With the SEC clamping down on Binance’s stablecoin BUSD, we are once again reminded of the reason Bitcoin was birthed. While ponzis stole the show in 2022, a strong message of censorship-resistance and decentralization is at the core of the world of cryptocurrency.

However, for a truly decentralized truly decentralized economy to work, a decentralized stablecoin is required, which we have yet to fully reach. Although projects like Frax and DAI have emerged, they are either held back by capital inefficiency or the need for more centralized stablecoins such as USDT for collateral.

Furthermore, a decentralized, fully algorithmic stablecoin like UST eventually collapsed due to overzealousness and the nascency of its risk market.

While we may not be able to create such a product just yet, the introduction of a proper risk market to hedge the downside of just risks could be a huge stepping stone for not just a decentralized stablecoin, but also for many liquid-staked derivatives out there.

Also Read: Passive And Index Investing In Crypto With Alongside

Hedging De-Pegs With Y2K Finance

Christened after scares that of impending worldwide doom at the turn of the century, Y2K finance seeks to allow market participants to hedge or speculate on pegged risked assets including:

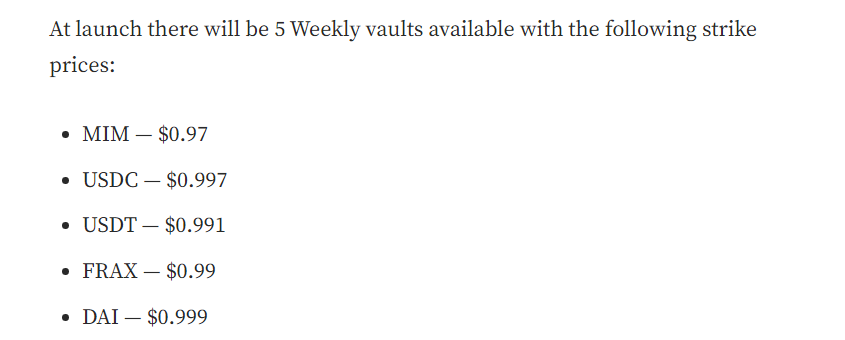

- Stablecoins USDT, FRAX, DAI, MIM

- Liquid Staking Derivatives: stETH, frxETH

- Wrapped Cryptocurrencies: wBTC

However, new vaults can be added or taken away depending on market conditions. For example, a BUSD vault was added during the SEC’s crackdown, which users could employ to hedge their BUSD risk.

Founded by Crypwalk and 0xdrej, Y2K’s flagship product, located on the Arbitrum Network, is named Earthquake, with Tsunami and Wildfire in the works.

Earthquake

The ironically named Earthquake is the foundation of their protocol, and offers two vaults:

- Hedge Vaults, where users deposit $ETH to “buy” insurance against their positions

- Risk Vaults, where users deposit $ETH and earn fees and yield if there is no major de-peg

Users can deposit their $ETH before the end of an epoch, after which their deposits will be locked for either a week or a month, depending on the kind of vault. The vault also takes a 5% fee on all types of vaults, as well as and additional 5% on risk collateral yield.

📢 Monthly + Weekly Vaults are now officially live!

— Y2K Finance (@y2kfinance) January 9, 2023

This new Epoch contains the following assets: $MIM, $USDT, $USDC, $FRAX, $DAI.

Deposits will be closing in less than 2 + 6 days respectively at 11:59pm UTC.

Good luck 🙂💥https://t.co/TsuDW9VpZE pic.twitter.com/YMOSxPdIxc

During the locked period, Chainlink oracles measure the asset pairs, and should there be a deviation greater than the listed strike price, the “Risk Vault” will be liquidated and rewarded to “Hedge Vault” depositors proportionate to their deposits.

Of course, the opposite is also true, and deposits in the “Hedge Vault” will be paid out to those in the “Risk Vault” should there not be a major de-peg.

However, “Risk Vault” depositors will always receive a premium regardless of the outcome for their participation.

Wildfire & Tsunami

Wildfire will be a secondary market for receipt tokens users get after depositing in either Hedge or Risk Vaults on Earthquake. Depositors will be able to sell their receipt tokens to others at an agreed price in order to immediately liquidate their position.

The buyer usually gets a discount for taking the other side, and will therefore profit a premium at expiry.

Tsunami, on the other hand, will serve as an on-chain derivatives alternative, and will be a Collateralized Debt Obligations-powered lending market for pegged assets.

Value Proposition of Y2K

During the height of $UST adoption, two protocols were receiving massive attention within the LUNA community.

These were Kujira and White Whale, two protocols that sought to cushion the blow of a falling LUNA and hedge risk should a de-peg occur.

While their progress was stunted due to the collapse of their native blockchain, many saw the potential it had, especially given that their network was built around the requirement for $UST to hold its peg.

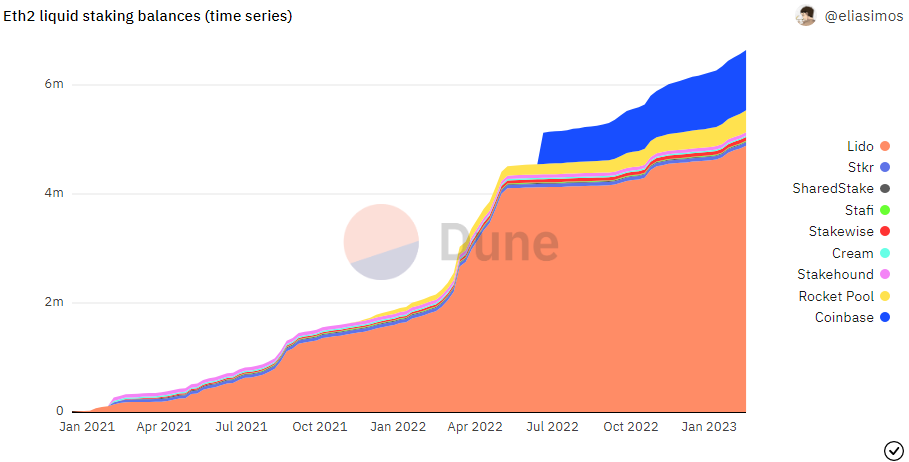

Although Y2K may not have the “auction market” style that Kujira has, the rise of Liquid-Staking Derivates has once again brought about the importance of tokens being able to hold its peg, or at least the ability to hedge it.

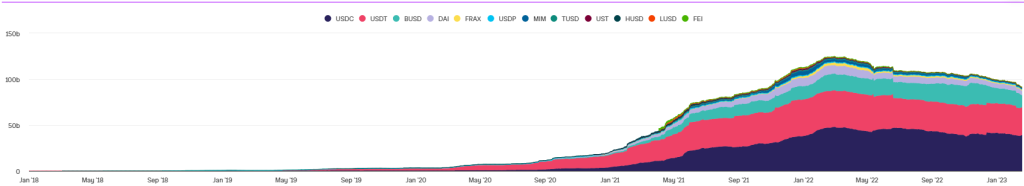

Stablecoin supply showed massive growth over the last few years, and Liquid Staking Derivatives for just Ethereum have more than tripled since the start of last year.

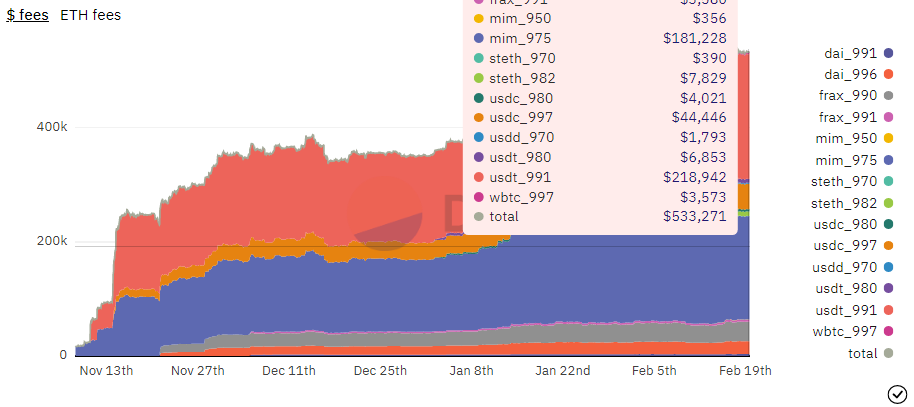

Y2K Finance has already generated ~$500K in fees in just 3 months, and attracts ~$100K in monthly deposits consistently for its vaults, with both fees and deposits spiking during major events.

With such a large market for pegged assets, however, Y2K Finance could turn out to be a promising project, especially once the bull market returns, or as uncertainty over pegged assets returns.

Y2K Tokenomics and Partnerships

Through an Initial Farm Offering (IFO), Y2K distributed an initial 5% of total supply to users actively using their vaults.

Their token, $Y2K, does not have a listed maximum cap on supply, with users earning $Y2K from incentives instead.

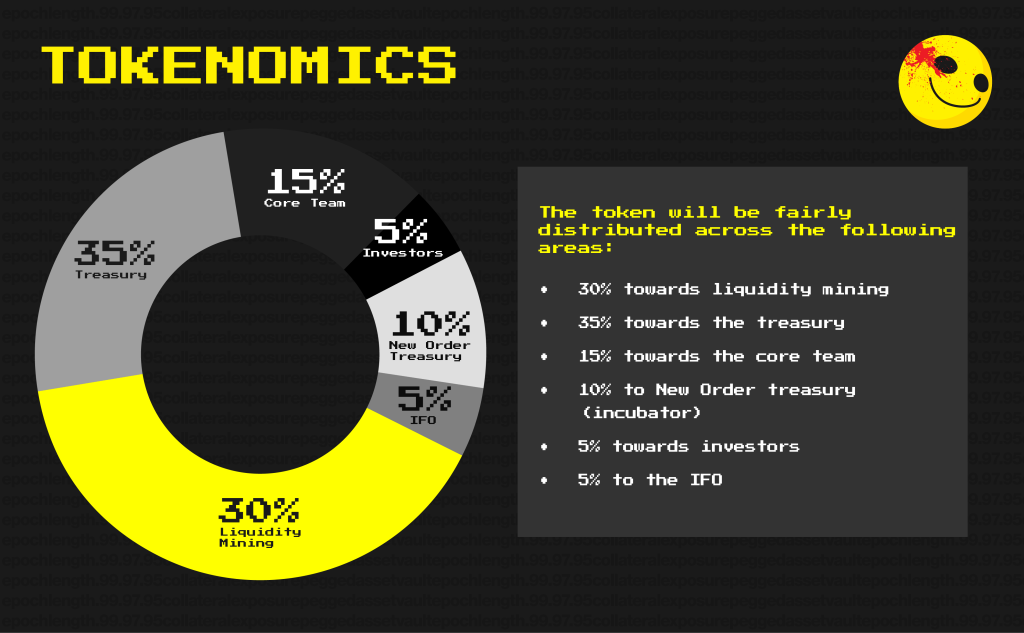

The total distribution goes as follows:

- 30% Liquidity Mining

- 35% Treasury (for protocol maintenance)

- 15% Core Team (24 month linear vest, 9-month cliff with 10% unlock)

- 10% New Order Treasury (Incubator)

- 5% Investors (24 month linear vest, 6-month cliff with 10% unlock)

- 5% Initial Farm Offering

Their native token, $Y2K, can be locked as $vlY2K (Vote Locked Y2K) for governance, 50% of protocol-earned fees, and direction of emissions, which could function similarly to “bribes” on curve.

$vlY2K, however, does not consist entirely of its namesake token, but a mix of $Y2K and $ETH in an 80/20 ratio respectively. Being native to the Arbitrum Network, $vlY2K can either be bought directly on Balancer, or by providing Liquidity on Balancer in the 80/20 ratio then locked on the Y2K site for 16 or 32 weeks.

Tokens locked for 32 weeks will receive double the protocol fees and voting power as compared to those locked for 16 weeks.

$Y2K can also be bought through Olympus DAO style “Bonds”.

The Protocol was also incubated by NewOrderDAO, which has previously invested in projects such as Redacted Cartel, which introduced a new dynamic to the Curve Wars, and Frogs Anonymous, a defi-native research hub.

With their Vote-Locked system, Y2K is also partnering with Hidden Hands, a gauge system by Redacted Cartel to facilitate “bribes”, or the emission of governance tokens.

Y2K has also completed 4 audits, one from PeckShield, one from Code4Arena, and two from Halborn.

Closing Thoughts

Y2K takes something we already have in traditional finance and puts a truly unique crypto spin on it, insuring de-pegs. As we inch towards real-world adoption, the ability to transfer risk becomes imperative, especially considering how quickly the markets move.

This has become even more clear thanks to Platypus’ $USP de-pegging in a recent hack. Add a few stablecoin death spirals and $stETH fears into the mix, and we can see the sheer importance of Y2K going forward.

Furthermore, being able to hedge against the risk of de-pegs could lead an increased number of institutions or whales into deploying more capital into something like ETH staking. While they would previously have to cut losses should there be a major deviation, they could now instead protect their downside, of course give enough people take the other side.

Y2K also opens up another means of selling covered calls in crypto – the act of selling “insurance” for premiums while holding the underlying asset, which often become popular in sideways markets.

With stablecoins and derivatives being assets that are supposed to keep their peg, this could open up a whole new avenue for the passive incomooooooors seeking more real yield narratives.

Also Read: How Access Protocol Revolutionizes Digital Content Monetization

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief