Key Takeaways from the love story between CZ and SBF:

- Binance fully acquires FTX

- Be wary of those who collateralized their tokens

- Approach companies with caution who uses their capital “efficiently”

___________________________________________

This might be the final catalyst, the last leg down. If you have yet to feel max pain, it will be served on a silver platter by CZ and SBF in a buffet spread for all participants in the crypto market.

With the current market sentiment reflecting either distrust or scepticism, the total crypto market cap is down 11% on the day, threading near the $900B mark; we are at support levels right now, and any lower will be disastrous.

I’ll try to unpack all the happenings over the past few days to keep you updated with the latest developments in the space.

How it all started

The latest season of how to crash the crypto market involved two prominent individuals. Sam Bankman-Fried (SBF), the (former) CEO of FTX and Chanpeng Zhao (CZ), the founder and CEO of Binance.

It has been a tough few weeks for the 29-year-old billionaire SBF. Notably, he has been at the forefront of conversations with unpopular statements about crypto regulation.

1) As promised:

— SBF (@SBF_FTX) October 19, 2022

My current thoughts on crypto regulation.https://t.co/O2nG1VrW1l

His statements were met with severe backlash from the crypto industry, with many claiming that SBF was trying to kill DeFi and pushing for regulation capture.

SBF vs Voorhees on crypto regulation

He then went on bankless to debate regulation with Erik Voorhees, a crypto entrepreneur.

Alameda’s balance sheet leaked.

At the same time, the balance sheet of Alameda Research, a sister company of FTX, was leaked.

It was reported that SBF owns about 90% of this proprietary trading

What stood out the most was the glaring issue of $2B of Alameda’s borrower collateral, all denominated in the native token of FTX, $FTT.

This essentially means FTX giving a huge chunk of that token to Alameda, and lenders allowed Alameda to use it as collateral.

WOW

— Dylan LeClair 🟠 (@DylanLeClair_) November 2, 2022

Per CoinDesk, Alameda research has $14.6 billion of assets, against $8b of liabilities.

For assets: $3.66b FTT, $2.16b “FTT collateral”, $3.37b crypto ($292m SOL, $863m “locked SOL”), $134m USD & $2b “equity securities.

Most net equity tied in completely illiquid altcoins.

The turning point came when Alameda and FTX could not sell their tokens to repay their debts when lenders came to collect their funds. Signs of insolvency? Maybe, but it was not made public yet.

Meanwhile, circulating rumours of insolvency for customer deposits started to gain traction.

Also, read Will There Be A Bank Run On FTX?

This is where the almighty CZ stepped into the scene with massive main-character vibes.

CZ plans to dump his FTT tokens.

The leaked Alameda balance sheet compelled CZ to exit their holdings of $2.1B in $FTT. While you might think the competition between the top two exchanges is an ongoing battle for the throne, Binance helped incubate FTX back when it was a young start-up. Binance were also an early investor in FTX.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

At this point, everyone in the market was distraught in anticipation of CZ dumping his load of $FTT. As many FTX users hurriedly started withdrawals, FTX assured their users that leaves would be slow and that withdrawals would be okay.

ah sorry – to be clear:

— FTX (@FTX_Official) November 7, 2022

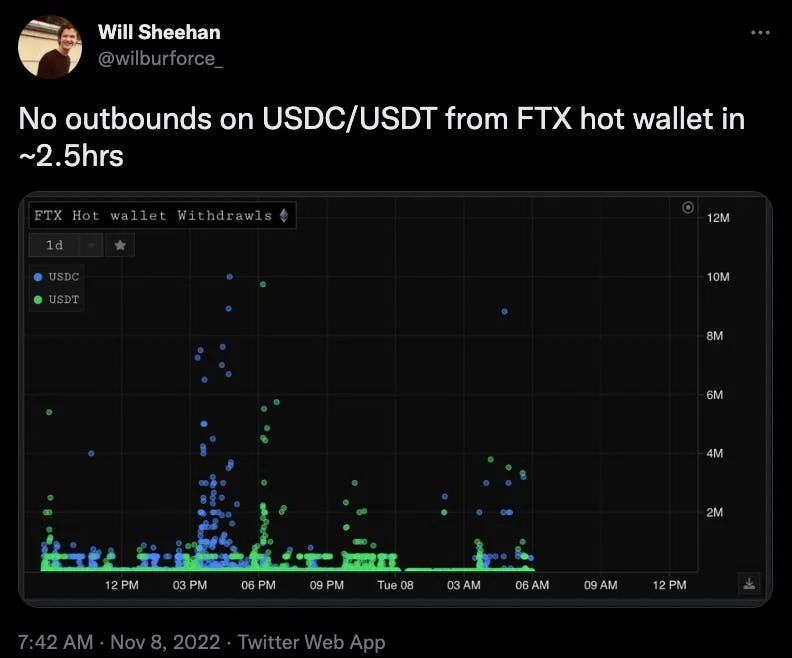

FTX is fine, withdrawals were slow as we refill hotwallets but have been processing all day

A bank run in full throttle

The bank run rumours kicked in at full throttle when FTX had to service loans against FTT, which was about to bust. This was on top of the stablecoins they needed to pay out their customers.

As the money they owed their customers began to spiral out of proportion, Alameda had to exit positions and was forced to liquidate its reserves.

In conclusion, it appears that Alameda is liquidating at least 4.5m SOL from their Solana validators.

— Laine ❤️ (Lisbon) (@laine_sa_) November 9, 2022

If this is dumped into the market we may see more SOL price volatility when the current epoch ends in about 30 hours.

Solana was the biggest to get hit. Zero mercy. Just three days ago, news of the collaboration between Solana and Google surfaced and saw the price of SOL hit $38. But in three days, the cost of SOL met its lowest of the year, of $22.

This led to FTX stopping servicing customer deposits. The liquidity crisis turned into apparent insolvency.

CZ with main character vibes

With depleted FTX reserves, the market was heading towards another liquidity collapse. But that is when news of CZ stepping in to buy FTX surfaced.

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

The breaking news brought leaders in the space speculating on how low the acquisition price might be, as low as $1.

Yup, 100% acquisition.

— Arthur (@Arthur_0x) November 8, 2022

Given how little time it took to close this deal. It's likely Binance acquire FTX for nominal/negligible amount and assume all the liabilities of FTX. https://t.co/x3meaQe34l

This bot which detects deleted tweets, also showed a bad sign for FTX clients moving forward.

Reflection point

While the incident with Celsius served as an important reminder for all participants in the market, I guess it’s human nature not to learn and commit the same mistakes.

The common denominator for the fall of any contagion was yield. The pursuit of profit was probably what got people into space, but as a double-edged sword, it caused the downfall of many.

The fall of LUNA was attributed to chasing the 20% of UST yield.

Celsius has an unsustainable yield on other assets.

Alameda is taking loans from FTX for extra yields.

Oh, not to forget, 3AC as well.

gm

— Zhu Su 🔺 (@zhusu) November 8, 2022

Greed is the root of all evil. And when people at the top make decisions plagued by avarice, everyone under will feel its backlash.

Max pain, here we come.

CZ’s plan for Merkle Trees

All crypto exchanges should do merkle-tree proof-of-reserves.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.

A win for decentralized finance?

Adding to what I mentioned about the inner greed of humans, removing them might ensure a safer environment and betterment for the crypto space.

That was the entire premise of DeFi’s existence. By removing the middleman, you remove the fear of exchanges halting withdrawals or collateralizing your funds.

Don’t trust humans; trust the code.

Not only did this catastrophic event shake off people who are only interested in the yield, but it also revealed that most of the market participants are in it for yield.

In an alternate universe, DeFi and derivative products adoption should increase with the insolvency news.

Perhaps the current products in the market are only in their infancy, but the shift towards utilizing DeFi will be inevitable. How long more till we learn, though?

Here are some alternatives DeFi platforms you can use for your trades.

GMX

It's always "What is GMX"

— Chain Debrief (@ChainDebrief) August 2, 2022

and never "How is GMX"

Here, we answer both questions

1/x 🧵👇 pic.twitter.com/m5xNvsGdDv

Gains Network

Today is a tough but important day for crypto.

— Gains Network 🍏 (@GainsNetwork_io) November 8, 2022

Aside from the chaos, it's been an opportunity for gTrade to prove its resilience.

While gTrade is a leveraged trading platform, it provides 100% on-chain transparency of holdings, positions, and activity.

1/3

Closing thoughts

Binance will own 90% of the CEX market if the acquisition does not fall through. While this monopoly creates a massive divide from exchanges consisting of the other 10%, is it suitable for the crypto industry?

What if other companies are secretly insolvent?

What happens when Binance falls?

How will government bodies respond to this?

It is a rough time, and we hope you are surviving. Here’s some guidance on what you can do amidst this turmoil.

It's a rough time in the market

— Chain Debrief (@ChainDebrief) November 9, 2022

A week ago, none of us could have predicted that FTX could go under. Regardless of whether you're affected, it may be time to go into survival mode

Until you make a concrete plan, here are some tips to protect yourself 🫡

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Decrypt