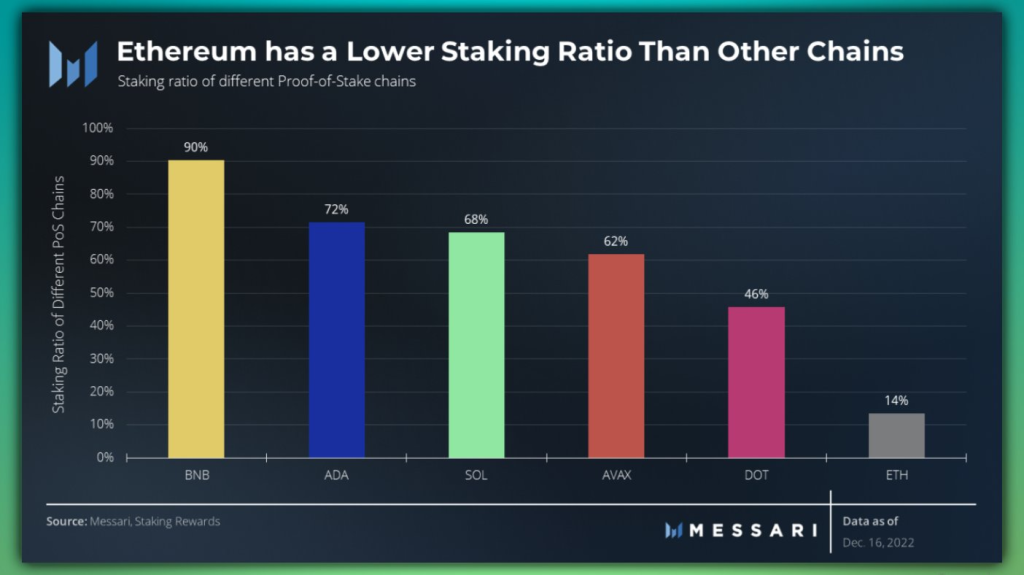

Taking a further look into the staking ratio of the most popular blockchains, we see that ETH, has the lowest staking ratio of merely 14%.

According to Taiki Maeda, a DeFi farmer, this number is expected to increase to 60-80% by the end of 2023.

Tracking liquid staking derivatives on DeFiLlama

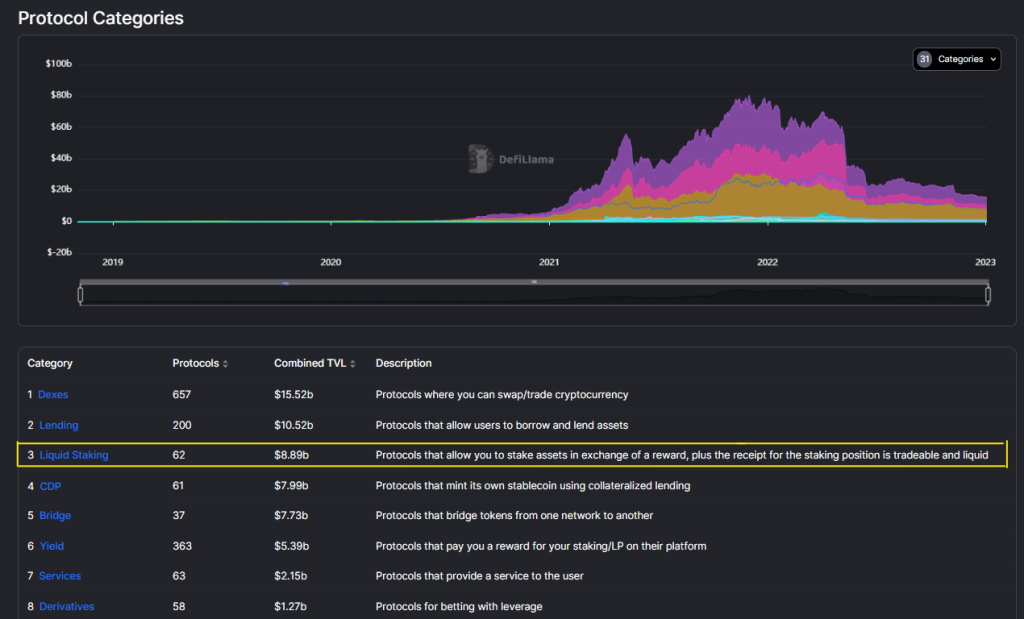

DeFiLlama has all the resources for DeFi in a free to access dashboard. As the seasons change, you may want to equip yourself how to track these protocols, quite simply the easiest and low effort alphas you can get your hands on.

Under the DeFi tab, find “categories”.

Select “liquid staking”.

Filter to Ethereum and you’ll see all liquid staking TVL rankings on Ethereum.

1. Lido

The Lido token, $LDO, is a pure governance token, a community that builds liquid staking service for Ethereum, allowing users to earn staking rewards without the need for locking assets.

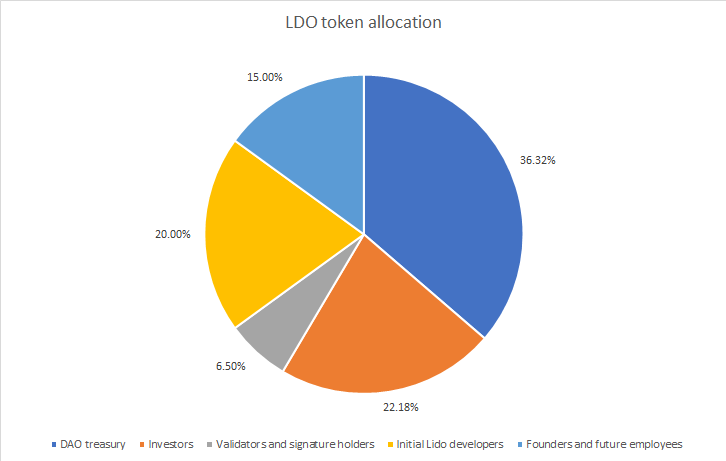

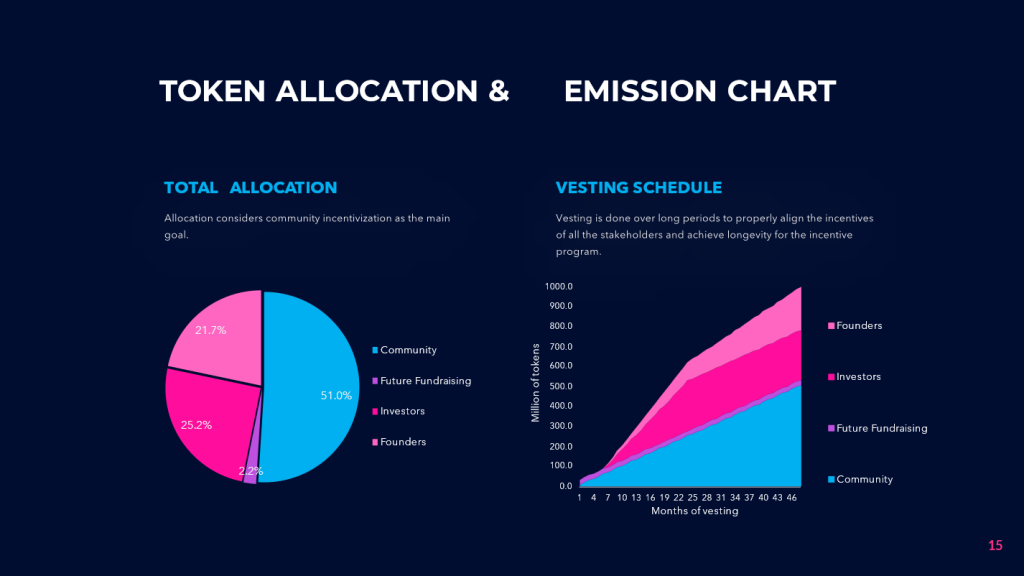

Upon the launch of the LDO token, 1 billion were minted and distributed between DAO treasury, investors, initial developers, founders, future employees, validators amd signature holders according to their allocations.

In Lido’s first round for investors last year, they raised $73M in new funding led by Paradigm, at the cost basis of ~$0.73 per token. August this year was their second round for where they sold roughly 1% (10 million LDO tokens) of their token supply to Dragonfly capital at ~$1.45 per token cost basis. Both rounds include a one year lock up with a 1 year cliff.

This means Lido is extremely well capitalized, where they would be able to reinvest all of their raised capital into the business.

With the price LDO is going for now, you can argue that you are getting in a relatively favorable valuations to VCs.

2. StakeWise

If you compare the market share to the market cap ratio between the top liquid staking derivatives, you’ll see StakeWise, with a market cap of ~13M, is the closest to LSD leader Lido.

With StakeWise V3 in the horizon, a major upgrade to the StakeWise protocol is in works to help “decentralize Ethereum”.

The V3 upgrade will feature permissionsless liquid staking for solo operators, a liquid staked Ether token with slashing protection, osETH and an open marketplace of minipools, called Vaults, to choose who will host your validator(s).

Decentralization of Ethereum is not a given – every wallet that’s staking ETH is responsible for where we land on the (de)centralization axis 🧙♂️

— StakeWise (@stakewise_io) October 18, 2022

So how do we tip the scale in favour of more (solo) operators?

A thread about the mission of StakeWise V3 in the staking ecosystem 🧵

V3 allows $SWISE holders to stake their tokens as collateral for various vaults in exchange for a share of protocol revenue. This will significantly reduce the risk that a slashing event experienced by one or more node operators will have a negative effect on the price of SWISE, making it suitable as an insurance asset.

More on their proposed mechanics below.

Currently, we are on the 20th month on the vesting schedule, and with the token inflation, the SWISE token could be dumped, with a trade off.

3. Rocketpool

By being purely decentralized, permissionless, Rocketpool focuses solely on Ethereum. Arguably they are the best liquid staking product in the market, if you do not compare their market share dominance.

It’s tech advantage, with Staking as a Service, SaaS, will enable bigger players to participate in staking in the most trust minimized and yield generative way, no more centralized risk like the case study of FTX.

Yet, they have been a miniority player for the ETH staking with only 3% market share, but that could be contributed to it having higher fees at 15% compared to Lido’s 10% by being late to the market.

They have proven a worth competitor, as they continue to gain market share, most recently, breaking the $500M TVL mark, their plans to scale and compete with Lido is still a high possibility in 2023.

Find out more in this thread below, it may give you a clear picture of how Rocket pool’s rETH will flip stETH.

There is only flippening that matters — when rETH flips stETH.

— jasperthefriendlyghost.eth | jasper.lens (@Jasper_ETH) December 25, 2022

It's closer than you think.

This is the first of three Twitter threads where I will break down my magnum opus – a 50 pg analysis of how rETH will win.https://t.co/yV7rGDtwwC

Board the Rocket

1/25 pic.twitter.com/4Iq1aiXPRb

Closing thoughts

The LSD narrative is hinging on Ethereum’s Shanghai upgrade, but I believe it goes just beyond investors finding a place to stake after their locked up ETH is due for an unlock. Instead it provides a viable alternative to grow a particular sector of DeFi, and through LSD, making assets more liquid will indefinitely allow more leg room for DeFi’s potential.

In the case of Lido, where we see millions from VC pilling in, could feed the emergence of centrealized governance ownership which essentially takes control of the blockchain. This is important in light of the fact that not every LS protocol allows the user to retain governance voting rights.

There is also a depegging risk. Many of these derivatives tokens rely the peg with its native token, and any significant imbalance with the native token could lead to an increase in selling pressure a cascading negative effects (as seen with Terra). There are always risks underneath any exciting narrative, be privy to them, enjoy and appreciate the tech but keep those risks at the back of your mind.

Also Read: Key Takeaways From Messari’s Top 10 DeFi Trends In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief