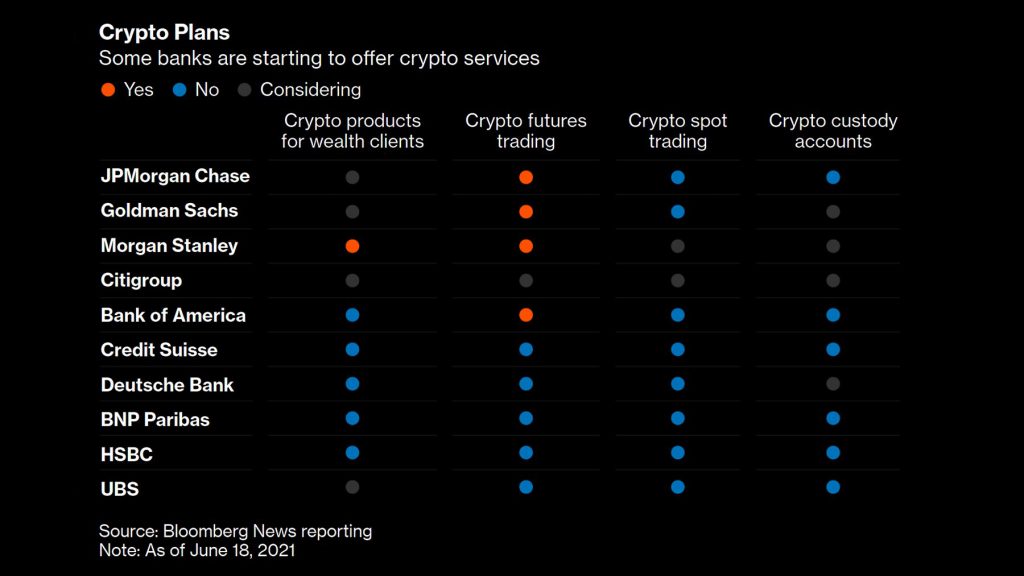

As banks around the world starts to embrace cryptocurrency and blockchain adoption, it may be hard to keep track on the progresses made by each banks.

Bloomberg, recently published an informative table showing how the biggest banks in the United States are involved with Bitcoin and what products were already announced by each of them.

Here’s a look at the table by Bloomberg.

Banks offering crypto futures trading in the United States include:

- JPMorgan Chase

- Goldman Sachs

- Morgan Stanley

- Bank of America

Citigroup is considering to offer this service.

Banks offering crypto products for wealth clients in the United States include:

- Morgan Stanley

JPMorgan Chase, Goldman Sachs, Citigroup, UBS is considering to offer this service to their clients.

Banks in the United States are embracing blockchain technology and are facing increasing demand from their customers to gain exposure to cryptocurrency as a new asset class.

JPMorgan for example, has been a long time proponent of Ethereum which leverages on smart contracts to execute blockchain transactions.

It currently has a digital currency called JPM Coin, enables participating J.P. Morgan clients to transfer US Dollars held on deposit with J.P. Morgan. JPM Coin current daily transaction volume is at US$ 1 billion.

We expect more banks around the world to start offering crypto services to investors around the world as more and more people start to embrace the new digital asset class.

In a separate news, the world’s largest interdealer broker, TP ICAP announced yesterday that it is launching a cryptocurrency trading platform with Fidelity Investments and Standard Chartered’s digital assets custody unit. The platform is currently awaiting approval by Britain’s financial regulator.

The new trading platform will offer post-trade infrastructure with a network of digital asset custodians as well as a separate execution and settlement dashboard.

“Investor interest in this new asset class has exploded dramatically in the last six to eight months,” Duncan Trenholme, co-head of digital assets at TP ICAP, told Reuters.

“In most of our conversations with clients, they want a separation of custodial roles from execution capabilities which is opposite to the models that exist currently.”

Simon Forster, Co-Head of Digital Assets at TP ICAP, said in the press release that the client demand to trade spot cryptoassets is “significant and growing”, with interest coming from traditional customer base across the different asset classes.

Also Read: Cryptocurrency Adoption Curve Is The Fastest In Human History