I love DeFi and enjoy the massive yields that I can farm off from the variety of staking mechanisms out today.

However, I have never been a big fan of NFTs, and I am easily stumped when deciding which NFTs are good, which one becomes popular, and I struggle to find profile pic NFTs that are even remotely appealing to my personal tastes.

Personal opinions aside, the market growth for NFTs is extremely impressive. Whereas DeFi exploded in 2020 and eventually spread multi-chain, much of DeFi’s popularity with the retail world is still not entirely ready yet.

Also Read: What Blocks People from Entering DeFi? An Introduction to OnDefy

I believe that DeFi will fully take off once the user experience and safety becomes much better. Much of the efforts needed to interact with DeFi (purchase a token, bridge to other chains, engage in lending/staking/LPing) can be abstracted away into one-click platforms eventually.

So what is it about the NFT space itself that has taken the crypto world by storm?

NFTs and flexing

In contrast to DeFi, the idea of owning digital art with authenticity that can be verified on-chain is much simpler to grasp. NFTs are essentially collectables (now verified on blockchain) which makes it so enticing.

The high end art pieces, such as Punks and Apes are examples of NFT value accrual funneling upwards and ownership of these collections is just like buying up rare art.

As with art, these pieces end up being either a store of value, as well as a status symbol. Due to the fixed supply of NFTs in a specific collection and the status symbol providing a premium value to the floor price, high end NFTs serve the purpose of a Veblen good.

In other words, I expect the prices of these to appreciate indefinitely over the long time frame even as demand increases.

Many NFT collections of today will not survive in the future and the popularity of reselling NFTs for a quick flip will fade away over time. However, higher-end NFTs will survive, retain and even grow in value, becoming the new digital luxury good of this generation.

Also Read: BAYC Vs. Ether: Is It Better To Hold Blue Chip NFTs Or Their Underlying Cryptocurrency?

However, is that really the end-game for highly valued NFT collections?

What if these prized NFTs could be allowed to do something productive? What if these “illiquid JPEGs” could be put to work and introduce a new level of capital efficiency into the ecosystem?

In short, what if a bridge between NFT and DeFi exists? Enter projects like JPEG’d, DeFrag, DropsNFT, FloorDAO and a glimpse of the future may be found.

Financialization of NFTs: Lending

These projects are an example of DeFi working with NFTs.

For example, put up NFTs as collateral and take loans on them for yield farming. The first example, JPEG’d, plans to achieve the following for NFTs, starting with the well established CryptoPunks collection, followed by EtherRocks, BAYC, and eventually other collections.

Here is the simplest way to explain JPEG’d:

- Take loans on your NFTs as collateral and borrow/mint a stablecoin that can be put to use in yield farming

- Other DeFi mechanics in the roadmap, such as speculating on NFT price via futures/options

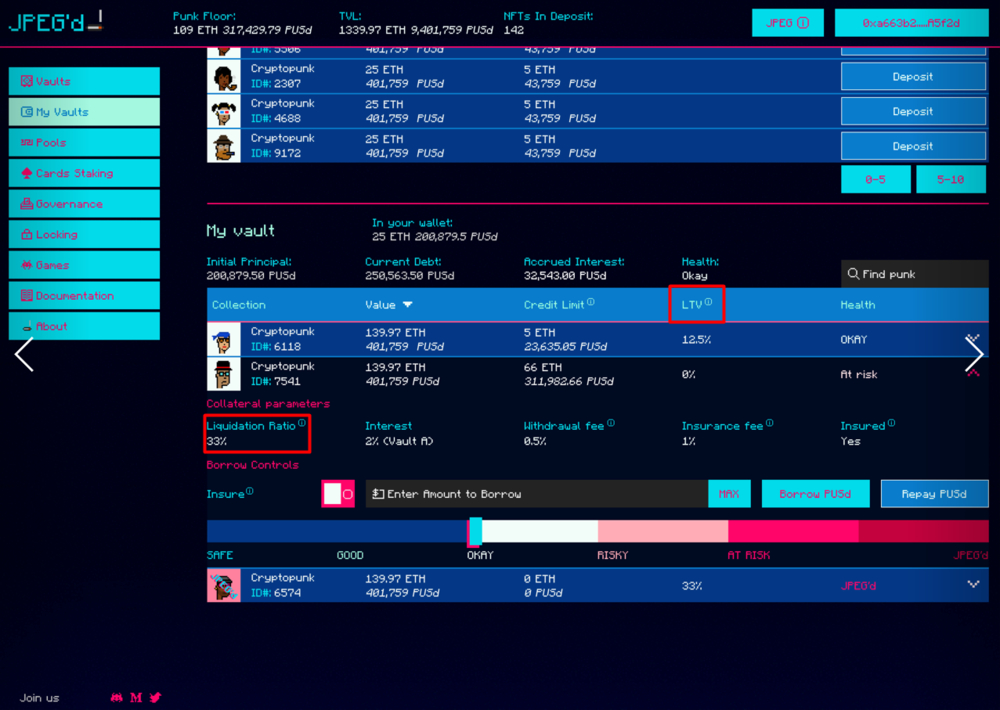

Currently, JPEG’d offers up to 32% of the collateral value to be borrowed, and if the Liquidation Ratio hits 33%, liquidation occurs.

Why would people take a debt position on JPEG’d and risk liquidation if the price floor drops? Would people want to take a risk on losing their NFT put up as as collateral?

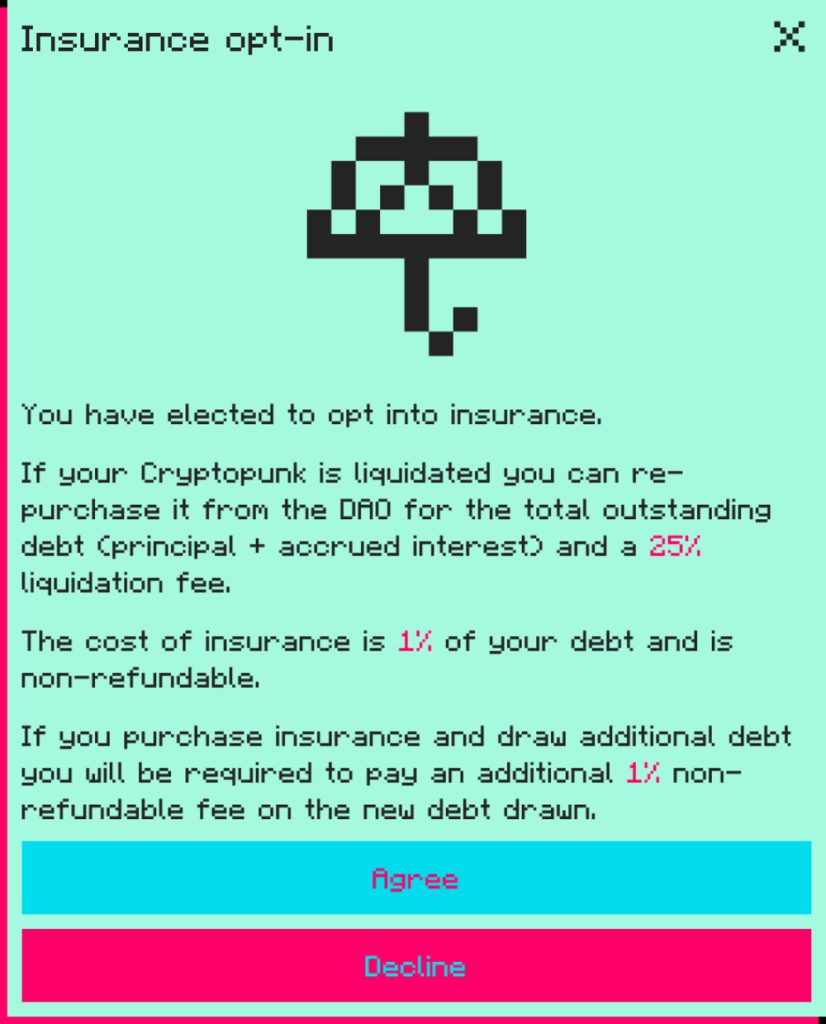

JPEG’d tackles this via its novel insurance mechanism, which allows for users to purchase back their NFT after they repaying their loan within 24 hours at a 25% premium.

Of course, the other projects mentioned such as DropsNFT and DeFrag also try to tackle lending in their unique ways. In fact, DeFrag Finance uses the idea of put options to insure against liquidations of NFTs that may occur. More information can be found on our article featuring DeFrag here.

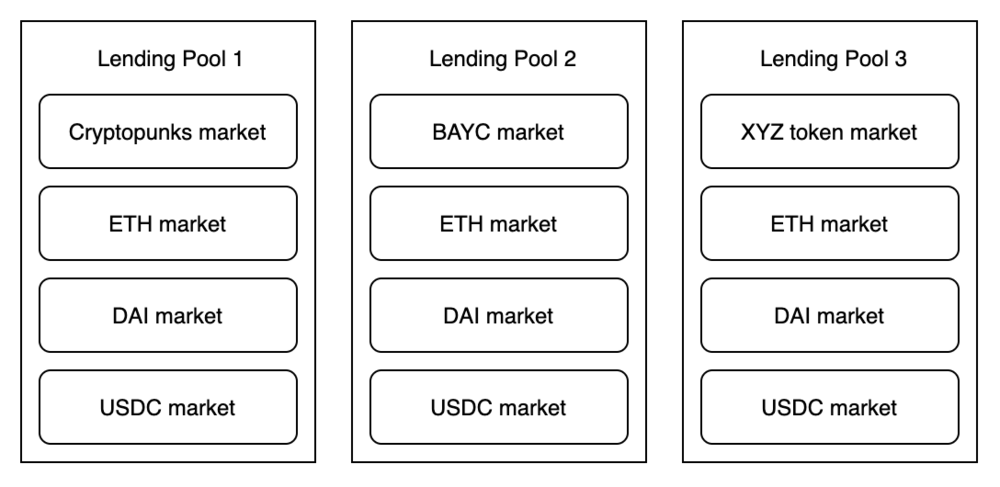

DropsNFT is also a competitor to JPEGd in the NFT lending market. While JPEG’d allows for the minting of their own stablecoin pUSD and can be thought of as a system like MakerDAO, DropsNFT functions more like a money market akin to AAVE.

DropsNFT offer isolated lending pools for these NFTs. It means that the risk is isolated to those that supply capital to the pool. Whereas in the case for JPEG’d, the team will have to be wary of stablecoin depeg for pUSD and hence only list the higher end/most liquid NFTs at first.

Financialization of NFTs: The Bigger Picture

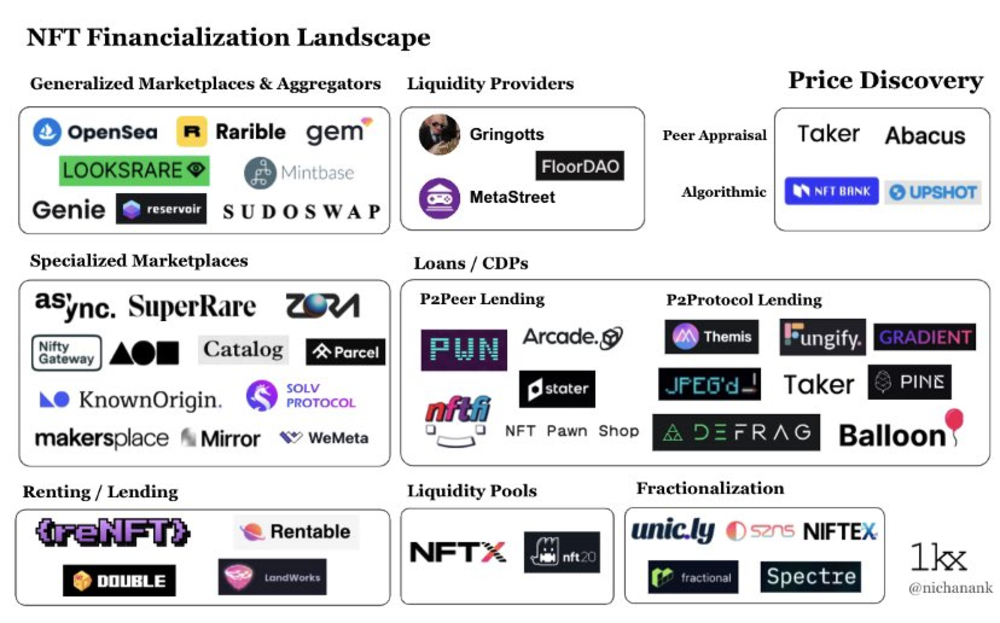

However, lending and borrowing on your NFTs is not the only niche when DeFi meets the NFT space. Just as DeFi was not constrained to only lending, other niches and usecases for the NFT financialization landscape exist.

These issues are of course, being tackled right now as I type this article: in fact, the variety of projects in NFT-Fi is pretty big!

Certain questions and trends to think about would be the following:

- How can NFTs be traded more efficiently?

- How can retail access a portion of high-end and prized NFT collections?

- Can the prices of NFTs be predicted and could there be a market for speculating on these prices?

- How does one appropriately valuate an NFT?

- Can DeFi composability be applied to the NFT space?

Closing thoughts

Currently I do not have a bias for which of these projects are going to succeed and dominate in crypto. I believe that this is a new sector entirely that allows for greater capital efficiency on NFTs and creates composability with the rest of DeFi.

In fact, various discussions and buzz on Crypto Twitter regarding this could signify a potential new meta for crypto investors in the future.

Fine art lending is a lucrative business w/ $30bn of art-secured lending volumes per year

— 0xHamZ (@0xHamz) April 16, 2022

On-chain lending primitives are a natural consequence of prized NFT collections$JPEG is best positioned to capture mkt share and is great risk reward at current prices

Regardless of whichever platforms take off, I believe that there is an interesting addressable market in the works, and for the first time in crypto history, we can see DeFi and the NFT space working together to create a brand new product that is decentralized and more transparent for all.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Is It Better To Hold Blue Chip NFTs Than Their Cryptocurrency?

Was this article helpful for you? We also post bite-sized content related to NFTs — from tips and tricks, to NFT alphas on Instagram, and you can follow us here!