Even though the bear market is upon us, the Web 3.0 space is still slowly expanding and demand for crypto talent continues to grow. Aside from those that are building in the space, we also have groups of people that are involved in looking at and analysing the industry as a whole.

For today, we will be featuring 3 analysts from Singapore: Lai Yuen from Octava Digital Assets, Jun Hao, an intern at Graticule Asset Management Asia, and Martin from Nansen Research.

Here are their opinions and thoughts regarding the world of crypto:

Background And Introduction

1. Lai Yuen, Full Time Crypto Analyst

Lai Yuen is a fresh finance graduate from NUS and is now working as a full-time crypto analyst. He was the Co-President of NUS FinTech Society, which was focused on equipping students with the skills and knowledge for a career in FinTech.

They regularly host events with industry experts to share insights with students, something he believes is important for students to have when it comes to the space. He even has plans to launch an NFT project to create sustainable public goods funding in crypto in the future.

“We need to continuously inspire the next batch of talents to join this growing industry.”

In fact, he was very recently featured on CNA Insider’s articles to talk about his experience and reflections after the LUNA collapse.

2. Jun Hao, Crypto Analyst/Research Intern

For Jun Hao, a final year finance undergrad from NUS, he started falling into the crypto rabbit hole for only about a year, but has had 3 crypto-related internships, mostly from an analyst/research perspective.

3. Martin, Data Journalist In Nansen

Lastly, we have Martin, who some of our readers may be familiar with from our video here:

Martin had an accounting & finance degree, and always had a huge interest in understanding the world around him. This led him to focus on researching businesses/start-ups and new concepts, which eventually led him to crypto.

He is currently a Data Journalist at Nansen and is focused on research articles from a content marketing angle.

What drew them to work in crypto?

In 2018, after learning about how Venezuelans were using Bitcoin for their daily transactions and savings in a failing economy caused by corruption, Lai Yuen took the “orange pill”.

He now believes that crypto provides us with a hopeful alternative to current systems plagued with inequality and misaligned incentives.

“Being bullish on crypto is being bullish on human ingenuity.”

This is the future of how people will coordinate on many things (monetary policy, operating a DAO etc).

If Bitcoin’s innovation was solving the Byzantine general’s problem, then adoption of crypto at the social layer could solve many other problems we have today. Designing incentives to create positive-sum outcomes is one such example.

On the other hand, Jun Hao was a big skeptic on digital currencies and only had a background in traditional finance. His perspective on crypto changed after he discovered DeFi, which he believes is exciting and innovative. This eventually attracted him to work in the space.

Martin thinks that the entire industry is in a start-up-like phase, and everyone in it truly wants to work in this field.

“People are constantly pushing new boundaries and dreaming big.”

To him, there is also a level of optimism and purity in their intentions which is quite a contrast to other more mature industries where people work for the sole purpose of just money and nothing else.

How They Research Into A Project

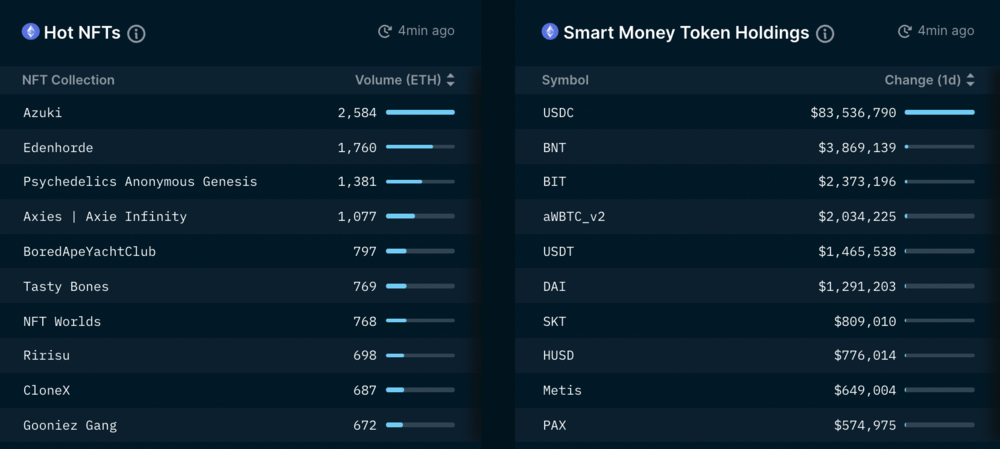

For these analysts, tools like Nansen, Dune Analytics, and Token Terminal are their bread and butter.

For example, Nansen analyzes on-chain activity which tracks and identify trends, as well as net inflows/outflows for wallets. Is Smart Money (those that purchased good tokens early) buying, and if so, what are they buying?

These are not the only tools they use however – reasoning is important as well. The tokenomics and value accrual of the token are something they like to look at.

In this thread, I'll cover

— Ron (@0xnyew) May 23, 2022

▸Definition of Tokenomics

▸How to Analyze Tokenomics with a Simple Framework

▸3 Takeaways for Tokenomics Research

(+my checklist to filter crap)

Let's dive in.

Just like evaluating stocks, looking at revenue, market cap/FDV, and the team and investors behind the token is important as well. Martin generally prefers doxxed teams, and a product that has a minimum viable product out (real users and traction).

Of course, as crypto projects vary from project to project, there is no such thing as a one-size-fits-all framework. An investor cannot simply just use P/E or P/B ratios to compare projects. Lai Yuen likes to ask the following:

“Is the project is solving a meaningful problem, and if so, is it the best project to invest in for this problem?”

Other than these metrics, joining Twitter, Discord and Telegram works well as a strategy too.

“Getting a first-hand experience of talking to the founders of a project is very important and pretty mind-blowing. If you know how to communicate with the team and what to look out for, these are all you need.” – Jun Hao

Long Term Analysis On Web 3.0

“It will not be in the way that we are currently imagining it to be,” says Lai Yuen, on his thoughts regarding Web 3.0.

It will not be the case where every celebrity has their own DAO, and every individual owning 100 tokens/NFTs in 100 various interests (be it financial or non-financial) as that is unsustainable for the average person.

While he is excited about the Metaverse and an immersive online experience (Ready Player One), tokenization of every single thing is not the right way to go.

Fringe cases of tokenization may be useful in the long run, but ultimately Web 3.0 must be a sustainable system that does not just rely on massive VC backing. To him, Web 3.0 is meant for strangers to collaborate in meaningful ways in a trustless environment.

Jun Hao loves the vision that Web 3.0 sends across – the fact that we can own what we create. However, he also agrees that there are many nuances to consider before this becomes not just a vision, but a movement and reality for the people. Due to the pace that people are building and funding, however, he is optimistic on adoption.

Martin’s take on Web3 is that it enables creators and end users to participate more actively in the upside of the future Internet. The current structure of Internet accrues most of the value towards a handful of large tech companies. However, Web3 allows that value to be spread more equitably by enabling ownership over digital assets.

To him, the true value of the internet can be unlocked by the properties enabled by crypto/blockchain technology. Martin draws the parallel to when China started opening up and adopted more capitalist friendly approaches, where ownership and rights were handed over back to citizens.

Crypto Analyst’s biggest takeaway

“My biggest takeaway is to be humble and open to new things.”

Meeting many older, smarter, and more experienced investors and founders has shaped Lai Yuen’s view on the markets and how to make investment decisions. It is also important to make friends with diverse opinions and be willing to discuss alternative views.

The fast pace in the crypto sphere is something that everyone has to master and keep up with. Even if the markets are quiet, it is always the time to learn something new about the space.

A word of warning, however:

“Nothing is too big to fail, only too big to bail.”- Martin

Recommendations for new investors

The most important advice is to come into crypto with an open mind, but also healthy dose of skepticism when it comes to making new investment decisions.

“We often have hand-wavy explanations of why we should invest in new projects, and it is important to think critically about what the underlying mechanism is for new coins.” – Lai Yuen

Investors must do their research unless they willing to lose their investment money.

“As with everything new and dandy, there are bound to be malicious actors in this space.” – Jun Hao

Knowing exactly what you are doing when interacting with protocols or performing transactions with a wallet is critical.

For beginners that are still uncomfortable with crypto, sticking to just a centralized platform that is user friendly can be a temporary start.

For Martin, he believes in not rushing into buying something. Instead, take the time to learn and understand the product is more important. Even though you might miss an opportunity, there will always be more chances waiting.

“It is also much easier to learn about something by doing it first-hand.”

How to work in the space

For students, Lai Yuen thinks that it is difficult to get credible experience on the resume aside from taking crypto internships or joining student organizations like NUS FinTech.

Real and genuine interest/activity in the space is key – buying tokens, writing smart contracts, or building a Twitter account are some examples.

Also Read: 10 Ways To Master Etherscan And Discover The Next Crypto Alpha Before Everyone Else

Building on core competencies, whether as a marketer, financial analyst, developer, or other roles are also critical.

“Feel free to approach seniors for advice – most would be more than happy to guide you or direct you to appropriate mentors to help you out.”

For Jun Hao, he believes that one should not be afraid of the steep learning curve in the space. Understanding the fundamentals slowly will go a long way.

“Diving into a project in an ecosystem one of the best ways to learn,” he adds.

For example, going to DefiLlama, checking out the different categories of projects, and joining the community for discussion could be a start. As for hiring opportunities, there are many companies that are willing to take along interns that display a genuine interest in the space.

“Tag along with the role and you can learn a lot!”

In Martin’s case, he believes that due to the start-up phase in crypto, it indexes on personalities and characteristics that start-up’s look out for. Proving that you can do the job you are applying for before you get a shot is beneficial.

“You can take an initiative by having an on-chain resume (understanding and using protocols on chain).”

Aside from that, the following can be helpful:

- Actively writing on Twitter/Medium/Substack

- Contributing to DAOs/Discord communities

Closing Thoughts

While these analysts may be young, they clearly have experience in the space and are more than willing to share their stories and advice. Just like each and every one of us, however, they also started out being skeptical on crypto.

One thing that stood out to me was the fact that all of them deep dived into what they were interested in and were in short, not afraid to get their hands dirty.

If Web 3.0 is about ownership for the masses, then perhaps it also means we can put in more effort and be a participative player in the game as well.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief