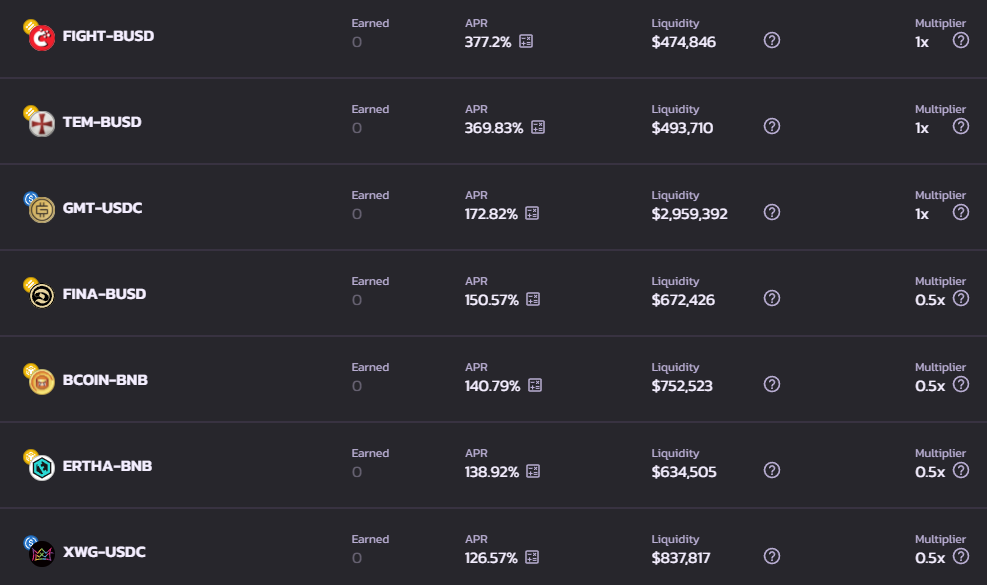

Like many new rookies out there, I was tempted by the mouth-watering APYs only available in Decentralised Finance (DeFi). The double to triple-digit APYs are so much more than what TradFi (traditional finance) banks are offering.

Without batting an eyelid, I jumped into the rabbit hole of DeFi and never looked back.

With so many different blockchains out there and only a small capital, I decided to go with the blockchain that is easy to onboard and cheap gas fee, Binance Smart Chain (BSC).

As that was my first step into the DeFi world, I decided to take caution and not go full “degen” to chase the 1000% APYs.

One thing led to another, and I stumbled upon the supposed “next big thing” — PancakeSwap ($CAKE).

How I became a victim of “FOMO”

FOMO is short for Fear Of Missing Out, and is by far one of the most common mistakes made by rookies when investing in cryptocurrencies.

I too, was a victim of FOMO as everyone around me was talking about PancakeSwap. From Crypto Twitter to YouTube, everyone said that PancakeSwap would 10x or even 100x.

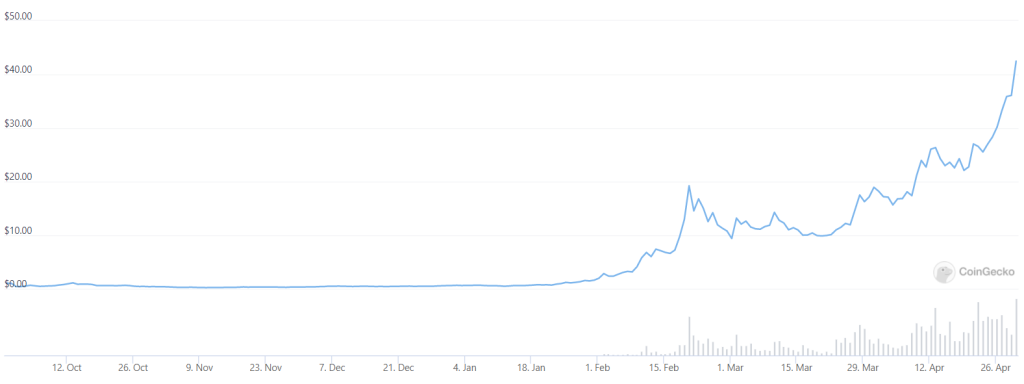

Thinking that it could be my way to quick riches I just aped into $CAKE at US$35.

I mean what could go wrong right? Even if the token price dip, the high APYs should be able to negate the price dip.

Over time, I slowly realised that PancakeSwap was way overhyped by influencers and I failed to see the bigger picture. I blindly aped into the token when it was at an all-time high (ATH) and thought that I could “buy low, sell high”.

Not taking profit

Every experienced investor would talk about when and how you should enter the market but not many actually talk about when and how you should realize gains.

Thinking that $CAKE would start to moon and I was going to be set for life, I HODL-ed the token as it saw a higher high.

It peaked at over US$42 before it went into a nosedive. Every day the chart went lower until it bottomed at US$9 before it showed any signs of recovering.

At one point, my portfolio was in the green, and I should have started to scale down my position and taken some profit. But instead, thinking I was a genius, I decided to HODL.

And before I knew it, the price of $CAKE started to crash and burn.

Just scraping the surface

Doing your own research (DYOR) is not just simply clicking on the first link on Google and skimming through the content.

It is about taking time and effort to really dive deep into the project and understand the ins and outs of the project.

My research on $CAKE before I aped into it only scraped the surface of the protocol. All I knew at that time was that PancakeSwap was the leading Decentralized Exchange (DEX) on the Binance Smart Chain (BSC) network and it is widely used by many.

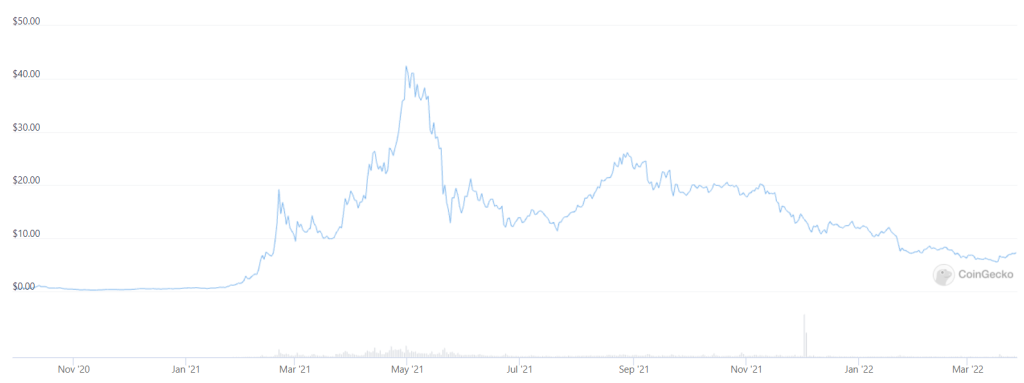

Clearly, I did not do a comprehensive research on the $CAKE tokenomics. If I have done so, I would have noticed the telltale sign that the price of $CAKE would fall sooner or later.

The tokenomics were hyperinflationary in nature as the $CAKE emissions were far more than the amount of $CAKE burnt. It is only a matter of time before the supply of the token surpassed the demand for the token and the price would start to free fall.

As the token price starts to fall, it will be hard for investors to stay bullish and one-by-one, they will start dumping the token. This will inevitably lead to a downward spiral.

Unsure how to DYOR? Here is a simple guide on how to DYOR:

Read: DYOR: How To Do Your Own Due Diligence On Crypto Projects Before Investing

Wrapping up

Crypto is still the wild west and things are moving at an astounding pace. The leading protocol today might just be dethroned tomorrow.

While PancakeSwap is still going strong with over US$4.52 billion in TVL, I doubt that the price of $CAKE would go back to ATH anytime soon.

I have accepted the reality that I am “exit liquidity” for the many early investors out there and decided to painfully cut loss on $CAKE. I swapped my $CAKE token to a METIS-USDC pair and farmed it on pickle finance.

Do I know what is Metis? No.

Will I ever learn? One day I hope.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: Chain Debrief

Also Read: My First “Degen” Crypto Farming Experience: How I Lost 80% Of My Capital In A Week