Investing and trading are two different methods of profiting from the financial markets. Both investors and traders seek profits through market participation.

In general, investors seek greater returns over a longer period through buying and holding as opposed to traders who take advantage of both rising and falling markets to enter and exit positions over a shorter timeframe, taking smaller and frequent profits.

Investing vs Trading

Investing

The goal of investing is to gradually build wealth over an extended period of time by purchasing and holding a portfolio of diversified financial securities.

Investments are often held for a few years at least, taking advantage of perks like interest, dividends, and stock splits along the way.

While markets inevitably fluctuate, investors will “ride out” the downtrends with the hope and expectation that prices will rebound and any paper losses will be recovered eventually.

Trading

Trading usually involves a higher frequency of transactions, such as executing long and short positions on commodities, currency pairs, crypto or other instruments.

The goal is to generate returns that outperform buy-and-hold investing.

Traders often use the help of indicators such as moving averages, relative strength index and other technical analysis tools to find high-probability trading setups to profit from.

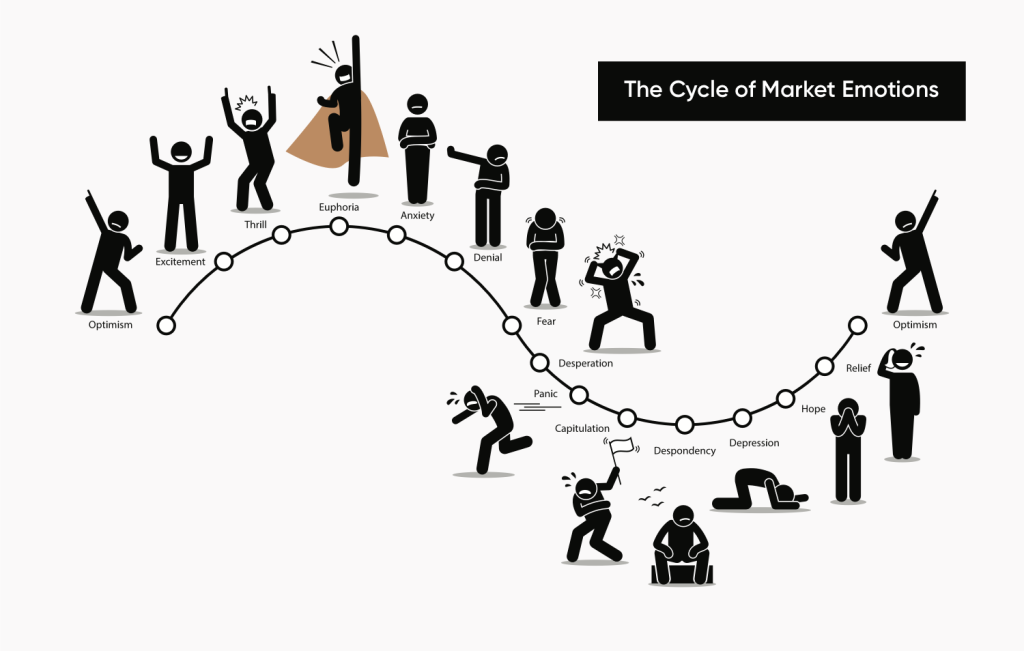

Two most common emotions traders experience

- Fear: A common cause of fear is over-leveraging on trades. Entering a big position size relative to your account magnifies risk and volatility unnecessarily and often cause traders to make mistakes under the stress of bigger losses than normal.

- Greed: When traders have a winning position, they often want more. An example can be having a take profit level, but removing it because they get greedy and chase for more profits. This often does more harm than good, as price will reverse and they will eventually close it for lesser profits or even take a loss.

Impact of trading the market emotionally

When you trade the market emotionally, it often exposes you to unnecessary risks.

There are various systematic and unsystematic risks in every market that traders need to deal with. While there are a plethora of strategies to counter these risks, you tend to adopt a myopic approach when you trade with emotions, which elevates the quantum of risk manifold.

This will lead to irrational decision making processes which will usually end up causing your account to deplete rather than grow.

Ways to control your emotions

There are a few ways you can control your emotions when trading or investing in the crypto market. Everyone is different but these can apply to anyone.

1) Create a strategy

Formulate a trading strategy specifically catered to your needs, market knowledge and availability.

It can be to trade purely based off of price action or with the help of different indicators. Find out what suits you and tailor your strategy in that direction.

2) Avoid small caps and invest what you can afford to lose

You may have heard stories of 18-year-olds turning US$1000 into a few million dollars because he invested in DOGE or SHIB. This may prompt you to invest some money into memecoins but my advice is to avoid it entirely.

There are only a few success stories of investors of memecoins and it all boils down to luck. Unless you are completely fine with seeing that part of your investment go to zero, never buy it.

3) Lower your trade size

If you choose to trade in the crypto market, do not over-leverage your trades. Crypto, by nature is already a highly volatile asset. Ironically, you have the option of up to 125x leverage on centralised exchanges.

This is a sure-fire way to get liquidated on your trade as all that is required is just a 0.8% move in the opposite direction!

4) Plan your trades

“If you fail to plan, you are planning to fail” — Benjamin Franklin

If you choose to buy based off hype (because someone said that it will pump soon) and without doing your own research, you are doomed. Not knowing what you’re putting your money in to is the worse way of investing. Never do that!

Conclusion

As human beings, we all have emotions. Only robots don’t. This is a reason why some people choose to automate their strategy — to completely eliminate emotions.

When it comes to trading / investing in the crypto markets, it pays to keep away from them and adopt a disciplined approach. This way, you are one step closer to that target of yours.

[Editor’s Note: This article does not represent financial advice.]

Featured Image Credit: Chain Debrief

Also Read: My First Experience With Crypto: How The “Next Big Thing” Crashed And Burnt