DeFrag Finance has recently been in the spotlight, thanks to some notable partnerships and a successful NFT mint.

Allowing you to take loans against your NFTs, this protocol’s unique features have certainly piqued the attention of many.

So, will we finally be able to borrow against our profile pictures, or will they remain illiquid JPEGs for now?

What is DeFrag Finance?

DeFrag Finance is a decentralized, non-custodial liquidity market protocol where NFTs can be put up as collateral. Based on floor price and collateral ratio, the protocol will then insure your NFTs through a put option that you have to purchase.

Buying a put option gives you the right, but not the obligation, to sell the underlying asset at a stated price within a predetermined period.

Liquidity for these options is provided by underwriters within the protocol, who are in turn incentivized through premiums.

However, these options differ from traditional finance as they do not require complex negotiations like strike price or expiration date.

How do NFT loans work?

NFT loans have two crucial issues — price volatility and low liquidity. So, what would happen if a collection’s floor price collapsed?

The protocol hedges against this through put options. Using them allows the protocol to extend loans and provide liquidity to users, even through choppy market conditions.

They also use a “Peer-to-Pool” system instead of the traditional “Peer-To-Peer”, due to NFTs’ inherent lack of liquidity and fragmentation.

Metamatician NFT

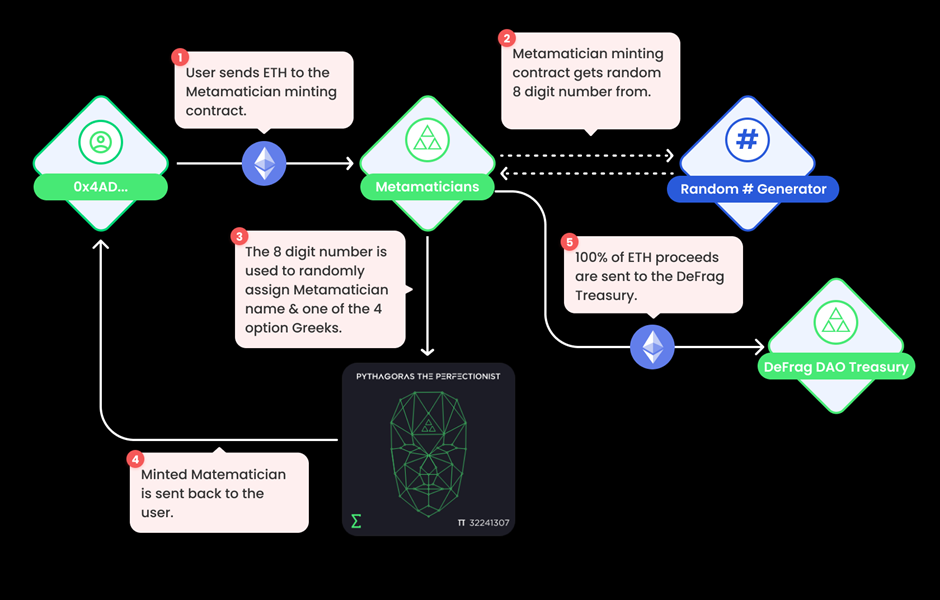

The protocol, which functions as a DAO, recently launched their Metamatician NFTs. These provide a frictionless borrowing experience and help raise liquidity for underwriting loans.

Users that own an NFT will have a stack in the first Underwriting Pool, allowing them to earn premiums and enter the universe of NFT collateralized loans.

Metamaticians are based on famous mathematicians and generate with 8 random numbers. These unique properties can give boosts to holders within their financial ecosystem.

Additionally, all minting proceeds (0.618 $ETH each) will go to the DeFragDAO treasury. Once the community votes in the initial NFT project to be used as collateral, the $ETH will be transferred into the initial underwriting pool.

As borrowers take loans, the protocol will automatically issue the required number of NFT put options and lock up sufficient funds.

What is Fractionalization?

To understand how borrowing and liquidations work on DeFrag Finance, it is important to understand how NFTs are fractionalized.

Multiple people can claim ownership to an NFT by dividing it into smaller parts. Smart Contracts facilitate this by generating a set number of tokens linked to the original.

How does borrowing work and why should you borrow?

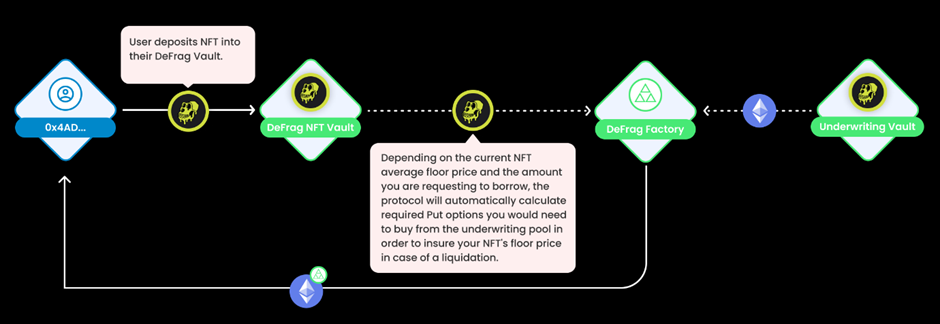

Borrowing on DeFrag Finance is simple and intuitive. Firstly, users need to select the project they would like to borrow against, such as their blue chip NFTs. Then, users will create their DeFrag vault, where they can deposit these NFTs as collateral.

Users later choose how much $fETH (fragmented synthetic version of ETH) they would like to borrow. Depending on the NFT floor price and borrow amount, the protocol calculates the required Put Option to insure against liquidations. It is important to note that issuance and sale of NFT put options happen automatically in the same transaction. Much like flash loans, it would be impossible to perform these functions separately.

DeFragDAO provides two main reasons why you should borrow on their platform:

- Users can get an instant loan without having to negotiate terms with a peer or counterparty.

- Users get back the same NFT they collateralized. Liquidation is the only even that fractionalizes your NFTs.

How do liquidations work?

Once the average NFT is below a liquidation price set by DeFragDAO, collateral deposited can get liquidated through their put options.

In the event of liquidations, the underwriting liquidity pool will lock up $ETH in case it needs to purchase the liquidated NFT. Closing open loans will then be possible through the NFT proceeds. Afterward, the NFT is fractionally owned by the underwriters, proportionally distributed between those providing liquidity to the specific pool.

Closing thoughts

DeFrag Finance has its priority in unlocking the liquidity behind NFTs. To achieve this, it has announced further partnerships with projects such as Synthetix, 1inch, AngelDAO, and Impossible Finance.

We are excited to announce a strategic partnership round. DeFrag will be well-positioned to achieve its mission to unlock NFT liquidity by creating a non-custodial liquidity protocol where borrowers can use NFT assets as collateral.https://t.co/MUWgXsjzNh pic.twitter.com/uQxX309cdS

— DeFrag.fi 🧮 (@DefragFinance) March 3, 2022

With platforms like OpenSea seeing billions in volume, we can rest assured that NFTs are here to stay. However, borrowing still comes with plenty of friction, keeping capital locked up. Being able to properly collateralize your NFTs could therefore lead to exponential growth in the space – much like we saw with DeFi summer.

At the moment, pricing these NFTs remains the largest problem, and developers are trying to create more stable LTV ratios through increasingly robust formulas. As the protocol grows to include generating yield from NFTs and includes GameFi, we can be sure that DeFrag Finance is something we should keep a constant eye on.

Featured Image Credit:

Also Read: Was It A Necessary Evil? How The Balloonsville Rug Pull Made The Solana NFT Space Safer

Was this article helpful for you? We also post bite-sized content related to NFTs — from tips and tricks, to NFT alphas on Instagram, and you can follow us here!