In the previous Elrond Part 2 article, we analysed Elrond’s business model and its plan for DeFi 2.0 by integrating DeFi functionalities into Maiar, a simple-to-use mobile application.

Currently, the only decentralized application (dApp) that has been implemented is Maiar’s decentralized exchange (DEX).

In today’s article, we shall take a deep dive into Maiar DEX.

$EGLD

Before we begin, let’s find out how to obtain $EGLD.

$EGLD can be purchased on most centralized exchanges (CEX) such as Kucoin. Once you have some $EGLD in your CEX account, you can then withdraw your $EGLD via the Elrond network to your Elrond wallet.

Maiar DEX

Moving on to the DEX, if you have no idea how a DEX is supposed to function, do check out my previous DeFi article on DEX and slippages first!

As a DEX, Maiar allows users to swap their crypto assets. Because the DEX is built on Elrond, which we have learnt to be highly scalable and fast in the Elrond Part 1 article, we can rest assured that the transactions on Maiar DEX are near-instant with minimal cost.

Also Read: Introducing Elrond ($EGLD): The Internet-Scale Blockchain

In ensuring that the DEX has sufficient depth for its liquidity pools, the Automatic Market Maker (AMM) at the back end also allows users to provide liquidity and farm for yield.

Apart from the transaction fees earned by liquidity providers, Elrond has also launched a liquidity incentive programme worth over $1 billion to reward those who provide liquidity to Maiar DEX.

1/ TODAY IS THE DAY.

— Beniamin Mincu 🔥🌓 (@beniaminmincu) November 19, 2021

The Maiar DEX is going live 🌕

A state of the art DEX built on a sharded architecture, w/ 100% community ownership.

Unveiling Elrond Superwave, a $1.29 Billion USD liquidity mining incentive program for 1y, w/ $282M for first month.https://t.co/IYxYS0Y8ry

MEX

MEX is the governance token that powers Maiar’s DEX. Returning to the point above on Elrond’s incentive programme, the US$1.29 billion dollars will be distributed in the form of MEX tokens.

Locked MEX (LKMEX)

LKMEX is earned when you choose to lock your rewards while farming, which I will explain more about later.

LKMEX will be locked for a year. After a year, 17% of LKMEX is unlocked. For the next 3 months after one year, another 17% will be unlocked after each month. After both the 4th and the 5th month, 16% of LKMEX will be unlocked. Here is an example:

In December 2021, I accumulated 100 LKMEX in locked rewards

Dec 1st 2022: withdraw 17 LKMEX

Jan 1st 2022: withdraw 17 LKMEX

Feb 1st 2022: withdraw 17 LKMEX

Mar 1st 2022: withdraw 17 LKMEX

Apr 1st 2022: withdraw 16 LKMEX

May 1st 2022: withdraw 16 LKMEX

*Upon withdrawal, LKMEX will have the same value as MEX

Now, let’s examine the features of Maiar DEX individually.

Swap

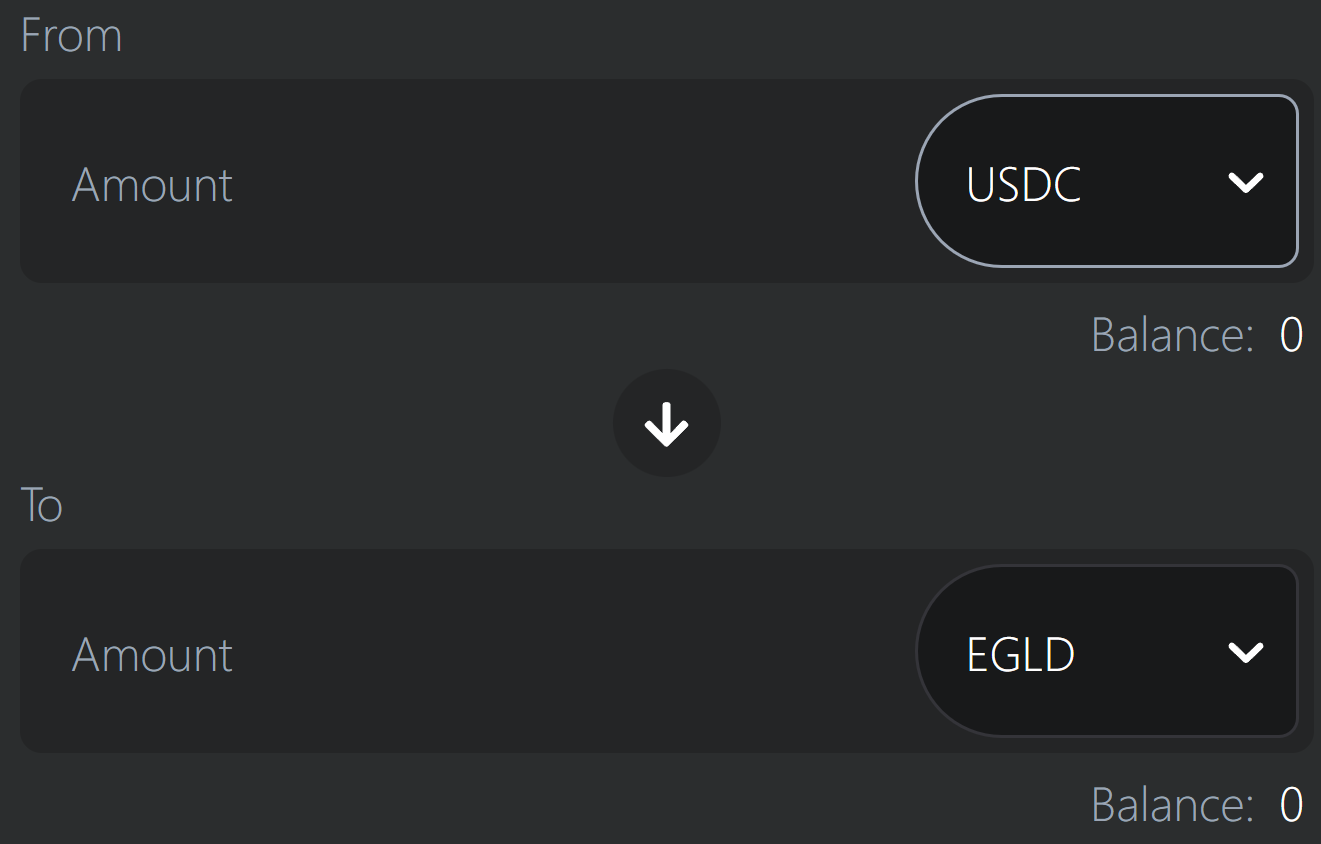

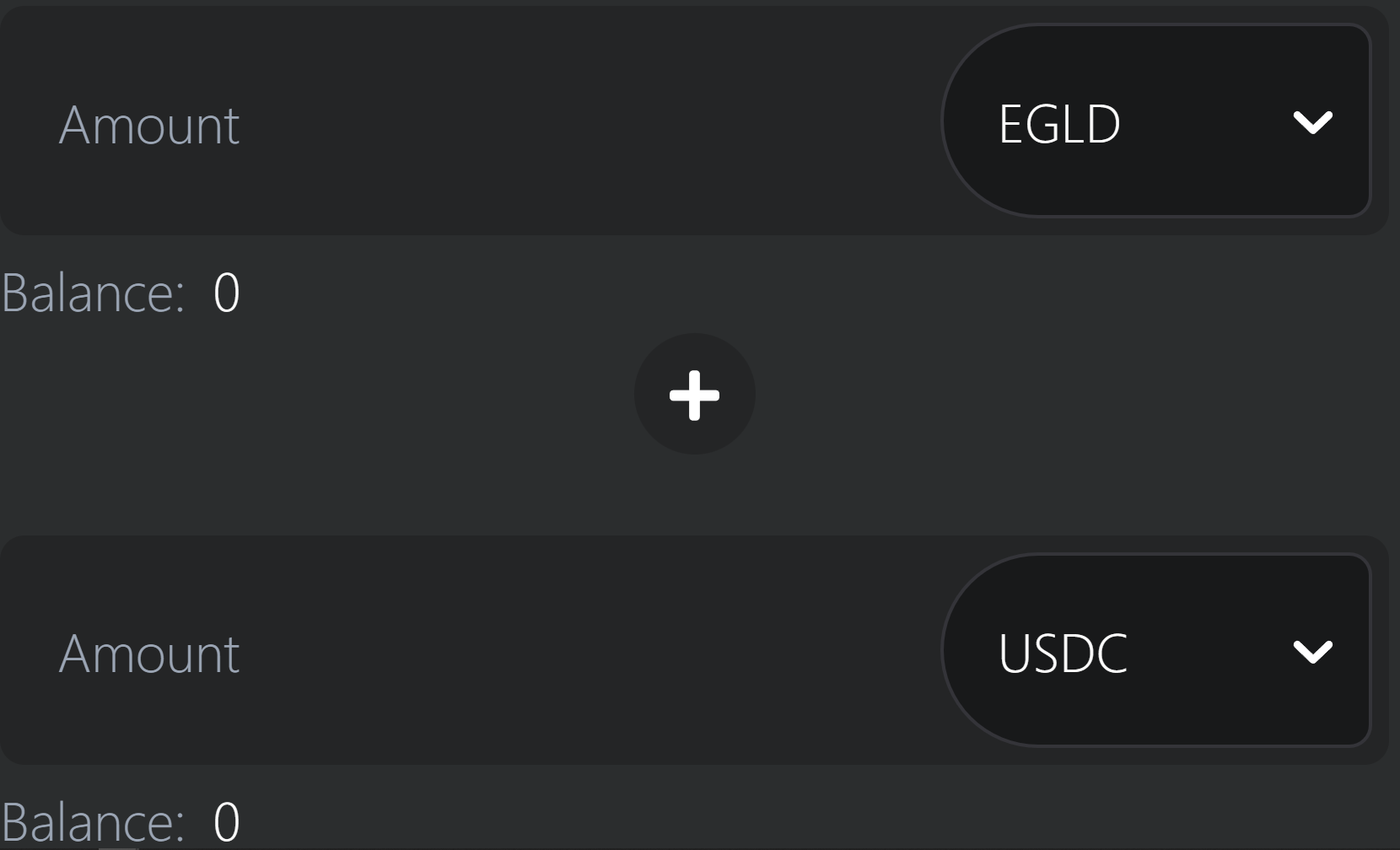

Firstly, under the Swap tab, the Maiar DEX can be used to swap between assets.

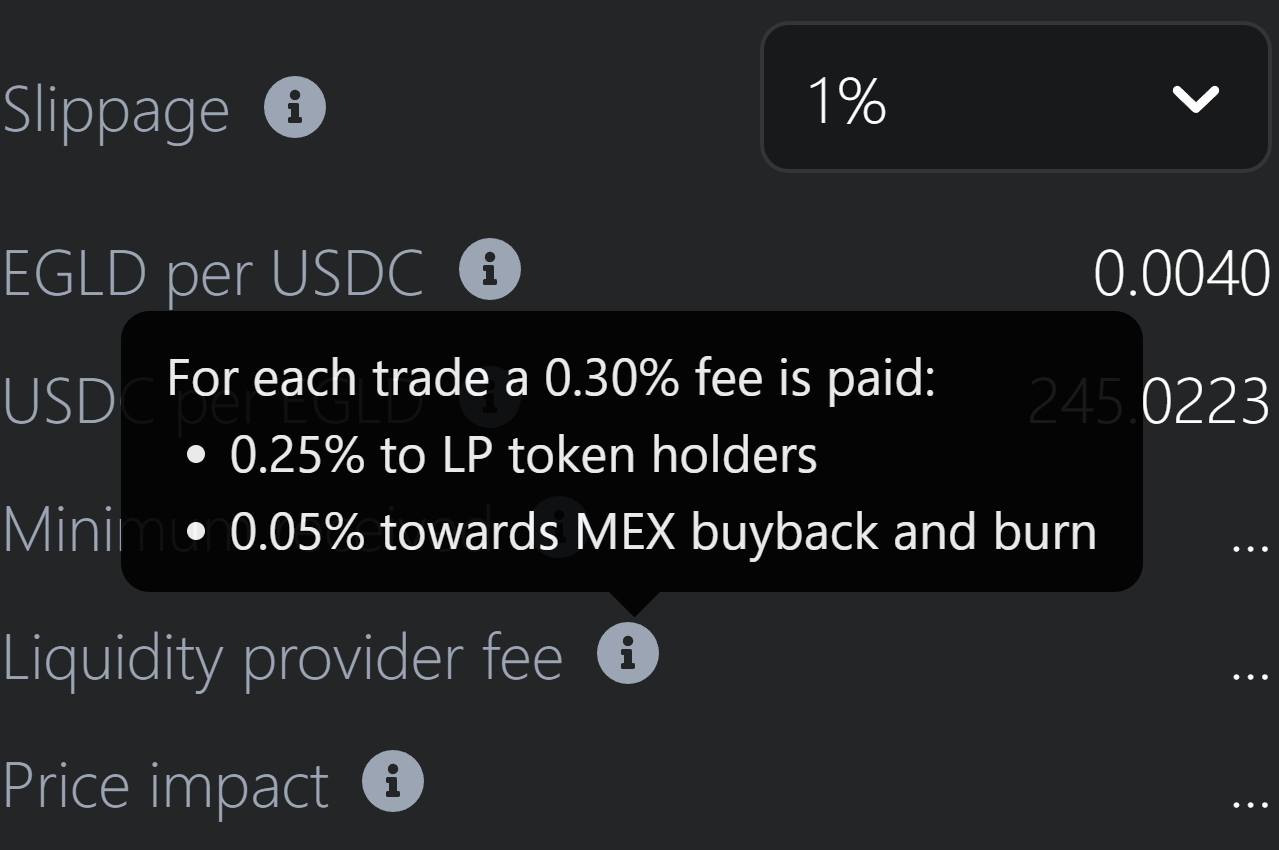

As an user, a transaction fee of 0.30% is imposed, of which 0.25% goes to the liquidity provider and 0.05% is used to buy MEX and burn it.

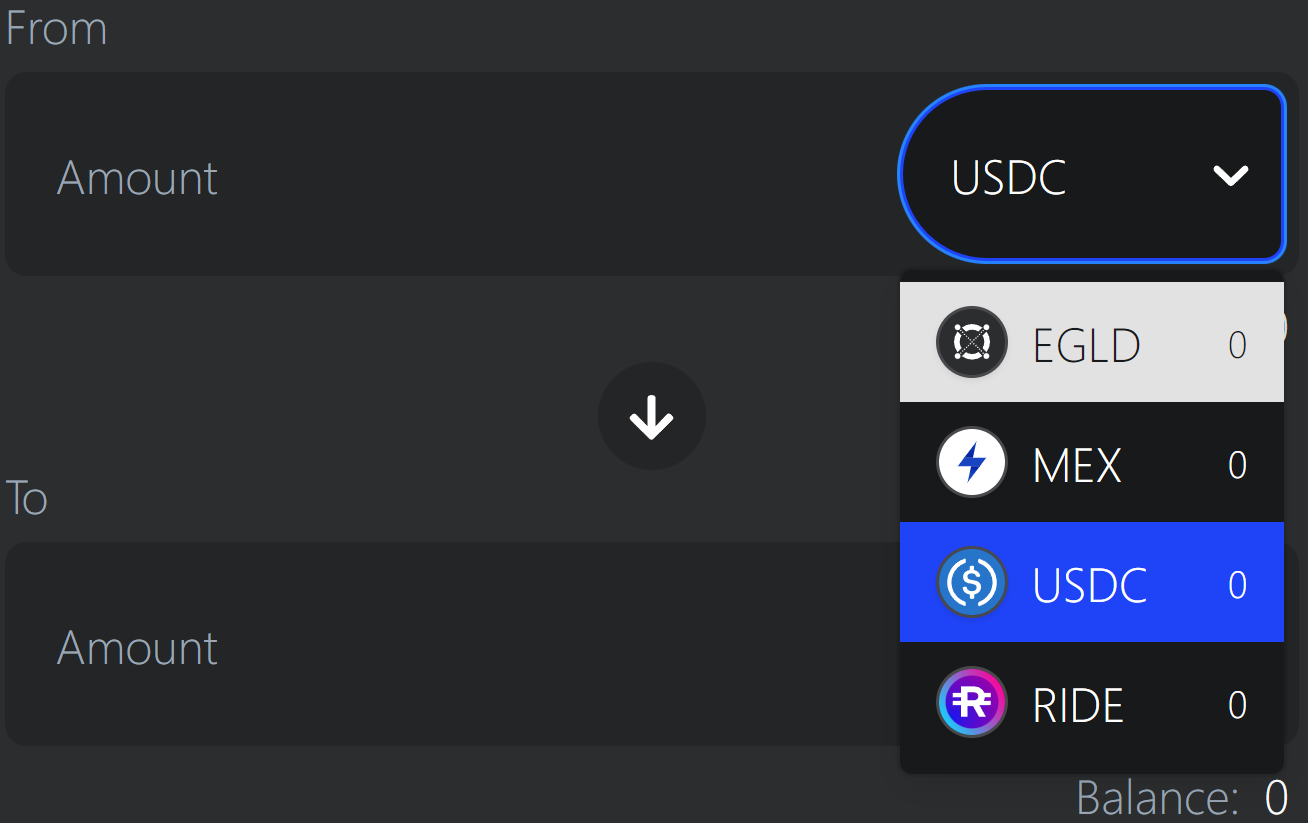

As can be seen above, simple features like controlling the slippage is implemented in Maiar DEX. However, due to the infancy of Elrond’s blockchain, not many assets are available for swapping. As can be seen below, only four tokens can be swapped.

Liquidity

Under the Liquidity tab, users can add liquidity to receive LP tokens. When users trade on the exchange, swap fees are deposited into the liquidity reserves.

As such, these LP tokens will then accrue in value and this functions as a payout to all liquidity providers proportional to their share of the pool.

An interesting feature to note is that besides staking one’s LP tokens in a farm, LP tokens can also be tradeable or used as collateral to take a loan against their value.

This is because of Elrond’s unique ESDT (Elrond Standard Digital Token) architecture, and it is the first protocol to allow such utility.

Granted, this feature is not implemented yet, but it is an interesting feature to look forward to.

Farms

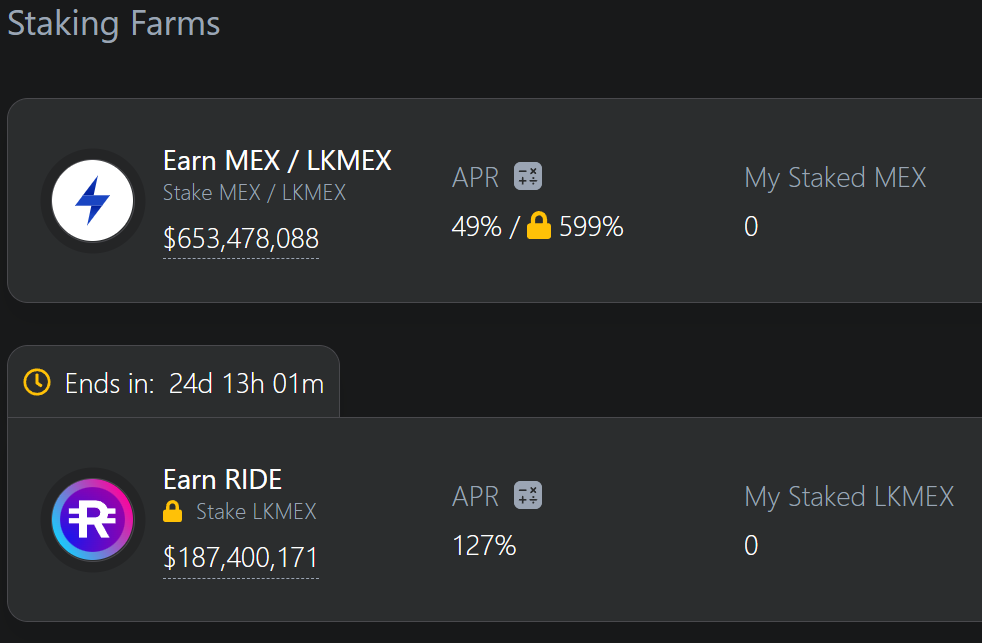

There are two types of farms: Staking Farms and LP Farms

Staking farms only requires the staking of 1 token (MEX or LKMEX), to compound it or earn another token (RIDE, which is the token for Elrond’s launchpad).

Looking at the first farm above, we can observe how much higher the APR is when staking LKMEX to earn LKMEX. This is to incentivise yield farmers to lock their rewards, which boosts the sustainability of the price of MEX.

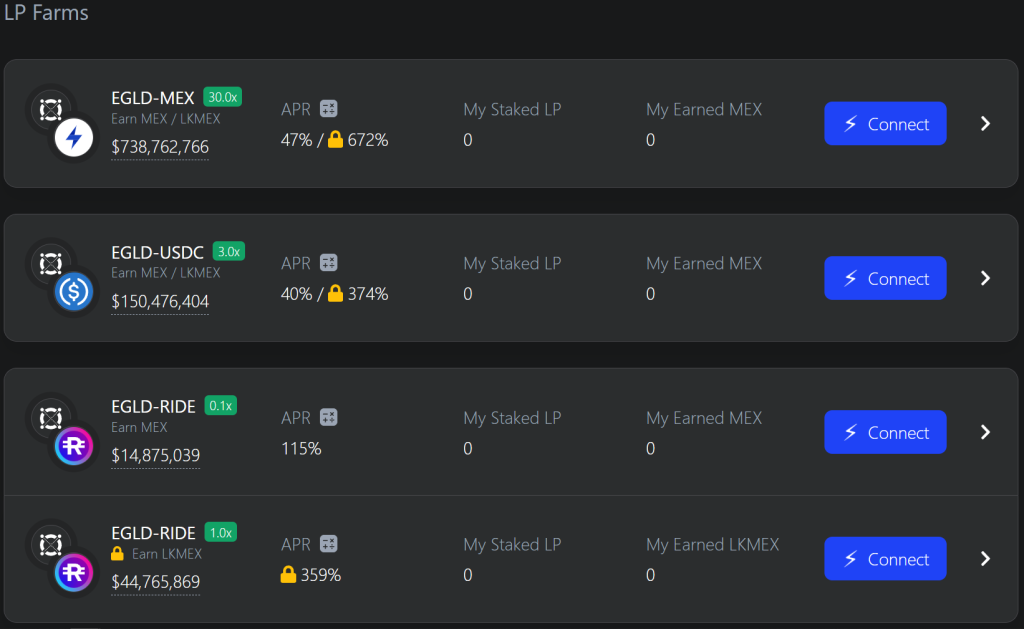

As for LP farms, it requires the staking of LP tokens and there are four main farms.

Similar to just now, we can observe how much higher the APR is when locking one’s rewards.

Opinions on staking

Personally, I have little interest in the staking farms because they require staking MEX/LKMEX, which are farm tokens.

No matter what protocols claim about their ‘value accrual’ mechanism, farm tokens are ultimately tokens with negligible value. In the case of MEX/LKMEX, it is a governance token and its only utility is to stake and earn more yield.

In my opinion, governance tokens have an insignificant demand, and as a farm token, when farmers earn yield, they will harvest and sell the farm token, causing its price to dump.

Since the yield is in the form of the farm token, the APR will also drop and users will be less incentivised to yield farm. When they withdraw liquidity from the AMM and cash out their MEX tokens, its price will dump even harder, thus creating a vicious cycle.

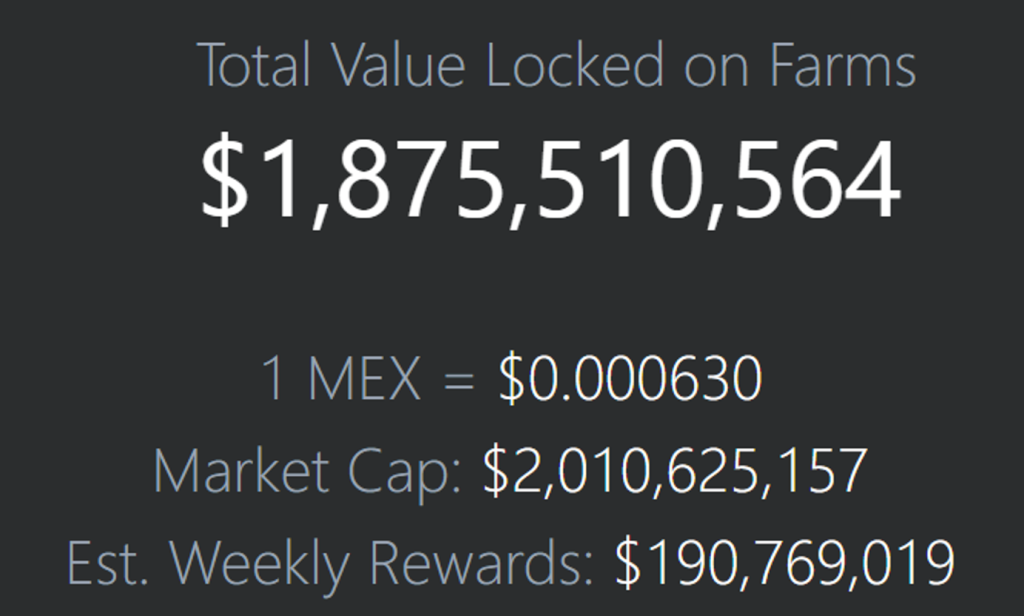

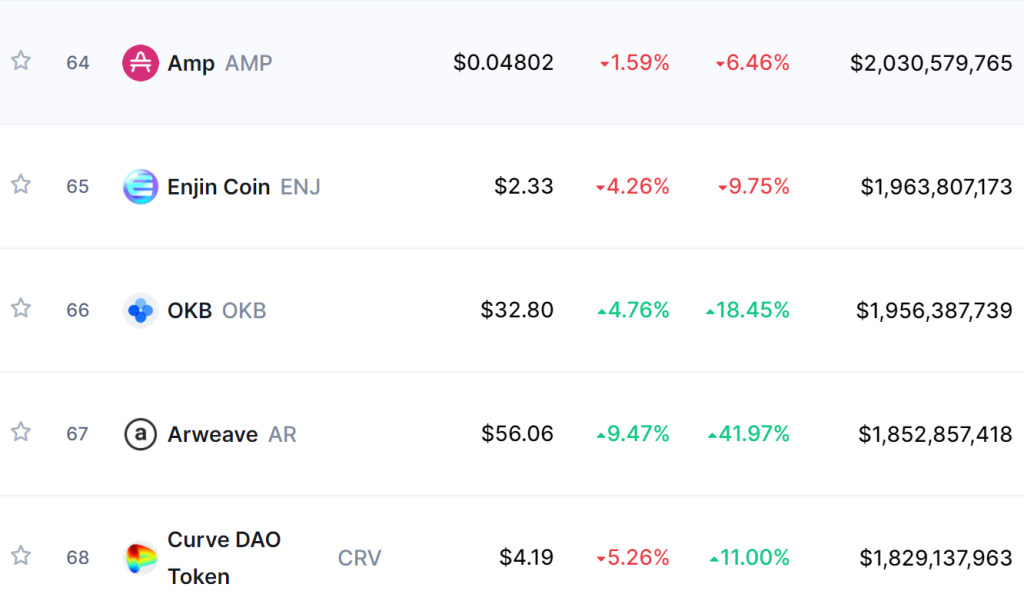

As can be seen above, MEX has a market capitalization of over $2 billion dollars. This places MEX, a farm token, higher than coins like Enjin (an NFT/P2E/Metaverse coin that has actual demand and utility) and Curve (OG DeFi) in terms of market cap!

Additionally, weekly rewards of US$190 million imply a 9.5% dilution every week.

All these factors that argue against the sustainability of MEX’s price are corroborated by the price of MEX dropping ~60% from US$0.0016 in late November to its current price of US$0.0006.

Opinions on farming

As for LP farms, I am not interested in locking my rewards as I am bearish MEX. Farming EGLD-MEX also makes little sense as my impermanent loss (IL) will be insane as MEX continues to drop.

And because I am bullish EGLD long-term, farming EGLD-USDC also means that my IL will increase if/when EGLD pumps.

The only decent farm I see is EGLD-RIDE. Unlike MEX, RIDE is not a farm token and has actual utility as a launchpad token.

If the Elrond ecosystem grows and thrives, RIDE is likely to enjoy solid gains when new projects go live on Elrond’s blockchain. This suggests a correlation between the price of EGLD and RIDE, implying minimal IL.

Strategy

With all that being said, I am not invested in Elrond’s ecosystem. This is because the network is still in its infancy, and it will take months or even a year for Elrond to reach its fullest potential.

But who knows what will happen to the crypto market by then?

Sure, there are yield farming opportunities now like EGLD-RIDE offering an APR of 115%. But this APR will likely drop when MEX keeps dropping. Additionally, there is a lot of FUD revolving around RIDE due to their token launch process.

From an opportunity cost perspective, farming on Harmony’s DeFi Kingdoms makes more sense as the yield is much higher (JEWEL-LUNA yielding 700%). I also believe coins like JEWEL and LUNA have more near-term price catalysts as their projects are more mature.

With comparatively lesser yields and lower short-term upside, it is not surprising that I’m not invested in Elrond’s ecosystem.

Nevertheless, Elrond’s superior technology and unique business model makes this blockchain an interesting space to keep an eye on. Perhaps, as more features and coins are integrated and the ecosystem matures a few months down the road, I will revisit my investment thesis on Elrond.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Also Read: Elrond ($EGLD): The Business Model Behind The First Blockchain To Coin The Term DeFi 2.0