Launched in mid-2020, Yearn has grown to be one of the most popular decentralized finance (De-Fi) protocols.

Known as the ‘gateway to De-Fi’, Yearn is an Ethereum-based protocol that aims to build a holistic suite of financial products fully governed by the community. Yearn provides a one-stop solution for optimizing users’ yields on their cryptocurrency assets in an automated and decentralized fashion.

With the use of decentralized and self-executing smart contracts, Yearn protocol executes investment strategies across the De-Fi ecosystem to maximise returns while minimizing risks.

Yearn’s protocol strips away the complexities in interfacing with various De-Fi protocols and the deployment of sophisticated, yield-generating strategies, by offering users a single, simple interface to optimize their cryptocurrency assets.

This was what the founder of Yearn, Andre Conje, sought to achieve on his own, amidst the wide opportunities and complexities of the De-Fi space.

Yearn has now grown into one of the most active and engaged community in the De-Fi space, where numerous innovative solutions and strategies for yield generation are constantly launched.

How Yearn works

One of the core potentials of De-Fi is the ability to synergize or tap on various different protocols freely, resulting in a synergy of innovation.

Also known as ’composability’, the interoperability of De-Fi protocols and applications result in the creation of efficient and creative financial products that are unique only within the De-Fi space.

At its core, Yearn’s main objective is to harness the potential of numerous other De-Fi protocols out there into a single, easy-to-use interface where users have the ability to pool their cryptocurrencies into any of Yearn’s vaults to generate yields.

Having a central point of yield aggregation across various De-Fi protocols is beneficial for the community as they could put their cryptocurrency holdings in use and earn yields.

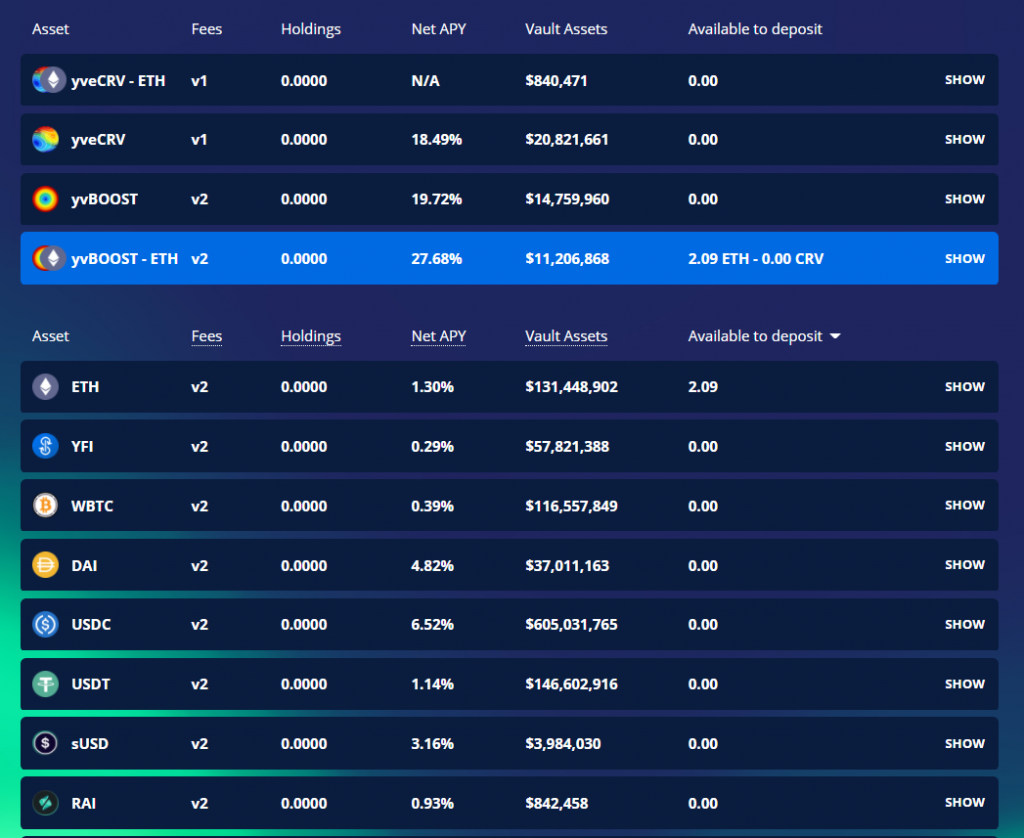

Currently, the yields across a list of supported coins range from 0.29% to as high as 27%. One thing to take note of is that Yearn aggregates yields only from credible and audited projects to ensure yield optimization and more importantly, risk mitigation.

Yield generation is achieved through automated smart contracts which are deployed to tap on various investing strategies across numerous De-Fi protocol.

On a high level, pooled user funds on Yearn generate yields through various mechanisms that include providing liquidity on decentralized exchanges and earning trading fees, lending pooled assets to generate interest, earning protocol tokens by staking assets, as well as a combination of those mechanisms across other leading protocols.

Users do not need to know about the underlying complexities of the strategies to take part on the protocol; they can simply provide their cryptocurrencies on Yearn and start earning.

The different products and services on Yearn

Although Yearn is primarily known for being a yield aggregator across the De-Fi ecosystem, its decentralized community has been very active in launching other products to optimize yield generation. There are four main categories of products that are currently on the Yearn platform.

Yearn Vaults (yVault): Vaults are pooled funds that follow defined and unique strategies designed to maximize the yield of the deposited assets while minimizing investment risks. This represents a passive investment strategy where users do not need to have technical knowledge on implementation.

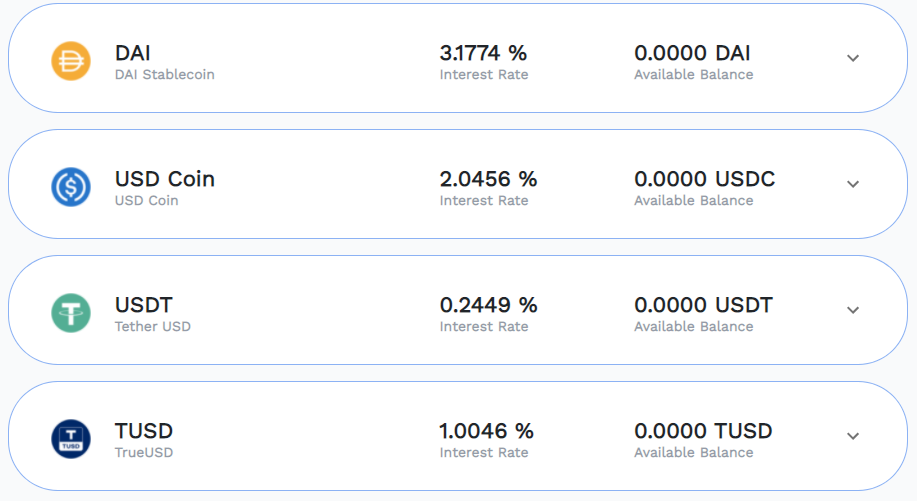

Earn: Yearn’s lending aggregator that channels users’ funds across lending protocols such as Compound, AAVE and dYdX to achieve the highest interest rates for lending Yearn’s pooled assets. Users can choose from a list of assets to deposit and start earning an accrued interest rate that has been automatically aggregated and optimized.

Zap: Zap is a tool that allows users to save on gas fees by bundling several trades in one simple click. More specifically, Zap enables users to enter or exit into liquidity pools on Curve finance protocol, which is a stablecoin decentralized exchange (DEX)

Users earn YFI tokens by locking cryptocurrencies into the yearn.finance contracts running on the Balancer and Curve DeFi trading platforms, via the yearn.finance platform. The more assets users lock onto the platform, the more tokens they are rewarded by the protocols.

Why is Yearn worth looking at?

Fair Launch

Yearn pioneered a decentralized governance mechanism called the ‘fair launch’ token distribution process, where its native token (YFI) was distributed through an open and transparent process that favoured no one.

This tenet of distributed equality is entrenched into the protocol, and one that makes Yearn probably the most active and engaged community in the space.

Cronje and the early developers that started Yearn were not allocated any tokens for their work in establishing the platform. This has resulted in YFI’s token launch to be known as the fairest token launch ‘since Bitcoin’, since it was open to everyone.

Managed by the community, for the community

Due to the fair launch token distribution event, the responsibility for managing the protocol falls squarely on the community.

Holders of the FYI tokens are conferred governance rights, and are therefore responsible for discussing new strategies, conceive new product launches, extend community resources and promote the project.

Users could simply propose a new investment strategy, new vaults of new product integration and if it gains momentum via a voting mechanism, it will be implemented. Leveraging the ‘wisdom of the crowd’ is one the advantages of Yearn.

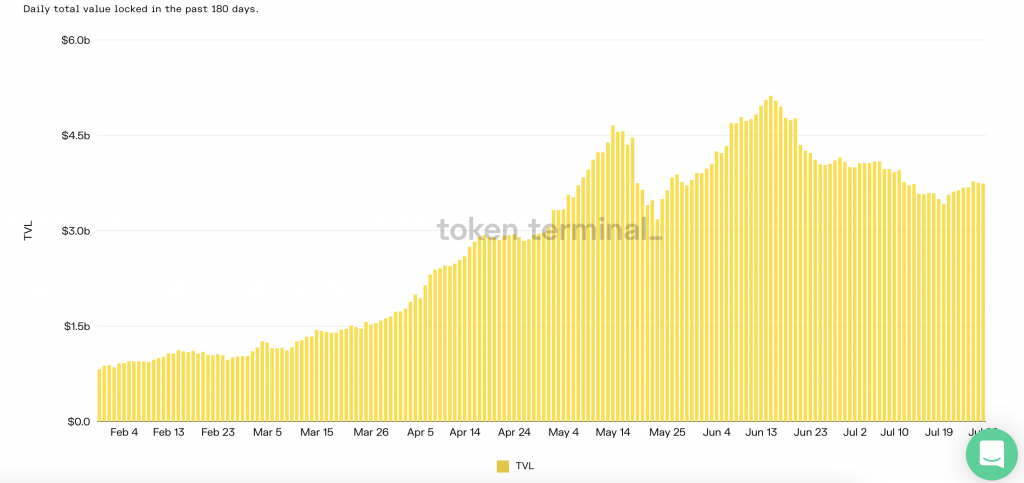

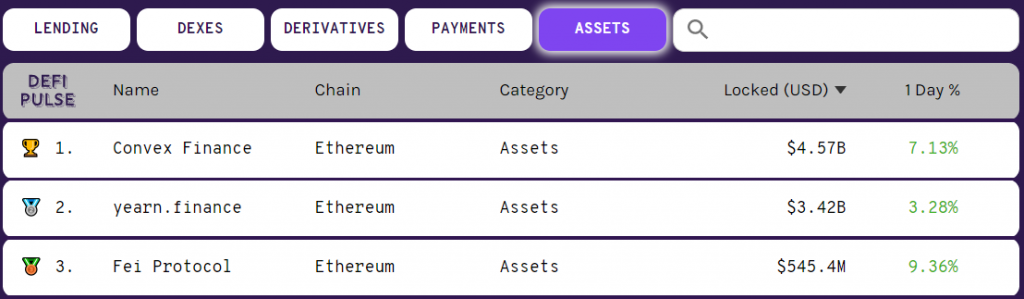

A popular protocol

Yearn grew to become a popular De-Fi protocol that has a strong use case and a fair distribution mechanism that has resulted in one of the most active community in the space. It is no wonder that it has amassed one of the top total value locked (TVL) under the asset management category.

Yearn is a great example of how protocols can incentivize adoption and maximise the synergy of individual DeFi applications to cultivate a strong decentralized community that is vibrant and constantly innovating.