Key Takeaways:

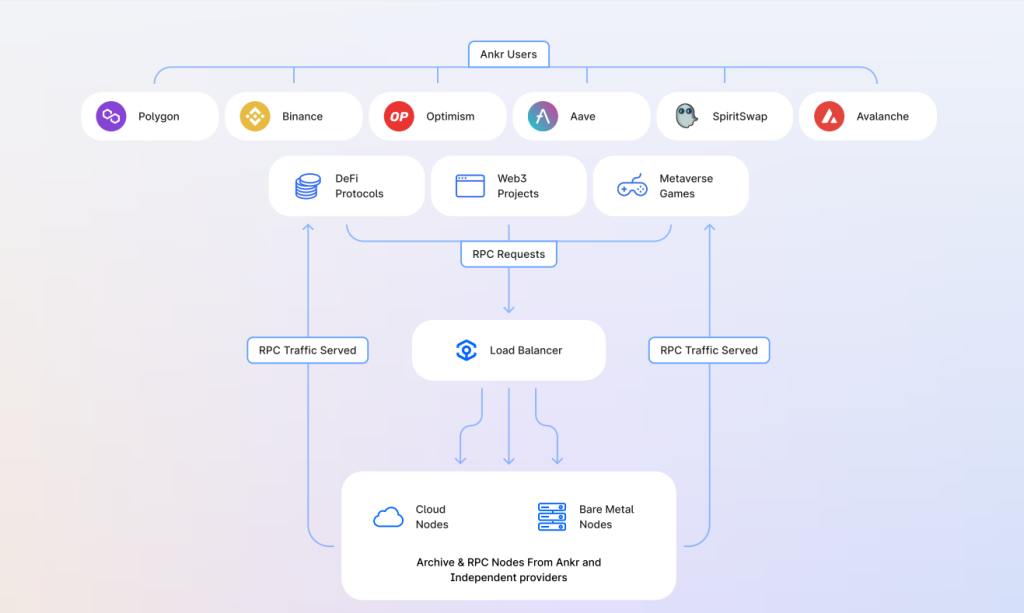

- Ankr provides a wide network of nodes that blockchains can tap into to increase security, scalability, and decentralization

- The Ankr Network also provides a full suite of advanced tools, including free RPC services

- The Network uses a Load Balancer to distribute requests, ensuring a seamless Web3.0 experience

___________________________________________

Proof-of-Stake (PoS) blockchains have cemented themselves in Web3.0. With Ethereum’s shift to PoS from Proof-of-Work (PoW), the importance of network scalability and infrastructure has once again been brought to the forefront.

However, as networks grow, the need for nodes to support them increases alongside that. Despite node deployment being pivotal to Web3.0, it is still expensive and difficult to do so, and often beyond the reach of the average retail participant.

One project, however, may be the solution to all this.

Also Read: WTF is STFX_IO?

Introducing Ankr: Fast, Reliable Web3.0 Infrastructure

Co-founded by Chandler Song, Stanley Wu, and Ryan Fang in 2017, Ankr aims to harness idle cloud computing power in data centers all over the world to power various Web3.0 services.

Since then, Ankr has become pivotal to the operation of many leading blockchains, including Polygon, Binance, NEAR, Optimism, and Fantom.

Ankr provides a full suite of services, including:

- Free RPC Services

- Advanced APIs/SDK

- Gaming SDKs

- AppChains / Personalized Blokchchains

- Liquid Staking

- Multi-Chain Explorer (Ankr) Scan

- Enterprise Solutions

To do so, they run an incentivized node economy, which is made up of its own nodes alongside an organic group of independent node providers to match the number of users.

By using this services, public RPCs are available to all and free to use on the Ankr Network platform.

How Do Blockchains Benefit?

Blockchains have always tried to solve the trilemma of scalability, security, and decentralization.

However, these individual categories are hard to achieve for blockchains on their own, due to the immense amount of resources required to advance any part of the trilemma.

Enter Ankr.

To understand how it helps blockchains, we must first understand their “Load Balancer“.

Once an RPC request is received on Ankr, and all security measures are satisfied, they are sent to the Load Balancer, instead of random nodes.

The Load Balancer acts as a traffic router, sending the requests to the best-suited nodes for the job.

It does so through an algorithm which scores:

- Node Health ( whether node is synced with the blockchain)

- Geographic Location (Lowest Latency, Protocol does not get this information)

- Workload ( Load Balancer spreads out workload across all active nodes)

Image: How The Load Balancer Works via Ankr

Thanks to Ankr having nodes running on more chains than any other Web3.0 infrastructure provider and the nodes being spread worldwide, it provides “speed, reliability, redundancy, and decentralization” to any blockchain tapping into Ankr.

How Do Users Benefit?

Not only are users able to get a more seamless Web3.0 experience, Ankr also operates advanced API services. These offer time and money saving advantages, especially when querying from multiple chains at once.

Currently, Ankr has three advanced APIs available for public use, namely

- Query API ( Ankr indexes blockchains for quicker querying)

- Token API ( Query token data across supported EVM-compatible blockchains. Includes no. of token holders, fair value, price, etc)

- NFT API ( Similar to Token API, includes querying ownership history, metadata, marketplaces, etc)

The $ANKR Token – A Full Tokenomics Run Down

Launched in mid-2020, $ANKR picked up steam in the last bull market, but has fallen approximately 90% since the peak.

In the last day, however, there has been a resurgence of interest in $ANKR due to Consensys’s announcement that Node provider Infura may be able to track your IP address via MetaMask.

ConsenSys announced an update to its privacy policy on November 23 (including metamask infura and more): When you use Infura as your default RPC provider in MetaMask, Infura will collect your IP address and your Ethereum wallet address when you send a transaction. pic.twitter.com/cBsqU2374o

— Wu Blockchain (@WuBlockchain) November 24, 2022

The $ANKR launch was relatively fair, with 40% being released through pre-mines and airdrops to the community. An additional 35% was sold between $0.0033 to $0.0066 per token, which translates to approximately a 3x at current prices.

Thankfully, more than 97% of $ANKR supply is already circulating, and all lock ups have been fully vested.

As for utility, the $ANKR token is required for a number of uses, including:

- Payment for Ankr Network Premium Plans

- Pay Collateral deposits (staking) to become a node provider on Ankr Network

- Reward Node Providers serving Network Traffic

- Reward Ankr Stakers for securing the Network

- Payment for independent node auditors

- Governance

To host an independent node, users will have to self-stake 100,000 $ANKR (~$2370) as collateral to deter bad actors. 21% of all transaction fees go to self-stakers, with 49% going to other individual stakers.

The remaining 30% goes towards the Ankr Treasury, which is controlled by Ankr DAO.

Individual stakers ( stakers without a node) currently earn 8.95% APR on their $ANKR, but face an 86 day lock-up period. Currently, there is more than 99 million $ANKR being staked by 693 wallets. Currently, only ERC-20 Ankr can be staked on the site.

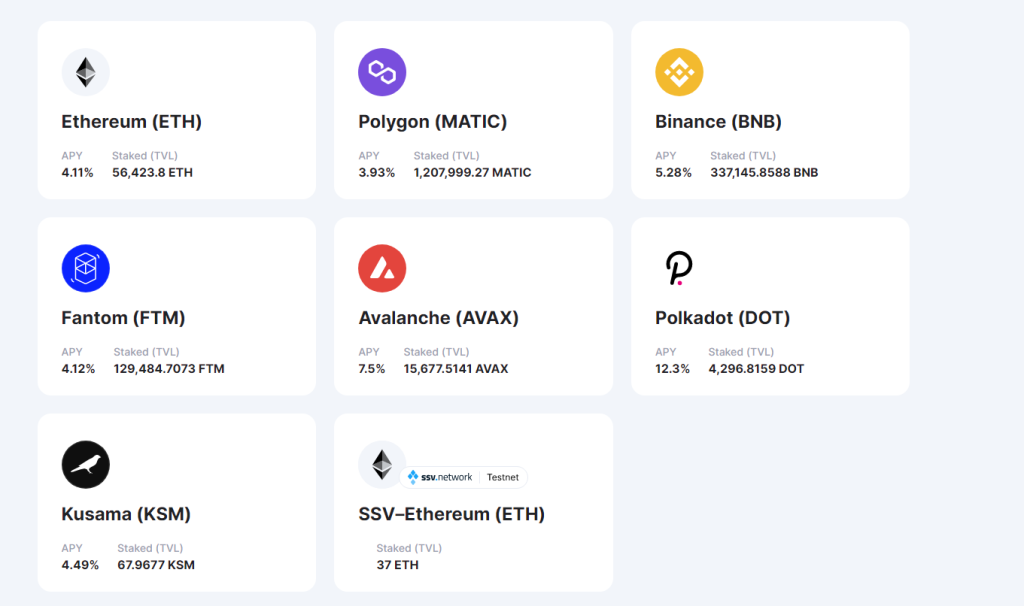

Liquid Staking With Ankr

As part of its full suite of Web3.0 solutions, Ankr also offers liquid staking alternatives.

With many Proof-of-Stake blockchains, tokens have to be locked up in staking pools in order to validate the network. However, this also leads to capital inefficiency, as you are unable to deploy your funds elsewhere.

Instead, users can use the liquid staking alternative provided by Ankr, and will receive a “receipt” token that reflects the staked amount. This receipt token will continually rebase to include the base value of the token and the yield generated by staking.

As Ankr aims to be the leading multichain staking-as-a-service provider, it will continue to partner with key DeFi platforms, driving utility to liquid staking tokens on Ankr.

Closing Thoughts

To be frank, the application layer of Web3.0 is far from ready. From poor UI/UX to constant exploits, applications still have a long way to go before mass adoption reaches.

In the meantime, a lot of effort and resources should be focused on infrastructure, and making sure the key principles of Web3.0 are secured. The need for decentralization, scalability, and security have become even more important in the face of the ongoing crypto contagion.

Ankr’s value proposition lies in the ease at which it provides access to nodes – the most important piece of infrastructure for Web3.0 protocols, allowing native crypto projects to build with it, or Web2.0 projects to enter the world of Web3.0 seamlessly.

Also Read: How Quant Network ($QNT) is Future-Proofing Scalability

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief