A subtle week with a mini price pump, a perfect recipe for a bull trap. We are still waiting on the Genesis hole to full unravel. Apart from Metamask updating their policy, rumours on wETH de-pegging being entirely false and SBF addressing the $8B hole, we are in for a quieter week, something I found, rather uncomforting.

Could Stock-to-flow reveal the answers? 📈

In the 2018 cycle, Bitcoin’s downtrend finally stopped after breaking out of the previous Stock-to-flow price cycle.

Stock to flow model measures the new supply relative to existing supply. As with the name suggests, Stock, refers to the total existing supply, while flow is the new supply of an asset created each year.

While this measures and compares the relative abundance of scarcity, could I be a signal for us heading out of these choppy waters? Maybe.

If the aforementioned is going to be true, we have yet to seen the worst of the markets, a larger storm is incoming. This very storm will take BTC to $8-11K levels which will not only spells disaster but spiral crypto markets into complete fear.

Oh do I need to remind you that majority of cryptos follow BTC’s direction, in varying intensity.

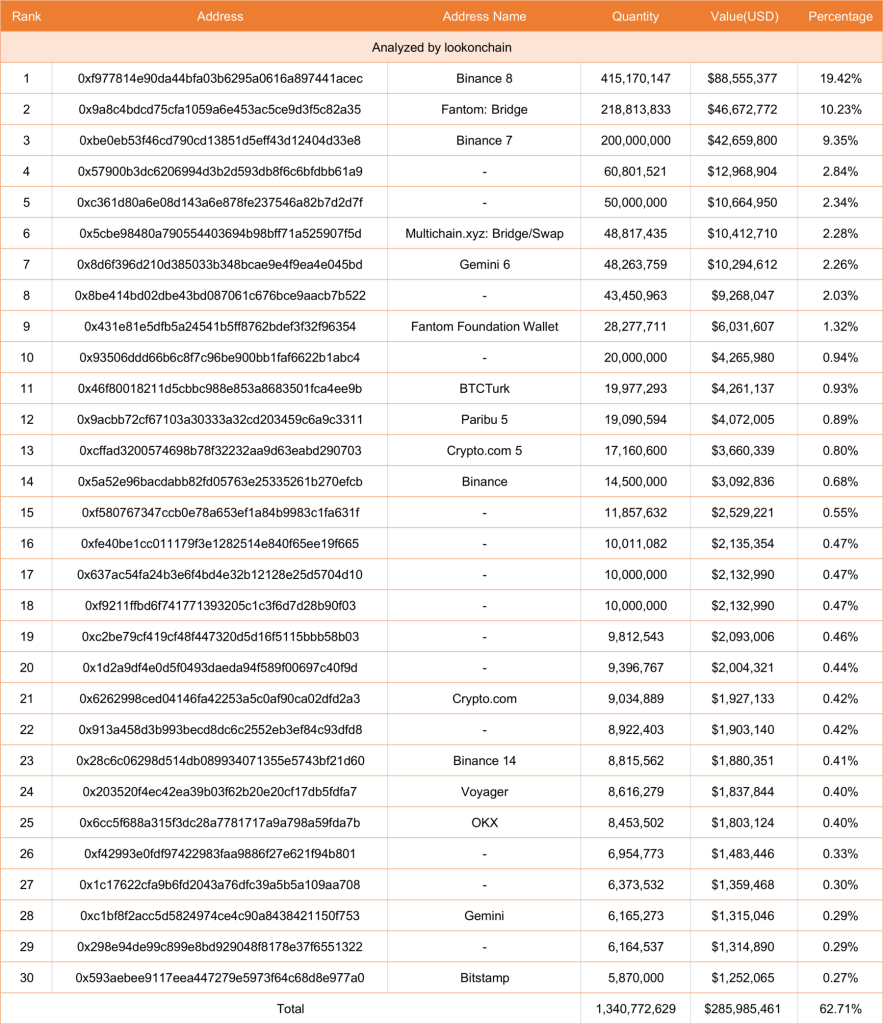

$FTM is up 20%, here’s some Fantom whales to follow 📈

$FTM is mainly used for payments, on-chain governance, network fees and securing the network through staking. Although these are rather common utility across other Layer1 tokens, its recent pump was largely contributed from the return of Andre Conje.

$FTM has a total supply of 3.175B and currently, 2.1B are currently in circulation while the rest is reserved for staking rewards.

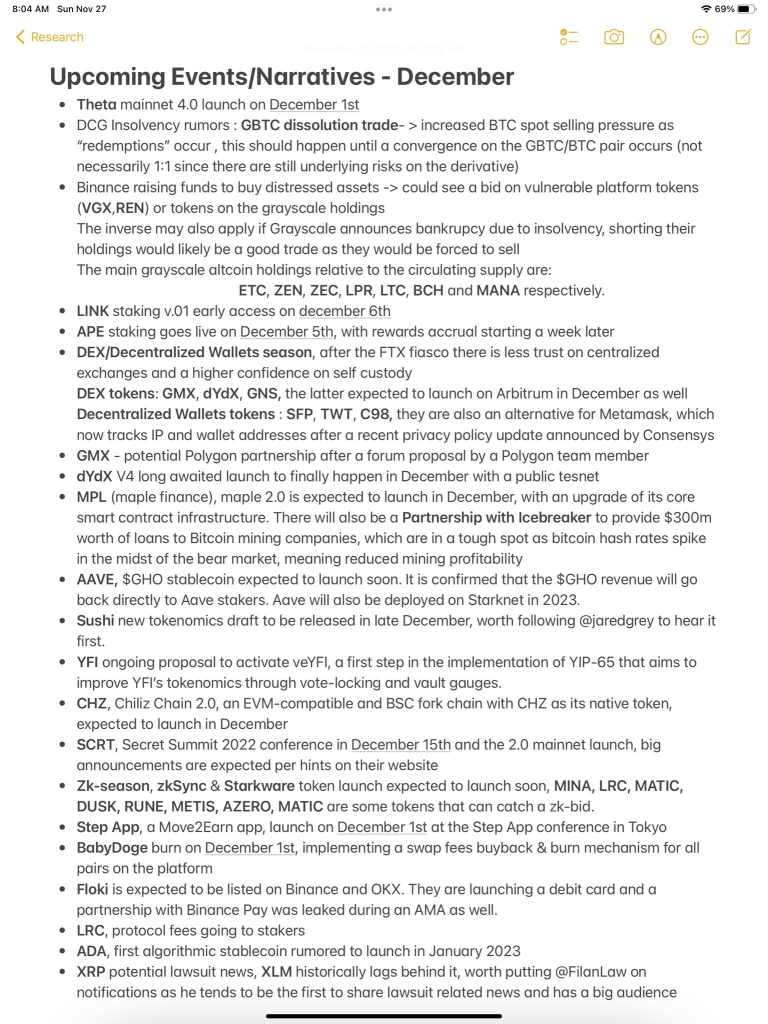

The Initial token distribution of FTM is as follows:

– 32.75% is allocated to Block Rewards

– 12.00% is allocated to Advisors/Contributors

– 6.00% is allocated to Strategic Reserve

– 1.57% is allocated to Public Sale

– 11.69% is allocated to Private Sale II

– 25.35% is allocated to Private Sale I

– 3.15% is allocated to Seed Sale

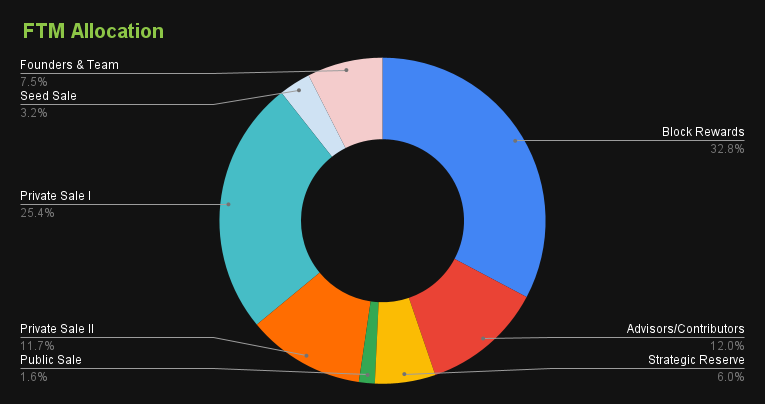

The initial token launch date for FTM is 15 Jun 2018 with an inflationary type emission rate since genesis. The supply of FTM is expected to be fully vested on 31 Dec 2025.

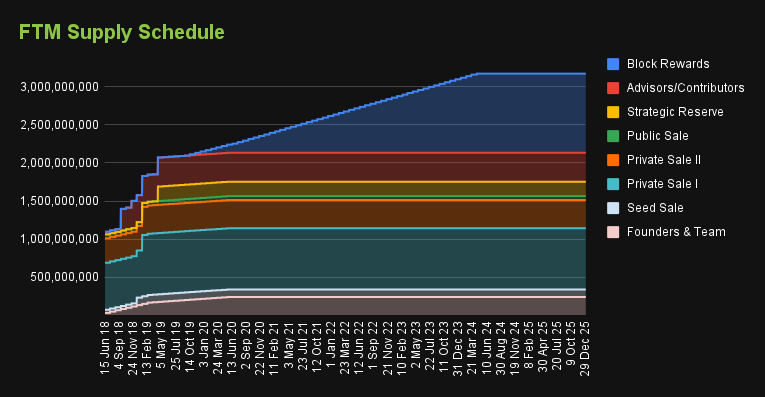

Among the top 30 holders of $FTM, they hold a total of 1.34B $FTM, accounting for ~63% of the total supply.

The distribution of tokens are not concentrated among a few addresses and instead, relatively widespread.

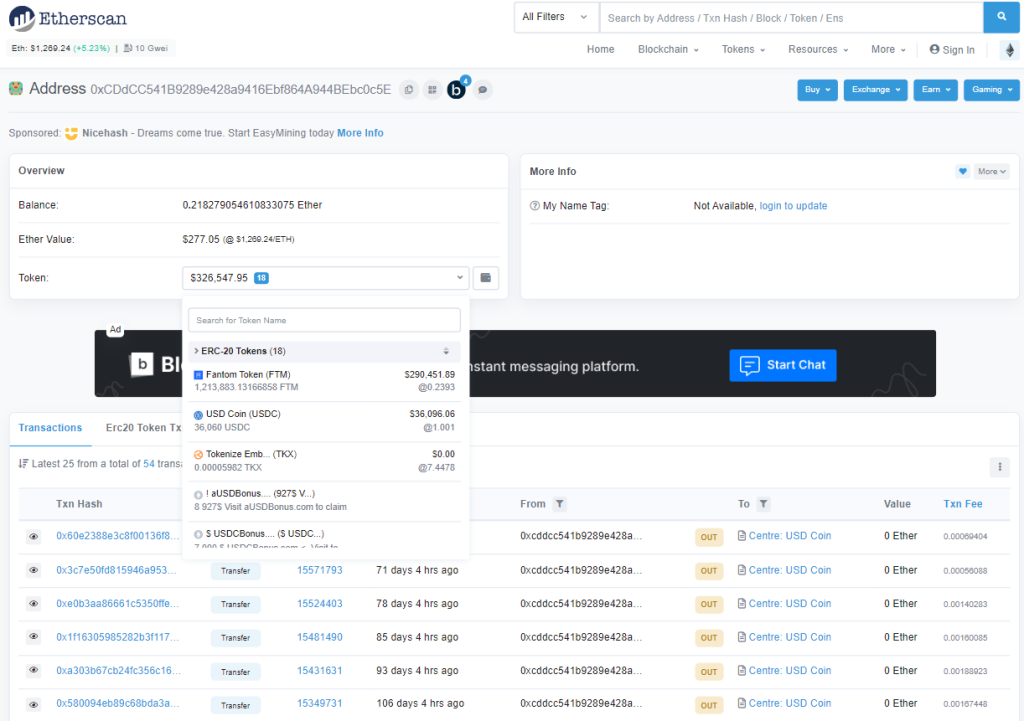

WHALE 1: 0xcddcc541b9289e428a9416ebf864a944bebc0c5e

This whale is an early holder of $FTM, buying 4M $FTM at an average price of $0.0106.

He sold 2.8M of $FTM at $1.69 in 2022 for a profit of $4.7M.

He still currently holds $290K worth of $FTM tokens.

According to Chainalysis, crypto adoption in the middle east and north Africa grew 48% year over year.

Blockchain is venturing to the underbanked, bringing self-custody, p2p payments and inflation protection around the world.

Whale 2: 0xd00671c779fe589bd95721dba80a679666c13e7c

Now this whale seems to have an excellent record at buying low and selling high. A dedicated FTM trader almost.

He is always buying the dips, good idea to copy trade when it FTM dips.

☔ Collapse in FTX, Rugs in DeFi, Here’s how to stay SAFU

📈 FREE ALPHA – How to find protocols before they go viral

🌎 Ray Dalio’s views on the macro environment

📺 The ultimate crypto youtube hack

Under the Radar: Injective Protocol

Launched on Cosmos, Injective is IBC enabled and natively interoperable with several sovereign blockchains networks. Especially with cross chain transactions between Ethereum and the Cosmos Hub, Injective provides quick transactions.

In addition, Injective’s core exchange module provides an advanced on-chain order book and matching engine for spot, perpetual, futures and options markets, resistance to Miner-Extractable Value (MEV) through frequent batch auction order matching, and zero gas fees for users.

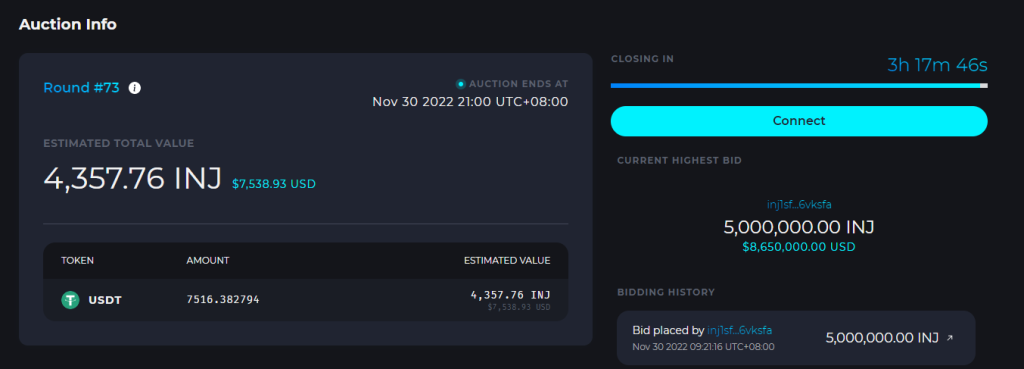

Every week, 60% of fees collected from DApps built on Injective are burned through auctions. Unlike other token burning mechanics, Injective’s auction gives users an opportunity to arbitrage by bidding on each basket.

Let me explain, imagine a total basket of $100 worth of fees and you make a bid for $90. Jacky, tops you by placing a bid for $95. Jacky wins the entire $100 basket.

Now the payment of $95 will be made in $INJ which will be burnt immediately. Soon after, a new auction period will begin, it’ll be free for all once more.

With their unique burning mechanism, $INJ is set for their biggest token burn in history, with over 5M INJ tokens are set to be burned forever.

This week’s example, user inj1sfem88pzh8pjs4lwm7lfuf9agqnktuvz6vksfa made a bid of 5M $INJ, amounting to $8.65M even when the fees collected this week only amounted to $7,538.

Not only does the bidder win, but this makes the INJ token deflationary overtime.

However, according to INJ whitepaper, there is no maximum supply cap for the INJ token and naturally inflating over time through block rewards.

While this is fine, the token emission rates are no where to be found as well. Only

If INJ is banging heavily on its weekly burning mechanism, the number of tokens burnt weekly has to be > than its inflating token emission, else, even with 100,000 $INJ burnt weekly, it might still have an NET-NET inflationary result if 100,001 tokens are printed weekly.