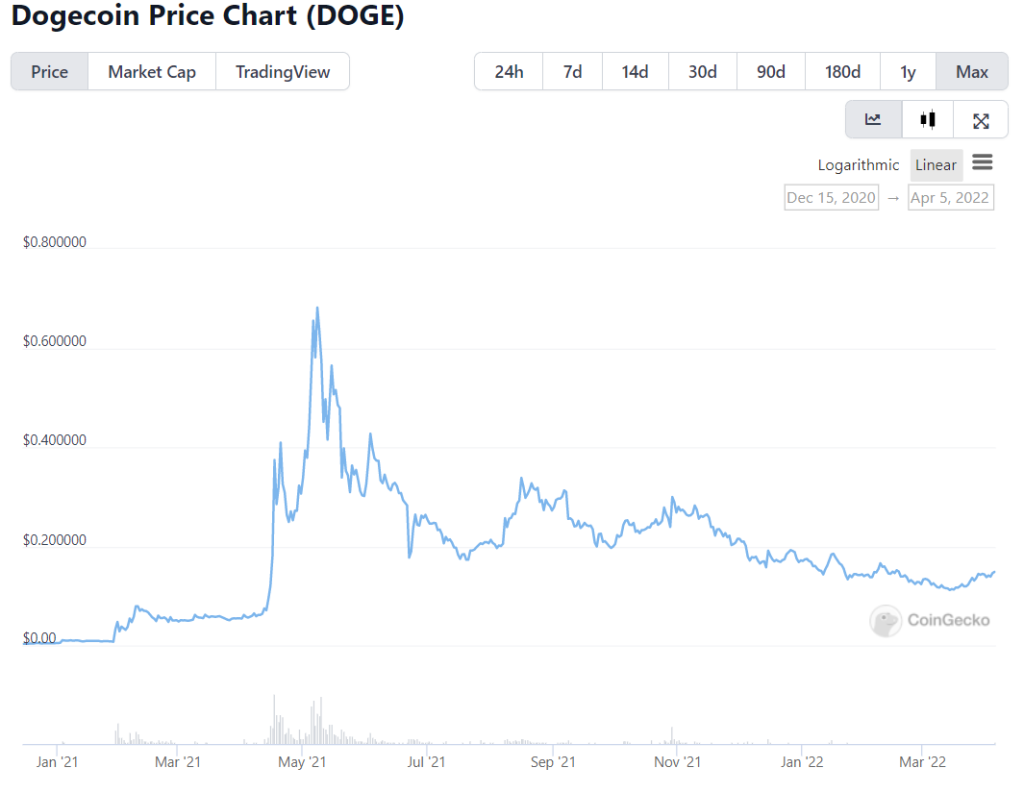

Crypto communities, in all their wisdom and power, can often be an echo chamber. How else do you explain meme coins skyrocketing in value and exceeding billions in market cap? Take Dogecoin, for example. It was created as a joke, it has an unlimited supply, and yet, it’s trading at over 10 cents per coin as it stands.

Forget fundamentals, the coin owes all its success to Twitter threads and Reddit rallies. It’s supported by a community which decided an internet meme was worth investing in, and they’ve been on that wave ever since.

While there are plenty of remarkable innovations in the world of blockchain, their communities are rarely driven by the promise of technology. It seems that a .gif of a moon-bound rocket inspires far more support than a whitepaper ever could.

Needless to say, the phrase ‘do your own research’ has very different connotations in the DeFi space as compared to its traditional counterpart.

We spoke to Raphael Ng, Associate Director at Salzworth — one of the top asset management firms in Singapore — to find out his thoughts on decentralised finance.

How is the rise of DeFi affecting TradFi?

One of the main differences separating these two branches of finance is the level of bureaucracy involved.

TradFi is littered with regulations and red tape. It has a relatively high barrier to entry, however, this helps grant investors safety and peace of mind.

On the other hand, DeFi is almost like a free-for-all. Anyone can participate with as little money as they’d like, but getting scammed has almost become a rite of passage.

This comparison makes one wonder whether there’d be any overlap between both of their target audiences.

Raphael believes that DeFi is becoming an attractive competitor for the high-risk segments of traditional investment portfolios.

“DeFi and cryptocurrency are slowly gaining interest from some investors as an alternative asset class that offers uncorrelated returns against traditional asset classes,” he says. “It is certainly drawing funds and attention away from the high risk segments such as growth stocks and VC investments.”

What are the drawbacks of DeFi?

While DeFi empowers investors to take control of their finances, this isn’t a concept which would appeal to all. “Not everyone is able to navigate or even interested in “DIY” finance,” Raphael explains. “While most people wouldn’t say no to growing their finances, actual management can seem ‘tedious’ and ‘boring’.”

Even among the people who claim to be interested in DeFi, it can be argued whether they’re drawn to the idea of financial control or quick gains. A study conducted by Crypto Literacy found that 98% of crypto-aware internet users were unable to pass a test assessing knowledge in concepts such as DeFi, blockchain, and NFTs.

Welcome to the official Twitter page of the Crypto Literacy Quiz!

— Crypto Literacy (@crypto_literacy) November 1, 2021

Led by @Coinme, @CoinDesk, @DCGco, & @PanteraCapital, we're excited to announce November as #CryptoLiteracyMonth to help promote consumer education of digital currency.

Take the quiz: https://t.co/mNmqIGl024 pic.twitter.com/Ioo1Esl5Qs

Perhaps, it isn’t decentralisation which has suddenly made finance more appealing. Rather, it’s the memes, tokenised .jpegs, and the pipe dreams of immense gains.

“A lot of people do not understand risk management and capital preservation, which is the key to longevity in any investments,” Raphael says.

“Many of our clients are professionals and they do not manage all of their own finances. They might actively trade a portion of their portfolio and outsource the rest to other specialists. For example, they subscribe to our Salzworth Global Currency Fund when they are looking for absolute returns”

Taking control isn’t a desirable outcome for everyone.

Are younger generations more likely to invest in DeFi?

Raphael believes so, for three reasons. The first links to a higher risk appetite. “Many of them do not understand the concept of risk management,” he says. “They are just chasing returns.”

“Returns and risk go hand in hand though. Crypto returns can be higher than those of equity and forex markets, but correspondingly, the fall or ‘dump’ in crypto tokens can be rather brutal as well.”

Next, Raphael believes the low barrier to entry is another reason for younger investors to choose DeFi. As it stands, the KYC requirements to open a brokerage account are far more stringent than those needed for crypto.

This might change in due time, but for now, convenience reigns king.

Finally, Raphael believes that the user interface of many crypto apps caters to a younger audience. This is definitely visible through concepts such as gamified staking and farming pools.

How will the DeFi and TradFi relationship change over the next decade?

“There will be cross pollination and eventually there will be some form of amalgamated offering,” Raphael says. Although the two branches of finances seem to have started off on opposite ends of the spectrum, they’re likely to find a meeting point in due time.

1/ Will the best financial products of the future be DeFi or TradFi?

— Rex Salisbury (@rexsalisbury) October 14, 2021

The answer is both.

Let's call these products"Defiant" because they defy categorization.

(i know corny..but it's the best i could come up with and I'm on dad duty in 1 minute).

“I know DeFi purists will baulk at this but with regulations coming in, it is likely just a matter of time,” he adds. “We already see centralised exchanges being directed to conduct KYC checks on outgoing transfers, and increasing traceability of the flow of funds across wallets.”

While these regulations might sound like bad news for DeFi natives, they could inspire new investors to adopt the space. “As it becomes more regulated, the space becomes more investible for TradFi players.”

“We already see this happening. Large VCs are investing into DAOs and also buying into early rounds of DeFi protocols. They own large percentages of the governance tokens issued. Is this still DeFi?”

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!

Featured Image Credit: Financial Times / Raphael Ng

Also Read: Spotting Opportunities In The Crypto Space With QCP Capital, Chain Debrief And Salad Ventures