2021 was widely known as the year of GameFi. There was a huge spike in interest with nearly 50% of the active cryptocurrencies wallet interacting daily with blockchain games.

With so many games in the market, it is hard to differentiate between which game is a cash grab and which will be able to survive the test of time.

Beast Masters is one of the most recent GameFi scams. It had a successful NFT pre-sale and raised about USD$3 million. The game was scheduled to launch in early 2022.

Days after the presale, the team deleted its official Telegram and Discord and disappeared without a trace. What’s left is a now-defunct Twitter and players holding onto a bag of worthless Beast Masters tokens.

To avoid getting scammed, here are three key elements to look out for:

1. Tokenomics

Tokenomics is the bedrock of GameFi and good tokenomics is vital for a game’s success.

It comprises a multitude of factors from token distribution to vesting period that aims to create a sustainable economy.

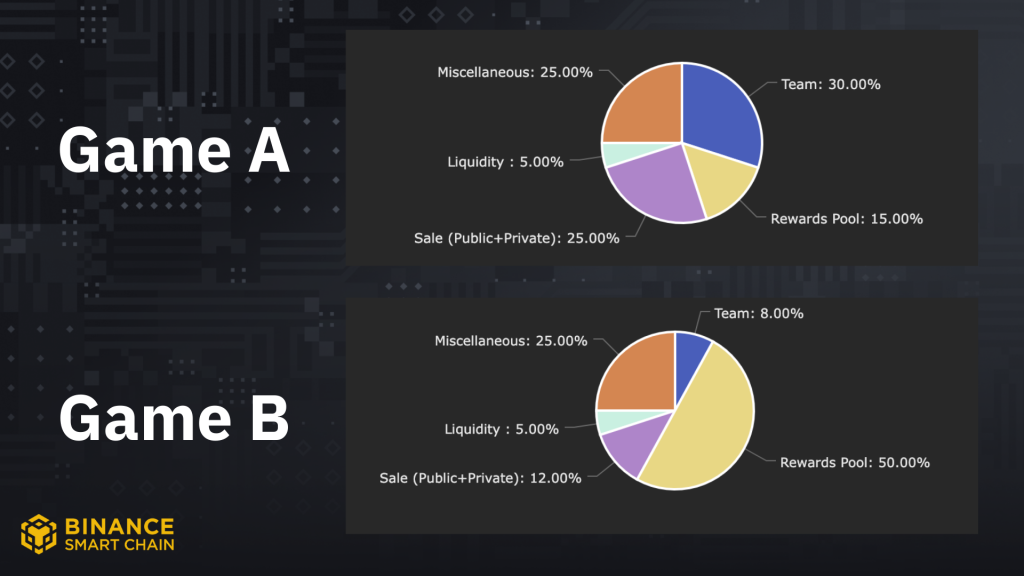

A properly structured token distribution should see a fair distribution between the community and the team.

From the above example, there is a distinct difference between Game A and Game B models. Game A allocates more tokens to the team and sales, while Game B is more community orientated with 50% of the tokens in the reward pool.

Token distribution leaning towards the community would foster stronger community support and loyalty to the project.

A longer vesting period generally builds confidence within the community as it limits the supply of token in the market. Furthermore, token selling by the team is generally frowned upon as it cast a negative sentiment on the project and in the worst case it might trigger mass selloffs.

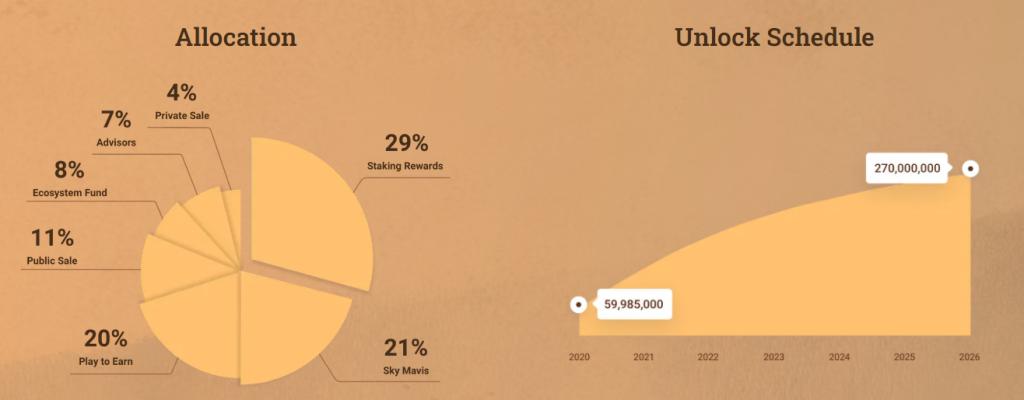

If we look at the most successful play to earn game Axie Infinity‘s tokenomics, we can see that the tokens are fairly distributed between the team and the community.

In addition, it comes with a long and gradual cliffing period of over five years. This tokenomics helped to build early confidence within the community.

On the other hand, a cash grab would see more tokens allocated to the team rather than the community.

2. Prominent backing

Partnerships, be it with crypto VCs or GameFi guilds, are critical for the success of the project.

A partnership with a large GameFi guild is a sign that the game is on the right track. They would do their due diligence and weed out unsustainable projects and only partner with promising projects.

Large established guilds like Yield Guild Games or GameFi are able to onboard a large number of players to the game. It would draw confidence in the game and help it gain the traction it needs to take off.

Furthermore, the network effect brought from scholarship also helps to forge strong communities within the game.

Axie partnered with a multitude of big names from South Korea multinational electronics corporation Samsung to AAA video game giant Ubisoft.

The partnership helped boost its overall reach out of the blockchain ecosystem and bring in non-crypto gamers into the ecosystem.

A cash grab game would not be able to get any prominent partnership as the VCs and game guild would do their due diligence beforehand and weed out games that look scammy in nature.

3. Player experience

Last but not least, the gameplay experience will make or break the game.

Games with fun and an interactive gameplay would be able to attract new players and at the same time retain the existing userbase.

No matter how hyped up the game is, a mundane player experience with repetitive gameplay would eventually lead to the game’s downfall.

Player experience is also linked to the barrier of entry for new players. A low barrier of entry with free to play element allows new players to try the game before deciding if they would want to invest in the game.

All in all, player experience is the deciding factor if the game will succeed in the long run or it will crash and burn.

D90 and D30 retention are essentially the same.

— The Jiho.eth 🦇🔊 (@Jihoz_Axie) September 22, 2021

This means that almost everyone who is still playing Axie after 30 days, is still playing after 90. pic.twitter.com/yACyXUpjK0

Axie Inifnity’s success can be attributed to its player experience.

While the concept of the game might seem simple, there are lots of different mechanics and strategies behind the game. This resulted in an impressive player retention rate where the D90 player retention is nearly identical to D30 player retention.

Cash grab games would typically see a poor design and mundane player experience as not much thought put into place.

While the game could be hyped up by the community and see initial success, it is not sustainable in the long run as it requires new inflow of gamers to support the game.

Conclusion

At the end of the day, GameFi is still in its infancy stages and it will take a few more years to mature.

Considering all factors, the longevity of the game is still highly dependent on the inflow of new users. Positive gameplay experience is the key to keeping the community engaged and attracting new users.

2/ Building a native web3 community: Pick your blockchain partner, engage with their community, build culture on Discord and Twitter, engage fans with NFT drops. Today, the web3 vs hardcore gaming communities don’t perfectly overlap. Mix carefully

— Amy Wu (@amytongwu) October 23, 2021

4/ Game economy design is art and science. @AxieInfinity is the first at-scale web3 game experimenting with complex tokenomics. Study what they’ve done, plus classic web2 economy design. Complexity will range from F2P skin sales to multi-currency MMOs

— Amy Wu (@amytongwu) October 23, 2021

6/ There are 200+ web3 gaming teams. When players experience a wealth of hundreds of live blockchain games, the novelty will wear off, players can choose where to earn, and what matters will be what has always mattered: is the game fun?

— Amy Wu (@amytongwu) October 23, 2021

Featured Image Credit: CYBravo

Also Read: From The Sandbox To Decentraland, Here’s A Look At The Top 5 Crypto Metaverse Games