At the heart of every cryptocurrency project is the blockchain technology.

A blockchain is a system of recording information in a way that makes it difficult or almost impossible to change. It is a digital ledger of transactions that is duplicated and distributed across the entire network of computer systems.

Every blockchain should be three things — scalable, secure and decentralized. The popular blockchains you probably heard of are Bitcoin and Ethereum, and are described as Layer 1 blockchains. They form the underlying main blockchain architecture.

What is a Layer 1 blockchain?

A Layer 1 blockchain is a set of solutions that improve the base protocol itself to make the overall system more scalable. Few other examples of Layer 1 blockchains include Bitcoin, Ethereum, Binance Smart Chain, Litecoin and Avalanche.

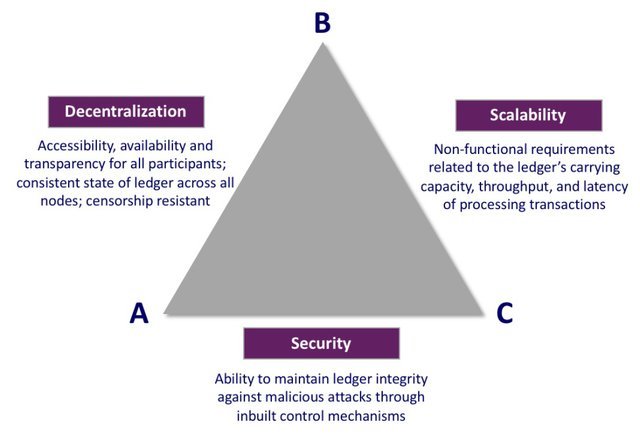

Scalability Trilemma

The scalability trilemma refers to the blockchain’s ability to juggle three organic properties that constitute its fundamentals principles of security, decentralization and scalability.

The trilemma states that any blockchain technology can only feature two properties at most, never all three at once. Thus, the current blockchain technology will always have to compromise on one of the fundamental properties.

An excellent example of this is Bitcoin, while its blockchain has managed to optimize decentralization and security, it has had to compromise on scalability.

Consensus protocol in Layer 1

Proof-of-Work, or PoW, is the traditional consensus mechanism for Bitcoin and ETH. It aims to achieve both consensus and security using miners to decode complex cryptographic algorithms. However, PoW struggles with two main issues – it is slow and resource-intensive.

Proof-of-Stake, or PoS, is a mechanism that features a distributed consensus over the blockchain network. Users can authenticate block transactions on the basis of their stake.

PoS wins over PoW in terms of transaction speed but loses in terms of security. The Ethereum blockchain wishes to transition from PoW to PoS through Ethereum 2.0.

Ethereum 2.0 is the collective term for a set of upgrades that are currently underway to make the Ethereum blockchain more scalable and sustainable.

Sharding in Layer 1

Another method that has been ported from the distributed databases sector and adapted for Layer 1 solutions.

An experimental approach in blockchain space, since it involves the breaking up of a network into a series of separate database blocks known as “shards” — hence the term “sharding” — which essentially makes the blockchain more manageable.

This approach also eases current requirements for all nodes to process or handle transactions in order to maintain the network, since all the “shards” are processed in a parallel sequence, thus allowing for greater processing capacities to be freed up for other processes. One example of a cryptocurrency utilizing this mechanism is NEAR Protocol.

Layer 2 solutions

Before we continue talking about what Layer 2 solutions are, let me give you an analogy to better your understanding.

Imagine its late at night, you are at your local 24h supermarket wanting to buy a supper snack. There is not many people, and a few cashiers which you can use to pay for your snacks. In less than 5 minutes, you will be out of the supermarket enjoying your supper snack.

However, what happens when you want to perform that very same transaction during a peak period of the supermarket where everyone is there to buy their groceries for eg. dinner. You will be met with long lines at the cashiers and the time taken to perform your transaction of buying a snack will be longer.

When it comes to Layer 1 blockchains, transaction fees will increase when overcrowding happens. On the Ethereum blockchain, peak periods saw transaction fees ranging between US$60-US$150 per transaction.

Can you imagine transacting costs being more than the snack you want to buy?

So what is Layer 2?

Layer 2 is the framework that gets built on the Layer 1 platform. It is built for the main purpose to improve scalability.

Layer 2 solutions create a secondary framework where these transactions take place independently of Layer 1. This is also commonly referred to “off the chain” which allows for scalability to happen.

Layer 2 solutions often execute, smart contracts, dApps and transactions and finalize them periodically on the layer1. Some Layer 2 solutions to look out for include Polygon $MATIC and Loopring $LRC.

Also, checkout our previous article on The Ultimate Guide To All Bridges Between Ethereum And Other Layer 1s And Layer 2s

The benefits of Layer 2 scaling includes:

- High throughput

- Completely Secure

- Decentralization

- Lesser load on base layer

- Extremely scalable

- High Transaction speeds

This way, transactions will be much faster without sacrificing on the security of the blockchain.

Bullish narrative for Layer 2 solutions

- The most future proof scaling solutions. Considered as a modular approach, Layer 2 solutions enables Layer 1 to scale with the segmentation of different dApps within the blockchain like gaming and DeFi. The separation of apps in different research pools and give them their very own ‘market’, equating to a more sustainable system.

- Adoption is rocketing. The total value locked from all Layer 2 has been rocketing in the past six months. In my opinion, Layer 2 solutions are still new in the crypto space and is on its way to mass adoption. As exchanges enables withdrawals directly to Layer 2s, increasing user experience, users will enjoy fast and cheap transactions in fees without needing to pay for the expensive gas fees.

Conclusion

So to wrap up, Layer 1 solutions are main chains which performs all transactions while Layer 2 is a framework built on top of existing blockchain with fast transactions without compromising on network security.

2021 saw the wave of Layer 1 solutions being implemented and adopted. In my opinion, 2022 will see the rise of Layer 2 solutions along with mass adoption.

Most of Layer 2 do not have their tokens yet if history is any indication, it would be likely they would introduce one in the future.

My recommendation is to try Layer 2 solutions thought using of their testnets, dApps and bridging funds over so you might qualify for airdrops in the future.

For more establish Layer 2 networks, also keep an eye out on liquidity mining programmes as Layer 2 might give out their own token as incentives for using dApps in their ecosystem. This would give you double the rewards in receiving dApps token and the Layer 2 token.

Featured Image Credit: Chain Debrief

Also read: New To Crypto? Here’s How To Start Investing In Cryptocurrencies In Singapore