For new retail investors, getting started or investing in cryptocurrency may be scary, as there are stories of scams and investors losing millions of dollars.

Back in 2017, stories of investors losing millions in ICOs (initial coin offerings) were aplenty, leaving a bad reputation for cryptocurrency as a whole.

To make matters worse, the market price of Bitcoin crashed from a high of US$19,000 to US$6,000 in just a few months in 2018.

However, the tide has since turned, and cryptocurrency has surged in popularity in the past year. In fact, it’s not just popular within retail investors. Institutional investors have also jumped on board the bandwagon.

Singapore’s largest bank DBS has set up a digital exchange which enables investors to tap into a fully integrated tokenisation, trading and custody ecosystem for digital assets.

Around the world, the rise in cryptocurrency acceptance from the public has been accompanied by increased institutional interest, including big names like HSBC, Goldman Sachs, and JPMorgan.

In the span of 12 months, Bitcoin exploded from trading at US$8,166 on 8 March 2020 to hitting record highs of over US$61,000 in March 2021.

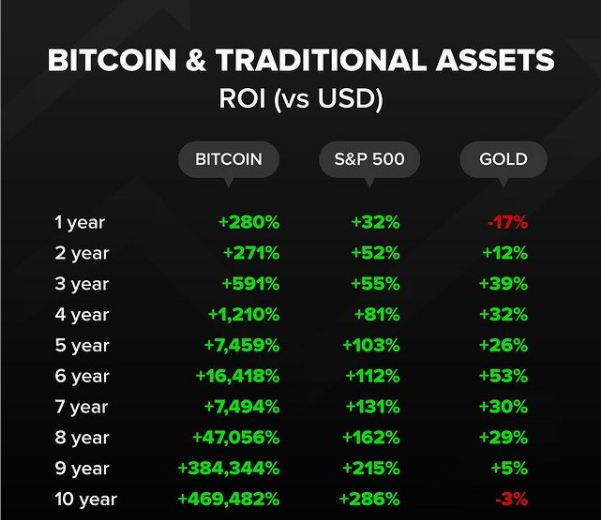

While most investors might be scarred by the huge drawdown of the crypto crash in 2018, seasoned investors have actually seen a positive year-on-year total return for Bitcoin annually.

Here’s how to begin investing in cryptocurrency in Singapore, if you are looking diversify your investment portfolio:

Creating an account with a crypto exchange

The first step is to open an account with a crypto exchange, and you can start buying your first cryptocurrency. Here are a few reputable crypto exchanges in Singapore that you can consider:

- Coinhako

- Gemini Singapore

- Binance

- Huobi

- Coinbase

All of these exchanges offer hundreds of cryptocurrencies for you to buy from, and signing up for an account is straight forward. After you key in your basic information and complete your KYC process, you are able to deposit money into the exchange and start buying your first cryptocurrency.

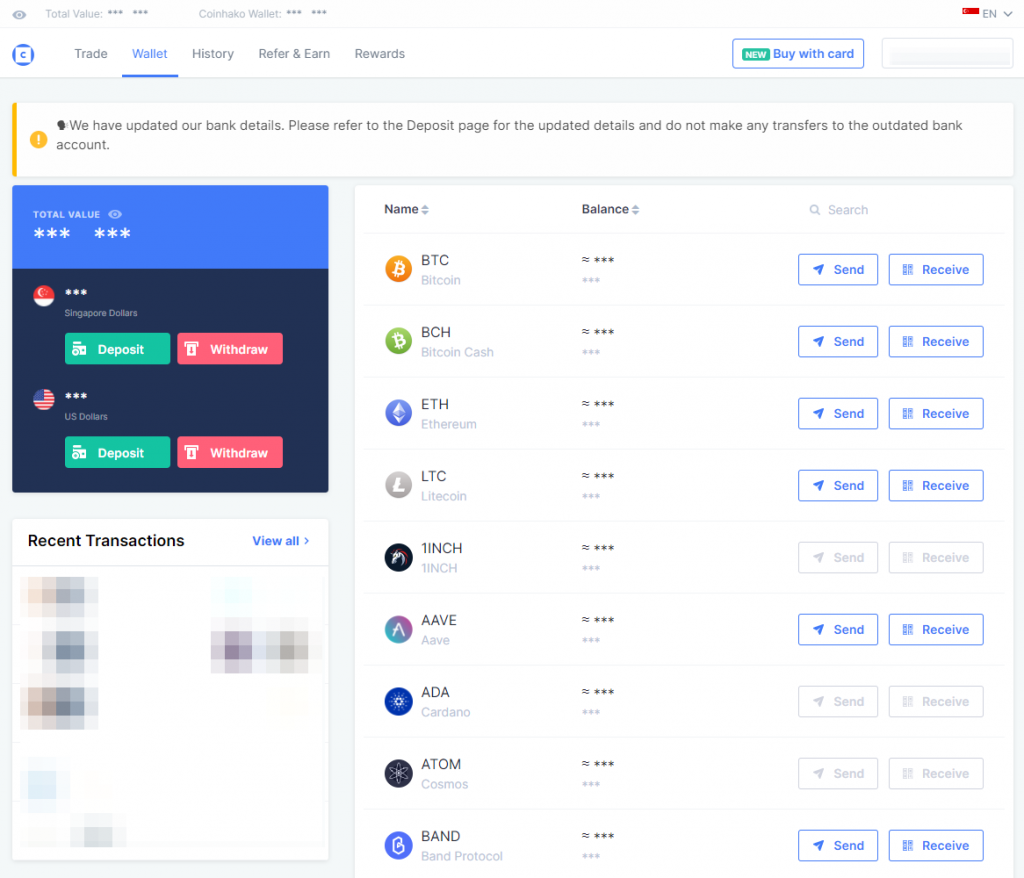

Coinhako Overview

Coinhako is a local company started by Singaporeans back in 2014. Coinhako is the first cryptocurrency exchange allowing users to purchase cryptocurrencies with SGD.

Here’s what the interface of the application looks like:

Here is a quick overview of Coinhako’s features:

| Number of Currencies available | 42 as of 14 July 2021 |

| Deposit Methods | Xfers FAST |

| Funds Withdrawal | Direct To Bank Account |

| Deposit Fees | 0.55% (Xfers), none for FAST |

| Withdrawal Fees | US$2 per withdrawal (For SGD) US$15 per withdrawal for USDT |

| Trading Fees | 1% |

| Sending Fees | Dynamic |

Coinhako allows you to purchase 42 cryptocurrencies using Singapore dollars, which is a convenient way for Singaporean users to directly purchase the cryptocurrencies once the money is deposited into the Coinhako account.

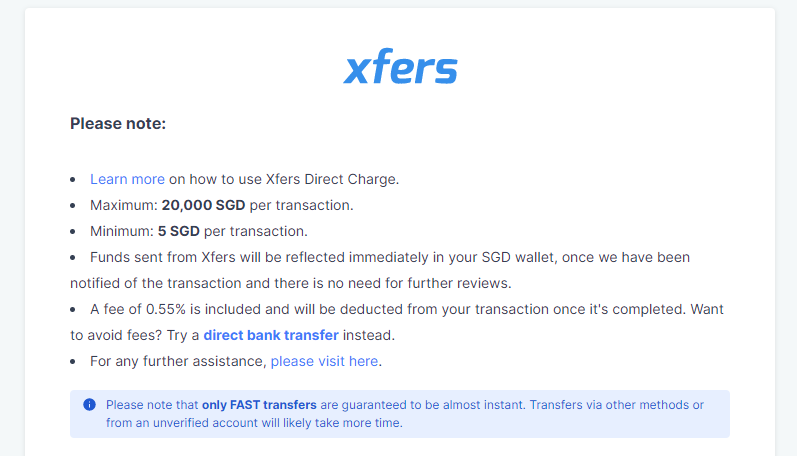

Depositing Money Into Your Coinhako Account

There are 2 main ways that you can fund your account:

- Xfers Direct

- FAST Transfer

To start using Xfers, you’ll need to create a Xfers wallet and then make a deposit to the Xfers wallet. Once the deposit is effected, the amount will appear in your Coinhako dashboard.

You can also deposit your funds directly into Coinhako via a direct bank transfer. There are no fees involved for a direct bank transfer, however, the fund will take up to 1 business day to reach your Coinhako account.

| Method | Time Taken For Funds To Reach Account | Fees |

|---|---|---|

| Xfers Direct | Within minutes | 0.55% |

| FAST Transfer | Up to 1 business day | None |

With the funds in your account, you can start purchasing your first cryptocurrency.

How much should I allocate into cryptocurrency?

It should be noted that cryptocurrency is a asset class with high volatility. Investors should be able to stomach the volatility and have the conviction that projects with good fundamentals will eventually increase in value as adoption increases.

It is often recommended that retail investors allocate about 1-5% of their net worth into cryptocurrency. Another way to look at it is to pump in 1-5% of your investable monthly cashflow into cryptocurrency.

For example, if your take home pay is S$4,000, and after deducting your expenses, you are left with S$1500 to invest, you can invest between S$15 to S$100 into cryptocurrency. For retail investors who are very familiar with cryptocurrency and are willing to take a higher risk, you can choose to allocate a larger amount into this asset class.

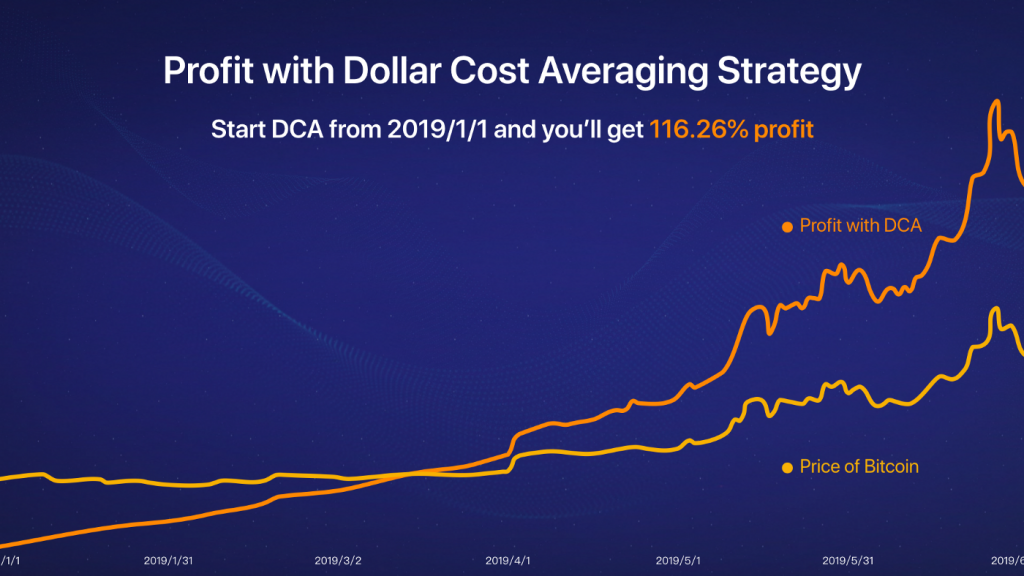

Another way to invest is make use of dollar cost averaging, which has been a proven strategy with the price of crypto sloping upwards since a few years ago.

Dollar-cost averaging is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase.

The goal of dollar-cost averaging is to reduce the overall impact of volatility on the price of the target asset, and aims to avoid making the mistake of making one lump-sum investment.

Buying fractions of a cryptocurrency

Unlike shares, investors can buy fractions of cryptocurrencies. Currently, 1 Bitcoin is going for around US$50,230. However, you don’t have to purchase one Bitcoin.

You can put in a small amount — whatever you’re comfortable risking. The same goes for all the cryptocurrencies out there.

For advanced users

Once you get your first exposure in cryptocurrency and start to explore the new world, you will soon discover that in crypto, you can do a plethora of things, including:

- Buying and selling different crypto tokens

- Trading crypto derivatives such as Futures or Perpetual Contracts

- Leveraging and borrowing on margin to boost gains on your derivatives contracts

- Shorting the market using derivatives

- Pledging crypto collaterals and getting a loan from a lending protocol like Aave without KYC or approval letters

- Harvesting yields through yield farming protocols like Curve, Balancer, Autofarm, Yearn Finance

- Staking your crypto (like fixed deposits) and getting a yield as reward for securing the network

- Trading synthetic stocks like mirrored-Apple shares and earning a yield through capital appreciation and becoming a liquidity provider

- Becoming a liquidity provider and a market maker by staking your tokens into liquidity pools and earning yield and fees for facilitating the exchange (you become the exchange/broker)

- Trading and flipping NFTs (Non-Fungible Tokens) and increase your crypto allocation due to market inefficiency of the NFT market

- Buying NFTs like Axies and earning yield from them by playing the Axie Infinity game or outsourcing it to scholars to earn yield through their time and effort.

- Buying and holding NFTs as a speculative play in hopes that the scarcity will result in sky high valuations (CryptoPunks/BAYC)

- Earning passive income through a centralised platform such as Hodlnaut, Celsius or Nexo

All of these examples fall under decentralized finance. Here’s a guide on how to get started with decentralized finance.

Investing in your first cryptocurrency

Investing in a whole new asset class is a scary, yet exciting process, as the risk and rewards are both high.

The abovementioned points are just tips to get started on the act of buying cryptocurrencies, but you also have to decide on the cryptocurrency you would like to invest in, as the possibilities are endless.

One way to decide if you should buy into a particular project is to read its whitepaper, which will help give you an idea of the problems it is trying to solve and their growth trajectory.

It is important to believe in the cryptocurrency you are investing in, much like how it is advised to purchase shares of companies that you personally patronise.

If you’re just beginning to dip your toes into the crypto world, begin with an amount that you are willing to part with, before building up your portfolio as you gain more knowledge on the space.

If you are a new Binance user, you can register using our referral link and get 5% off your trading fees.

Also Read: How To Get Started With Decentralised Finance (DeFi) For Beginners