Many crypto investors see Bitcoin and Ethereum as the blue chips of cryptocurrency because of their high liquidity, long-lasting reputation and high market caps making them relatively less prone to price manipulation and heavy price fluctuations.

The total market capitalization of cryptocurrencies at the time of writing is $1.2 trillion. Currently, Bitcoin and Ethereum dominate the crypto market, together they account for 66.63% of the total crypto valuation by market cap.

Breaking this down, Bitcoin makes up 48.27% while Ethereum makes up 18.36% of the total market cap of cryptocurrencies.

So it is common to see crypto investors have both coins in their portfolios. But if we were to go with one which of them is the better buy?

Let’s start with the king of cryptocurrency.

Bitcoin

Bitcoin is the oldest cryptocurrency, it was launched in 2009 to facilitate the purchase of goods/services (i.e. medium of payment ) and a store of value to serve as an alternative to traditional money.

It was a means for people to make payments, send and receive money without a third party or central authority.

Bitcoin utilizes a technology known as the blockchain which is a decentralized and distributed digital ledger technology that securely records and verifies transactions across multiple computers or nodes.

To prevent malicious actors from hacking or changing the records on this ledger Bitcoin uses a consensus known as Proof-of-Work(PoS) to secure the network.

Now to the underdog.

Ethereum

Ethereum is an open-source, decentralized blockchain platform that enables the creation and execution of smart contracts. It was proposed by Vitalik Buterin in late 2013 and launched in 2015.

You see Bitcoin uses the blockchain for mainly monetary transactions Ethereum took it further and revolutionized this technology, whereby you can run self-executing (smart) contracts on the network as long as predetermined conditions are met.

Smart contracts permit trusted transactions and agreements to be carried out by anonymous parties without the need for a central authority, legal system, or external enforcement mechanism.

This gave birth to dApps (decentralized applications) and gave Ethereum a fleet of use cases like gaming (GamFi), social media, finance (DeFi), Non-Fungible Tokens (NFTs) etc.

At lunch, Ethereum used the same consensus as Bitcoin which is Proof-of-Work. Ethereum switched to Proof-of-Stake (PoS) in September 2022.

The native token of Ethereum is called Ether (ETH) and it is used to pay transaction fees, staked and as a medium of payment where accepted.

Bitcoin and Ethereum: The Perennial Battle

Since 2009, Bitcoin has seen a very high rate of adoption and is currently the most popular cryptocurrency.

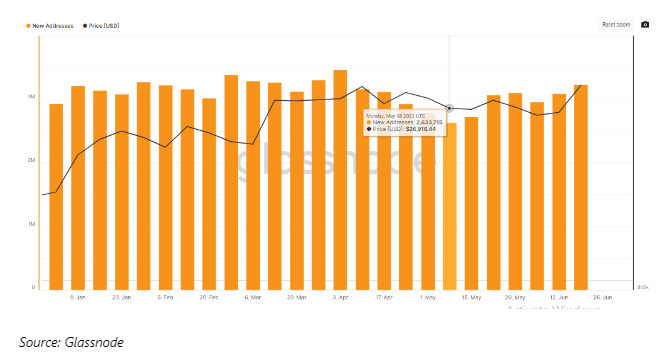

So far in 2023 between 2.63 to 3.64 million new Bitcoin addresses are opened weekly while the number of daily active addresses thus far in 2023 ranges from 712,644 to 1,278,842.

Bitcoin has a total supply of 21 million and currently, its circulating supply is 19.4 million which means over 92.4% of its total supply is already in circulation.

This limited supply and its relatively high demand are why some refer to it as “digital gold” because these features make Bitcoin a store of value.

Currently, there are 2,087,764 BTC held across all exchanges, representing 9.94% of the total supply this is the lowest level since 2021.

Higher BTC holdings on exchanges typically indicate increased sell pressure, while lower holdings suggest reduced sell pressure. This gives you an idea of the general sentiment of BTC.

Bitcoin started 2023 at $16,531 after 6 months it is currently trading at $30,595 which is a growth of 84% YTD.

Moving forward, the biggest upcoming event for BTC is the Bitcoin Halving this event happens every four years and it reduces the amount of BTC given to miners by half.

This will reduce the amount of new BTC released to the market and help BTC maintain its scarcity further reinforcing the status of Bitcoin as “digital gold”.The Bitcoin halving is set to happen between April/May 2024.

Since its launch in 2015, Ethereum has grown to become the second-largest cryptocurrency by market cap.

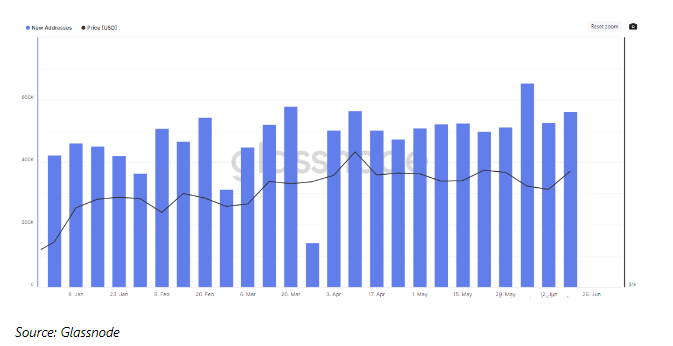

In 2023 so far between 141,980 and 653,662 new Ethereum addresses are opened weekly. The daily active Ethereum address went from 191,964 on January 1st to 542,392 by January 8th.

Since then the number of daily active address have been between 240,410 and 407,185.

Unlike Bitcoin, the maximum supply of Ether is unlimited, at the time of writing the circulating supply of ETH is 120,238,679.

However, Ethereum has undergone some upgrades that have improved the network for example “The Merge” of September 2022, which transitioned Ethereum from a Proof-of-Work consensus to a Proof-of-Stake consensus.

Before the merge, Ethereum had two layers the execution layer(mainnet) and the consensus layer (Beacon chain), new Ethereum were issued on both layers.

Since the merge new ETH are no longer issued on the execution layer since the network no longer uses Proof-of-Work new ETH are now issued only on the consensus layer.

Ethereum introduced fee burning during the “London Upgrade” of 2021 this means that some of the transaction fees paid to the network in ETH are burnt(in a bid to make Ether deflationary).

Since the merge in September 2022, about 242,446 ETH have been burnt the supply growth of Ether since the merge is -0.3%.

At the moment 15,095,941 ETH are currently held across all exchanges which is 12.5% of Ether’s circulating supply remember an increase in this number translates to higher sell pressure.

Ether started 2023 at $1,197 by April it has risen to $2,117 which was a yearly high. The Eth price rally in April happened a few days after the Shappella upgrade which enabled stake Ether to be withdrawable.

At the time of writing Ether is currently trading at $1,918.

The Bottomline

The motivation and purpose behind Bitcoin and Ethereum are very different. While BTC was meant to be an alternative to traditional fiat Ethereum enabled smart contracts and made it possible for dApps to be built on the blockchain.

This very nature of Ethereum positions the network nicely, because of the endless possibilities that it offers via enabling smart contracts it can benefit directly or indirectly from whichever narrative takes off.

An example of this was the NFT bubble when Non-Fungible Tokens were booming most of them were sold or paid for in Ether(ETH).

Bitcoin seems to be attracting more users than ETH and it is the most mainstream crypto.

MicroStrategy bought 12,333 BTC for $347.0 million at $28,136 per #Bitcoin pic.twitter.com/YjyOwxUR02

— SMC Report (@SMCReport) June 28, 2023

Macroeconomic events and decisions affecting crypto are more highlighted on Bitcoin.

The upcoming Bitcoin halving is not just seen as an event that affects Bitcoin but an event that affects the entire crypto market.

Now between BTC and ETH which is the better buy? Well, it depends on your investment goal, your capital and also your risk appetite/tolerance.

Although it is becoming a norm to hold both in your portfolio the better buy so far has been Bitcoin from January 1st to July 1st Bitcoin grew by 84% putting this into perspective Ether in the same time frame grew by 59.7% the S&P 500 grew by 16% and Nasdaq 100 grew by 39.7%.

Moving forward, a lot of people see the upcoming Bitcoin halving as bullish not just for Bitcoin but for Crypto at large.

Nobody knows for sure what the future holds for both BTC and ETH. However BTC seems to appear as a better investment for now.

Also Read: 5 Ways AI Can Help You Make Money in Cryptocurrency

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

By Godwin Okhaifo