Key Takeaways:

- STFX allows users to create “Single Traded Funds”

- In Contrast to most TradFi/DeFi funds, these are short-term and are dedicated to one trade

- Aside from vaults, STFX has a star-studded community, which can help you level up in the bear market

___________________________________________

Have you ever traded a cryptocurrency before?

If you’re in Web3.0, the answer is probably yes. In fact, with almost $15 Billion of crypto Open Interest a day, most crypto participants have likely been either long or short at some point of time.

However, trading is too often a lonely game – with participants hoarding “Alpha”, or an edge over others, to eke out value from the markets. Trading, after all, is a blood sport.

But it doesn’t always have to be. While crypto twitter is a great place to discuss trades and strategies, often, we don’t know whether these traders have actual skin in the game. STFX, on the other hand, lets you put your money where your mouth is.

Also Read: What is GBTC and Why Won’t They Show Their Proof of Reserves

Introducing STFX_IO

STFX is a DeFi and SocialFi protocol for Short-term asset management.

In contrast to the “long-term, continuous, multi-asset portfolio funds” which have dominated TradFi and DeFi to date, STFX has pioneered STFs.

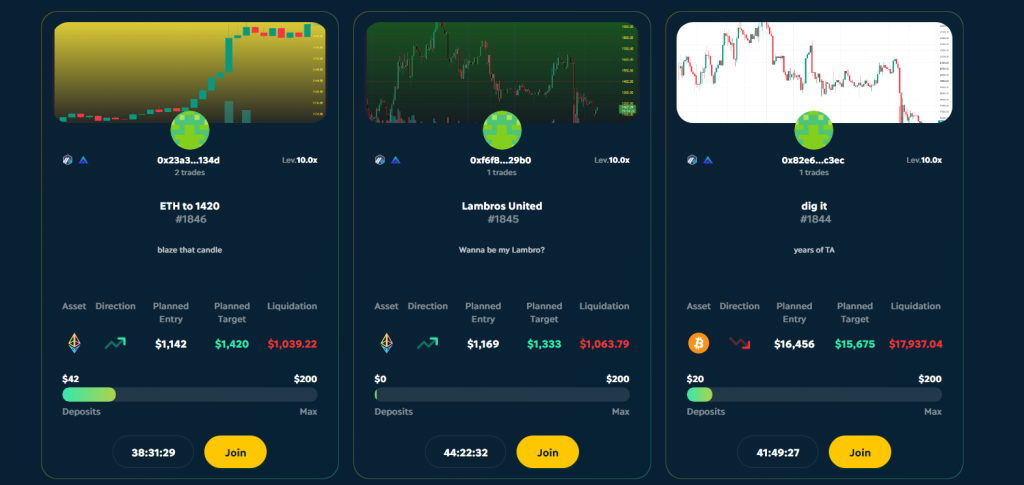

These Single Traded Funds are non-custodial, short-term vaults, that are dedicated to one trade.

STFX allows users to create or invest in these short-term “funds”, focused on a single trade. Users can then raise funds for the execution of their trading idea.

For investors, vaults help them save time on searching for the optimal yield-farming or trading strategies, and on fees. Furthermore, these vaults differ in complexity and risk profile, allowing users from a range of backgrounds to particpate

A Partnership With GMX

“At the heart of DeFi lies composability, a trait uniquely native to crypto”

The term “Composability”, or “money legos” has long pervaded in crypto, and speaks to the idea of protocols working together to bring about a new service.

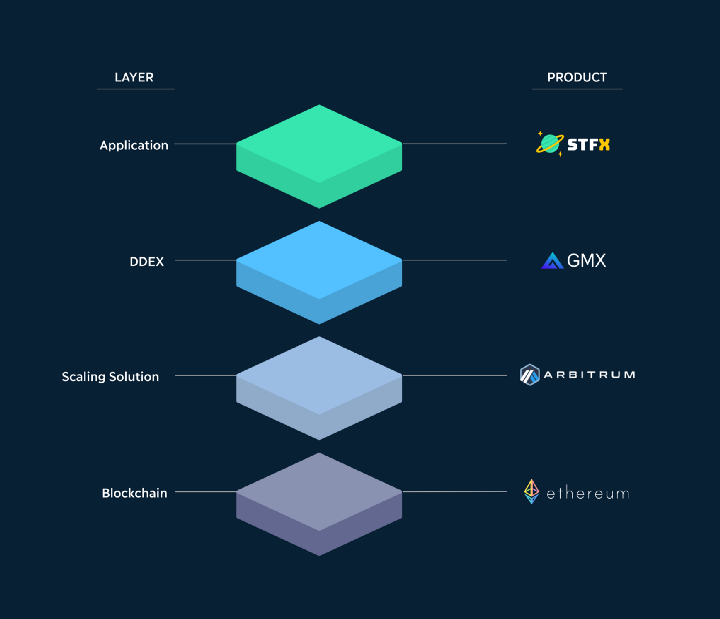

STFX is built on Arbitrum, a layer 2 scaling solution for Ethereum. Similarly, GMX, a decentralized SPOT and perpetual contract trading platform, also builds on the same layer.

By working with GMX< they are able to tap into the liquidity it provides, while keeping the decentralized spirit of STFX. Furthermore, GMX provides “real yield” by taking the other side of trades and through various fees, unlike protocols that print them from highly-inflationary tokens.

The rates on GMX are also competitive with other leading DEXs and trading protocols. By using oracles for price discovery instead of an Automated Market Maker, LPs are also somewhat protected from impermanent loss.

A Deep Stack of Traders and Builders

While STFX is already a top-tier protocol, its community is what makes it really shine.

GCR spreading some morning alpha on STFX discord pic.twitter.com/qIuecve5hr

— Cyborg Psyops Layers (@cc_yborg) October 5, 2022

GCR, infamous for offering a Do Kwon a $10 Million bet against LUNA at the peak of its hype, has often been spotted actively discussing trading strategies and approaches in the discord chat.

Furthermore, they have a slew of trading relate chats to speak about almost any topic you can think of. They also have an “STFX academy”, which helps you to elevate your trading strategies.

Should you need a place to learn, grind, or simply chat away in the bear market, there is no doubt that STFX will provide you with access to everything you need.

Closing Thoughts

The bear market is a difficult time for all of us. Whether you are a trader, investors, or simply speculator, Bitcoin at 16k has undoubtedly left some shaken.

At the end of the day, the easiest way to strive through the bear market is to upskill yourself. And what better way to do that than with a community of like-minded people? Be it a discord chat, your circle of anons on twitter, or even Chaindebrief’s very own telegram group chat, finding a community is imperative to not only surviving, but thriving through a bear market.

Also Read: Slaying The Bear Market: 5 Skills You Need To Excel In a Crypto Downturn

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief