Celsius very recently had claims of insolvency in light of the current macro-economic situation. It is one of the largest centralized gateways to crypto and has raised nearly $864 million of venture capital and at one point be in custody of $3 billion worth of funds. How has Celsius become insolvent and what does it mean for the broader crypto market? Let’s dive in.

What Is Celsius?

For starters, Celsius is a do-it-all fintech app that is meant to give easy access to cryptocurrency service via CeFi. In essence, they take your money or crypto and promise you a fixed interest rate. They then utilize DeFi for it to earn a yield to pay you and gain a return for themselves as well.

They aim to provide trading, high-yield deposits on cryptocurrency and crypto-backed lending. In essence, while they advertise their services like a “decentralized” bank, the service is more like a hedge fund and these strategies require supervision.

They could also be considered a custodial asset manager. In traditional context, Fidelity wraps a basket of stocks into retail-facing ETFs and take a fee for providing the service.

Celsius does exactly the same thing but “decentralized”. It provides regulated access to loans and yield but takes a fee for doing so. This helps to reduce exposing users to the inconveniences of self-custodied crypto in a hot wallet like MetaMask.

While they promise free withdrawals and redemptions if users want to exit their position, ultimately, they manage the investors funds on their behalf.

Oof pic.twitter.com/vrQ8SQHwle

— icebergy ❄️ (@icebergy_) June 13, 2022

In the event that Celsius does go bankrupt and is unable to fulfil its obligations, investors will not be able to use any legal remedies or rights and funds are non-recoverable.

So How does Celsius Make Money?

Celsius is a nutshell makes money by 2 main ways:

- Originating loans to institutions and individuals

- Keeping whatever profits are left after running strategies for customers

Celsius did do pretty well in 2020 and 2021, reaching an evaluation of nearly $10 billion. The only issue? They manage their funds like how degens do, giving promises of sky-high yields with a veneer of legitimacy.

The start of the collapse

Obviously, $LUNA was a major surprise to many investors, and possibly is the biggest wealth destruction event in crypto.

$LUNA promised “anchored” yields at 20%, making a super popular product which was “risk-free”. Unfortunately, when market began volatile, this led to a death spiral of on-chain selling and the failure of this massive protocol.

Celsius who promises high yields on stable coins definitely has some exposure to $UST, estimated to be worth nearly $500 million. Given the not so fortunate events, that $500 million is now worth about $3.3 million.

This matter is made worse by poor judgement calls of

- Use of on-chain leverage

- $stETH

Use of on-chain leverage

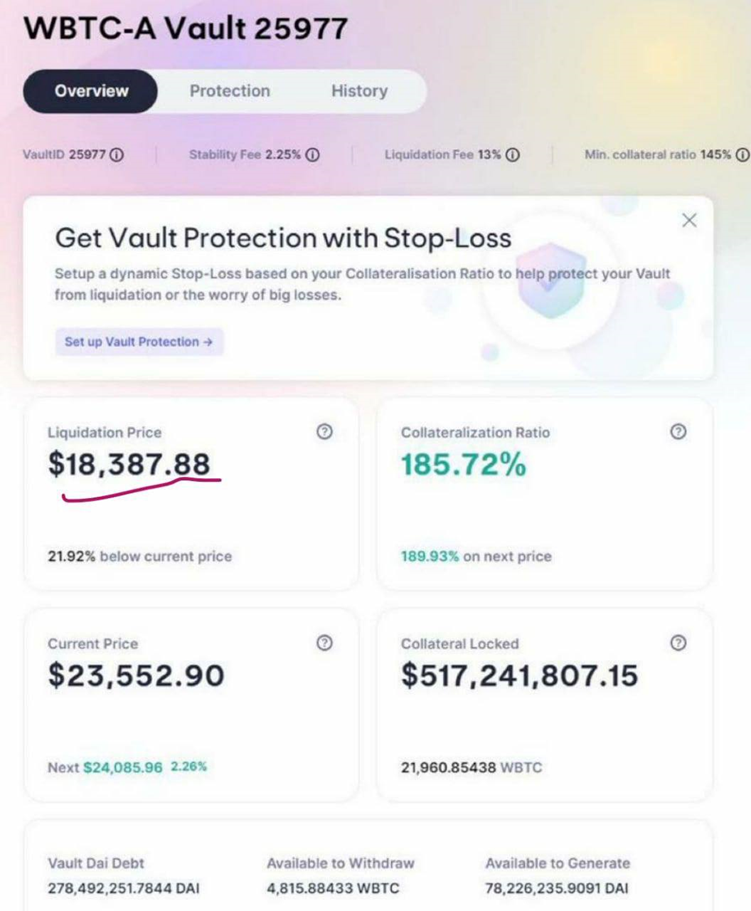

In order to sustain yields promised to investors, Celsius itself utilizes leverage through permissionless on-chain MM like MakerDAO.

This means that they take user deposits like $WBTC and use it as collateral to borrow $DAI.

🚨 Celsius Network has 17,919 $WBTC leveraged in Maker protocol. This position faces liquidation at $22,584/$BTC. $278 mil $DAI debt, making it the largest individual debt position on the protocol. pic.twitter.com/MNF0B3zbQv

— Dirty Bubble Media: 🌡☠️ (@MikeBurgersburg) June 13, 2022

This position faces liquidation at $22,584 but luckily was saved with more assets by reducing the liquidation price to $18,387, which isn’t great anyway since $BTC is sitting at around $19,000 at the time of writing.

Maker is a collateralized lending platform which is done via putting in $1.50 of volatile collateral to borrow stablecoins. If the value falls below the liquidation threshold, it is liquidated to repay the loan and prevent bad debt.

While having a whooping 9-figure loan on Maker is troubling, it shouldn’t be a problem for a protocol as big as Celsius as if its lending collateral is falling in value, they can just liquidate their customers’ lending collateral to repay their own. This is where $stETH comes into play.

$stETH

For $ETH deposits, Celsius promises sky high yields of 6-8% of interest, likely from staking on the Proof-of-Stake Ethereum Beacon chain which is a major issue as assets are locked up on this chain and cannot be unstaked to repay debts.

That isn’t an issue with the crypto protocol Lido create $stETH which is one of the most respectable and innovative DeFi projects. It allows anyone to earn $ETH staking yields without running staking infrastructure.

Seeing a lot of misconceptions and confusion around $stETH (@LidoFinance liquid staked Ether)

— ChainLinkGod.eth (@ChainLinkGod) June 11, 2022

Thought I’d write a short thread on my perspective

Staking on proof-of-stake only provides about 4.2%, so how is Celsius able to provide 8%? $stETH can actually be used to earn more yield as compared to $ETH as since $stETH already earns staking yield, it can be enhanced by providing liquidity to Curve Finance, hence giving even more yield.

Unfortunately, the major issue is that while $ETH can be converted to $stETH, the vice versa cannot be done, until the beacon chain merges and Ethereum goes through a hard fork. This means that they bought a ton of $stETH, which can’t be redeemed for $ETH until 6-12 months after the merge which hasn’t even happened yet.

Celsius relies on its $stETH holding its ratio from 1:1 as well, because it needs to match their liabilities. In a liquidity crisis and bear market, this strategy does not bode well as the $stETH/ETH ratio begins to slide and depeg.

So why can’t they just swap $stETH back to $ETH and pay back debts to avoid liquidation at a loss? Due to all the uncertainty around $stETH, they can’t even cash it out at a loss (trading at $0.96 to the dollar against $ETH).

Celsius failed to isolate risk and found itself in an insolvent and overexposed position. So when crypto drops and users want their money back, all Celsius users feel the pinch because there is only one pool of money.

Celsius has nearly 445k $stETH with only 143k worth of $ETH in the pool, this amounted to billions in combined liabilities across multiple assets and protocols.

What does this mean?

Celsius opened up a bunch of loans to provide attractive yield, but also chose to leveraged it by making themselves insolvent, meaning they do not have the money to pay back the mass withdrawal. It was a huge risk they chose to take, while still facing the massive risk of liquidation of their $WBTC loan.

Celsius decided to pause withdrawals and transfers and give users a choice to get liquidated or top up their own collateral.

It would make sense in this situation for Celsius to quickly repay their loans so that they can reduce the risk of liquidation and repay customers who want to withdraw. Instead of deciding to repay their own loans, they decided to top up their collateral which is a truly degen move.

In less volatile markets and a large number of reserves available, this makes perfect sense rather than taking the hit and selling at a loss. But while being insolvent and having a lack of funds to repay, this makes the situation even worse as the market continues to crash due to the high likelihood of a recession.

Celsius lender MakerDAO has a minimum 150% collateral ratio. Topping up collateral doesn’t actually mean repaying the loan and locking in their means it can’t be withdrawn to repay it in the future, while their reserves continue to dwindle day by day.

Conclusion

Celsius obviously played their cards horribly, and if their assets cannot match their liabilities, they basically will be doomed. There are only a few ways they can save themselves which is by taking a loan, external funding, or bite the bullet by providing acquisition to their competitor NEXO.

After what appears to be the insolvency of @CelsiusNetwork and mindful of the repercussions for their retail investors & the crypto community, Nexo has extended a formal offer to acquire qualifying assets of @CelsiusNetwork after their withdrawal freeze. https://t.co/JFtKTHRLcY

— Nexo (@Nexo) June 13, 2022

Markets are obviously shaken by the news, which could have been a major catalyst for the downfall of 3AC as well. Not a great day/week/month in crypto and there’s surely more to be seen. Stay safe and manage your investments wisely.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: The Mindset You Need: How S’pore Crypto Analysts Approach Projects Today