Stablecoins are rapidly becoming a vital component of the DeFi ecosystem. These crypto assets, fixed to the value of a fiat currency – often the US dollar, provide a stable reservoir of value that can be used to execute various transactions. Today, we look into AAVE GHO and Curve crvUSD as the decentralized stablecoins of the future.

Introduction

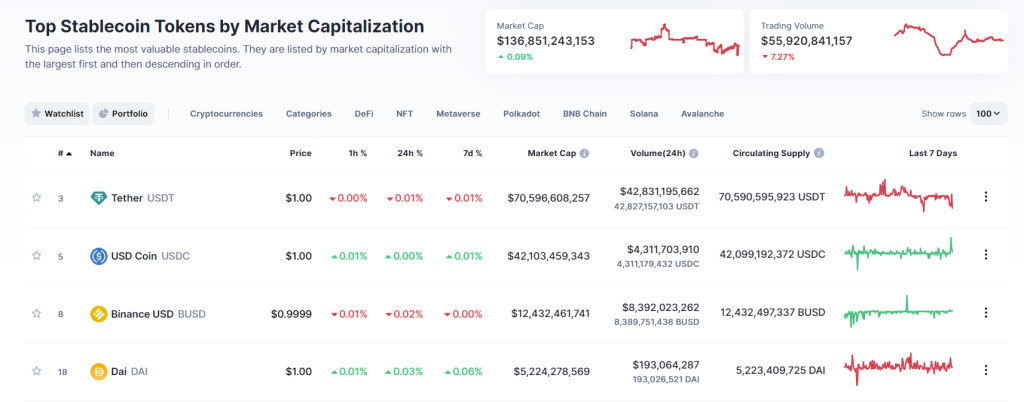

According to data from CoinMarketCap, stablecoins boast a total market capitalization value of a whopping $136 billion, with USDT (Tether) contributing over half of that figure. BUSD (Binance), TUSD, and USDP are other prominent stablecoins in the market today.

However, some crypto assets are centralized, which means they are regulated by a central authority and are liable to the same risks as any centralized financial system.

Fortunately, we are beginning to see the introduction of decentralized stablecoins. Unlike their centralized counterparts, these stablecoins are free from control by any

single authority. Examples of these decentralized stablecoins include GHO and crvUSD, which are native to the two DeFi giants, Aave and Curve Finance, respectively.

In this article, we’ll review the ‘GHO vs crvUSD’ stablecoins battle, explaining how they work, their different operating mechanisms, and how they keep their value stable.

AAVE’S $GHO

$GHO is a multi-collateral stablecoin native to Aave with one of the largest liquidity protocols in the DeFi ecosystem. This decentralized coin is designed to offer stable value to the users of the Aave protocol, curtailing the need to rely on centralized exchanges and traditional financial institutions. The GHO stablecoin is backed by a ‘pool’ of other crypto assets, including the Ethereum token (ETH).

Aave is owned and controlled by the Aave DAO, a community of token holders participating in the protocol’s governance. Aave DAO also manages the ‘pool’ financing the GHO token, making it the first stablecoin in the DeFi space to be governed by a DAO.

This can be considered a massive advantage to the protocol and its users as those who stake the protocol’s AAVE governance token may borrow $GHO at a discounted rate.

Furthermore, the Aave DAO will also determine the token’s supply, interest rate and risk parameters. The DAO will receive all interest fees during the GHO loan period, a clear distinction from lending and borrowing all other digital assets on Aave.

Here is all you need to know about $GHO, a flexible and decentralized stablecoin by @AaveAave.

— ipor_intern (@ipor_intern) October 16, 2022

How does it aim to solve the stablecoin trilemma?

Let's find out 🧵👇 pic.twitter.com/RRxtu8AsiC

$GHO launches on Ethereum testnet

Earlier this year, Aave deployed its native stablecoin, GHO, on the Görli testnet – one of Ethereum’s most notable testnets. This test launch is an important step toward fully integrating stablecoins into the Aave protocol. Moreover, it enables the Aave DAO to analyze the stability and operation of the GHO token within the protocol before it finally launches on the Ethereum mainnet.

Yesterday AAVE launched their stablecoin $GHO on the Ethereum Goerli Testnet.

— Airdrop Official (@its_airdrop) February 10, 2023

It's a multi-collateral stablecoin native to AAVE.

🧧You can free mint the genesis testnet launch remembrance NFT here: https://t.co/AFaIe6lvQw pic.twitter.com/LqLzTTQGOG

$GHO and its Benefits

Incorporating the GHO stablecoin into the Aave protocol offers a variety of benefits to its users. For example, users can access a stable reservoir of value on the liquidity platform, lowering the need to entrust their assets with CEX and financial assets.

Additionally, integrating GHO brings more stability to the lending and borrowing process on the Aave platform.

Off the Aave protocol, GHO will be utilized as a multipurpose stablecoin, providing owners with a non-volatile reserve of value, which can be used for various purposes, like purchasing goods and services, DEX trading, and so on.

Curve Finance $crvUSD

Curve Finance is one of the world’s leading decentralized exchanges. Commonly known as Curve.fi, this DeFi protocol provides liquidity to execute stablecoin trades via multi-asset pools while maintaining low fees and minimal slippage risks. Curve, which already has a native token – the Curve DAO token (CRV), is looking to launch its own stablecoin called crvUSD.

Also read: Is Curve’s New Stablecoin DeFi’s Biggest Innovation Of 2022?

The LLAMMA Mechanism

According to the project’s whitepaper on GitHub, the core idea backing the decentralized crvUSD stablecoin is the lending-liquidating AMM (Automated Market Maker) algorithm (LLAMMA). This algorithm operates by alternating between a given collateral and the crvUSD stable coin, depending on which asset has a higher or lower value. So, if the deposited collateral dips in price, LLAMMA works by converting a portion of it to the stablecoin; this aims to preserve the value of the collateral and reduce collateralization risk.

1/ Curve just released the Curve stablecoin docs.

— Ignas | DeFi Research (@DefiIgnas) November 22, 2022

The biggest innovation is Lending-Liquidating AMM algorithm (LLAMMA).

So, how does it work?

*I'm learning as I'm writing this thread*

Furthermore, while gradual, LLAMMA’s liquidation mechanism is fully automated from start to finish. Another significant advantage is that users do not risk having their entire position liquidated. However, there is still a potential drawback, as LLAMMA’s rebalancing technique can lead to a loss in situations of outsized volatility.

crvUSD and its Stable Value

As with other stablecoins, the crvUSD token is designed to track the value of the US dollar. It maintains a steady exchange rate with the dollar through a stablecoin pool regulated by the PegKeeper – an automated smart contract. As discussed in the coin’s whitepaper, the PegKeeper ensures crvUSD’s price is kept at $1 in two primary ways.

The PegKeeper will mint and deposit uncollateralized crvUSD to the stable pool when the coin’s price exceeds $1. On the flip side, if crvUSD’s price is less than $1, the smart contract will withdraw and burn some of the stablecoins in the pool.

Aave’s GHO vs Curve’s crvUSD; Which is Better?

Quite frankly, there is no clear-cut answer to which of the GHO or crvUSD stablecoin is better. Choosing the better one of these decentralized stablecoins boils down to personal preference. After all, they employ distinct innovative mechanisms, and their use cases are somewhat unique on their various platforms.

10/11 We see $crvUSD and $GHO as models that offer unique appeals to different users.

— Wallfacer Labs (@wallfacerlabs) February 2, 2023

Both have clear paths to success. Which approach users favor likely depends on preferences between rules-based vs. discretionary governance, and belief in Aave and Curve’s respective ecosystems

For example, the GHO stablecoin ushers in the concept of “facilitators,” which are entities or protocols with the capacity to trustlessly mint – and burn – GHO. Various facilitators can utilize different techniques for the minting of the GHO stablecoin. That said, every facilitator has to be authorized by the Aave Governance.

Curve’s crvUSD, on the other hand, implements its own mechanisms, the chief of which is the LLAMMA. With the lending-liquidating AMM algorithm, collateral positions will only be gradually liquidated as the collateralized assets are slowly converted to the stablecoin. Undoubtedly, the LLAMMA mechanism improves existing stablecoin mechanisms, as it helps prevent losses by slippage, especially due to market volatility.

We cannot say that either of the AAVE GHO and Curve crvUSD as decentralized stablecoins is the better project. And while they may share some similarities, these coins are based on distinct mechanisms and concepts. That said, it is abundantly clear that both decentralized stablecoins will shake up the stablecoins market and enhance the services of their respective protocols.

Closing thoughts

Despite the recent failure of some stablecoins, we’ve seen the interest in stablecoins continue to build. That said, GHO and crvUSD offer renewed hope to the stablecoin market, bringing a different dimension to the DeFi world. With the backing of big companies and inventive protocols, it will be intriguing to watch how these decentralized stablecoins fare against each other while aiming to dethrone their centralized counterparts.

Also Read: Betting On Stablecoin Death Spirals With Y2K Finance

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

This article is done by our freelance writer, Opeyemi Sule

Featured Image Credit: ChainDebrief