So it’s the bear market. Survivors may have spare capital and are waiting for an opportunity to buy the dip. You may be a new investor and is interested in dipping your toes in to the crypto world.

So, what if you had $1000 lying around? How would you invest it? Before you make a move, do consider the following questions:

What If I Were To Lose This $1000 Completely?

This is the first and most important question that I would ask myself regarding the $1000. Even if this was “spare money” lying around, would I be okay if I were to lose that money?

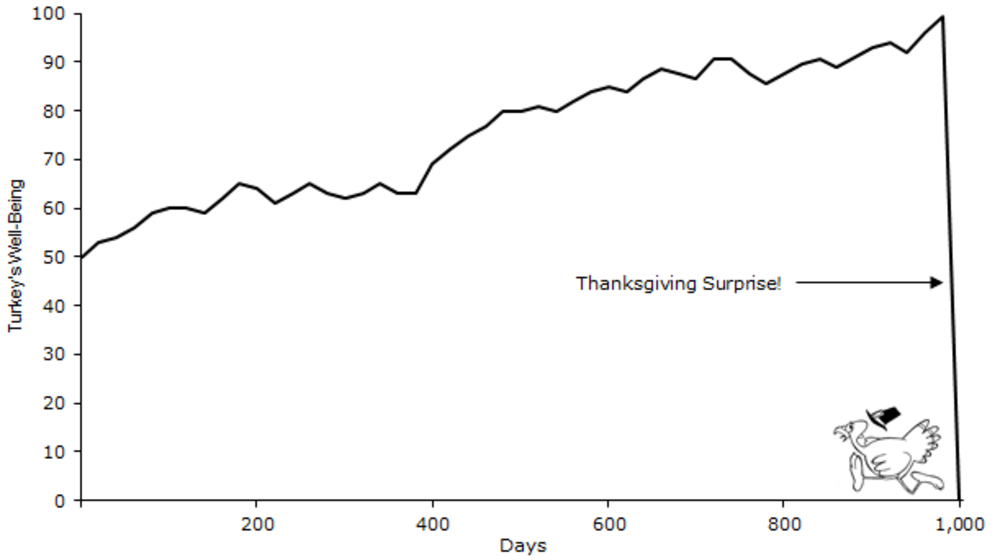

Very few of us tend to account for situations where we are wrong, and instead we always pick the optimistic scenario where our thesis plays out.

While you can easily say yes, you are okay with losing that money on paper, are you able to react logically when your coin starts to go down 30-40%, 90% from ATH, or even worse, get rugged completely?

The effect of emotions on our trading or investment strategies do affect our actions (whether as a newbie or veteran), even if you think you are safe from these mistakes.

Even if this is just an imaginary scenario where you had an extra $1000, I encourage you to think deeply about portfolio risk. Whether it is a large or small amount of money (value is relative after all) to you, take into account your level of risk management.

Also Read: House Money Effect: 4 Mistakes That Crypto Investors Will Fall Prey To

What Is My Expected Value?

Now that you have looked at risk of your $1000 going to zero and your money going bust, let’s look at expected value (EV).

Just a spoiler, I will be approaching this from a simple practical perspective so the mathematical/financial technicalities and nuances will not be covered.

EV in the context of crypto investing would be your expected future value of your investment. Why is this important? It gives a rough estimate on your portfolio over time, assuming you make that bet.

How do you calculate this? You will have to estimate the probability of an outcome, and get the weighted average of it.

For example, consider that within a year, a token has a 20% chance of going to 0, 30% chance of doing a 50% gain, 30% of doing a 100% gain (double), and a 20% odds of doing a 5x.

Your EV in this case would be:

(20% * 0) + (30% * 1500) + (30% * 2000) + (20% * 5000) = $2050

Since this is a positive EV, buying this token is a decent strategy as on average, you will earn about 2x of your initial capital by the next year.

Ideally, you want to make plays that are +EV (positive expected value). And over time over larger samples, you will make money.

From a probability perspective, you also have a 20% chance of completely losing 1000, and 80% chance of earning a positive return. Not too bad.

But how do you determine the probability of each outcome? There is really no answer to this question and it is based on how you factor in different aspects of the market (macro, fundamentals, technical analysis etc).

What you should take note of, before deploying capital, is to be familiar with probabilistic bets. This would help you in the bear market and serve as a criteria in deciding what to buy.

Time Spent Fretting Over This $1000 In Crypto?

Consider the example given earlier (expected value of your $1000 is $2050). Now, assuming you are not going to invest or put in any more funds, consider that you are only (roughly) doubling your money.

This is of course stellar returns when compared to any other asset class, but at the end of the day $2050 will not matter in your life on the grand scheme (quality of life does not change with an extra $1050 profit).

Furthermore, this is a hypothetical situation and the EV of crypto right now is probably much, much, lower (or even negative!).

What I am trying to say is that once you toss in your $1000 as a bet, be prepared not to spend too much mental energy on it.

If you find yourself fretting over this amount of money, checking your portfolio everyday on your Blockfolio/Crypto.com app, then you are doing it wrong… it means that for you, even a sum of $1000 is overinvesting in crypto!

If that is the case and you are worried about losing your money, then refer back to the first question asked in the article:

Are you willing to lose the money if you are wrong?

What I Would Personally Do

In my case, what would I do if I had $1000 to spare in the bear market?

What I would do would probably be…. absolutely nothing.

That’s right – I would not buy any tokens now because from my opinion and personal predictions, many projects have a negative expected value (-EV). They are simply not worth investing at this point in time.

Am I just a scared investor and permabear?

Not really. I just do not see the appropriate risk to reward ratio at the moment, and I think there are better uses for this amount of (imaginary) money that I receive.

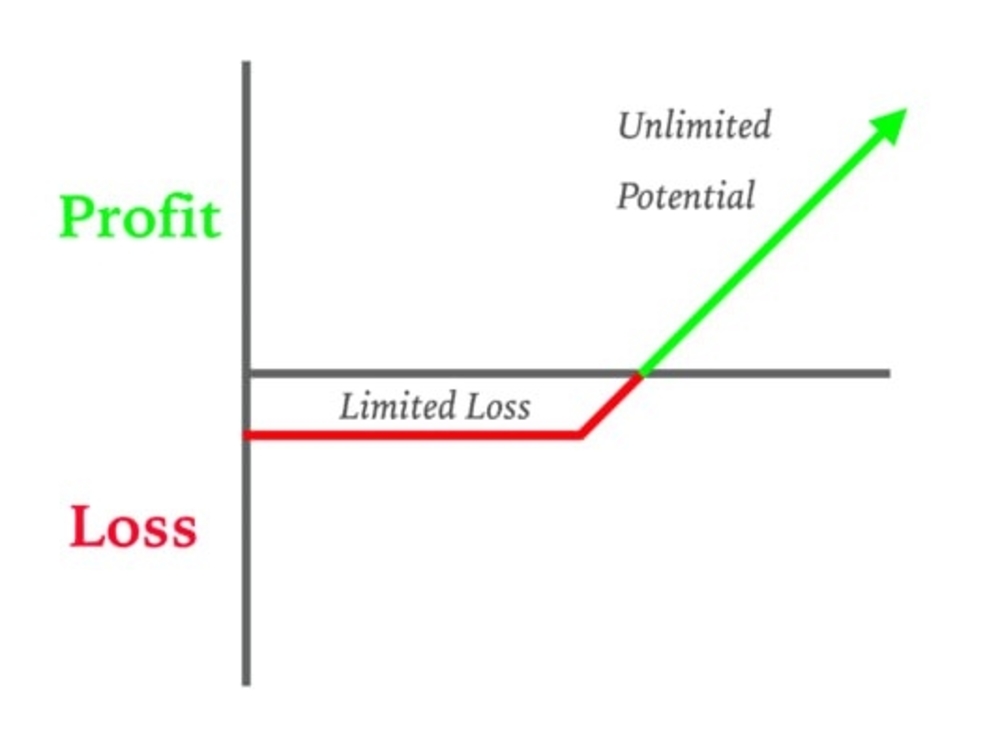

There are very projects out there that are the next 100-200x, and for me I am only focused on asymmetric bets that have heavy upside. In other words, I want to have limited downside (risk of losing 1000) when compared to the upside (5, 10, 20x returns).

Which projects are these? Well, I am not a shill and I will not reveal what projects I am looking into. What you think will survive and do well the next cycle is totally up to you to determine and decide.

Anyways, you don’t just listen to random strangers on the Internet on what to buy and sell, do you?

So What Is The Best Crypto Investment?

To me, the best investment is not just throwing money and hoping for a windfall, or over-trading and getting liquidated, but rather… yourself.

Let me emphasize and repeat this. You are the most important investment.

If you lack the skills, mental edge, or conviction in whatever you are buying, you ARE going to make mistakes. This has happened to the best of us, so imagine how vulnerable you would be to making mental traps when you have not upgraded yourself to keep up with the market.

At some point most of us either blow up or stagnate, or watch our returns become marginally lower over time.

Use this time to work on what you are weak on. Is it emotional investing? Sizing bets incorrectly? Having a wrong thesis and being a bag holder? Falling for influencer narratives? Being overly bullish or bearish?

Take some time to think about what you have done, and most importantly, journal it down – all your mistakes, good plays, and lessons learnt.

This doesn’t just apply to the crypto markets as well.

When was the last time you used this money to treat your family to a meal? When was the last time you used this money to do a health check on yourself? Or better yet, when was the last time you used this money to improve your physical and mental health?

Optimize Your Inputs pic.twitter.com/k3PvHyaea9

— The DeFi Edge 🗡️ (@thedefiedge) June 4, 2022

Every single edge that you can get from the markets and investment does not necessarily come from researching crypto. It can be minor things such as spending some time and money to fix your sleeping habits, eating habits, learning new skills, fostering relationships etc.

And finally, get a hardware wallet if you haven’t already – taking every step to ensure your funds are safe is important. Safe practices and a hardware wallet allows me to sleep well at night – which in turns compounds into better decision making.

Also Read: Crypto Scams Took 14 Billion USD In 2021 – How To Prevent Your Funds From Getting Stolen

Believe me, when you are healthy and feel a lot better about yourself, only then do you have clarity to approach the hazy world of crypto and distinguish the signal from all the noise around you.

Also Read: Top 5 Crypto Tools That Will Turn You Into An On-Chain Wizard

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief