Arbitrum and Optimism are the two most exciting ecosystems to be born as an L2 on Ethereum. Today we look into how they compete regarding users, developers and volume and find which winner will emerge in 2023.

How are they different?

Many say rollups will be the centrepiece of 2023, but why?

Scalability has been a long-faced issue for Ethereum. While they have been working on EIP-4844, aka Proto Danksharding, which decreases the transaction fees by 10-100x, it will still take a while to complete. Until then, L2s are perfect substitutes to solve the scalability issue with Rollups.

Rollups are a way to make blockchain faster and more efficient. They take the heavy lifting off the main blockchain and move it to a separate layer to process more transactions in less time and lower fees.

Optimism uses a single-round fault proof to validate transactions and employs the Ethereum virtual machine. In contrast, Arbitrum uses multiple-round fault proofs and runs its virtual machine, the Arbitrum virtual machine.

Arbitrum and Optimism are Optimistic rollups, meaning multiple confirmations are unnecessary, as transactions are verified upon block creation.

Although they both possess the same type of rollup, their differences lie in how they conduct fault proofs and EVM compatibility. This difference is almost too significant to ignore, with Arbitrum having a clear lead over Optimism in the number of unique contracts deployed.

TVL

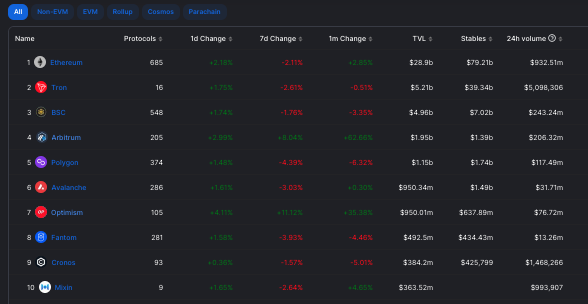

Arbitrum and Optimism are the two largest L2 today. Both saw significant growth despite market conditions, with a combined TVL of ~$3B today.

Currently, protocols within Arbitrum are almost double that of Optimism at 205 and 105, respectively. While nearly incomparable to the TVL on Ethereum, both layer2s poise as an alternative to DeFi on the mainnet, with faster transaction speeds and cheaper fees.

Daily active address

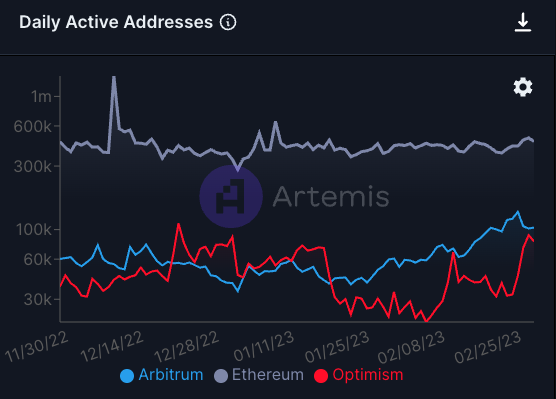

We see how lively each ecosystem is by looking at the daily active address. DAA will represent the number of unique wallets on a given day that sends or receive crypto. The higher the DAA number, the more active the network is, which likely translates to higher fees collected and revenue.

Here is how the layer2s lined up against Ethereum. Arbitrum and Optimism both garnered positive growth in their DAA, an increase of 304% and 462%, respectively, while Ethereum held steady and trended sideways while retaining the highest DAA.

Daily transactions

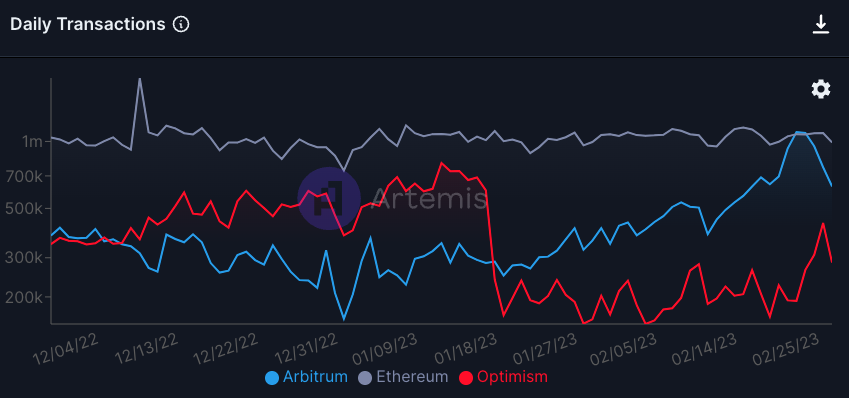

Interestingly, let’s look into the daily transactions among the three chains. We see on the 21st Feb that Arbitrum slightly edged out the daily transactions on Ethereum, both racking in 1.1M in daily transactions, while Optimism consolates at 192K.

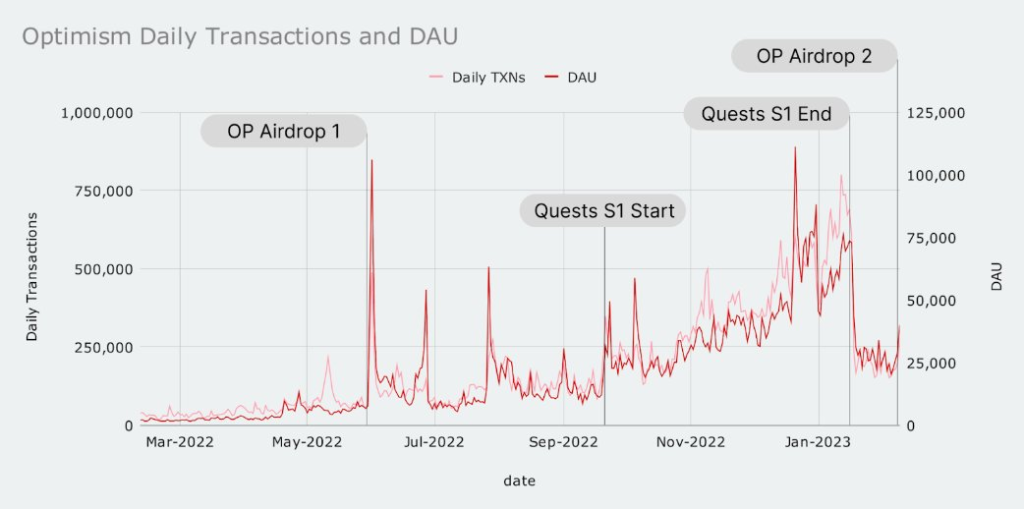

The significant drop seen in Optimism is also correlated to the end of their NFT incentive program at the end of January.

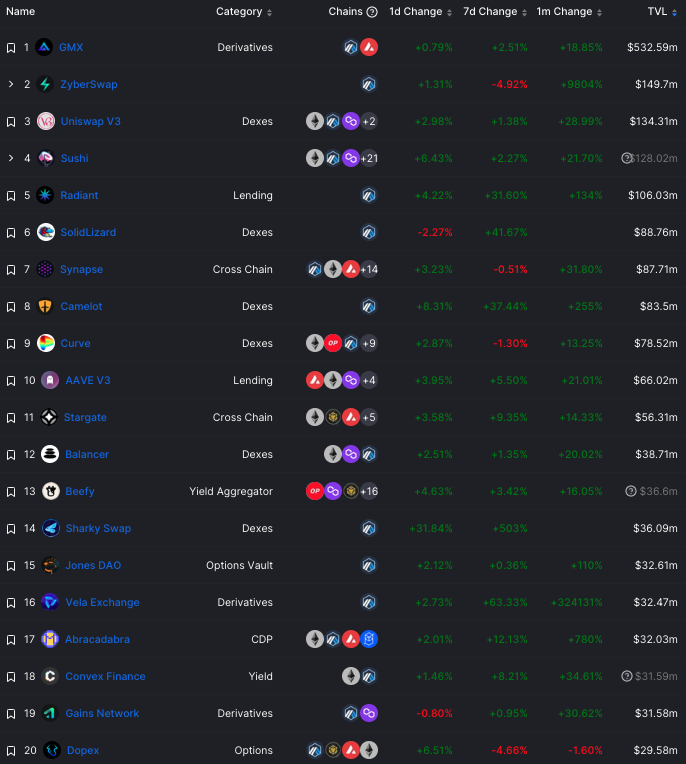

Since the start of 2023, Arbitrum has been on an upwards swing in this department. The introduction of dexes such as Zyberswap and SolidLizard, lending protocol Radiant and derivatives protocol Vela exchange boosted the ecosystem even more with the leading protocol, GMX.

If you were to pick one protocol of the top 20 on Arbitrum randomly one month ago, you’d likely be up with Only Dopex saw negative 1-month changes.

Similarly, Optimism’s ecosystem also showed similar results, with the biggest winners going to Velodrome and Beethoven X.

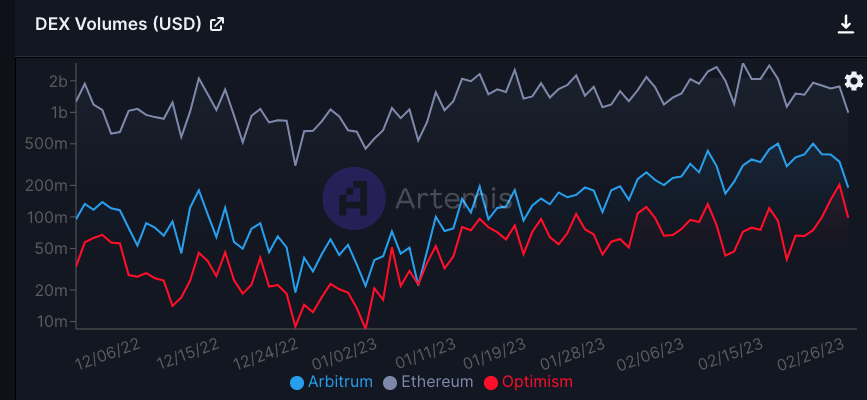

Volume

Looking closely at the DEX volumes, we also see a rising trend across the board. While the adoption of DeFi is starting to pick up, we see one of Arbitrum’s Dex, Zyberswap, surpassing Uniswap regarding TVL on Arbitrum.

On the other hand, Optimism saw a solid performance from its leading Dex, Velodrome, bringing in $312.8M in TVL, occupying almost a third of the Optimism ecosystem.

Velodrome. One of the first dexes built on $OP

— The Whale Plug 🐋 (@iamwhales__) January 25, 2023

Velodrome isn't just a dex it's the ultimate dex

Today I'm going to write a thread 🧵 on what Velodrome is all about, and why it should be in your radar in 2023

Read on 👇@VelodromeFi pic.twitter.com/2BXN0wseeS

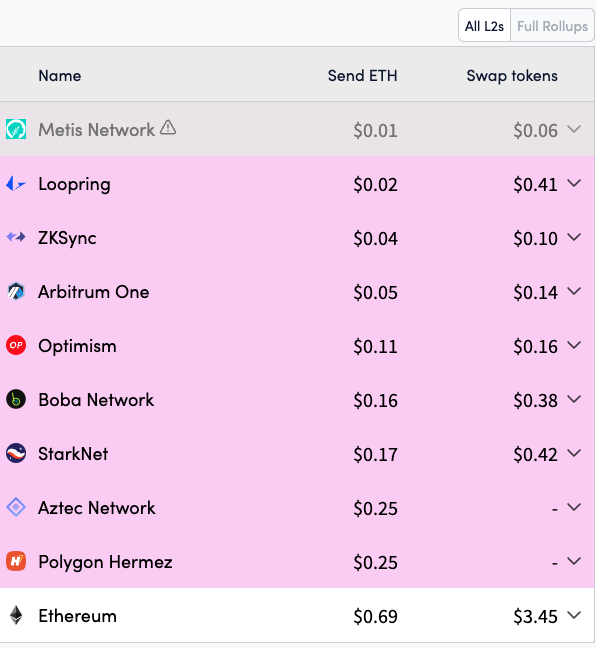

Fees

According to L2 fees, sending ETH on Optimism costs 2x higher than Arbitrum. However, the cost to swap is thereabouts equal.

Token vs No Token

Optimism leads the way as it airdropped the launch of its $OP tokens to active community members in 2022. $OP is a governance token that enables holders to make decisions for the community, and Optimism will use the token emissions and revenue generated to fund community projects.

Alongside the $OP token, the Optimsm Collective and the Optimism Foundation were also created. With Coinbase entering the scene with “Base” and adopting Optimism as its L2 of choice, a percentage of the fee from it will be paid to Optimisim collective could skew demand in favour of Optimism over Arbitrum.

Also, Read Coinbase Launches An Ethereum Layer 2 Blockchain, But No Token Included

On the other camp, Arbitrum only has its community members clamouring for a token. This comes with the expectation of a similar airdrop to Optimism, but even still, large transaction volumes have been observed on the Arbitrum network without a token.

Arbitrum is still centralized, as Offchain labs lead its activities.

There's a lot of buzz lately around the potential Arbitrum airdrop.

— CharlieX | DeFi (@CharlieXDeFi) February 20, 2023

But why would you even need a native token if you didn't need it back in 2019? pic.twitter.com/BxzrEyw3xN

Follow the liquidity?

On Arbitrum, the Odyssey resulted in an explosion of user (wallet) growth and network activity. The team eventually had to pause the Odyssey due to the network’s stress (pre-Nitro upgrade).

Since then, the network has continued to grow, with new protocols popping up on the top 20 charts monthly. As mentioned in the previous segment, their growth without a token has brought them significant daily transactions, showing their product offering has a solid product market fit.

Over on Optimism, the first token airdrop resulted in a jump in daily active users and daily transactions as users rushed to claim the airdrop.

Before the first airdrop and OP quest, network activity saw growth of 253% and 166% in active users and daily transactions, respectively. However, network activity plummeted to 50% after the quest ended, hovering around pre-quest levels.

This shows that although quests successfully incentivised activity growth, it was not sustainable in significant long-term retention.

Closing thoughts

There is no doubt both Optimism and Arbitrum have grown significantly this year. Regardless of the winner, value accrual will be derived towards Ethereum, making a case for the flippening over Bitcoin ever stronger. Even with Arbitrum already flipping Ethereum on daily transactions, there are questions about Arbitrum being centralized, which could pave the way for Optimism to take over with introducing Coinbase’s new product.

Also Read: Who Will Win The Decentralized Stablecoins War?

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief