FOMO or Fear Of Missing Out, is a feeling that most in the Crypto Market will eventually get.

As Bitcoin hits new all-time highs and sends the rest of the market into double, triple, or even four digit returns, here are some ways you can avoid the feeling and prevent yourself from apeing your portfolio into a random shilled coin.

Understanding the market cycles

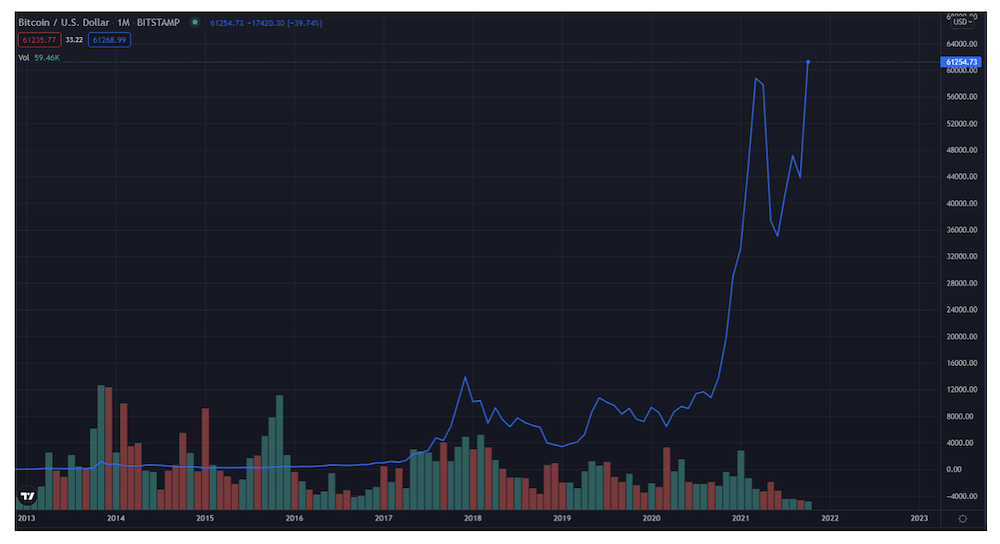

Though the cryptocurrency market has evolved into a blockchain developer’s wildest dream, the market cycles usually begin with a Bitcoin Bull run, typically after halving events.

Bitcoin is minted through “Proof-Of-Work”, which rewards miners with Bitcoin for solving complex mathematical equations.

Where do you think the #bitcoin price will be next halving? pic.twitter.com/Qfey6afm6P

— ChartsBTC (@ChartsBtc) October 17, 2021

These rewards come in blocks, with 50 BTC as a block reward at the inception of Bitcoin. Every 210,000 blocks (roughly 4 years), the amount of BTC rewarded per block actually gets cut in half, with such events being referred to as a “Halving”. With constant or increased demand, supply shocks indicate that Bitcoin prices will rise post- halving.

The last 3 halvings were followed by their respective bull runs, which usually causes a new Bitcoin All Time High and attracts mainstream media coverage. This pulls in retail investors to invest, pumping prices higher. During this period when Bitcoin is in price discovery, Altcoins generally increase slightly with Bitcoin, but dump heavily when Bitcoin prices fall.

After Bitcoin start to plateau, profits usually start to flow into large cap Altcoins, typically those within the top 20. This is widely known as the start of “Altcoin season” and is categorized differently by different investors.

One way to track this would be to take a look at Bitcoin Market Dominance. As Altcoin gains start to surpass Bitcoin’s, they will take up a larger percentage of the market by capitalization.

Take note however that Bitcoin’s Market Dominance has been trending downwards overall as the space grows.

After large cap altcoins breach their all-time highs and start to plateau as well, we enter the third stage of the market cycle, a full-blown altcoin season, where smaller market cap coins start to moon.

Currently, we are still a while away from an altcoin season, with Bitcoin Market Dominance high and most altcoins not being able to outperform Bitcoin to the upside nor downside.

However, knowing which part of the market cycle we are in can allow you to rebalance your portfolio accordingly.

Have a dedicated strategy

If you are already a full-time crypto trader, you may already have a strategy on when to enter the market.

However, most entering the crypto space could get caught up with the thousands of altcoins available in the market, chasing pump after pump just to have their portfolio outperformed by large xaps.

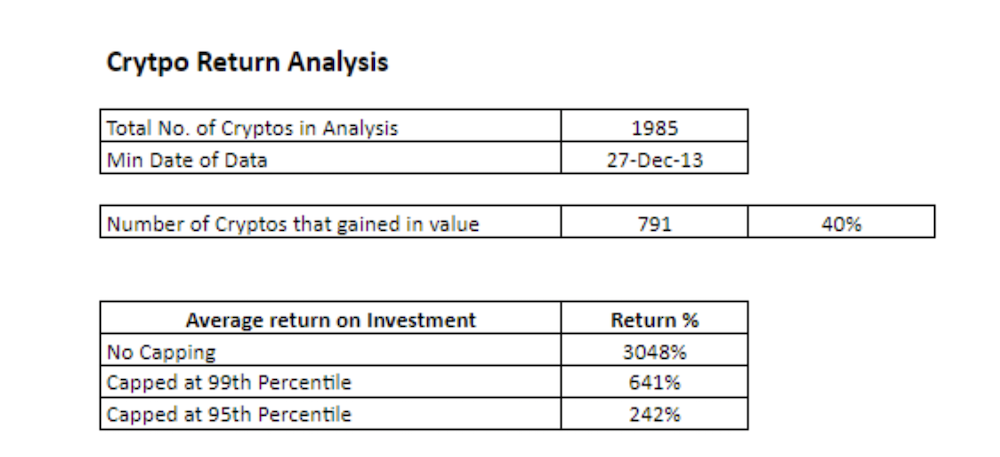

If you think your only chance of making it rich is YOLO-ing into the next random Altcoin, a recent analysis by U/nojobs on the cryptocurrency subreddit shows that only 40% of the 1985 cryptocurrencies tracked by CoinGecko have risen in value. However, those that do average a 3048% return on investment.

In times like these where we are in the midst of a bull-run, it may be worth it to take the time to choose a solid investment strategy, or at least pick coins that you believe in long-term to pick up bags of.

A common strategy employed by those in the crypto space is DCA or Dollar-Cost-Averaging, which means to make your investments based on a time period.

Usually this is done by adding to your current bags on the first of every month, or whenever you get your paycheque.

While this may be sound like a boring strategy, even Warren Buffet recommended this strategy to Lebron James when he requested for investment advice.

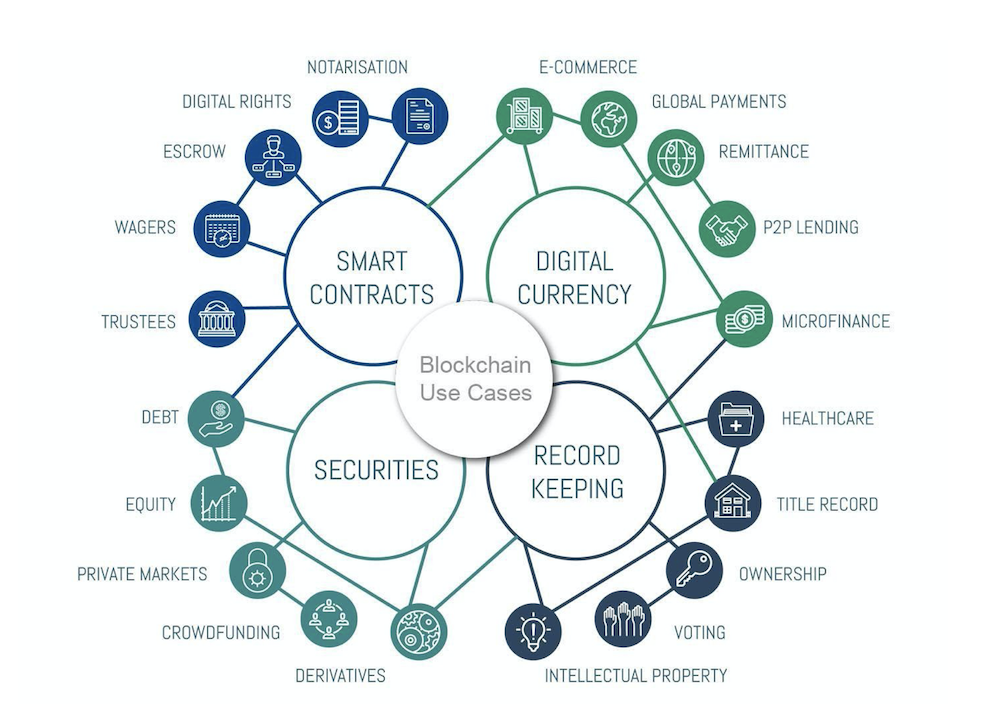

It may also help to take the time to do your own research on the ever-growing use cases of cryptocurrencies and choose a space you may have a particular interest in.

For example, being ahead of the herd in the NFT (Non-Fungible Token) space has shown impressive returns.

When in doubt, zoom out

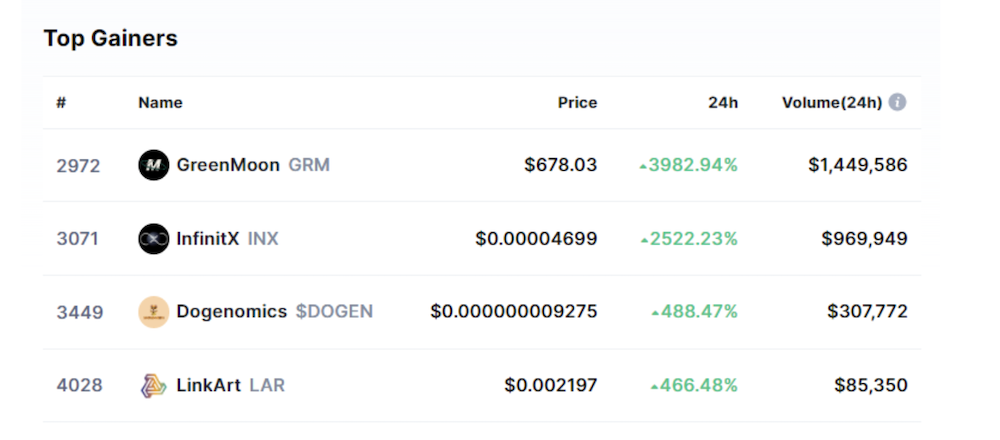

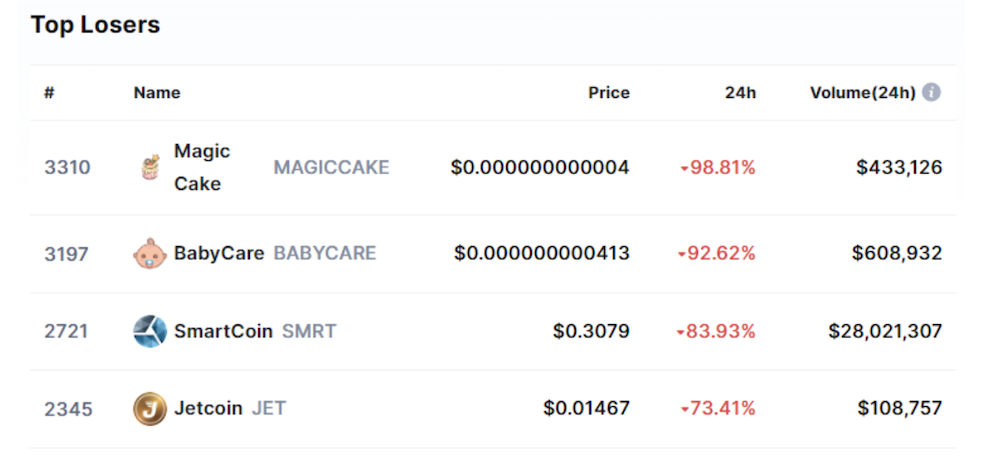

It is easy to get lured into bad projects on the premise of their insane returns when faced with statistics like these everyday.

However, most projects that show insane short-term returns tend to dump massively as well, with many retail investors being left holding the bag at the top.

Not every project is the next Ethereum and not every pump is warranted.

Instead, if you had bought Bitcoin during at the peak of any bull run, its prices would have come back to bail you out eventually, thanks to its status as a store of value and good tokenomics.

The same can be same with other projects with solid fundamentals, that have established themselves in the space with a good team and proper use cases.

Investing in a project for its actual value and not just speculating coin after coin can help you get a good nights sleep — even in the volatile space of cryptocurrency.

Still feel the FOMO?

While all the statistics in the world can show you that apeing into a project could be the worst thing for your portfolio, it is reasonable to still feel FOMO in a world with daily 1000x projects. So how do we deal with that?

The easiest way to tackle FOMO is to not actually deny yourselves from this part of the crypto space fully, but to participate in a small, controlled way. Putting less than 1% of 1% of your portfolio allocation into these riskier bets makes sense but take note that you should still do your research on these moon shots, and the large majority of your investment should be in logical, proper investments in the space.

Featured Image Credit: Chain Debrief

Also Read: The Curious Case Of The US Bitcoin ETF: What Is It, And Is It Worth Investing In?