The advent of blockchain technology has brought about a paradigm shift in the digital world, particularly for content creators. Non-fungible tokens (NFTs) have emerged as a revolutionary tool, enabling artists to authenticate and monetize their digital creations in ways previously unimaginable.

Central to this revolution is the concept of NFT royalties, a mechanism that allows creators to earn from their work in perpetuity.

Understanding NFT Royalties

NFT royalties are a form of passive income that artists and creators earn from the resale of their digital creations. When an NFT is sold, a percentage of the sale price, typically between 3% and 10%, is automatically paid to the original creator.

This royalty system is embedded in the smart contract of the NFT, ensuring that artists continue to benefit from their work long after the initial sale.

Also Read: What is The Best NFT Collection (2023)?

How NFT Royalties Work: A Practical Guide

The implementation of NFT royalties is made possible by the programmable nature of blockchain smart contracts.

- The process begins when an NFT is minted. At this stage, the creator embeds a royalty percentage into the smart contract that governs the NFT.

- This royalty percentage is a coded instruction that is set to automatically execute whenever the NFT changes hands.

- The Ethereum blockchain, which is the most common platform for minting NFTs, uses a standard called ERC-721a for NFTs.

- An extension of this standard, known as EIP-2981, provides a universal interface for handling royalties.

- When an NFT is sold, the smart contract triggers a function that splits the payment between the seller and the original creator.

- The seller receives the sale price minus the royalty, and the royalty is automatically transferred to the creator’s wallet.

- This transaction happens on-chain, meaning it’s transparent, verifiable, and cannot be altered or stopped once the smart contract is deployed.

Now, let’s say you own a Bored Ape and decide to sell it on an NFT marketplace like OpenSea. If you sell your Bored Ape for 5 Ethereum (ETH), the smart contract automatically triggers the royalty function. This means 2.5% of the sale price (0.125 ETH in this case) is automatically sent to the wallet of the original creators of BAYC. You, as the seller, would receive the remaining 97.5% of the sale price minus the marketplace fees.

The Benefits of NFT Royalties to Artists

In the traditional art world, artists often face a ‘one-and-done’ scenario. They create a piece of work, sell it, and that’s the end of their financial gain from that particular creation. The buyer, or any subsequent buyer, can sell the artwork for a higher price, but the artist does not see any of the profits from these secondary sales. This model has been the norm for centuries, but NFTs and the concept of royalties are turning this traditional model on its head.

This not only offers financial stability but also incentivizes artists to build long-term, engaged communities around their creations.

For instance, an artist who sells an NFT for $100 with a 10% royalty will automatically receive $100 if the NFT is later resold for $1,000. This mechanism ensures artists benefit from the appreciation of their work over time.

Moreover, NFTs democratize the art world by eliminating intermediaries. Artists can sell directly to collectors and receive their royalties, retaining more of their earnings. This direct-to-collector model also fosters a closer relationship between artists and their audience, leading to vibrant, engaged communities centred around the artist’s work.

In essence, NFT royalties are reshaping the art world, empowering artists, and fostering a more direct and rewarding relationship between artists and their audience.

Also Read: NFTs vs Cryptocurrencies: Which Has Better Bear Market Returns?

The Challenges and Considerations of NFT Royalties

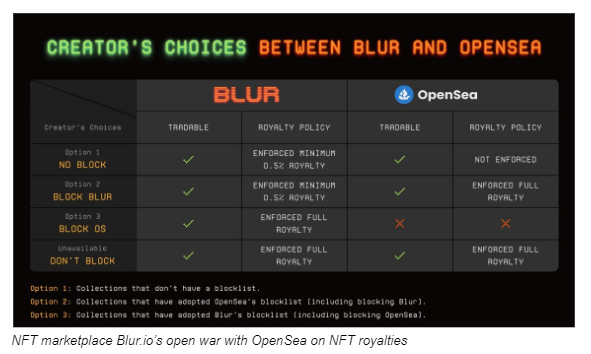

NFT royalties, while transformative, are not without their hurdles. The enforcement of these royalties is largely dependent on the policies of the marketplace where the NFT is sold. Some platforms, in a bid to stay competitive, have taken steps to reduce or even completely eliminate royalties. This creates an environment of uncertainty for creators who rely on these royalties as a source of income.

One notable example is the NFT marketplace LooksRare. In a significant shift from the norm, LooksRare decided to eliminate creator royalties.

Instead, buyers on the platform can opt-in to pay optional royalties at checkout. The marketplace has chosen to share 25% of the LooksRare protocol fee with creators and collection owners, claiming to be the first zero-royalty marketplace to do so.

Moreover, the inherent volatility of the NFT market means that creators cannot depend on a consistent income stream from royalties. This unpredictability can be a deterrent for artists considering venturing into the NFT space. Furthermore, there are looming concerns about potential copyright infringement and the lack of a comprehensive legal framework governing NFTs. These issues need to be addressed to ensure a fair and sustainable ecosystem for creators.

Also Read: Can You Make Money With Free To Mint NFTs?

The Future Outlook of NFT Royalties

The future of NFT royalties is largely dependent on the evolution of the NFT market and the broader regulatory environment. As the space matures, there is hope for more standardized and enforceable royalty mechanisms. The rise of decentralized autonomous organizations (DAOs) and the potential for on-chain governance could also play a role in shaping the future of NFT royalties.

An interesting approach was taken by Pirate Nation, a blockchain-based game. Through the use of a unique custom handler hook in their contract, they were able to quickly adapt to OpenSea, becoming one of the first NFT collections to earn full royalties on both Blur and OpenSea. This approach showcases the potential for flexible and adaptable royalty enforcement in the rapidly evolving NFT ecosystem.

Moreover, the concept of NFT royalties could extend beyond the art world to other forms of digital content, such as music, literature, and virtual real estate, further expanding the potential for creator earnings.

Closing thoughts

NFT royalties represent a significant advancement in the way content creators can earn from their work. While challenges exist, the potential for a more equitable and decentralized art market is an exciting prospect.

As the NFT space continues to evolve, it will be crucial for artists, marketplaces, and regulators to work together to ensure that the promise of NFT royalties is fully realized, paving the way for a new era of digital creativity and innovation.

Also Read: The NFT Marketplace War Between Opensea And BLUR

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief

Author: Marcus Chan