The United States arm for Binance, the largest cryptocurrency exchange in the world, is currently experiencing major price fluctuations on its platform.

What is happening to Bitcoin, USDT, USDC on Binance US? pic.twitter.com/KLMAwrOzFV

— Hector Lopez (@hlopez_) July 9, 2023

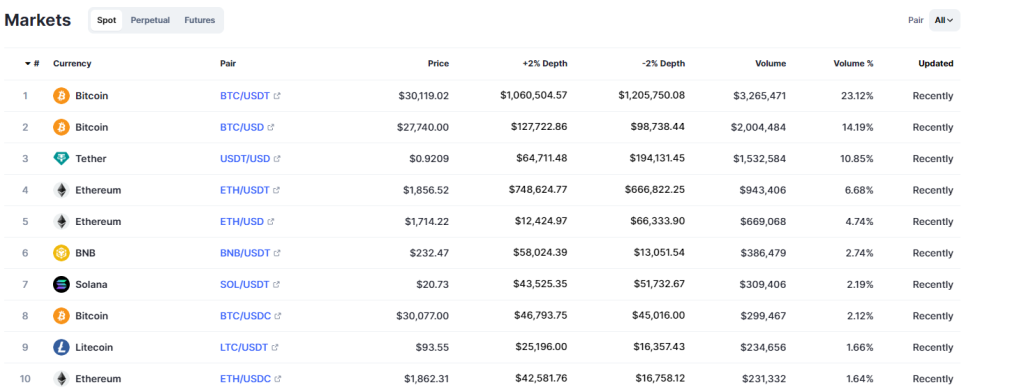

According to Twitter user Hector Lopez, cryptocurrencies on Binance US, which is a separate entity from Binance, are currently trading at up to a 12% discount from SPOT, or the fair price on the open market.

Currently, Bitcoin is trading at approximately USD$27,000 on Binance US, whereas data from Coingecko shows that the fair market price is USD$30,000. Ethereum is also trading at around a $300 discount.

Following Binance’s inability to find banking partners in the United States and halting of USD deposit services, the exchange’s holdings have seen a considerable decline with over $500M being withdrawn in the span of the last 3 months.

Image Courtesy: Arkham Intelligence

The lack of USD deposits onto the platform, coupled with a lack of buying pressure, could be major factors contributing to the de-pegging of major cryptocurrencies on the platform.

Why Have Arbitrageurs Not Closed The Loop?

In cryptocurrency, tokens trading at a discount are often arbitraged back to their fair value, especially on-chain.

These arbitrage opportunities usually take the form of:

- Buying assets at a discount on Platform A

- Selling the assets on Platform B for a profit

- Taking the profits back to Platform A to buy more assets at a discount

- Repeating steps 2-3

However, the current lack of a USD deposit channel on Binance US means that an arbitrageur’s best bet is to transfer stablecoins onto the platform, which are also under peg.

For example, popular stablecoins $USDT and $USDC are trading for approximately 89 cents on the dollar, which is almost a steep a discount as other cryptocurrencies such as Bitcoin and BNB.

Instead, users have to perform the arbitrage strategy by transferring cryptocurrencies which are slightly less de-pegged, selling them for those with a larger de-peg, and capturing the possibly minute differences.

All you Binance simps that believe CZ is a god who would never let you down, can deposit into Binance US and get cheap coins any time you want.

— Adam Cochran (adamscochran.eth) (@adamscochran) July 10, 2023

Good luck. https://t.co/0rpwQ9wP9t

Image Courtesy: CoinMarketCap, Binance US exchange depth

A combination of factors including slippage, fees, as well as possible regulatory backlash has so far prevents any large entities from entering the exchange to take advantage of the arbitrage opportunity.

However, if you hold any cryptocurrency on Binance US, the good news is that withdrawals are still functioning properly on the platform.

Should you want to off ramp and remove the risk of further de-pegs or other risks, your cryptocurrency will still be worth the same on most other major exchanges or on-chain.

Also Read: 5 Binance Alternatives For Singaporeans (2023)

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief