The Shapella upgrade is scheduled for 12th April, 10.27pm UTC or

6.27am SGT/UTC+8 on the 13th of April (Thursday).

______________________________

The Ethereum community is buzzing in anticipation of the Shapella (Shanghai/Capella) upgrade, which is expected to be one of the biggest events in the crypto space for 2023.

Ethereum’s Shangpella upgrade, a portmanteau of their previously planned Shanghai and Capella updates, promises to introduce several exciting new features, including significant enhancement in security, scalability, and smart contract operations.

Most importantly, the Shapella upgrade will now enable ETH validators to withdraw their staked funds.

In anticipation of this event, the Ethereum market has been experiencing a bullish run, with ETH on the rise. But the question is, what does the Shapella upgrade mean for the entire crypto landscape?

Today, we’ll look at the Shapella update, as well as what it means for the Ethereum market and the broader crypto space. This article will also explore the links between the current ETH price pump and the imminent upgrade.

Also Read: The Merge Is Completed: Here’s What’s Next For Ethereum

A Brief Recap of the Ethereum Shapella Upgrade

The Shapella hardfork includes a solution to the inability of users to withdraw their staked ETH assets from the Beacon Chain, which became a part of the network in December 2020.

Ethereum’s Shanghai Upgrade will take place in 2 days and investors can begin to unstake their $31B worth of $ETH about 15% of its supply that will be unlocked.

— DANNY 🧸🧧⛩️ (@DannyCrypt) April 10, 2023

What impact will this have on Defi and your bags?

Here’s how you can stay prepared for this important event: 🧵⬇️ pic.twitter.com/I8rxp8ionf

Shapella’s agenda entails modifications to the execution layer (the Shanghai component), the consensus layer (the Capella competent), and the Engine API.

As of this writing, the Shapella upgrade has launched on Ethereum testnets, including the Sepolia and Goerli testnets. Meanwhile, it is scheduled to go live on the mainnet on the 12th of April, 2023, at exactly 10:27 p.m. (UTC).

This translates to 6.27am SGT/UTC+8 on the 13th of April (Thursday).

Quite frankly, Shapella’s influence on the value of Ethereum seems ambiguous, as the possibility of withdrawing locked funds makes ETH staking an even more attractive objective. On the flip side, it might increase the number of ether tokens in circulating supply, resulting in a potential fall in ETH price.

That said, there has been a noticeable rally behind ETH value in the past few months in anticipation of the upgrade. As we advance in this article, we’ll explain why!

Ethereum’s Shapella Upgrade – A Huge Milestone for Crypto

As stated earlier, the Shapella update promises the introduction of new, exciting features to the Ethereum network.

The ability to withdraw staked assets from the Beacon Chain is one of these new features and the most prominent from this upgrade. But that’s not all – as other changes, like improved scalability, enhanced security, and enhanced smart contract operations, are also being anticipated.

As a result of the hardfork, smart contracts on Ethereum will take up less storage, making it cheaper for developers to deploy on the network.

Additionally, Shapella offers a variety of benefits to the liquid staking industry.

Liquid staking protocols currently account for about 32% of all staked ETH – a figure which is projected to increase significantly after the upgrade. With a potential market share gain, liquid staking providers – with liquid staking tokens (LSTs) – are expected to be big winners from this upgrade.

Besides ETH and the staking industry, the Shapella upgrade is also expected to have an impact on a wide range of verticals, such as ETH-backed stablecoins, decentralized exchanges (DEXs), leverage staking, and so on.

Finally, the Shanghai update brings us one step closer to the realization of the Ethereum 2.0 roadmap. It is crucial for facilitating the next scaling upgrade, Proto-Danksharding, which is projected to launch in the summer or fall of 2023.

Shapella and Its Effects on the Current ETH Price

On April 5, 2023 – exactly a week before the Shapella upgrade, the value of ETH rallied above the $1,900, breaking its highest price in 8 months. The last time we saw Ethereum’s price move this high was August 15, 2022.

So, what’s the reason for the ETH price rise?

One reason is a possible link to the internal Ethereum market. According to various analysts, the Ethereum network is enjoying attention from investors due to the upcoming Shapella update.

Given the significance of the changes on the network, it makes sense that investors are showing more interest in Ethereum.

Furthermore, the social ‘chatter’, or sentiment surrounding Ethereum and the impending update has been largely negative. This is a result of the fear that the price of Ethereum will plummet after the April-12 upgrade.

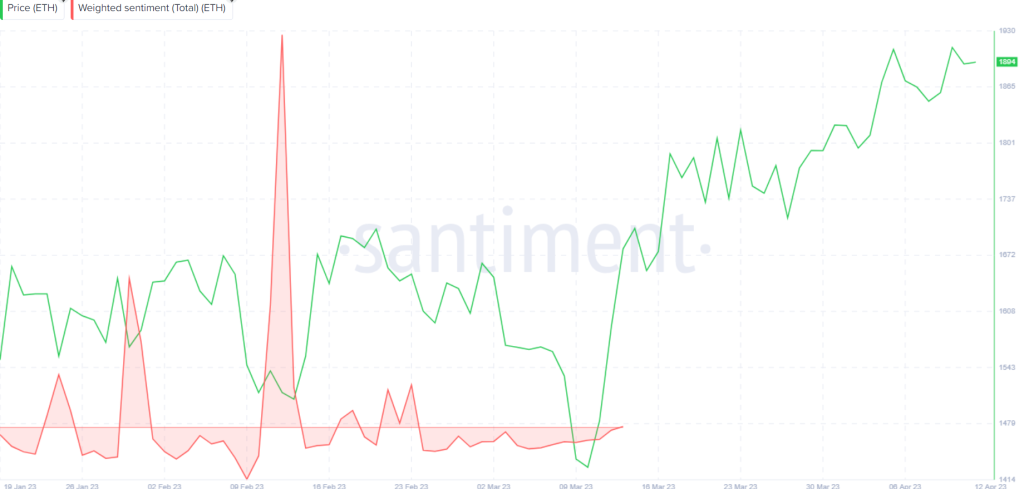

According to data from the blockchain analytics company Santiment, Ethereum’s net weighted sentiment has mostly been negative since mid-February. However, we recently saw a major spike in sentiment approaching the Shapella upgrade, which heralded the Ethereum rally.

On the Santiment chart, ‘weighted sentiment’ is a parameter that is measured by comparing the ratio of negative to positive mentions of a specific asset across notable social media platforms. When it stays negative for an extended period, as is the case with Ethereum for the last few months, investors may interpret it as the perfect time to buy the dip.

Additionally, the accumulation trend noticed in the chart amongst Ethereum ‘whale investors’ corroborates the bullish sentiment.

Between mid February and April 7, crypto whales – holding 1 million to 100 million ethers – bought 2.4 million ETH (worth about $4.4 billion). With the whales accumulating more coins, it only makes sense that the overall Ethereum market becomes bullish.

What to Expect in the ETH Market After Shapella

Much of the negative chatter on social media has been due to the fact that the Shapella upgrade would enable validators to withdraw and sell their staked ETH for profit, potentially leading to a fall in the coin’s price.

However, CryptoQuant – a data analytics company – has allayed this fear and argued against this potential outcome, claiming that the bearish pull may be minimal.

According to the company’s profit and loss analysis, a significant selling pressure is unlikely because most staked ether (9.4 million ETH, approximately 52% of the total) is currently at a loss. Meanwhile, CryptoQuant notes in its analysis that the average validator in the largest pools is also at a loss.

Given this situation, it’s quite unlikely that these ETH depositors would jeopardize their investment by withdrawing and selling their locked funds at the current price.

As for staked ETH currently in profit, CryptoQuant’s analysis shows that it is generating no more than a 30% yield, which is relatively measly compared to the large profits the Ethereum market can churn out. In essence, selling pressure arises when most market participants make extreme profits – which doesn’t seem to be the case for staked ETH.

Furthermore, the withdrawal process is designed such that staked ether tokens can’t be removed all at once. Instead, withdrawing locked assets will be spread over an extended period – meaning that the selling pressure – if any – will likely not overwhelm the market. This should help the market adjust to the increased ETH supply following the Shanghai upgrade.

The Bottom Line

As of this writing, there are approximately 17.5 million ETH tokens (worth about $29 billion) locked on the Ethereum blockchain. Whether the Shanghai upgrade will result in massive withdrawals of these tokens remains to be seen.

Also, there is no clear-cut answer to how this development will affect the operations of liquid staking protocols – which are the biggest contributors to the ETH staking market.

However, the Shapella upgrade could be a positive event that de-risks ETH as an asset, bolsters Ethereum’s security, and makes ETH staking more attractive. The new ability to withdraw ETH tokens conveniently will give investors renewed confidence to keep their assets locked.

Also Read: This Is Only The Beginning For Ethereum

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Opeyemi Sule and edited by Yusoff Kim