With ~300 million in liquidated longs just this week and total crypto market cap 60% from the highs, it is no secret that we are in a bear market.

But how did we get here?

While global macroeconomic conditions have led to general de-risking from risk-on assets, the current bear market has definitely been accelerated by its participants.

So what can we learn and apply in the future?

Also Read: Getting Rekt During The Bear? Here’s How To Level Up Your Crypto Game

Lambo Calculators – Not Great

If you cannot explain the source of your yield , you are probably the yield.

During peak bull market, even the sketchiest ideas were labelled “revolutionary”, as long as they were new or different.

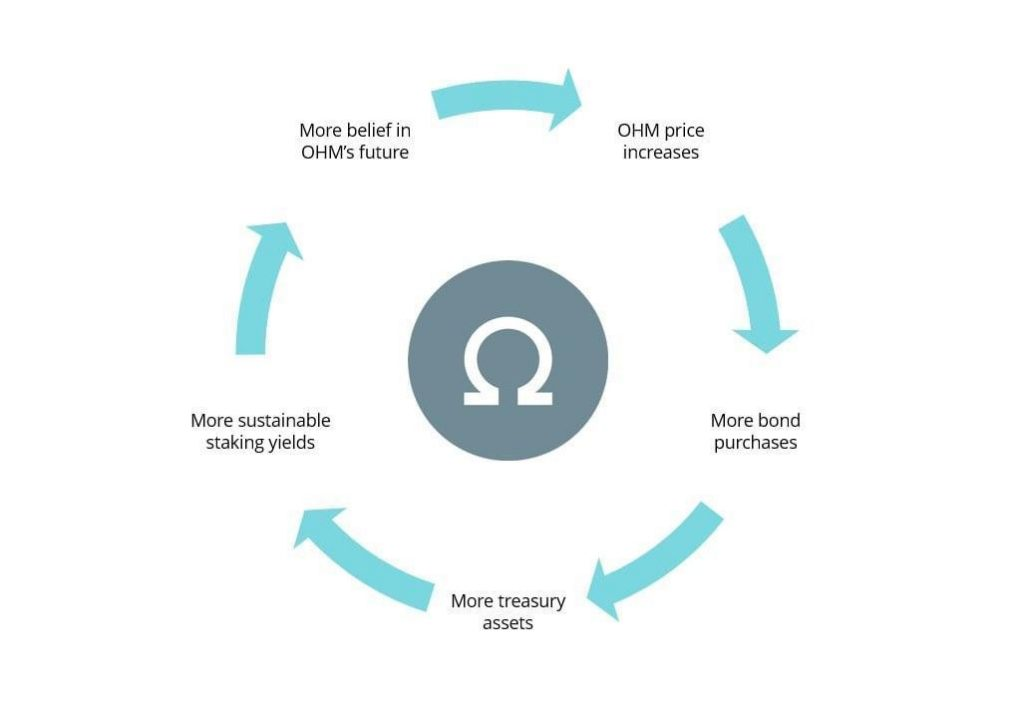

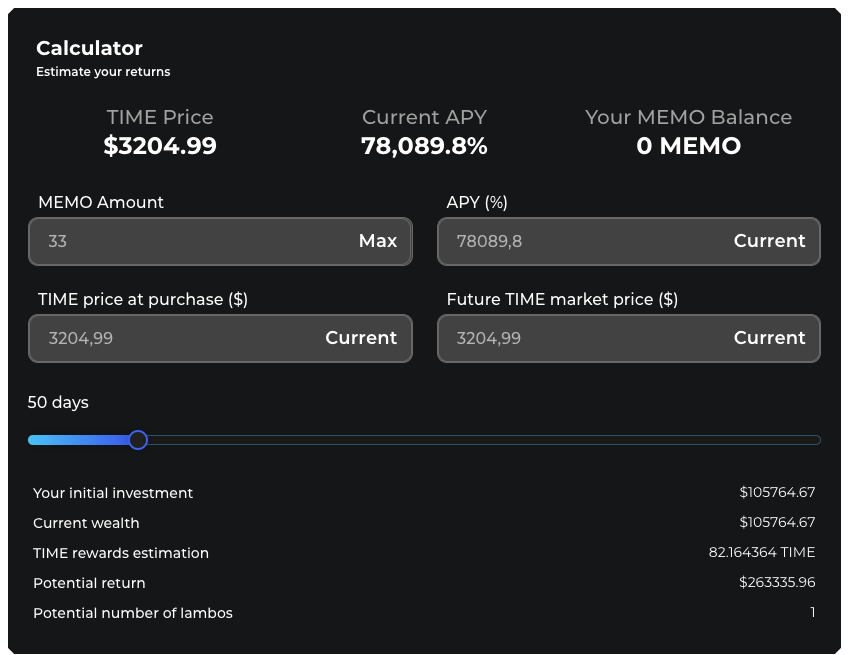

A great benefactor of this was Olympus DAO’s (3,3) model, which birthed about as many spin offs as there are stars in the sky. One of these was Wonderland, which boated a “lambo calculator”, which suckered retail participants into backing the project.

To the average user, an 80,000% APY seemed like a no-loss system. Even if prices went down 80%, HODLing looked like a guaranteed system for profit.

Since then, the collapse of high-yield systems, including Terra Luna’s Anchor Protocol has shown that unsustainable yields are, well, unsustainble.

GET A COLD WALLET, PLEASE

Somehow, crypto users love staying one email away from getting their hot wallets hacked.

1/ After almost a week of investigation, our team has not found any evidence that Phantom's systems were compromised during the August 2nd security incident.

— Phantom (@phantom) August 9, 2022

Work is still ongoing, but given the seriousness of the situation, we want to give an update on what we have done so far.

If you have not yet gotten a cold wallet, think about it this way.

Your crypto portfolio is probably going to six digits at some point. For 0.06% of that, you can get a hardware wallet that keeps all your coins in cold storage.

That’s about as +EV as it gets.

No More Messiahs

In the bull market, inflated valuations led to inflated egos.

And with gravity, all of that came crashing down.

One problem that crypto participants had, especially when everything was in the green, was crowding around figureheads. This led to strong echo chambers, and a lack of constructive criticism.

Worst still, these figureheads let it get to them, and were blinded by their communities.

Yeah but your size is not size

— Do Kwon 🌕 (@stablekwon) March 9, 2022

What has happened since?

- Terra collapsed

- 3AC liquidated, CeDeFi contagion

- Wonderland to zero

Altogether, these decisions have probably cost both retail and institutions billions of dollars, and has helped speed run our market to the down side.

Unfortunately, the need to rally behind a figure seems to still be a thing in crypto.

Ponzis Will Be Ponzis

From 3,3 to algo-stables to infinite yield, it is easy to look back and tell one another that they were built on ponzinomics.

But hindsight is always 20/20, and crypto moves way too fast for that.

Furthermore, it is genuinely hard to decide what a ponzi is.

I fucked up.

— ZAGABOND.ETH (@ZAGABOND) May 11, 2022

After the spaces today, I realized my shortcomings in how I handled the prior projects which I started. To the communities I walked away from, to Azuki holders, and to those who believed in me — I’m truly sorry.

1/x

Even Azuki’s founder, Zagabond, coming out as a serial rugger did not deter NFT traders from identifying the project as a “blue-chip”.

While the bear market has led to profitable protocols such as GMX shining, the vast majority of the projects in Web3.0 are still, well, not very useful.

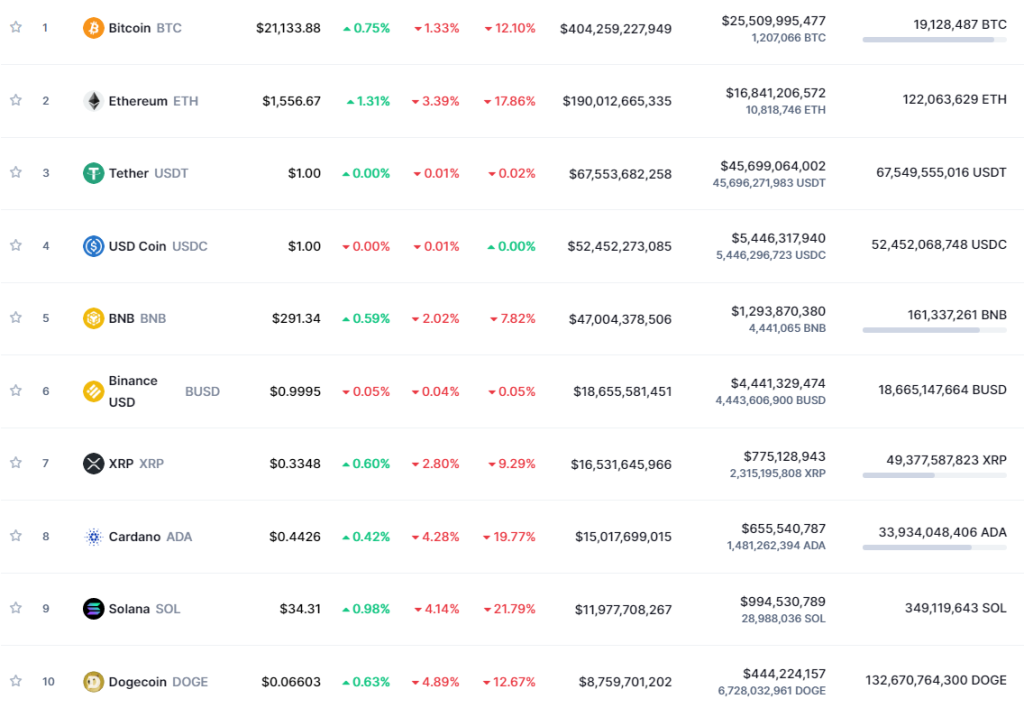

This becomes even more evident, when the top 10 cryptocurrencies includes 3 stablecoins, dogecoin, and two tokens with barely any usage.

Moreover, the top 30 still includes Bitcoin Cash, Litecoin, and Ethereum Classic.

Even with all the “innovation”, we are still left with the greatest casino of all time, instead of projects that can be value-invested in.

Closing Thoughts

It would be nice to be in it for the technology, but the majority of crypto participants are probably here to get rich, quick.

While that is not a bad thing itself – the rules of value investing and fundamentals are all but ignored in Web3.0, which makes it hard to identify genuinely good projects.

However, taking down notes on key indicators of what did well in previous markets and learning from them is essential. Whether you believe in a project or not, identifying their value capture is imperative to being successful in crypto.

Also Read: Is This Time Really Different? Lessons And Warnings From Previous Crypto Bear Markets

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: Chaindebrief