Key takeaways:

- Learn about market phases

- Educate yourself and make informed decisions

- Benefit from in-app features

- Use dollar cost average strategy to your advantage

- It is a marathon, not a sprint

A bear market occurs when a market experiences an extended period of declination in price. According to Investopedia: “It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.”

Bear markets are often associated with declines in an overall market or index, such as the S&P 500, but can also be connected with individual securities or commodities. In this case, a crypto bear market can be considered when the price of Bitcoin has experienced several months of downward price action.

While a dip in price can be discouraging, especially for new users, there are plenty of opportunities in this slower and lower volatility market phase for everyone to capitalise on. Here are five strategies you can adopt to make the most out of the bear market.

Also Read: This Bear Market Is Trying To Teach You Something

1) Understand The 4 Phases of a Crypto Market Cycle

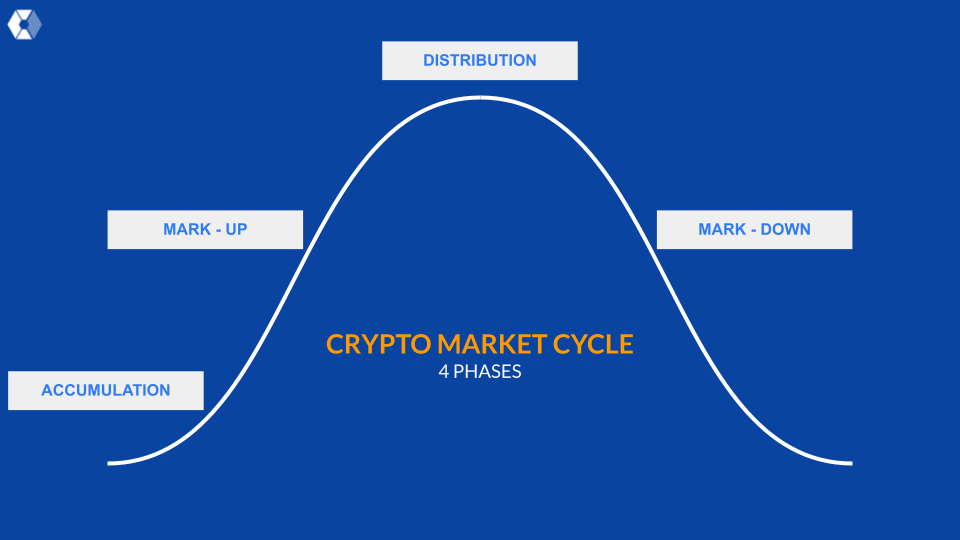

The crypto market cycle is generally defined by four phases – the slow accumulation, the quick run-up, the plateau in price and the subsequent drop in price. This is a pattern that repeats over and over again across all markets.

Firstly, accumulation is the first phase of most market cycles. It starts when most sellers have exited the market and prices are stabilising. In this phase, the market volume is low there is little interest in the market. Therefore, no clear trend emerges, and assets typically trade within a tight range.

Secondly, the markup phase – commonly referred to as the bull market – is when the market trends higher in price at an increasing rate. During this phase, new groups of market participants enter the market. This usually causes a spike in volume at the beginning of the phase.

Thirdly, we have the distribution phase. After a bull run, early buyers will start selling their positions to realise profits and thus become sellers. Buyers and sellers in the market are perceived to be at equilibrium as price plateaus.

Lastly, the markdown phase – commonly referred to as the bear market – is when the market plunges in price. When the supply exceeds the demand in the distribution phase, price will start to take a hit and consequently fuel fear in the market. This results in a negative outlook and sour sentiment.

But fret not as there will always be a light at the end of the tunnel. Bull market will return after bear markets and it is proven over time that the market only goes up (or at least the tested ones like S&P 500).

2) Use Market Downtime To Upskill Yourself

A bear market presents the time and opportunity for you to learn more about crypto at a slower pace to set yourself up for the next bull market. With less fomo as compared to an enormous bull run, investors can use this time to educate themselves about blockchain technology and cryptocurrency.

All the NoSleep Reading Lists in one place. Happy reading and vibing 🌊 https://t.co/Hgdowic6JB

— NoSleepJon 💤 (@nosleepjon) April 25, 2022

There is a variety of free resources out there to get you up to speed and Chain Debrief is one of them! Feeling like you want a challenge and yet be rewarded at the same time? Do check out our Learn & Earn platform, Nexus!

Read articles, watch videos, and put your crypto knowledge to the test while growing your crypto stash along the way. Start earning now!

For the more advanced, do check out our in-depth research reports.

Also read: 5 Twitter Threads You Need To Become A Crypto Pro

3) Step Away From The Charts

When the market is volatile, fomo and fud can tempt us to stare at the charts all day long in hopes of executing an order at the ideal price. If you are someone who prefers to time the market, you might wish to automate the process so that you are not glued to the screen.

You can set alerts using platforms such as TradingView and CoinGecko. When your alerts goes off, simply put out the chart and decide your next actions from there.

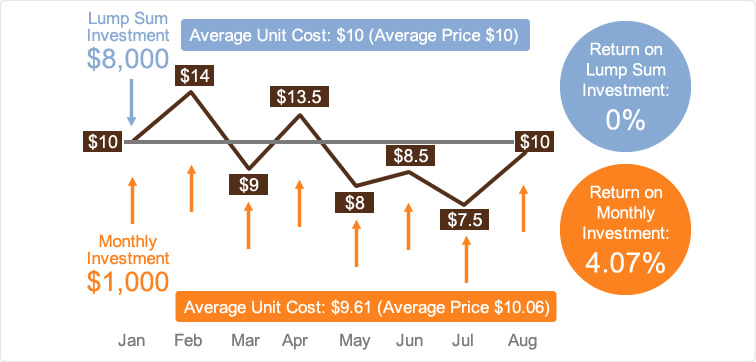

Timing the market is not for many especially beginners. Investors will usually take the well-known approach known as dollar cost averaging, especially during times that tug at the heartstrings.

4) Use Dollar Cost Averaging To Your Advantage

Dollar cost averaging (DCA) is the act of purchasing an asset at regular intervals for a fixed dollar amount (e.g. USD $500 every fortnight). Research have shown that over the long term, DCA can yield better results than trying to time the market.

Users can conveniently automate their DCA strategy on popular crypto exchanges and purchase crypto on a weekly, biweekly, or monthly schedule as they deem fit.

Users can also set buy limit orders at the price at which they would like to accumulate so that they do not have to be on their phone or laptop to press buy when their favourite coin trades to that level. In this case, the exchange will automatically fill their orders and purchase on behalf for them without any extra charge. Simple as it is!

Instead of trying to time the bottom perfectly, users can lower their average purchase price throughout a bear market to position themselves better.

5) Focus On The Long Term

No one knows when exactly a bear market will end. However, previous bear markets have been superseded by bull markets.

Develop a long-term plan that is not influenced by any short-term fluctuations in the market. This will ensure that you neither buy more assets than you can afford nor run out of cash when you would like to accumulate more.

The highs of bull markets are exciting, just as much as the bottom of a bear market is daunting. These events can stir strong emotions, especially in those new to the crypto market. Investing is for the long-term and not a few months old activity. Therefore, it is important to keep a level head through the dips and not let the bear market get to you.

Conclusion

As much as price may stay stagnant or continue to dip lower during a bear market, it is important to stay active. Use this time to educate yourself on different aspects of crypto and adopt a DCA strategy that you are comfortable with. These are building blocks that can help you to succeed during the next bull run.

As the saying goes, “bull markets make you money, bear markets make you rich.”

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Market Cycles In Crypto: How To Identify Tops and Take Profits