Seedly Personal Finance Festival 2022 is Singapore’s biggest virtual personal finance event of the year where experts from various fields were invited to cover a range of topics from TradFi (traditional finance) to DeFi (decentralized finance).

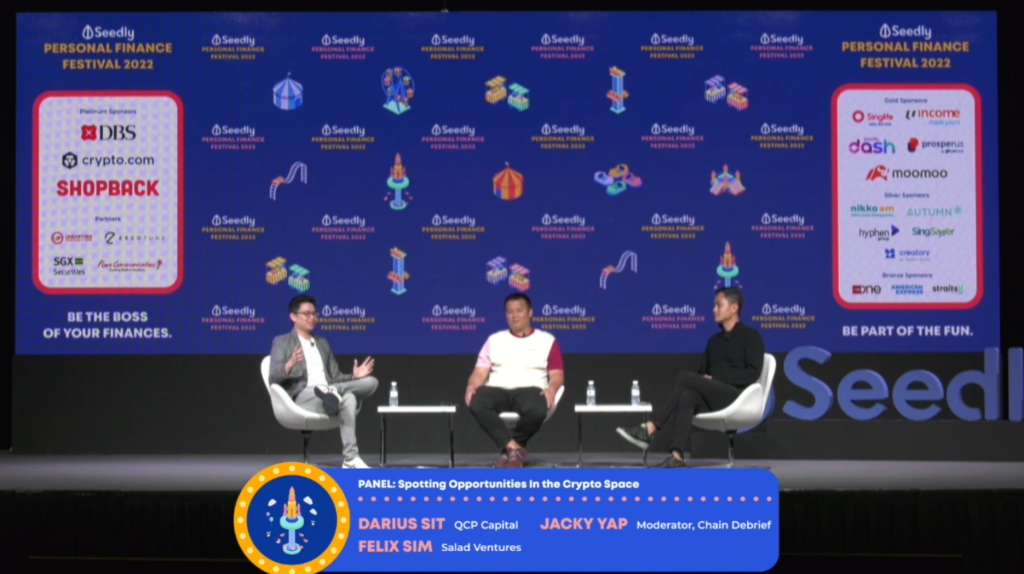

The segment on spotting opportunities in the crypto space was panelled by Jacky Yap, founder of Chain Debrief as the moderator, Darius Sit, co-founder & CIO of QCP Capital and Felix Sim, co-founder of Salad Ventures.

Opportunities are everywhere in the DeFi world. It takes skills, experience and knowledge to identify real opportunities in the crypto space. Darius and Felix shared some insights and opportunities in the crypto space.

Innovations in DeFi

Darius pointed out three key points:

- Crypto is a frontier space with a lot of funds flowing in that causing the asset prices to inflate

- DeFi is replicating TradFi ecosystem but without any intermediary. But cutting out the intermediary, DeFi is able to produce a higher yield margin compared to TradFi.

- New asset classes like option & structured product that monetizes volatility and yield are derived from financial engineering. This organic yield is more sustainable compared to yield derived from token emissions.

At this point in time, the yield generated from token emission is not sustainable and everything will crash when the music stops. But there are other protocols out there like decentralized option vault that does not rely on token emission for yield.

Darius is very bullish on DeFi and he thinks that in the next 5-10 years, it will dominate personal finance & investment. He added that more assets would start to flow in once AML (anti-money laundering) and KYC (know your customer) issues get solved.

Play-to-earn

Play-to-earn is actually not a very new concept. It has been around for a long time just that it is not that straightforward. Players that would want to cash out from the game have to sell their items on 3rd party websites like eBay.

Felix shared that blockchain games simplify the monetization process so that it is easier for players to cash out from the game. Players can just sell their items in the in-game marketplace instead of on third party website.

Crabada is one of the hottest play-to-earn games. Check it out here: Crabada: How Much Can You Earn From This Crab-Themed, Play-To-Earn Game On Avalanche?

Current opportunities in the Crypto space

Darius shared two key opportunities in the crypto space:

- Token appreciation

- Yield farming

“If you believe a protocol that you think is something new and it is scaleable in the next two years, I think it makes sense to buy the native token. It is similar to TradFi” He compared token appreciation to stock value appreciation.

He continues to share that the interest rate in crypto is much higher than TradFi and it easily beats inflation. For instance, Anchor Protocol is offering a staggering 19.45% interest on its deposit which is way more than what TradFi banks can offer.

Felix shared two play-to-earn opportunities:

- Playing the game

- Start a guild

Playing the game is more straightforward and simple. Players who play the game can earn in-game tokens from playing and then cash out those tokens for money.

Starting a guild is a bit more complicated. It is akin to setting up your own company/fund. Guildmaster would set up a few accounts and then rent them out to other players. This is a more passive and capital intensive approach where guild owners get a portion of the reward earned by the players.

Portfolio allocation

Darius is 100% in crypto and his portfolio allocation rule is to have a big enough fixed income portion to generate income to cover your expenditure.

His portfolio would see a mix of fixed income and speculative assets. Depending on the individual risk level, the fixed income portion would also increase or decrease.

Fixed income is also split into two different categories: high yield and low yield. High yield fixed income

On the other hand, Felix classifies crypto as a high-risk asset and advocates that investors should only invest an amount they are comfortable with losing.

Unsure of how to design your crypto portfolio? Fret not we have a guide for you: Here Are 3 Sample Crypto Portfolios For Those Who Are Just Starting Out

Is P2E a Ponzi scheme?

Felix agrees that today’s P2E space is closer to a Ponzi scheme than not but even if it is a Ponzi scheme today doesn’t mean that it will be a Ponzi scheme tomorrow.

He added that it is up to the gaming studio to “Unponzify” themselves. It can be done in many ways like creating a new form of payout or redesigning the whole tokenomic.

Even if the game is a Ponzi scheme, it doesn’t mean players cannot profit from it. Players have to be stringent when reviewing the game and also limit the exposure to a level they are comfortable losing.

Not sure if the game is a scam?

Also Read: GameFi And Blockchain Games: 3 Ways To Differentiate A Legit Game From A Scam

Darius’s take on Anchor Protocol sustainability

Darius thinks that the high yield of Anchor Protocol is probably not sustainable but it helps to bring in new users into the space.

While Anchor Protocol’s high yield might not be sustainable at this point in time, there is a whole suite of DeFi products with sustainable yield.

An example Darius pointed out is the DOV (decentralized option vault). Option vault generates yield by monetizing the volatility of the underlying asset.

The yield generated by the protocol is more sustainable in nature as it doesn’t rely on token emission to maintain the high APY.

Not sure what is DOV? Check it out here: All You Need To Know About DeFi Options Vaults (DOVs) And How To Get Started

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: NFT Festival MetaJam Asia Showcases Over 10,000 NFTs: Here’s How To Get Your Tickets