In my previous two articles, we went through the technical details such as Metis’ underlying technology and project aims.

But in this article, we shall explore the fun stuff and learn how to invest in MetisDAO!

Bullish thesis on $METIS

First and foremost, it might be an unpopular opinion, but I have to admit that I am not a fan of any DAO’s governance tokens.

Most of these tokens have little utility behind them to catalyse a rise in the token’s price as the token is only required for voting purposes.

And as an investor, I am rather indifferent towards governing a DAO. But Metis is a different story as it is more than just a DAO.

As elaborated in my earlier articles, Metis is a Layer 2 solution that supports the development of DACs. As a result, $METIS is not just a mere ‘voting’ token used for governing a DAO; it is a utility token too.

Also Read: What Is MetisDAO ($METIS)? Its Underlying Technology And What Makes It Better Than Other L1s And L2s

First, $METIS needs to be bought and staked in the vault if one were to create a DAC. On top of this, users are also required to own $METIS to pay for gas fees when they interact with any on-chain applications, similar to how the gas fees on L1 chains are denominated in the native token.

Last but not least, $METIS can also be used by yield farmers to provide liquidity on Andromeda’s AMMs to earn yield.

All these strategies will be explained in subsequent articles, but for now, let’s get back to our bullish thesis on $METIS and see how it compares to other coins!

Relative valuation

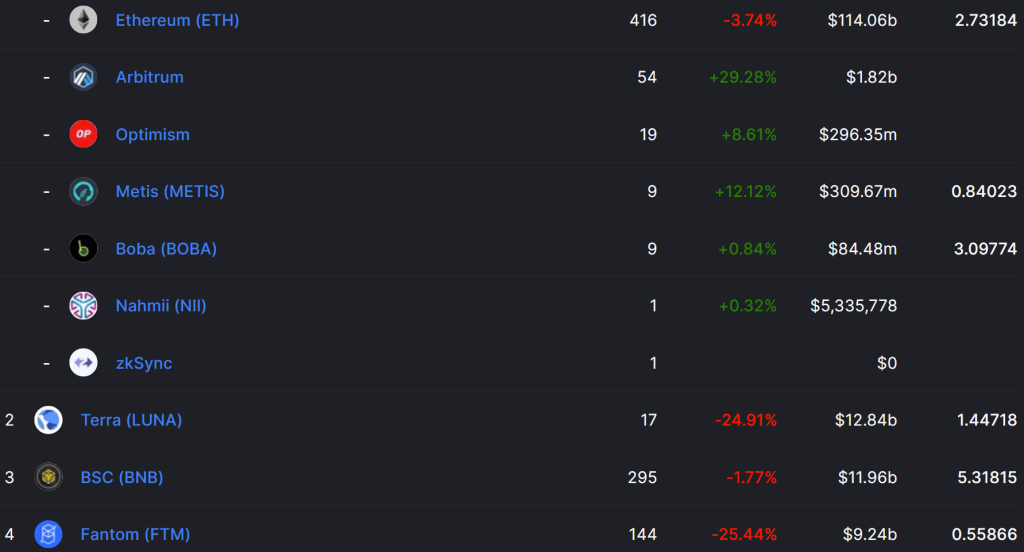

One metric that can be used in evaluating the relative valuation of a network is its Marketcap/TVL ratio.

At the current time of writing (31 January), METIS has a market capitalisation/TVL of 0.84, which is relatively low if we were to compare to that of other L1s.

In fact, the only L1 with a lower Marketcap/TVL ratio than Metis is Fantom.

As such, this could potentially hint towards an opportunity in the making.

Where to buy $METIS

If you share my bullish sentiments on $METIS, the next step would be to buy $METIS. But because L2s have yet to gain much traction and $METIS is still relatively new, buying $METIS may be rather obscure.

Currently, I am unfamiliar with any centralized exchanges that support the trading of $METIS. As such, $METIS will have to be bought on decentralized exchanges instead.

As for decentralized exchanges, $METIS can be bought on Ethereum’s Uniswap and Binance Smart Chain’s PancakeSwap.

Ethereum’s Uniswap

This is the simplest way to buy $METIS.

- Install the Metamask Chrome Browser Extension and create a Metamask account (default network will be Ethereum)

- Buy $ETH on any centralized exchanges (Gemini, Coinhako, FTX, Crypto.com etc)

- Withdraw $ETH to your Metamask account via the ERC20 network

- Go to Uniswap and swap your $ETH for $METIS (remember to leave some $ETH in your Metamask wallet to pay for gas)

Pros:

- For fellow Singaporean crypto enthusiasts who use local crypto brokerages such as Gemini and Coinhako, withdrawing $ETH to Metamask is easy as the default network for withdrawals is ERC20.

- Gemini has free withdrawals as compared to other brokerages that typically charge a network fee of 0.008 ETH

- Uniswap has rather deep liquidity and there was barely any slippage

Cons:

- Gas fees on Ethereum is rather expensive (1 transaction can cost from 30 USD to 300 USD)

BSC’s PancakeSwap

- Install the Metamask Chrome Browser Extension and create a Metamask account (default network will be Ethereum)

- Add the BSC network to Metamask

- *If you are using Gemini / Coinhako, they only support withdrawals to the Ethereum network and do not support withdrawals to BSC. Centralised exchanges that support withdrawals to BSC include FTX and Crypto.com. So you should either transfer crypto from Gemini / Coinhako to FTX / Crypto.com or simply deposit fiat from your bank account to FTX / Crypto.com

- Buy $BNB on FTX / Crypto.com

- Withdraw $BNB to your Metamask account via the BEP20 network

- Go to PancakeSwap and swap your $BNB for $METIS (remember to leave some $BNB in your Metamask wallet to pay for gas)

Pros:

- Gas fees on BSC is much cheaper (1 transaction costs around $0.10 to $0.15)

- Network fee when withdrawing from CEXs to Metamask is also cheaper

Cons:

- PancakeSwap has much lesser liquidity (the swaps I executed had a slippage of 2%)

- More steps needed in configuring your Metamask

- Less CEXs allow withdrawal via BEP20 as compared to withdrawal via ERC20

Evaluation

At the end of the day, I feel that deciding which platform you should buy $METIS on depends on how much you are planning to invest.

If you are only planning to invest a bit of money, your slippage on BSC will be lower as compared to Ethereum’s gas fees. On the other hand, if you are planning to invest a lot of money in $METIS, the slippage on BSC may be too high such that paying gas fees on Ethereum may be more worth it.

As a rough gauge, I think BSC is better for investments under $10k whereas Ethereum is better if you are buying more than $10k worth of $METIS.

Conclusion

Now that we are familiar with buying $METIS, the next article will elaborate on how we can bridge our $METIS tokens from Ethereum or BSC over to the Metis Andromeda Mainnet. On top of that, we will also take a look at how we can create our own DAC!

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: A Look At The MetisDAO Ecosystem: Aims, Applications And Developments On Andromeda Mainnet