It is no secret that Ethereum has been leading the crypto rally for the last two weeks.

Despite rumors that the upgrade may lead to major selling pressure and overall market conditions, Ethereum has been outperforming almost every other token. However, we are still unsure of where prices will land once the merge occurs later this year.

With that said, it is unlikely that $ETH floats in this range till then – so let us take a look at how to profit from price action, in every direction.

Also Read: The Ethereum Merge May Finally Take Place This September

Bullish

The easiest way to capitalize on $ETH outperforming the rest of the market is to take a SPOT position, and sell post-merge.

Alternatively, traders can try to capture the move with leverage, multiplying their gains.

A popular way to gain outsized returns during this period is to buy $LDO, the native token of Lido DAO. This trade was seen as having a higher upside compared to $ETH, as Lido holds more than 30% of all staked Ethereum.

Within the last month, $LDO has outperformed $ETH by 240%. However, speculation remains on whether it has run its course.

For those on the conservative side, pair-trading $ETH/$LDO may be the trade.

This can be done by shorting $LDO when overbought and longing $ETH, and vice versa. However, as $LDO is more volatile, trade sizing is extremely important here.

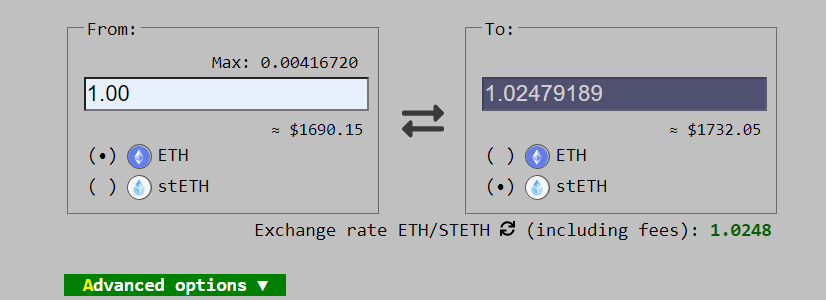

If your goal is to stack more Ethereum you can also buy $stETH, which currently trades at a discount, and exchange it for $ETH post-merge.

Bearish

While it may be foolish to be bearish on the strongest coin in the bear market, it is not without grounds.

4 myths about the Ethereum merge:

— samaru.eth (@TrustSamer) May 31, 2022

1. Reduce L1 gas fees

2. All ETH currently staking can be sold immediately

3. 32 ETH are required to run a full node

4. There is no 4 but I like even numbers

The upgrade, after all, could very easily become a “sell the news” event, due to the many misconceptions around it.

For example, after the merge

- Gas fees may not go down

- Transaction speeds will remain roughly the same

Furthermore, staking APR is expected to increase to 50% post-merge, which could lead to selling pressure.

If being a bear is more your thing, you could do the opposite of a bullish trade, and short $ETH or $LDO. However, there is always liquidation risk as you can only short with leverage.

Conservatively, a pair trade can be done, with a cryptocurrency that is expected to outperform to the upside, but not to the downside.

Shorting the $ETH/$BTC pair on major exchanges is one example.

Neutral

While long/short strategies are okay, there is still a way to go before the merge.

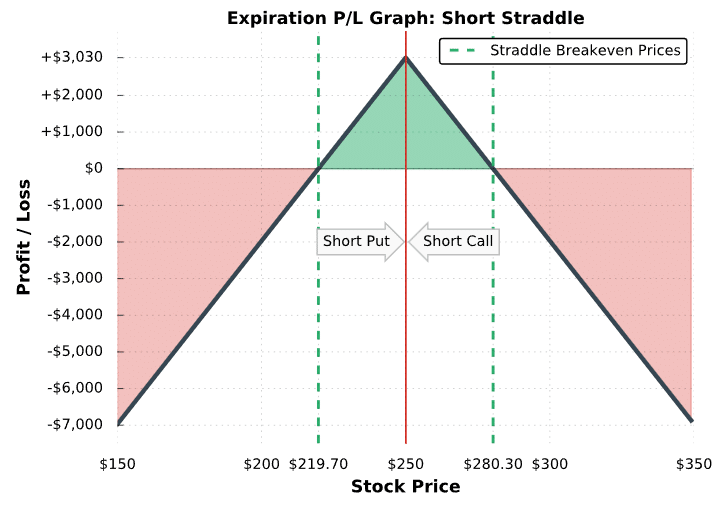

In the meantime, if you are betting that $ETH will move sideways, you could employ a “short straddle” using options contracts.

This involves selling both a “put” and a “call” option for $ETH with the same strike price and expiration date.

A put option gives the own the right, but not the obligation to sell/short an underlying asst.

A call option gives the owner the right, but not the obligation, to buy an underlying asset.

The maximum profit in this case would be the premiums collected on the options. However, the downside is unlimited as $ETH does not have a price ceiling.

Volatility

The crypto market’s inherent volatility means that leverage runs the risk of liquidation extremely often. However, traders can capitalize on that as well.

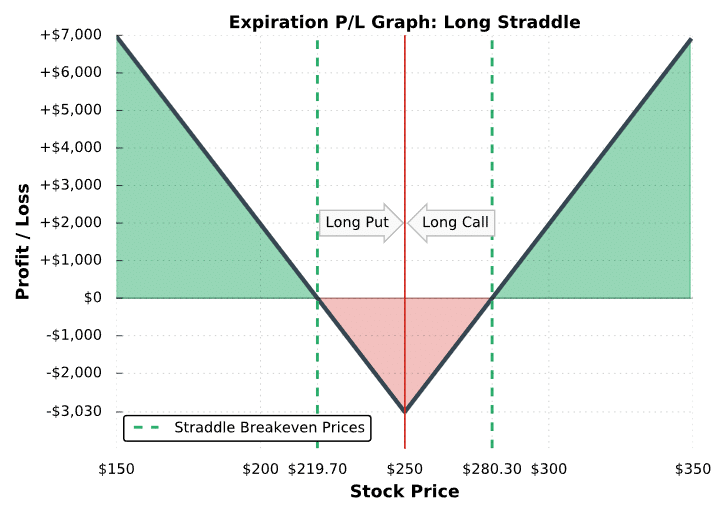

Traders can deploy a long straddle, which profits from sharp price movements.

This involves purchasing both a “call” and a “put” on the same asset, with the same expiration date and strike price.

In contrast to a short straddle, long straddles have unlimited profit, and limited risk. The risk comes from the premiums paid to purchase the options.

Closing Thoughts

While betting around major events seems like easy money, they are often “priced in” by the markets and have large costs tied to them.

Be it funding, premiums, or even liquidation, there is always risk involved when trading.

Furthermore, options are not readily available to anyone. While MOVE contracts are available on major exchanges like FTX, they are mostly for $BTC. Delving into the realm of options requires an advanced knowledge of markets, especially in a volatile one like crypto.

Also Read: 4 Crypto Narratives For 2022 To Look Out For And How To Play Them

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: cryptonomist