Despite the fact that the majority of crypto trading continues to take place on centralized exchanges (CEXs), decentralization remains at the heart of the core thesis around cryptocurrencies and blockchain technology.

As the earliest generation of decentralized finance (DeFi) protocols have evolved and matured, users have also begun to adopt these protocols in activities that were previously restricted to the sphere of centralized exchanges.

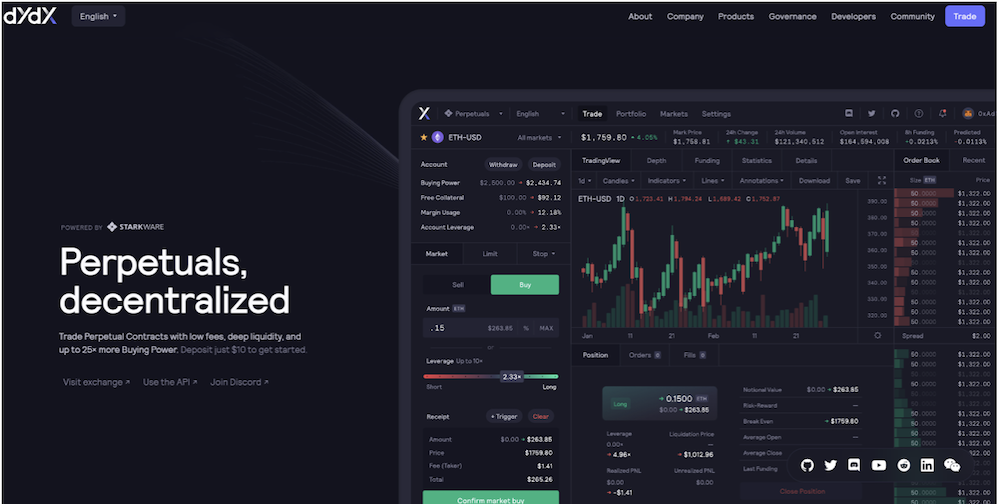

One such domain is that of futures, margin, and spot trading. Founded in 2017 by Antonio Juliano, dYdX has emerged as one of the leading platforms for decentralized derivatives and spot trading, enabling trustless access to complex financial instruments, in a non-custodial manner.

dYdX is one of the fastest growing DeFi protocols. The platform has supported over USD2.2 billion in volume from 11,000 unique traders from January 2021 to May 2021, with over USD40 million in total value locked from over 13,000 unique addresses.

How does dYdX work?

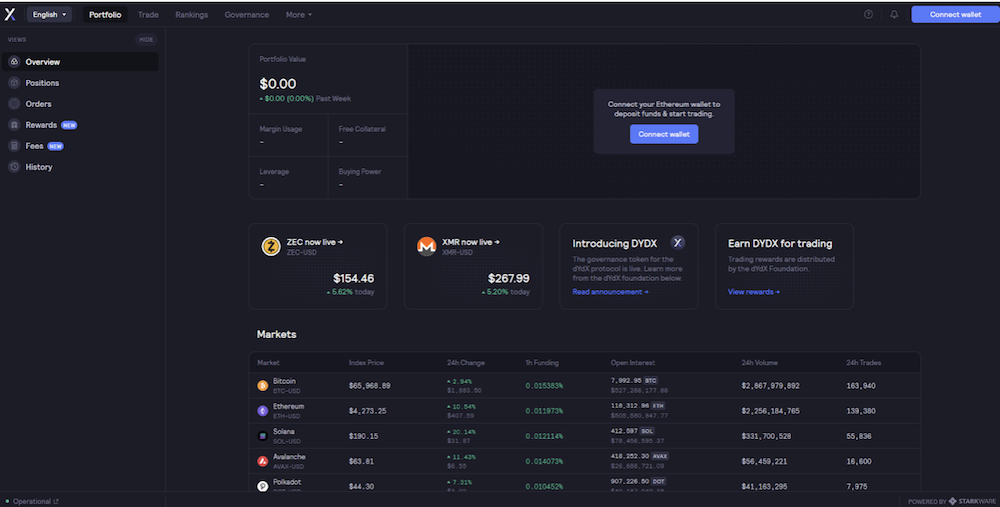

dYdX uses a centralized order book system but crucially remains non-custodial. The protocol settles trades with a layer-2 (L2) system developed and operated jointly with Starkware, settling trade on L2, which offers higher trade throughput and lower minimum order sizes. This is in contrast to other systems which settle trades directly on Ethereum (L1).

This is significant in that traders are able to trade perpetuals with zero gas costs and low trading fees.

All collateral on dYdX is held in USDC, and the quote asset for its perpetual instruments are in USDC. The protocol enables users to trade with up to 25x leverage, with a low minimum deposit of USD10 to get started.

dYdX also offers spot and margin trading for ETH-DAI, ETH-USDC, and DAI-USDC with up to 5x leverage. It is important to note that spot trading is done on L1 rather than L2.

The protocol also has a Youtube channel which contains a repository of videos for users to learn how to use the platform, as well as containing videos to panel discussions and community generated content.

Why use dYdX?

Simply put, dYdX enables users to begin trading crypto by connecting their wallets to the protocol, without the need to supply personal information (which is stored by CEXs). The use of a non-custodial trading platform enables users to retain control over their data.

Users who are utilizing non-custodial wallets (such as MetaMask) in their activities on the blockchain are also able to trade much more seamlessly, in contrast to having to send their tokens to their centralized exchange accounts for trading.

As a trading platform, dYdX also enables users to access high leverage and low starting collateral requirements. The platform currently offers 26 futures trading pairs and plans to add many more in the coming months.

dYdX Airdrop

In September 2021, the protocol airdropped a total of 7.5% of its initial 1 billion governance token (DYDX) supply to users who had traded on the protocol before 26 July.

Since the tokens were airdropped and began trading, the price of each DYDX token skyrocketed to an all-time-high of USD27.78 per token, and is was trading at ~USD20, with a market capitalization of USD1.15 billion at the time of writing.

More than 64,000 users qualified for the airdrop, with a minimum airdrop amount of 310.75 tokens for users who had simply deposited collateral on the protocol, and who executed at least one trade in August.

At the current price, these tokens are worth ~USD6,200. Users who had traded at least USD1 – 10k (second lowest tier) prior to 26 July received a minimum of 1,163.51 tokens, equivalent to ~USD23,300 based on the current price.

DYDX is currently listed on major exchanges such as Binance, Huobi, FTX, and KuCoin, and can be traded freely on centralized exchanges. As the governance token of the protocol, DYDX holders are able to participate in the governance of the protocol.

dYdX’s Blue Chip Investors

The protocol raised a seed round led by Chris Dixon of a16z and Olaf Carlson-Wee from Polychain Capital in December 2017 to begin development of its core product.

Other investors in the round included Fred Ehrsam, Brian Armstrong, Elad Gil, Scott Belsky, Avichal Garg, Kindred Ventures, Abstact Ventures, and 1confirmation.

The dYdX team continued iterating on the product and subsequently raised a Series A round of USD10m in October 2018, which a16z and Polychain also led.

Following the Series A round, dYdX raised a USD10 million Series B round, led by Three Arrows Capital and Definance Capital in January 2021, before its latest Series C round of USD65m, led by Paradigm, with other top-tier strategic investors such as QCP Capital, CMS Holdings, CMT Digital, Finlink Capital, Menai Financial, MGNR, and Kronos Research.

In total, the protocol has raised more than ~USD85 million, with a capitalization table that contains the most prominent investors in the space.

Why is dYdX significant?

The number of decentralized protocols enabling perpetual futures trading remains limited. The fact that the dYdX futures platform operates on L2 is a compelling value proposition for traders, given that dYdX enables users to not only enjoy the benefits of decentralization and non-custodial trading, but also to avoid the drawbacks of competing protocols built on L1 (namely high gas fees and trading fees).

The protocol’s strong user growth metrics and blue-chip investor base should certainly hold it in good stead for continued growth and expansion. The dYdX team plans to utilize the proceeds of its latest Series C round to continue adding new assets and features, launch a mobile application, as well as to strategically grow into new markets.

As dYdX matures as a platform, it will certainly be a protocol to watch as it has increasingly become a viable alternative for users who have historically traded futures on centralized platforms.

Featured Image Credit: Forkast

Also Read: Genopets: How The World’s First ‘Move To Earn’ NFT Game Differs From Other Web 3.0 Gaming Projects