What do LUNA, FTX, Celsius, 3AC and bridge hacks have in common? They are key contributors to breaking crypto in 2022. While they give us little reason to celebrate, one narrative popped off at the tail end of last year, the dawn of artificial intelligence (AI).

The concept of artificial intelligence has been around since the 1950s. When companies started to take it seriously, from the ALEXA and Siri to Google and Apple Devices to FSD (Full self-driving), a Tesla work in progress, it is no surprise the integration between AI and crypto is bound to happen.

The genesis of ChatGPT, a platform that serves users as a computer assistant, saw massive eyeballs and interest among the average joe and even the big institutions. Tech giant Microsoft is in talks with ChatGPT-owner to invest $10B, to put things into perspective, that is equivalent to the combined total value locked of Binance smart chain, Polygon, Arbitrum, and Tron combined.

Yes, that is how big this space is.

/1 The AI era is upon us. GPT-3 makes it clear: we will achieve AGI in our lifetimes.

— Haseeb >|< (@hosseeb) January 9, 2023

Crypto will have a big role to play in this.

Why? Because crypto changes the API of money, decoupling *money* from *people*.

In the age of AI, this will matter more than ever. 🧵 👇 pic.twitter.com/Ag2EsbpSod

We look into three AI coins and how they will (likely) be the most significant crypto narrative in 2023.

1. Fetch AI

The native token $FET is an artificial intelligence lab building an open, permissionless, decentralized machine learning network with a crypto economy. It optimizes use cases like DeFi trading, transportation networks, travel, etc.

🔸What's @Fetch_ai?

— Crypto Hub💡 (@CryptoHub210) January 6, 2023

The hype around Artificial Intelligence is real:

• Universities are banning ChatGPT

• Revenue from AI is expected to reach $126B by 2025

• Big Tech is pumping billions into this industry

Here's what Fetch contributes to AI👇

Their goal is to bring machine learning and AI to web3. Imagine a world where Ethereum dApps and smart contracts and powered by them.

Why a token, though? $FET is used to secure the network just like most native tokens while being the main currency for payment for their services. It will likely be a token for creating AI agents as well.

Sitting at a 155m market cap, the $FET token seems to be going back to its glory days.

2. Bittensor’s $TAO

When you think $TAO, the neural internet should come to mind. Imagine a club of big supercomputers who talks and learns from one another. By leveraging every available computer worldwide, they can connect and interact with them all, which results in an exponential growth as intelligence compounds.

Ingenious design, but we all know that with the introduction of tokens, the importance of looking into their tokenomics is one key factor in judging sustainability.

The $TAO token adopts its tokenomics similar to Bitcoin but different. With a total supply of 21 Million, 7200 $TAO tokens are issued daily, divided 50/50 between miners and validators.

They adopt a four-year halving cycle, with the first halving scheduled in November 2025. Full dilution will take over 100 years, and soon, they will launch their para-chain network, Finney. Hail homage to the bitcoin legend Hal Finney.

Like Bitcoin, $TAO will not see partnerships, and they do not partner with companies.

Here’s a video on buying TAO on the Bittensor exchange; they don’t seem to be on the typical centralized and decentralized exchanges we know.

Leveraging multiple computers will have a similar ripple effect, just like the positive outcome of the interoperability of blockchains and an omnichain future.

3. Ocean Protocol

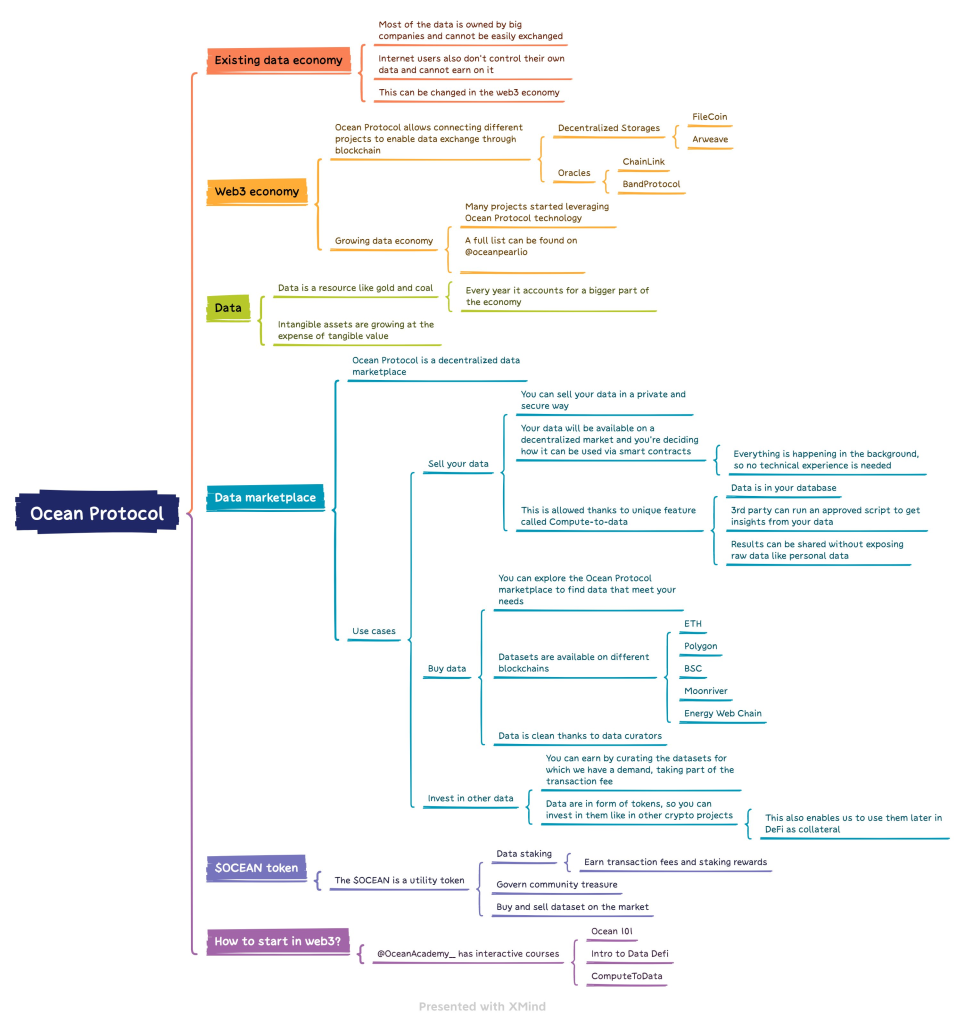

Ocean Protocol is building a decentralized marketplace where users can use it to sell– in a private and secure way, buy– with many datasets to choose from, and invest– by earning via transaction fees of popular datasets.

Their goal? to solve problems related to the new data economy.

Moment of pride:#OceanProtocol ranked as the 6th most productive crypto company measured by Github code contributions on January 3, 2023! 🤓💪

— Ocean Protocol (@oceanprotocol) January 10, 2023

Thanks, @finbold @proofofgithub for the recognition 😃 pic.twitter.com/iyZnfEHTDt

The existing data economy we know is owned by giants and cannot be easily exchanged. Internet users are the “farmers” who unknowingly feed these data to them and have little to no control over what they do with it. But that can be changed with web3.

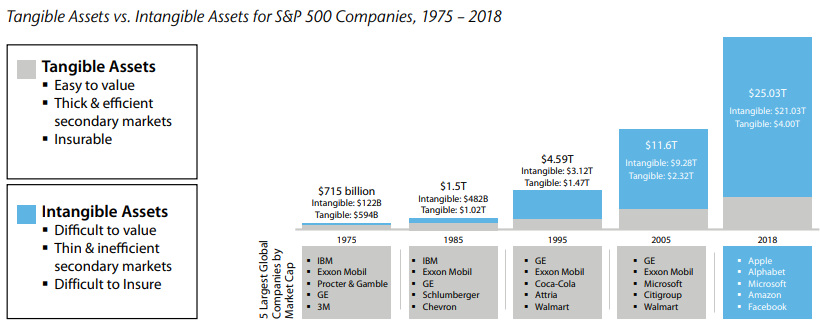

Data as a resource is gold. That is exactly how big tech rose above the ranks over the last decade, proving that intangible assets grow at the expense of tangible value.

That is where the native token $OCEAN, is needed. It serves as a utility token used for data staking, governing the community treasury and buying and selling datasets.

With the growing demand for data, the combined value of digital transportation is projected to be a $100T industry. The current total crypto market cap is now less than $1B. Huge opportunity, but we are banging on a successful execution before we see a significant upside.

$OCEAN has also seen a run-up over a couple of weeks and currently possesses a market cap of ~$138M.

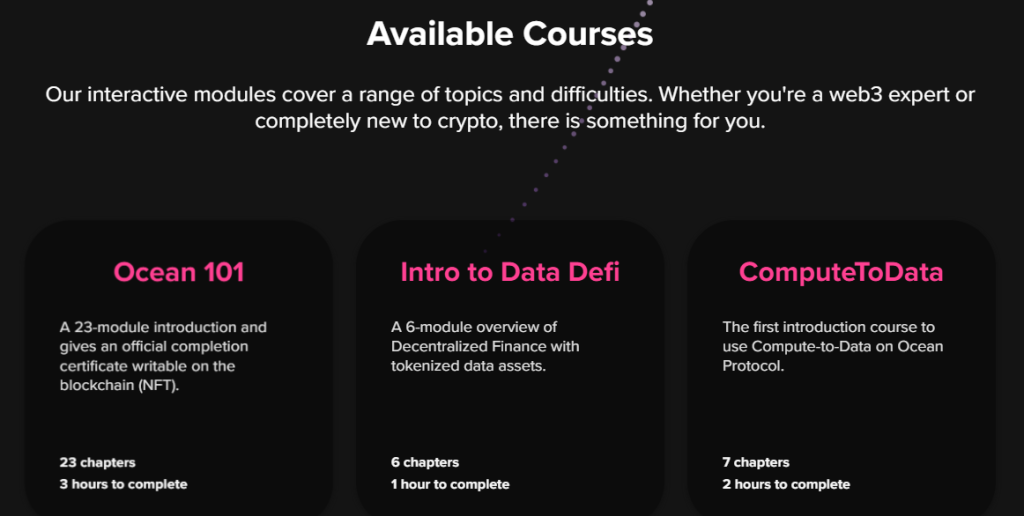

To learn more, head over to Ocean academy, which interactively covers topics of varying difficulties.

Closing thoughts

“Software is eating the world, but AI is going to eat software.”

This multi-trillion-dollar industry is one to watch in 2023, especially when coins may seem undervalued. On top of the moonshot opportunity AI presents, the execution of their products is vital for success in the tokens listed above.

In crypto, narratives come and go; things can get popular quickly but lose interest over the weekend. I believe AI will be here to stay; its use case here will trump other use cases, but it still boils down to demand and sustainability.

AI and crypto are a matchmaker in heaven. They have the potential to revolutionize industries by enabling decentralized and autonomous systems. Crypto provides a secure and transparent means of storage and transferring value, and AI can be used to make predictions and improve decision-making. While all these are still in the early development stages, further R&D is needed to fully realize their potential.

Also Read: 5 On-Chain Indicators To Spot Crypto Market Bottoms

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief