Dear Chain Debrief Community (still thinking of a name),

It has been a hot minute, but we are back, this time with a brand-new format and revamped content.

Our goal since day 1 has not changed, and that is to help you navigate the world of crypto. On top of the latest market news, we selectively handpicked, this newsletter will also include curated content across all verticals in crypto in the form of Twitter threads to projects under the radar.

We also wanted this avenue of content to be a notch higher than all our other channels. So expect to get various market insights not only within Web3, but also on the macro scale. Of course, none of this constitutes financial advice.

Buckle up, and sit tight, it’s a long and bumpy road ahead, but it’ll be a worthwhile journey.

🐻 APTOS just launched their Mainnet and token, But did it live up to the hype?

With a valuation of $2B, Aptos’s aim was to bridge the gap between Web2 and Web3 with the goal of mass adoption in its sight. The newest blockchain claims a TPS of 160,000, 4 times faster than Solana’s! But during launch, the TPS was only 4. LOL.

🤝 Arbitrum Acquires Prysmatic Labs, a core team behind Ethereum’s Merge

A tale of Layer2 joining forces with a Layer1 client team.

📺 Do Kwon of Terra says “It Was Never Really About Money Or Fame Or Success”

The co-founder of Terraform Labs discusses the charges against him, gives a message to Terra victims, answers allegations about potential fraud and non-transparent business practices and much more.

Here, we aim to bring insights into notable projects which are under the radar. Not limited to any blockchains, in particular, we are going boldly to showcase overlooked projects that show growing strength based on their on-chain metrics.

We may even dive into their project’s tokenomics. (only if you ask nicely)

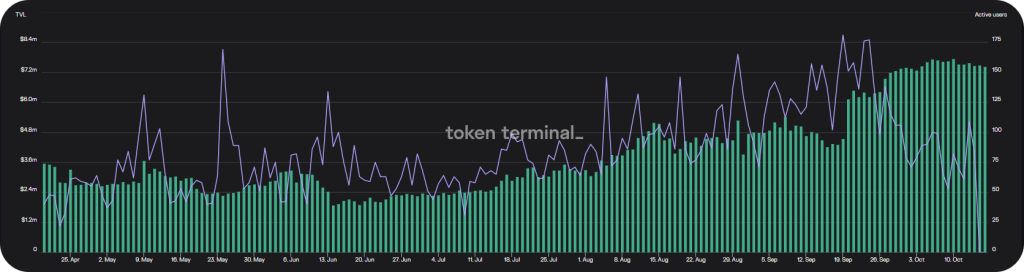

Under the Radar: CAP Finance is a decentralized exchange specializing in synthetic trading and synthetic market making. This protocol feeds into the “Real Yield” narrative, where protocols payout yield to users based on revenue generation.

The rising trend of TVL and Active Users shows a growing appetite for the growing derivatives market. With a market cap of $15.09m, though miles away from its competitors, dYdX and GMX, they offer zero fees for traders.

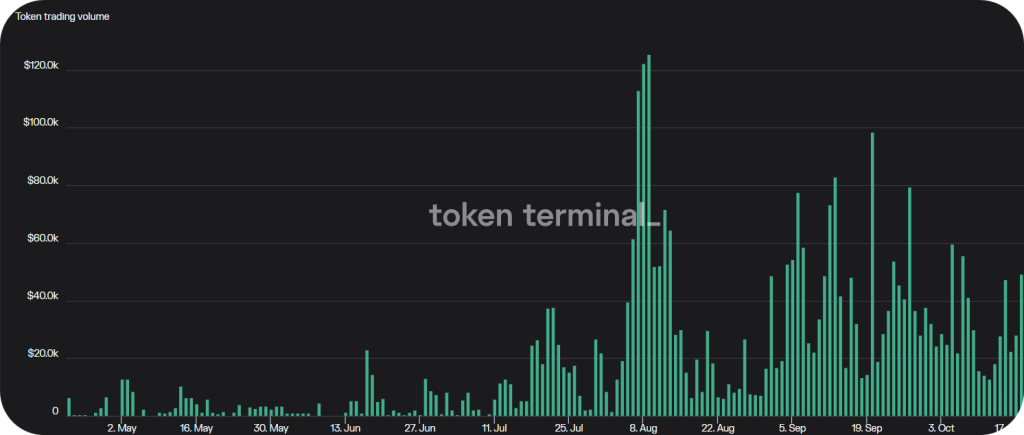

Token trading volume has also been on a steady rise. However, with the bear market upon us, and our “survival instincts” naturally heightened, a project with an undoxxed team might be a point of concern.

From the profile pictures of NFTs to DeFi being a new way of earning, we wanted a section where we could especially select information after scouring the various verticals Web3 has to offer and package it in a sweet and concise manner.

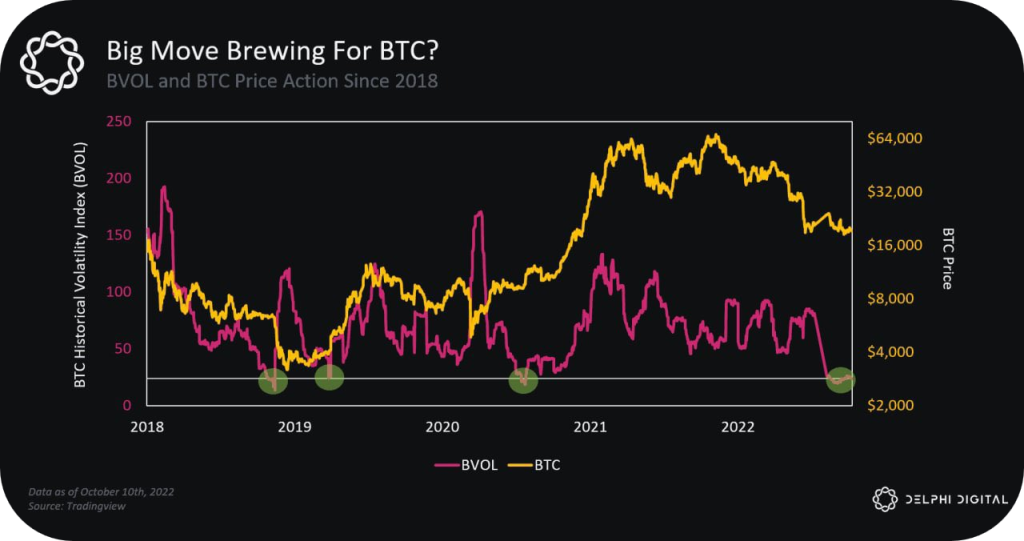

Bitcoin’s Volatility 📈

BVOL is the measure of Bitcoin’s historical volatility. The higher the BVOL score, the more volatile and riskier BTC as an asset is. The market trading sideways would likely lead to a lower BVOL score.

A low BVOL score is usually followed by an explosive move in price in either direction. Since 2018, Bitcoin has only been reduced to low levels of volatility only four times, currently, we are in one of those times.

Could we see another leg upwards? Or do we continue to search for the bottom?

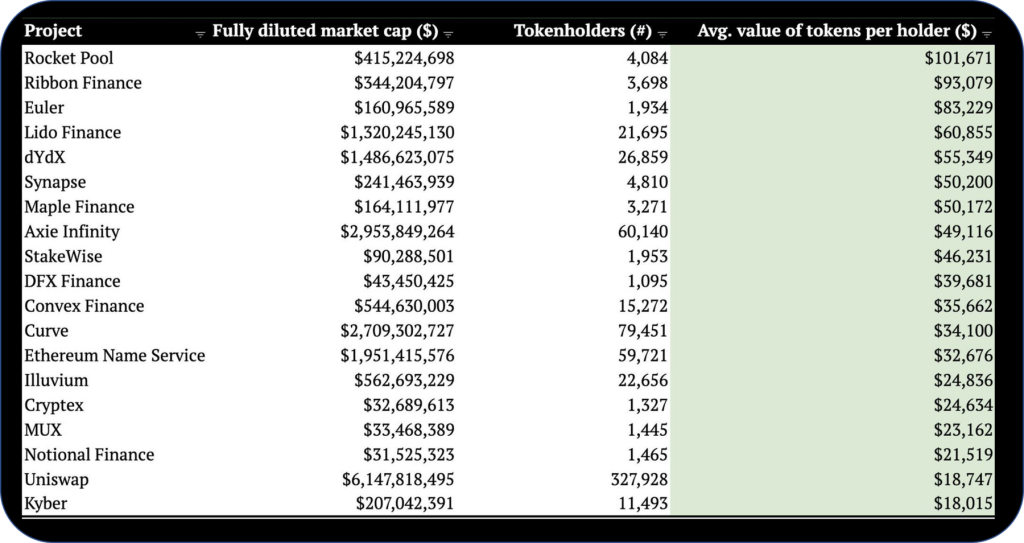

Protocols With The Richest Holders 💰

Going down the list of protocols, it might be wise to take a look into projects which you have not heard of. Map them all out with the narrative they fall under, and you may realize two things, either a narrative you already know of, or ones which are undiscovered.

However, having a project which has a higher average value per token holder does not guarantee worthy investment, especially when the number of token holders is low, you may be susceptible to a dump. On the flipside, you now know where “whales” are farming and where their foot is in the game.

LayerZero Airdrop: An Omnichain protocol which raised $135M let by A16z, FTX and Sequoia Capital

_________________________________________

Arbitrium Airdrop: One of the most vibrant ecosystems building on Ethereum, Arbitrium is set to drop their tokens in the future

_________________________________________

_________________________________________

SUI Airdrop: Backed by FTX, Binance, Coinbase and A16z, SUI’s airdrop may have a huge potential

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief