It gets a bit awkward to share about my participation in the Web 3 space. Part of the reason includes the many negative perceptions of cryptocurrency.

For example, Bitcoin being used for money laundering, tokens having no intrinsic value, and everything being a scam are common stories that one hears.

So, let’s dive deep and answer once and for all: Is Crypto just a giant Ponzi?

What is a Ponzi Scheme?

Named after a swindler from the 1920s, Ponzi Schemes are a type of fraudulent investment scam.

They rely on new money to pay off old money, which may then be reinvested due to the consistent profits. However, once there is no new money left, the house of cards collapses, and schemers make away with as much as they can.

Many have argued that cryptocurrency, and specifically Bitcoin, is a Ponzi because it relies on new money coming in. Furthermore, unlike stocks, there are no legal obligations for governance voting, nor dividends being paid out.

Why crypto may be a Ponzi Scheme

The following features are present in many Ponzi Schemes:

- Low-risk, high returns promised

- No actual investments

- Complicated strategies are used to cover the lack of investments

- The Mastermind takes away a large portion of the money

And crypto, unfortunately, fits a lot of these criteria.

Take the Terra ecosystem for example, with its native tokens $LUNA and $UST both in the top 10 by market capitalization. The entire project is built around an algorithmic stablecoin, unbacked by real-world assets.

Anchor offers absurdly high interest rates on $UST (300x the average U.S. rate), and the founders sustain rewards and buy other cryptocurrencies by selling their $LUNA, printed out of thin air. While I am personally optimistic on the Terra ecosystem, it becomes obvious why onlookers can be skeptical.

Also Read: Is Terra (LUNA) And UST Game Changing Or Just A Big Ponzi?

$USDD and $USN on Tron and Near respectively are hoping to emulate this after seeing $LUNA’s success. However, if one collapses, it could lead to bank runs in all three ecosystems. This could mean billions of dollars being wiped out as users rush to exit their positions.

BREAKING: Mark Cuban calls for more stablecoin regulation after trading DeFi token that crashed to zero https://t.co/aAHwPWXFyp $TITAN

— Joe Weisenthal (@TheStalwart) June 17, 2021

To make matters worse, similar projects have failed before. Iron Finance received massive media coverage, highlighting how badly things could go if everyone decided to sell at once.

Meme tokens such as Shib, Doge, and even Safemoon have reached widespread retail adoption, with many buying in thanks to their low prices. These tokens genuinely have no intrinsic value, and Safemoon even has a built-in tax that discourages selling.

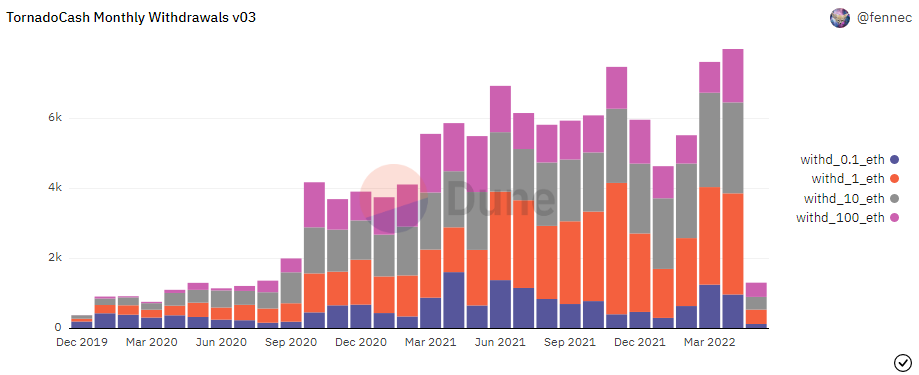

The rising use of Tornado Cash to obscure transactions also hints toward the malicious actors in the space.

Also Read: How To Improve Your Transaction Privacy On Ethereum Via Tornado Cash

Why it doesn’t matter

There are many arguments on why cryptocurrency is not a Ponzi Scheme, and many have great points.

For example, there is genuine wealth creation in the space. Innovative use cases are being developed, and most protocols are taking losses to fund future growth.

To the unconvinced, there is but one question:

Would you rather be rich, or would you rather be right?

The only rational decision for a ponzi scheme “investor” is to be the first in, milk it and get out

— N◎tte 🦀⚡ (@crypto_notte) November 24, 2021

5. Olymus Dao as a one-sided market with no selling pressure. As of today OHM is a very closed ecosystem with very little price discovery. There are no ways to short OHM in size..

Instead of casting everything aside, unearthing the potential of projects can make you immensely wealthy while contributing to the general good.

In fact, primitives such as Aave have managed sustainable, above-average interest rates for stablecoins. Axie infinity created income streams for gamers. The blockchain also allows users to bank themselves while providing more efficient methods for cross-border remittances.

Identifying such projects and investing in them often leads to immense rewards.

Closing thoughts

With that said, there do exist outright scams in the market.

New influencer shill price list leak 📸 pic.twitter.com/l1MGgqfldv

— ZachXBT (@zachxbt) April 18, 2022

The sheer number of influencers, celebrities, and athletes doing undisclosed paid promotions has become a problem.

However, the rise in education and increased media coverage are making such activities even more of an outlier. With increased regulations, the masterminds behind these schemes will hopefully face legal repercussions as well.

At the end of the day, even the most skeptical investors could probably find something to pique their interest. Whether you judge it to be a Ponzi scheme or not, it will not hurt to allocate a small percentage of your portfolio for exposure to cryptocurrencies.

Featured Image Credit: Chain Debrief

Also Read: “Returns And Risks Go Hand-In-Hand” – A Traditional Finance Fund Manager’s Thoughts On Crypto

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!