The price of real estate has been increasing in many countries around the world. For most people, purchasing real estate will require them to take on loans, and even result in mounting debt.

What if there was a hassle-free way to own a part of an expensive piece of real estate, with the ability to easily sell it off whenever you want to?

The problem with real estate

There are many problems with buying and owning real estate.

First and foremost, real estate is very expensive, and users would normally have to take on a huge loan just to buy one property.

The next problem is illiquidity. Since it is so expensive, real estate is usually an illiquid asset as it takes some time to find a willing buyer with enough capital to purchase the real estate.

The problem with illiquidity is that the owner would not have instant access to capital as it is all tied up on the asset.

Furthermore, the law of each country usually favours those who stay on the land and restrictions are imposed on outsiders. These restrictions make it hard for foreigners to buy real estate outside of their own country.

How CitaDAO solves these problems

“We believe bringing real world assets on-chain is critical for the next phase of DeFi growth and adoption. Real Estate on-chain will transform DeFi and grow existing DeFi markets, such as collateralized loans, into a trillion-dollar TVL ecosystem.”

Joel Lin, contributor of CitaDAO

CitaDAO is a Decentralized Finance (DeFi) platform for real estate built on top of the Ethereum network.

It aims to solve the multiple issues of owning real estate. These include the lack of liquidity, access limitation, and lack of composability.

It creates borderless, transparent, scalable, and easier access to real estate for the community by enabling the asset to be tokenized and transacted on-chain.

This will allow DeFi players to diversify their portfolio on-chain and hedge against inflation with sustainable yield through the power of real assets.

How does real estate tokenization benefit investors?

The tokenization of real estate effectively negates the illiquidity portion of owning real estate, as you can simply trade it like any other crypto token on the Decentralized Exchange (DEX).

For instance, if one day you decide that you do not want the Hollywood villa on your portfolio, you can simply swap it for USDT on Uniswap.

Furthermore, it significantly increases the ability to diversify your portfolio holdings with a small amount of capital.

Tokenization essentially breaks down a real estate property into bite sizes by dividing it into many small pieces, such that anyone can get exposure to the prized property with a small amount of capital.

Even an average joe can take part in the IRO and get exposure to a luxury property in a prime location as well as a commercial property in the busiest city on Earth.

What is an IRO and how does it work?

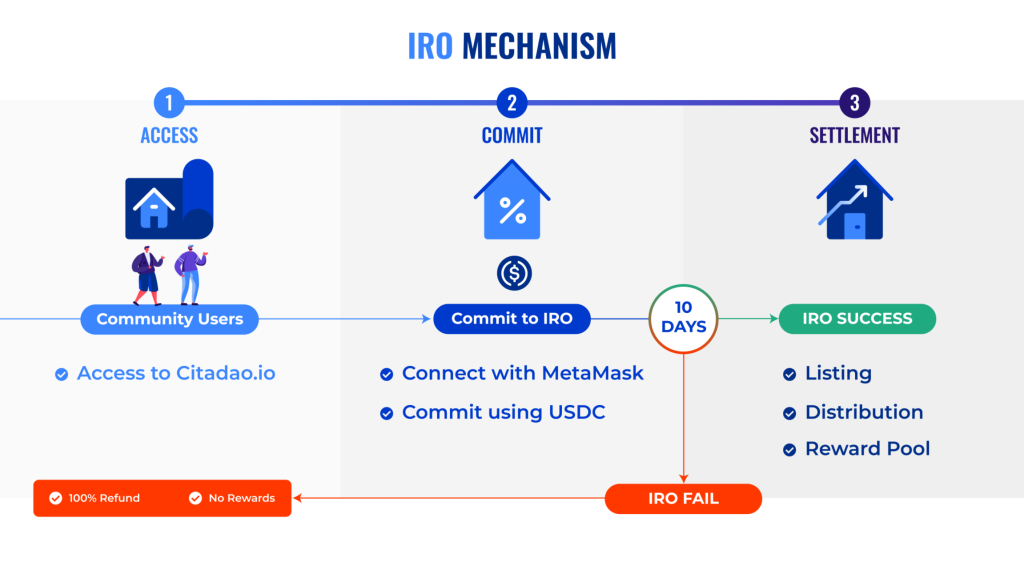

Introducing Real Estate On-Chain (IRO) was pioneered by CitaDAO, and was launched on 8 March 2022.

It essentially tokenizes the physical real estate and turns an illiquid asset into a liquid asset that can be bought or sold on a DEX.

In order for an IRO to be successful, it must garner enough interest from the community through the staking of USDC to back the listing.

If the IRO is successful, the community members who backed the listing will receive Real Estate Tokens (RET) which represent the right to buy out other RET holders to redeem the title deed to the property.

If the IRO fails, members who backed the project are able to redeem their commitment from the smart contract.

CitaDAO’s Genesis IRO

“For the first time in history, crypto anons will be able to collect rent from rent-seekers. The first IRO for CitaDAO will be a building leased to TradFi in Wales. If we want to bring legitimacy to Web3, this is our opportunity and Real Estate will play a crucial role. This is the way.”

Joel Lin, contributor of CitaDAO

In just two days, CitaDAO’s genesis IRO managed to secure US$3 million in commitments from the community.

The first real estate listed was a heritage property along Queen Street, the heart of Cardiff City in the United Kingdom. The property is currently leased to a blue-chip global bank.

Token supply

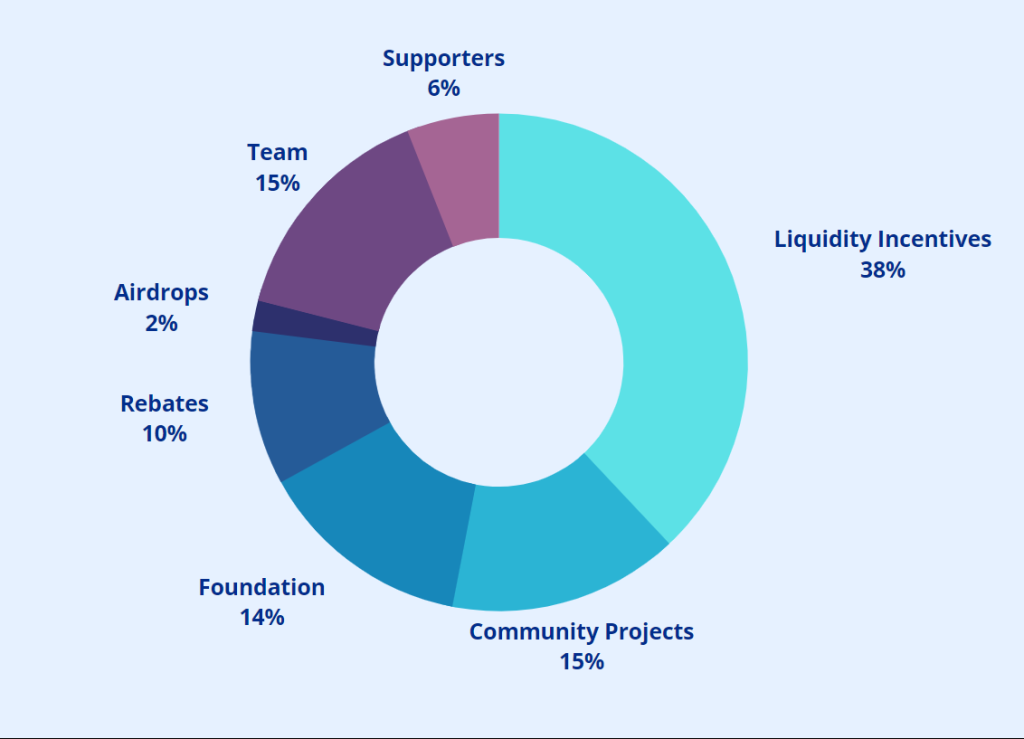

The project’s native governance token is KNIGHT, and there is a total supply of ten billion tokens. The tokenomics is well structured, with the majority of the tokens (79%) going to the community with a four-year vesting schedule.

The team is clearly here to stay, as their tokens have a long and gradual vesting period of up to 48 months with a 12 months cliff.

The benefit of being a token holder is not only limited to the project governance activity. It also includes exposure to the Real Estate introduced on-chain, with 2% of all Real Estate Tokens on the platform being owned by the DAO treasury.

Notable backers

The project is backed by some of the biggest venture capitals in the crypto scene. Its fundraising saw participation from Ava Labs, Sora Ventures, SNZ Capital, Turn Capital, Origin Capital, Bixin Ventures, and CatcherVC.

It also roped in leaders of other successful blockchain and DeFi Projects such as Synthetix, Mercurial Finance, Manta Network, Kyber Network, and Bitgo, as well as professionals from the real estate industry such as Parmenion, CBRE, and Canada ICI.

Conclusion

If you’re worried about the legal implications and roadblocks, fret not, as CitaDAO has done its homework and formed a structure that is legally enforceable, and its token is allowed to be listed on exchanges.

While this is not the first attempt to tokenize real estate, CitaDAO stands out from the rest as it incorporates DeFi use cases into its tokens to support secondary liquidity. This difference could be the key ingredient needed to kickstart a new generation of real estate on-chain.

All in all, CitaDAO is a noteworthy project that could propel a future where all illiquid assets will find much-needed liquidity on-chain.

Check out the latest IRO here.

This article was written in collaboration with CitaDAO.

Also Read: CitaDAO Closes $1 Million Builders Seed Round To Bring Real Estate onto DeFi