Headlines recently seem to be flooded news of scams, hacks, and exploits. However, scam revenue is actually down 65% compared to this period last year – according to a report by Chainalysis.

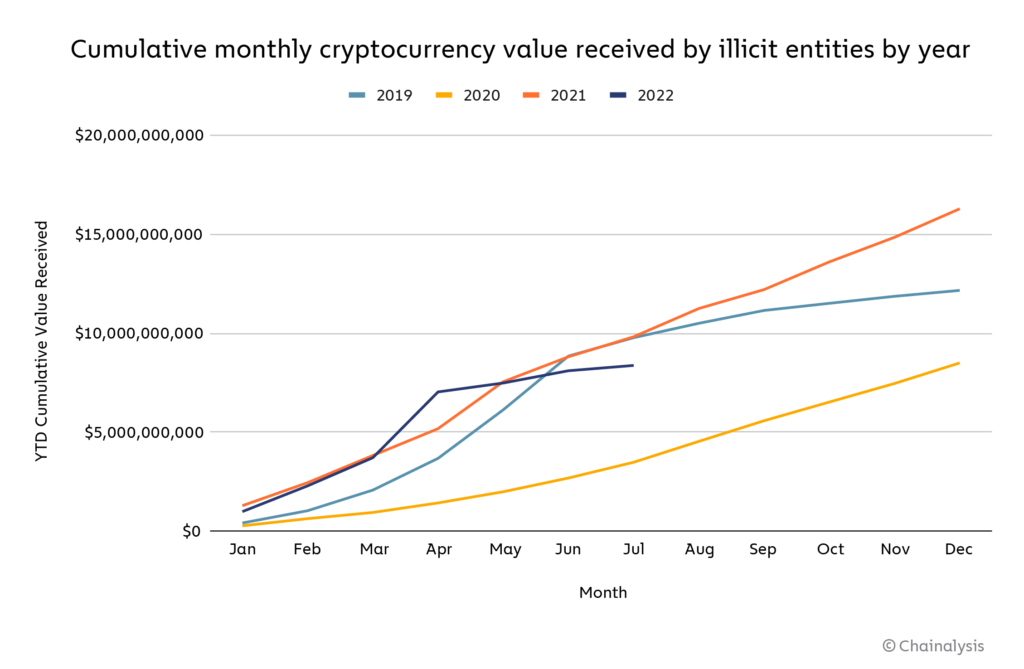

“Cryptocurrency transaction volumes this year for both illicit and legitimate entities are tracking behind 2021 through July.”

However, the crime spree on Web3.0 seems to have no end in sight.

“Overall, criminal activity appears to be more resilient in the face of price declines”

The drop in overall transaction volume seems to be due to the lack of bull market and participants, rather than an actual dip in cyber crimes.

Digging Into The Data

Despite the depressing statistics, total scam revenue is down 65% from July 2021, currently sitting ~$1.6 billion. Notably, the number of scams seems to be in line with $BTC price.

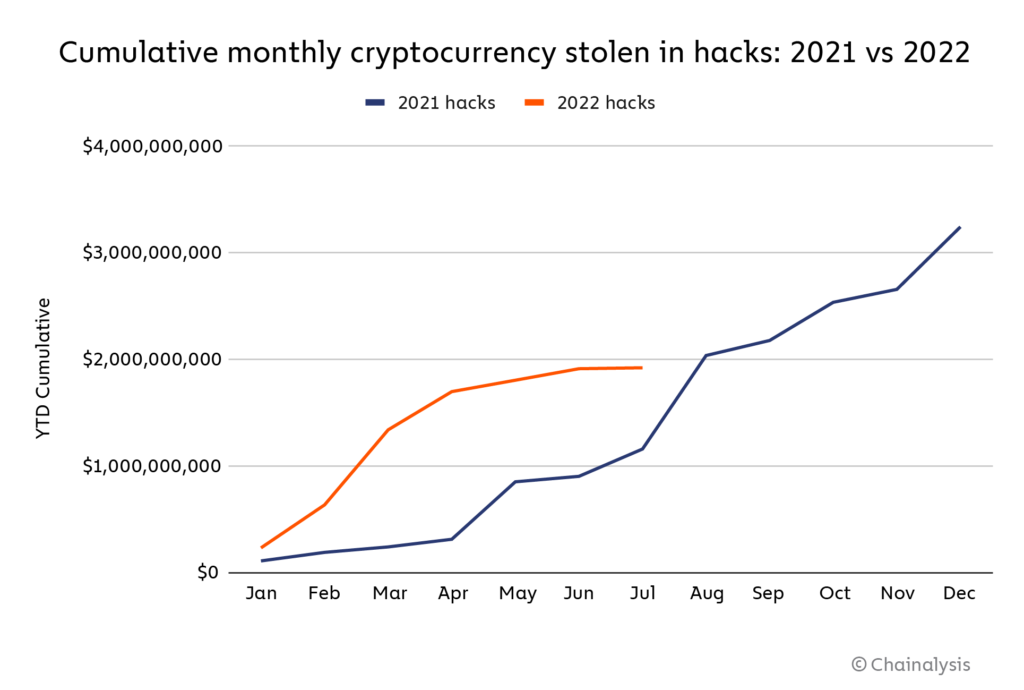

However, a total of $1.9 billion has been stolen so far this year.

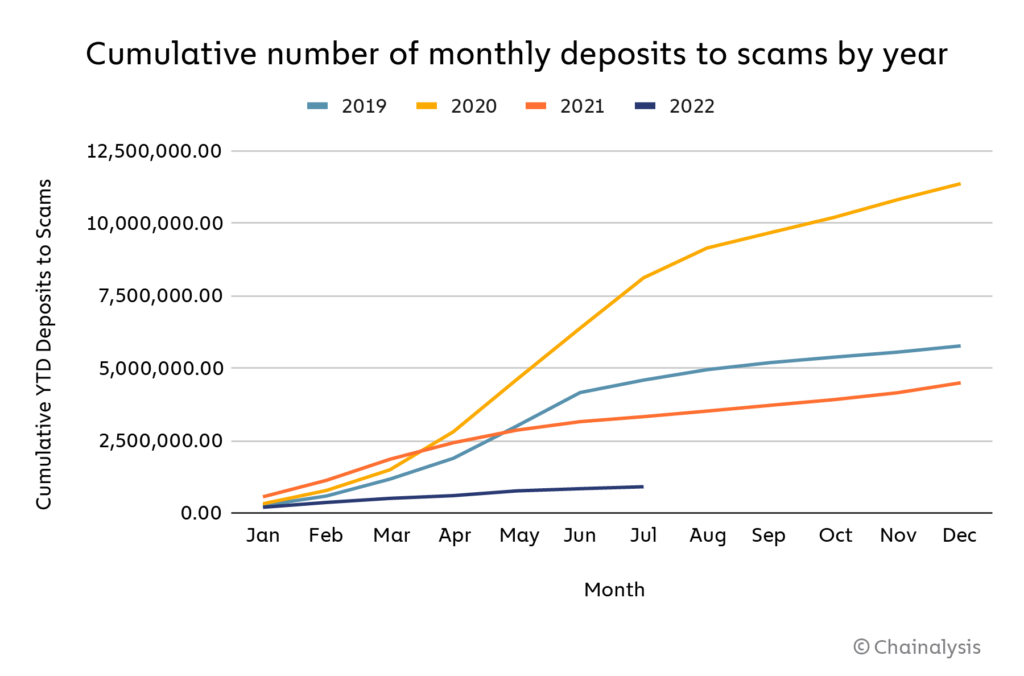

Another eye-catching infographic shows that “fewer people than ever are falling for cryptocurrency scams.“

The total amount of individual transfers to scams so far in 2022 is the lowest it’s been in the past four years.

However, it is no secret that major protocol hacks have been pervading the space recently.

This includes the Axie bridge, Solana wallets, and Uniswap – to name a few. It also has yet to include the $190 Million Nomad Bridge Hack in august.

“DeFi protocols are uniquely vulnerable to hacking, … their open source code can be studied ad nauseum by cybercriminals”

While individuals are falling for scams less, these large protocols that house their funds are doing the inverse. To stop this, the industry has to “shore up security and educate consumers on how to find safe projects to invest in”.

Also Read: How Do Bridges And Networks Get Hacked? Understanding 51% Attacks

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief