Key Takeaways:

- Curve’s LLAMMA rebalances your collateral; when the price of the collateral falls, it gets swapped for Curve stablecoin instead of getting rekt entirely

- Collateral gets liquidated continuously, at a gradual pace

- Model prevents bad debt

- It limits losses and allows more passive portfolio management

___________________________________________

A component of crypto that stands out differing from traditional finance is DeFi. The goal of DeFi is to challenge the use of centralized financial institutions involved in all financial transactions. This way, it eliminates the fees that banks and other financial companies charge for using their services, and users have full custody to make trades and move their assets wherever and whenever they want.

However, many months after DeFi summer, innovation within DeFi has not been spectacular but relatively stagnant. Especially with the recent happenings this year, DeFi is forced to take a backseat, dropping in activity from its high of $176B in total TVL to $41.8B.

While many projects continue to build in the bear market, priming innovations and product releases during the next bull run, we saw one of the most prominent DeFi participants, Curve, finally making a huge design change to their protocol.

Being an AMM, Curve relies heavily on its liquidity pools but does not have a native stablecoin to underpin the ecosystem.

While many stablecoins depend on Curve for liquidity, Curve decided that it is optimally efficient to be worthwhile pursuing their stablecoin. They dropped their whitepaper along with the entire repository for the backend.

The only thing missing now is its front end and deployment.

Today we dive into their whitepaper and find out how different Curve’s new stablecoin is compared to the rest of the pack.

1. Automated self-liquidation

This feature, I must say, will set Curve’s stablecoin apart. The most impressive feature in the entire ecosystem is called LLAMMA, also known as Lending-Liquidating AMM algorithm.

The idea behind LLAMMA is the conversion of collateral and the stablecoin. For example, for other lending platforms, when the price of your tokens drops, the health of loans may rapidly decay, and you get liquidated instantly.

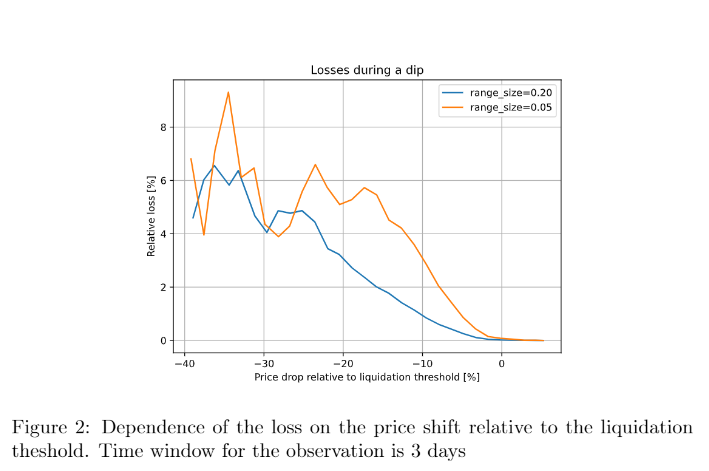

However, no significant loss happens for the Curve’s new stablecoin, even at the liquidation threshold and when the collateral price dips and bounces.

If LLAMMA observes the price of the collateral is dropping, it automatically liquidates your portfolio into Curve’s stablecoin. If the price goes back up, your collateral gets repurchased.

Therefore, this strategy limits your downside and allows more passive position management. Of course, liquidation is still possible and remains an active part of the ecosystem.

This also means that Curve executes complex logic on-chain to rebalance liquidity internally automatically by becoming the first lending-based stablecoin connected to an intelligent AMM.

2. Collateral divided into bands

As the title suggests, the collateral price is divided into several bands. Instead of depositing a specific liquidation price, you deposit collateral over various liquidation prices. As the price drops, the contact tracks which band is “active” and which is currently in liquidation.

Liquidity must be added to at least five bands, up to a maximum of 50. The larger the range, the more your position gets liquidated sooner but gradually. A smaller range means the liquidation process can happen faster.

Imagine taking a 0.5 ETH loan with a liquidation range between $1000-1050. Your liquidation bands may look like this

Band 1: $1000-$1010: 0.1ETH

Band 2: $1010-$1020: 0.1ETH

Band 3: $1020-$1030: 0.1ETH

Band 4: $1030-$1040: 0.1ETH

Band 5: $1040-$1050: 0.1ETH

Once the price of ETH drops to the $1040-$1050 range, your position becomes liquidated. The Curve’s stablecoin position is now backed by 0.4ETH (0.5TH Loan – 0.1ETH liquidated in the $1040-$1050 range) and approx USD 104 (Liquidated 0.1ETH converted to Curve USD stablecoin).

They’re headed in the right direction. Passive LP solutions for uniswap v3 never really caught on, it’s time to try a different approach. https://t.co/GArHUbVUNL

— zefram.eth (@boredGenius) September 26, 2022

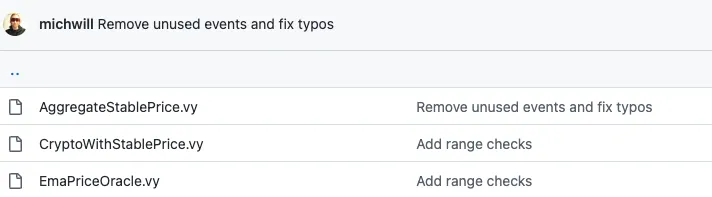

3. Price Oracles

Using smoothing functions, Curve’s stablecoin can balance sudden price swings.

Price Oracle – a source of price data streamed onto the blockchain

What happens when someone relies on a CEX for prices. On a CEX, price jumped x3 and back a few times (maybe rekting leverage traders). On Curve, current price (gray) went up x1.6 and down, price oracle (EMA) did x1.3 and down.

— Curve Finance (@CurveFinance) November 13, 2022

Big implications when thinking of liquidations pic.twitter.com/JH86z3WnVq

Curve took to Twitter to illustrate this concept and the importance of applying exponential moving averages to smooth out prices during liquidations.

This means that Curve lowers the chances of you getting liquidated against how centralized exchanges ruthlessly do it.

As you can see below, they are applying multiple contacts to handle price oracles, including smoothing functions of an EMA.

What does it mean for your bags?

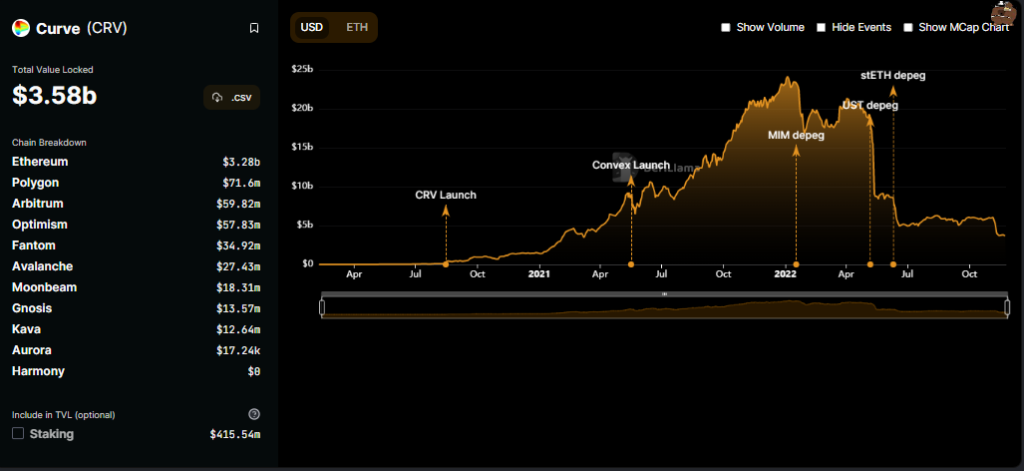

The clear implication for Curve’s native token, CRV, is most likely higher revenue in generating fees. “We also note the DAO is intended to gain admin power over the $crvUSD ecosystem, providing more governance utility for veCRV.”

As with all stablecoins we know, they formulate a pair with respective cryptocurrencies to give us a price value of the token based on the USD dollar value. The new Curve stablecoin will do nothing less, but in addition, potentially able be profitable from liquidations even if trading fees are set to 0.

As the addition of trading pairs through Curve’s stablecoin may also increase volume flow through the greater Curve ecosystem, we may see the new stablecoin gain the most utility by simply having pairs with the merge of existing v1 and v2 ecosystems. All those ecosystems below are included.

Furthermore, not every investor has time to monitor their positions all day. Having features as proposed by Curve’s whitepaper could help in volatility spikes. In addition, it offers a strategy that limits your potential losses and allows more passive portfolio management.

While all these are not set in stone, this concept is just the beginning. Definitely bullish.

Also Read: How Manipulation On AAVE And CURVE Went Wrong, Attacker Got Rekted Instead

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief