As the dust of the FTX saga seemingly settles, things just made a turn for the worst, especially after a 30-pager court filing for FTX’s bankruptcy was just released to the public.

While bringing justice to one of crypto’s biggest fraud artists is a necessary step for web3 adoption, the gravity of the situation may have just taken the crypto space 10 steps back.

They said 3 months in the stock market is like 3 years in the crypto, but no one told me that came with the negative aspects of a cyclical market.

It is hard to think just 5 months ago, the market got hit by the UST crash. If you are still around, I urge you to stay, let’s play the long game, we will reap the benefits of our patience…. in due time.

But of course, it is usually the hope that kills.

💥 Signs the FTX crash was bound to happen

Take a glimpse of how it all started in 2019, from the rise of the FTX empire, to how it all came crashing down due to greed.

📉Temasek has no exposure to cryptocurrencies, after writing off $275M Investment in FTX

A write-off is a reduction of the recognized value of something, in this case, Temasek, Singapore’s state-owned investor, is down badly amounting to $275M in losses. Shortly after the investment deal between Temasek and FTX, Binance took its exit from the crypto market of Singapore. Seems too much of a coincidence, no?

🍌 The dirty little secrets of FTX

There is more than meets the eye, and it is scarier than you think. We review the 30-pager FTX court filing and found out the dirty little secrets of how SBF ran FTX in his very own personal way.

The complete thread on FTX, Start to finish

We are at the bottom, It is time to accumulate

What happens to crypto post-FTX?

RTFKT is only the beginning of Nike’s master plan

Here’s why Ethereum has not meant its lows amidst the FTX crash

Under the Radar: dYdX is a decentralised exchange for perpetual contracts. Its growth in popularity is heavily contributed to the failure of CEXs, where investors find alternatives to crypto leveraging in a non-custodial manner.

Utilizing smart contracts, traders maintain custody of their assets, without trusted intermediaries. There will not be any misuse of funds here unless dictated in the codes.

The announcement of dYdX moving to Cosmos may very much be a bullish indicator. As they are not able to get more than 1000 order placements per second even with the L2 approach on Ethereum.

Its logical move towards Cosmos may undertake the role of becoming the leading decentralized perps exchange, with the lights of GMX currently leading the charge.

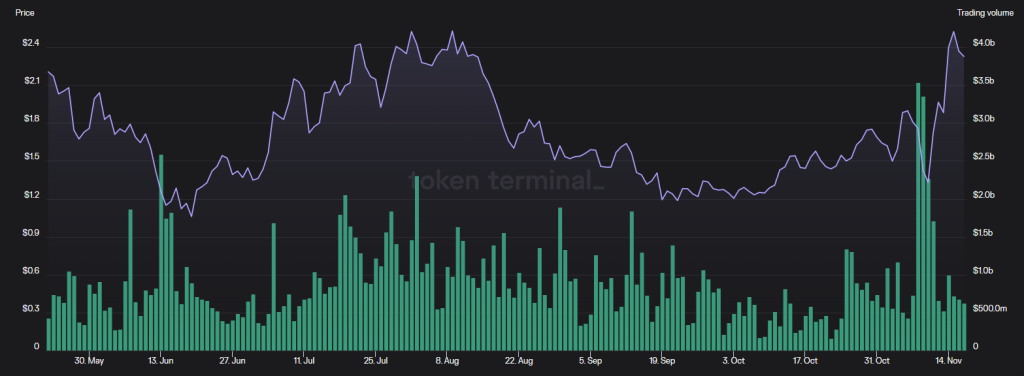

With traders straying away from centralized exchanges, it is evident that the demand in dYdX is starting to see steadily growing adoption.

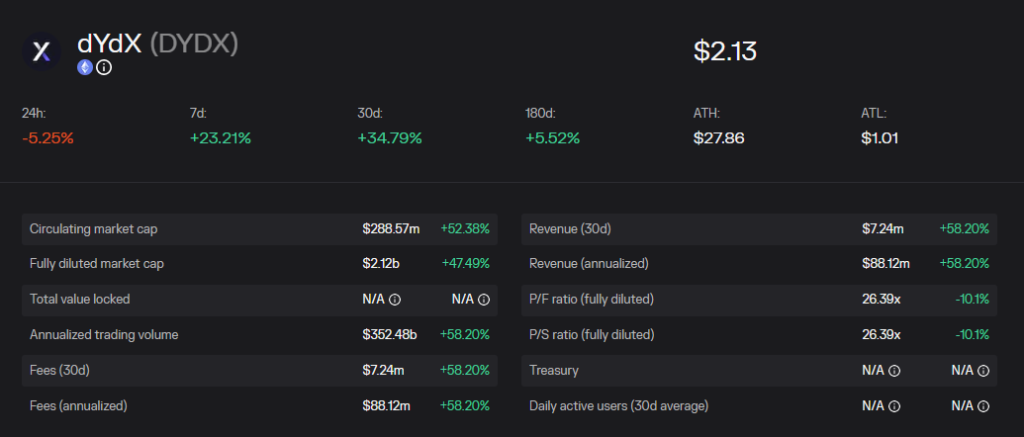

With its trading volume up 135% year on year, we see significant growth in its token value as well as its circulating market cap.

Even with sombre prices in the market, there’s one group of individuals capitalizing on the volatility of the market.; Leverage traders. What this means is a steady demand regardless of market conditions.

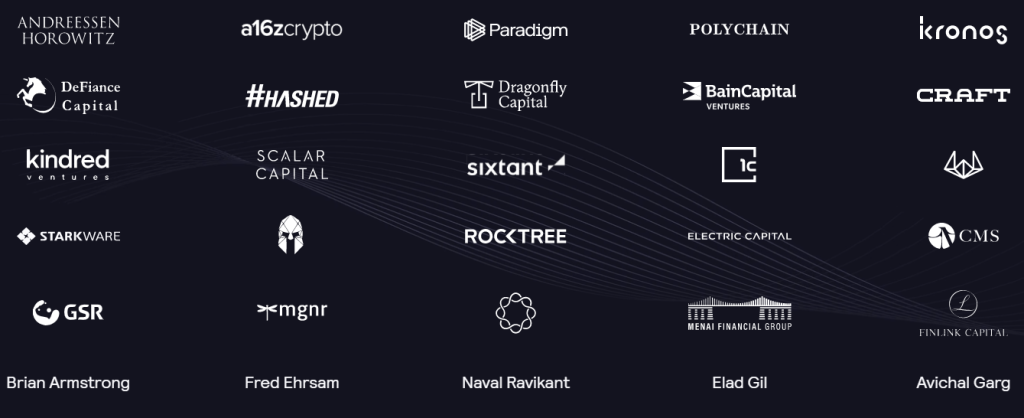

Not only does dYdX propose a viable solution for the future of trading in a decentralized manner, with its global backers consisting of angel investors and leading funds from a16z, Paradigm, Polychain among many others, may enable them to achieve their mission to be the “next generation exchange.”

Furthermore, dYdX is not in full effect yet, just waiting for the integration with Cosmos and interoperability. Game changer.

While dYdX is getting excited about Tendermint & the SDK, i personally look forward to it utilizing ground-breaking tech like Interchain Accounts & Interchain Security.

When dYdX launches, it’ll join a large family of sister chains, including multiple awesome orderbook siblings like Injective Labs, Onomy Protocol and Sei Network + a bunch of migrating Solana protocols.

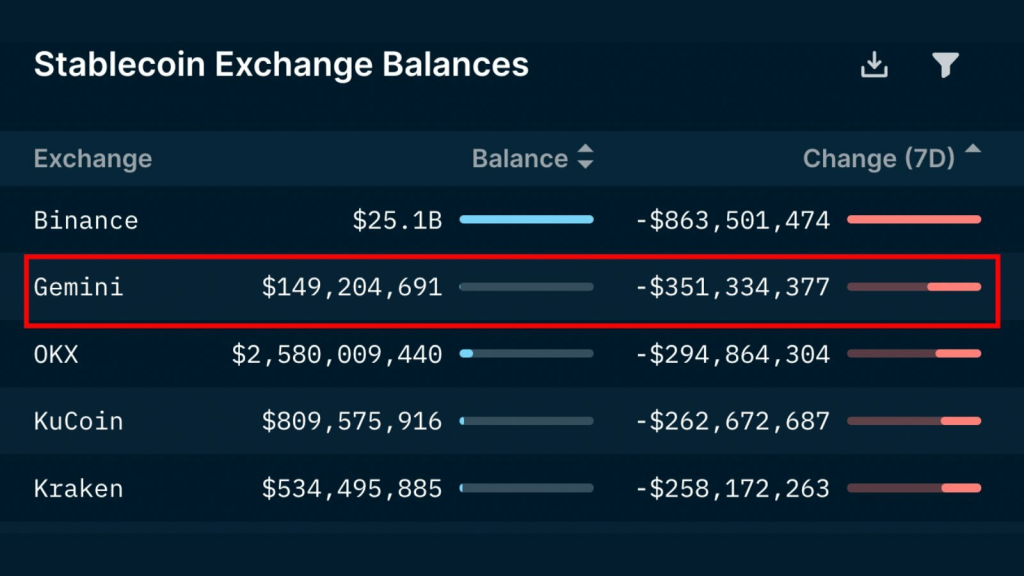

Gemini’s massive withdrawal symptoms

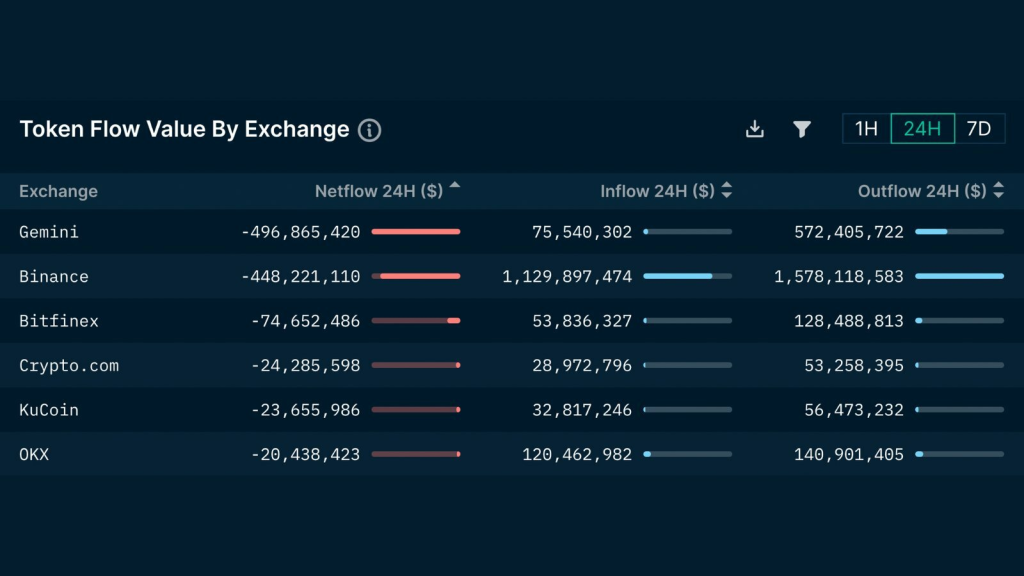

Over a 24-hour period, Gemini experienced its largest outflow of ETH and ERC20 tokens from addresses Nansen has labelled.

The outflow amounted to ~$500M which is almost 8x the total amount of inflow.

Their stablecoin balance also amounted to the second-largest outflow over the past 7 days amongst all other exchanges.

Among the top five other exchanges, Gemini is the only exchange who’s 7-day change is significantly more than its stablecoin balance.

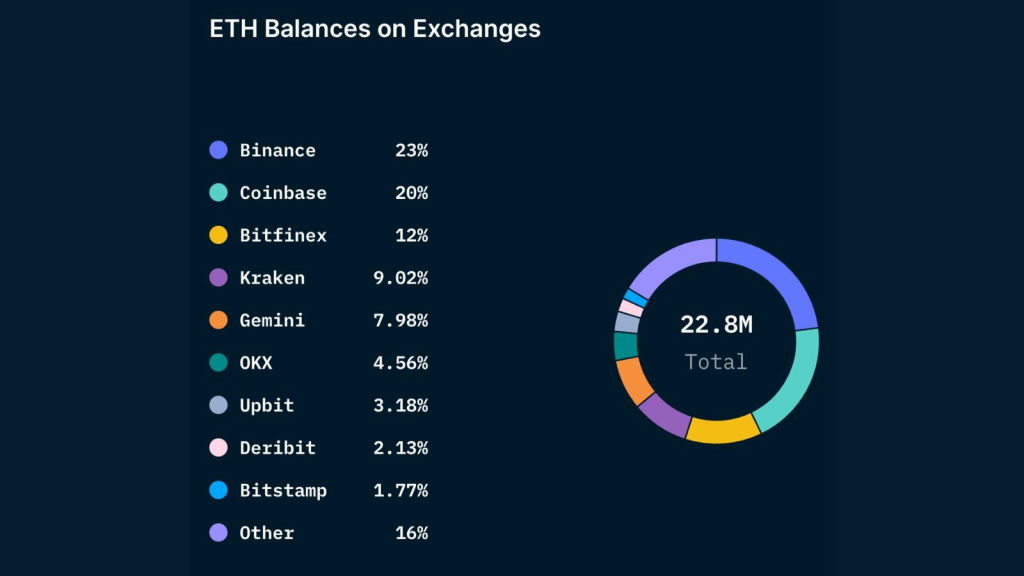

In terms of ETH, Gemini currently holds 1.8M ETH, attributing to 7.98% of all ETH on exchanges.

They also rank 5th on ETH balance amongst most exchanges, right behind, Binance, Coinbase, Bitfinex and Kraken respectively.

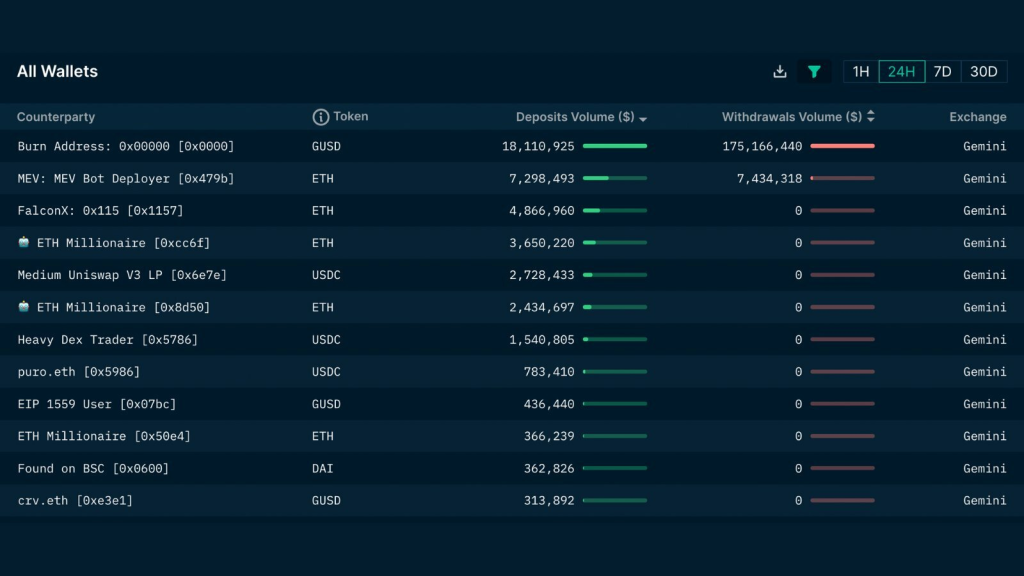

The largest withdrawals consisted of over $120M in ETH, $20M in USDC and $3M in LINK withdrawn as seen below.

Largest deposits show similar sums deposited, with ~$10M in ETH and approximately $5M in USDC.

Nansen’s Report On FTX

Key Takeaways

FTX and Alameda have had close (on-chain) ties since the very beginning.

The initial success of Alameda, FTX, and the meteoric rise of FTT most likely led to a rise in the value of Alameda’s balance sheet.

With the collapse of Terra/UST in May, a liquidity crunch ensued as many creditors started to call back loans following the 3AC and Celsius crashes.

Based on the data, the total $4b FTT outflows from Alameda to FTX in June and July could possibly have been the provision of parts of the collateral that was used to secure the loans.

Revealed by the leaked balance sheet of CoinDesk, net equity in Alameda’s business had consisted of FTX’s own centrally controlled token, FTT.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief