Investing can be tough. Especially when there’s so many different crypto to choose from and in current market condition where it could be a very good buy opportunity – which one should you get?

One thing you can do to aid your choice is to keep track of the crypto portfolio of venture capitals and hedge funds.

From there, you can then curate your own list of crypto that you’ll want to purchase.

The 5 funds that I’m sharing today are Alameda Research, a16z, Binance Labs, Dragonfly capital and Framework Ventures. The slight con however is that it only reveals the coins that they are holding and not the amount.

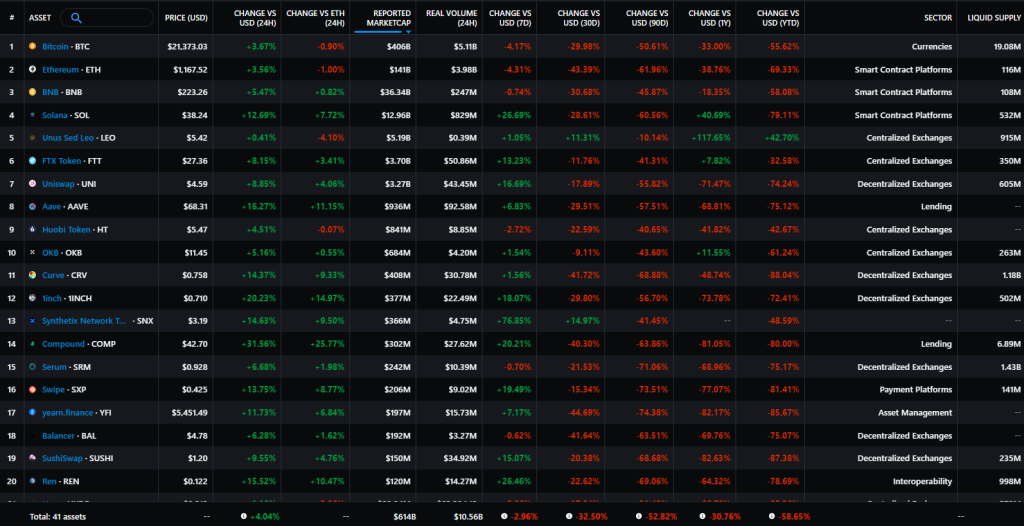

Alameda Research

Alameda Research is a quantitative cryptocurrency trading firm that uses internally developed technology and deep crypto expertise to trade thousands of digital asset products and derivatives.

Alameda is founded in October 2017 by Sam Bankman-Fried, CEO of FTX.

Portfolio

It is no surprise that Alameda holds the top 3 biggest crypto coins (excluding stablecoins) by market cap – BTC, ETH and BNB.

I believe that they also hold a big amount of SOL and expectedly so given that Alameda invested USD $314.2 million in the blockchain’s developer Solana Labs last year. Bankman-Fried is also known to be a big supporter of Solana.

Apart from these, they also hold FTT, UNI, AAVE and many others for diversification purposes.

Andreessen Horowitz (A16z)

Andreessen Horowitz (a16z) is a venture capital firm in Silicon Valley, California, that backs bold entrepreneurs building the future through technology.

They invest in seed to venture to late-stage technology companies, across bio + healthcare, consumer, crypto, enterprise, fintech, games, and companies building toward American dynamism.

a16z has $33.3B in assets under management across multiple funds.

Portfolio

They recently announced a $4.5 billion fourth fund, bringing our total funds raised to more than $7.6 billion. They believe blockchains will power the next major computing cycle, which they call crypto or web3. Their notable investments are AVAX, UNI and NEAR.

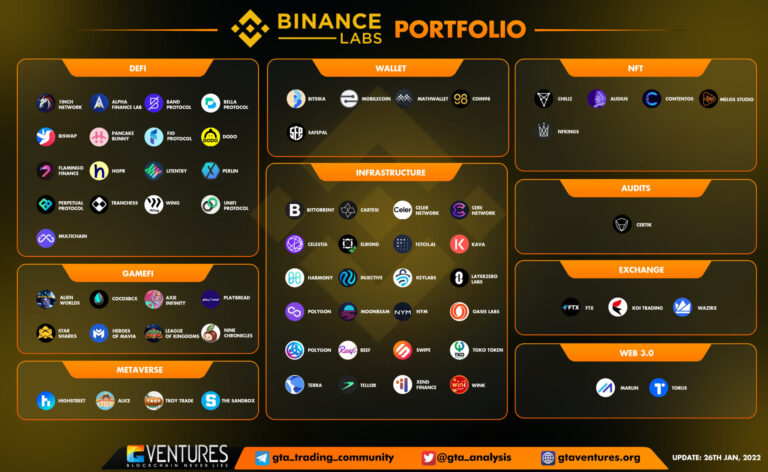

Binance Labs

Binance Labs is the venture capital and accelerator arm of Binance, the world’s largest crypto exchange by volume.

Binance Labs identifies, invests, and empowers viable blockchain entrepreneurs, startups, and communities, providing financing to industry projects that help grow the wider blockchain ecosystem.

They are committed to supporting fast-executing, technical teams who positively impact the crypto space and build the decentralised web.

Portfolio

Since 2018, Binance Labs have invested in over 170 projects across more than 25 countries with projects like 1inch, a decentralised finance and exchange aggregator; play-to-earn games Axie Infinity; and Polygon, a decentralised Ethereum-focused layer 2 scaling platform.

According to Messari, Binance Labs portfolio only consists of 17 assets. Some notable coins are BTC, ETH, MATIC, SAND and ONE.

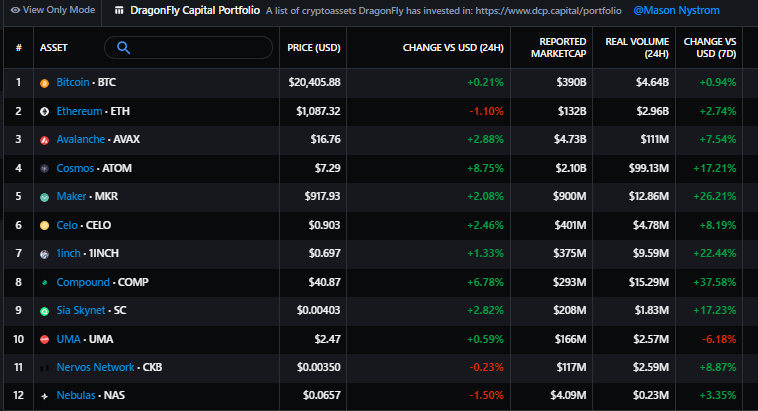

Dragonfly Capital

Dragonfly capital is a cross-border cryptoasset investment firm. Managed by experienced VCs from the U.S. and Asia, Dragonfly Capital Partners brings together the leading participants in the decentralized economy.

You may also find out more on how Dragonfly Capital do their crypto research here.

Their global ecosystem enables them to invest in and support the most promising opportunities in the cryptoasset class. Notable investments from Dragonfly capital are BTC, ETH, AVAX and ATOM.

Portfolio

Framework Ventures

Founded in 2019, Framework ventures is a venture capital firm based in San Francisco, California. The firm prefers to invest in blockchain technology and cryptocurrency digital assets as well as seed-stage, early-stage, and later-stage companies.

Portfolio

Framework Ventures hold 15 assets in total and surprisingly only 2 smart contract platforms token in ETH and a lesser known KAVA.

They do have a diversified portfolio where there is one coin from almost every sector.

However, will they do well?

I believe in diversification but with a portfolio like that and some questionable coins that I have never heard of, I think this will fare worse than others.

Closing thoughts

If you are looking to buy the dip and are unsure of what to buy other than BTC and ETH, checking what the big boys have can reward handsomely when things start to turn around.

For those who have been in the scene for awhile, some if not most of these coins shouldn’t be new to you. You may not find the next 100x but if BTC does a 3x in future, these can still turn out to be more than a 10x.

As they are major players in the scene, it is important to note that these companies went in during seed rounds, where eg. the price of AVAX was bought at US$0.50. Even with the bear market we are currently in, they might still be up on their initial investment.

Always remember that these coins can still go to zero even though huge funds hold them. It is by no means a guarantee that you will make money off it. After all, these are what they are betting on to do well in future and they can be wrong too.

Always remember to do your own research before aping in!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Things To Consider Before Putting In Your Next $1000 In Crypto (Beginner’s Edition)