I’m sure many of us are surprised by the recent market rally caused by the Ethereum Merge.

The macroeconomic conditions completely contradict all rationale approaches towards this rally – inflation, interest rates, oil, and the waging political conflicts between the world superpowers becoming an increasing concern.

While it is difficult to extrapolate and rationalize why Ethereum especially is skyrocketing apart from the merge, we can take a look at how smart money is playing this rally.

Also Read: Market Cycles In Crypto: How To Identify Tops and Take Profits

TradeFi, GameFi, DeFi, CeFi, and all things related

Across all markets, the FED rates have a significant impact of whether the market goes up and down. The Federal Reserve’s releases are a great example of how a short speech can move the entire market.

Across the board, smart money generally exited positions for Ethereum around the levels of 1800-2000. The weekly chart for both BTC and ETH paint an ugly accordance to the falling wedge, signifying that there is possibly more dumping to continue.

A significant issue is that most traders across all markets ape blindly without understanding if the merge is a catalyst to potential upside of the market.

The reality is that the macroeconomic conditions do not justify the growth of potential upside, especially with economies and political stability at a knife’s edge.

Is The Merge Overhyped?

The merge does have significant positive impacts that many are anticipating, there are also negative implications for the market.

For example, lets take a look a narrative on the “triple-halving” driving Ethereum into a deflationary supply crisis.

“Halving” simply refers to a concept of deflationary rewards, where rewards to miners are decreased significantly, making mining for cryptocurrency a lot harder. This effectively creates “deflationary” pressure and causes a supply shock, creating significant price appreciation.

Historically, “halving” events are linked towards bull runs.

However, ETH “halving” does have a key difference, instead of using an algorithm to automatically issue issuance, it is done through software updates that is agreed upon by the community. Currently, the major reason why the issuance rate is so high is to incentivize miners to choose this blockchain.

With the merge, the rate will be slashed from 4.3% to 0.4% as validators now consume ~99.95% less energy. By this design, this will signal a complete transition with more people looking to stake and re-stake (like Wonderland TIME) instead of a mine and dump economy.

An interesting implication is that staked tokens are unable to be sold off post-merge. Ethereum withdrawals will not be implemented and will only be done so at a later update, known as the Shanghai fork which is expected to occur in 2023.

Boolish right?

Perhaps not. Not only is the ETH on the Beacon chain already off the market, but only PoW emissions are allowed to be sold currently while on both PoS and PoW, they are still accruing rewards.

This means that by the time the Shanghai merge comes, there will be close to 31 million ETH available to be dumped, (~25% of supply) causing significant price instability.

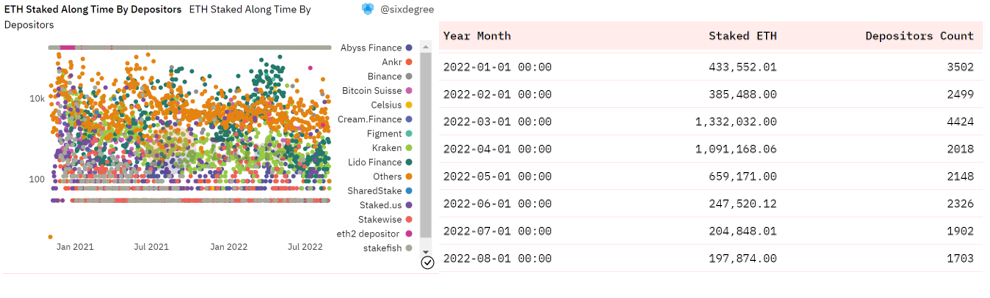

Interestingly, staking for the merge increased at an exponential rate in March and April.

Of these numbers, a majority of them were retail investors, with only ~15% made up of “whales”. Dormant ETH wallets are also becoming more active, a heavy indication of whales looking to either manipulate the market, become a validator, or dump on retail investors.

Ethereum Genesis ICO giant whale 0x4bAf012726CB5EC7Dda57Bc2770798A38100C44d is active again after nearly 3 years of dormancy. Since yesterday, a total of 145,000 ETHs have been transferred out and distributed to multiple wallets. Wallet link: https://t.co/hpLujWwxWi

— Wu Blockchain (@WuBlockchain) August 15, 2022

The Way Of The Whales

Ultimately smart money already took significant profits, exiting a majority of their positions. However, those that have staked, and locked assets have looked towards bear market hedging strategies to help retain or increase their portfolio value in the next run.

Traders generally follow 3 core principles, downside management & capital preservation, asset selection & accumulation, and liquidation optimization and capital efficiency.

The first two are the more salient options.

Downside management & capital preservation refers to the human nature of loss prevention. In other words, buying high and selling low. A well thought out plan to hedge against the market will go a long way.

Asset selection & accumulation is perhaps one of the most important factors as well. The proper ideology of selecting the right asset is so important.

The general rule of time in bear markets is sticking with the bluechips, BTC and ETH.

Bluechips can have varied opinions amongst investors as many look at multiple principles. Hence, it is also important to have adequate diversifications in not just crypto but all financial markets. Perhaps its time to look at those treasury bills. 🤑

Strategies for asset holders

There are a few main categories to hedge in this market, and this includes the categories of linear instruments, non-linear instruments, and synthetic and asset-light strategies, and yield opportunities. In this article we will just cover linear instruments.

The first strategy is to long your assets + leverage cover shorts. This works by positioning spot positions along with short positions. Let’s assume that the max leverage in a trade is 5x. Your Principle would be divided into 6 portions, 5 of which are used to purchase spot while the 1/6 portion is used to short as margin.

This strategy works in such a way that upside of your assets is much higher than your downside.

Providing a full downside hedge with only a small potential chance your perpetual position can be liquidated makes it an attractive option.

However, funding rates can be high occasionally, making this a cost to factor in as well. Furthermore, the 5 portions of your asset can also be farmed, giving further upside to your capital.

Another strategy would be to long your assets + short in LP pools. This would be to buy spot with your full principle while entering a leveraged farm position by borrowing the same amount of the purchased asset.

Your spot asset would also be used to farm asset-stable LP, accruing rewards in 2 pools. Just note that it is important to compare APR to implied and realized volatility to ensure that this strategy makes sense.

The good part about this strategy is that it is automated as the LP is based on a certain ratio. However, it is also important to take note of impermanent loss and upside liquidation that could harm this strategy.

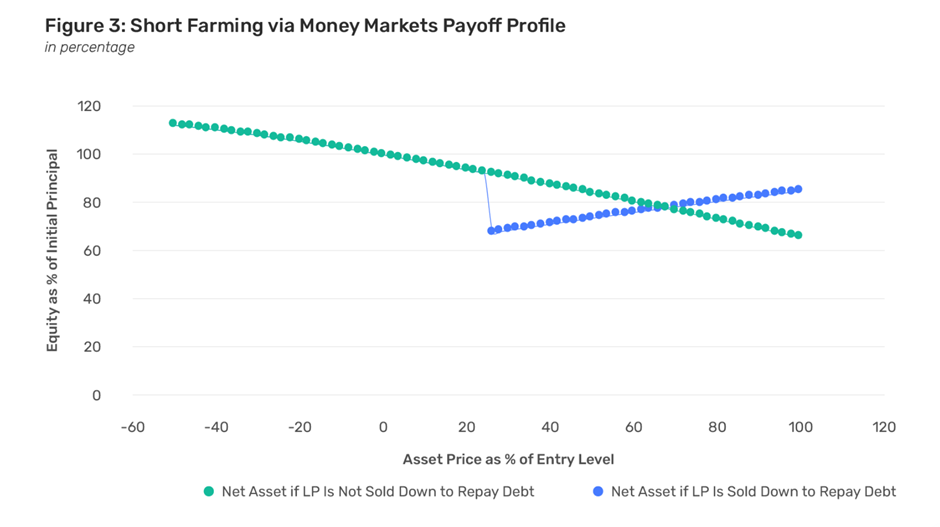

The last strategy is short farming via money markets. This involves depositing the stablecoin into a money market protocol, borrowing an asset and selling half of it into stablecoin before putting it in to farm.

Compared to the 2nd strategy, this strategy is net short, meaning you are generally more bearish and there is a higher risk of loss should assets rally.

Under certain circumstances, the LP may balance out however, allowing you to accumulate more assets.

As mentioned by Treehouse Finance, Below is the NAV 1-month into trade inception, assuming stablecoin deposit APR 6%, asset borrow APR 12%, LTV at inception 60% and liquidation happens at 75% LTV. The step-down on blue series shows the time when borrow gets liquidated.

Closing Thoughts

In all markets, a bear market is a crisis but also an opportunity.

On top of just selecting strategies and evaluating principles, it is important to consider your risk appetite and taking this opportunity to accumulate more assets.

Overexposure is never a good thing even in bull markets and consider evaluating your spots bags to come back stronger in the bull run.

Also Read: Getting Rekt During The Bear? Here’s How To Level Up Your Crypto Game

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief