There are many lists of top NFT projects to look out for out there, but many may lack key information on how to make decisions with respect to whether to flip or HODL the projects.

In this article, we zoom in on how to identify top NFT projects to flip or hold in the long-run.

In this article, we will be using a framework created by @0xAldnoah on Twitter.

By observing past successful NFT projects, we can use a set of factors to determine whether a project has a high probability of succeeding as well.

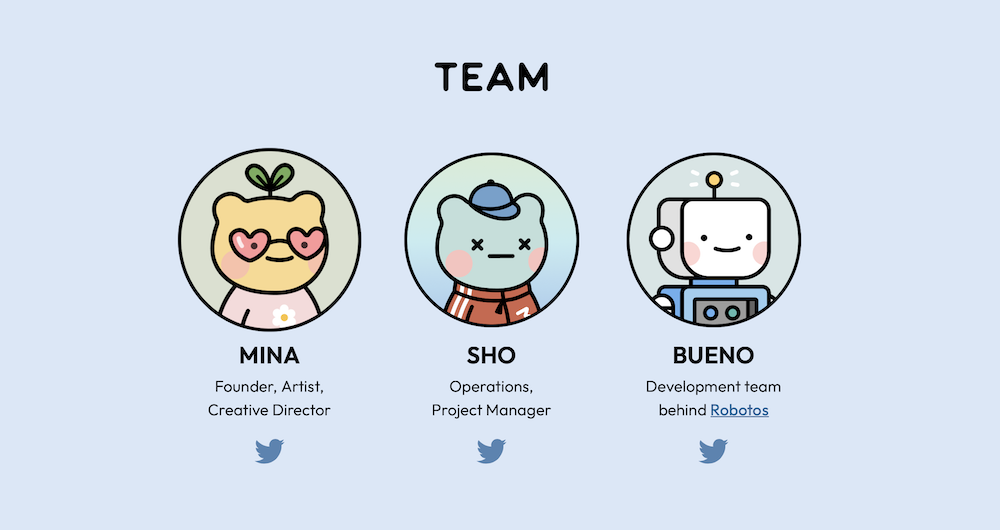

1. Team (identity, activity and reputation)

A healthy and transparent team is fundamentally correlated to the success of an NFT project.

Team Identity: We would prefer to see a fully-doxxed team, one where their names, faces and backgrounds are revealed, to assure us that the team themselves are fully invested in the project.

Team Activity: Projects that have teams hosting consistent AMAs and engaging with their fanbase is a great indication of a team that cares about their project and their buyers.

Team Reputation: If the team has launched previous successful projects, it’s an optimistic tell for their new projects.

Teams that are stacked with experience, like Crypto OGs or experienced artists with a long line of past works are also positives!

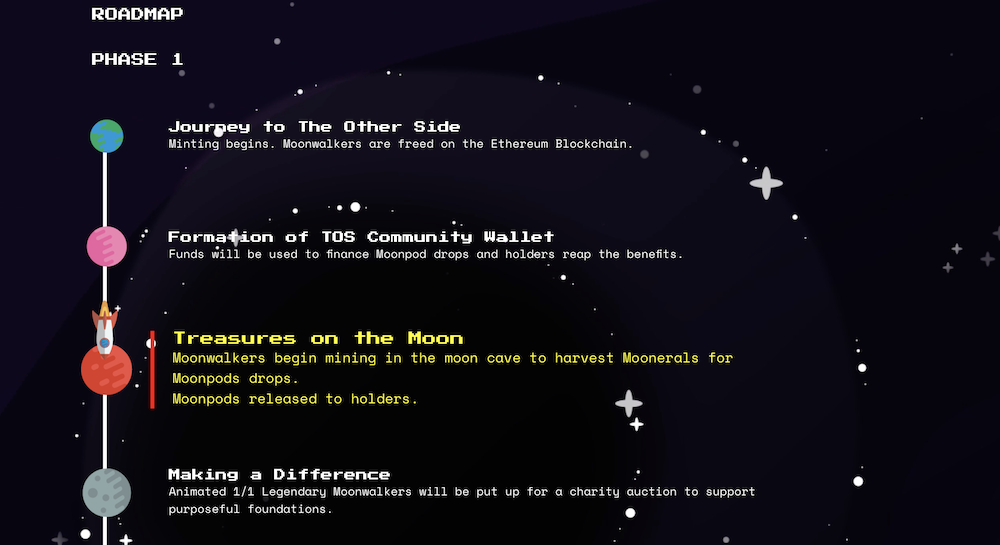

2. Roadmap (innovation and achievability)

As mentioned in one of my previous articles, “What Could Be The Next Blue Chip NFT?“, legacy value is important and here we talk about the project’s innovation.

A good project would have the first-mover advantage by creating fresh ideas not yet seen in the NFT Space. Good examples are Wolf Game and CyberKongz.

However, in the second point, we also have the ensure that we have confidence that the team has the ability to achieve what they have set out to do.

This links back to why we want a project’s team to be transparent about their background so that we can check that they have people with the necessary skills and capacity to deliver.

3. Community (public support and engagement)

With regards to the community factor, we would like to see public support. An indication of public support would be to have many Key Opinion Leaders (KOL) supporting and buying the project.

A Project like the Bored Ape Yacht Club is proof of this as they have an overwhelming number of KOLs holding unto their NFTs.

A social media following of over 30,000 on Discord and Twitter is also an encouraging number, However, it is hard to accurately tell as bots are common nowadays and it is hard to discern if there are still many active members interacting in a Discord group.

Social engagement refers to a high number of replies, retweets and likes would indicate enthusiasm from potential buyers.

Voluntary activity from members of the community is a good indication as well. However, if the whitelist requirement contains one where you have to spam chat, this point will be harder for you to discern.

Hence, you can then try to observe the engagement quality — whether community members are making genuine connections with one another and enjoying themselves and the team, or are grinding out to achieve whitelist status for the sake of flipping the project.

4. Art

As art style is very subjective, there are not many defining factors for whether an art style will be successful.

We can refer back to the first-mover advantage where a new art style that has not been seen before might have a higher chance of succeeding. If the art style is also one that appeals to many of the community members, it is a good sign.

5. Price, utility and supply

Price is also another subjective matter. The mint price of a project doesn’t necessarily dictate its success rate. Both successful and unsuccessful NFTs like CloneX and Pixelmon have had high mint prices.

As for supply, fewer supply scores higher points as a project with less supply has a higher chance of higher inflation in floor price.

Lastly, for utility, we would like to see more utility in the project we are looking to FLIP or HODL, be it metaverse, P2E or membership tokens. This would be a good time to analysis the project’s roadmap in detail.

6. External support

If the project has support from venture capitalists, it is a good indication that the project is already backed by a large pool of funds which allows the project to develop and progress how they really want to.

7. Mints per transaction

This is the number of mints a project allows each user to purchase. The higher the number, the worse off an indicator it is.

A low number of mints allowed per user signifies that the project is in high demand and there is a high volume of users expected to purchase their NFTs, hence they do not need a few users to purchase large amounts of their NFTs to sell out.

8. Whitelist to total supply ratio

Whitelist to Total Supply Ratio is an indicator of how many NFT sales the team has decided to assign to Whitelisted buyers.

This indicator is a more grey area as some crypto investors can argue that by having a higher ratio, more of the project’s NFTs are assigned to buyers that have been invested in the project for a while and have done the necessary tasks to achieve Whitelist.

However, from another perspective, the project’s demand will be limited to only those in the project’s bubble, and there will be less demand from the general public.

9. Presale traded volume

Presale traded volume is an indicator of how much the project’s NFTs are traded before the sale. There is a period of time between a project’s presale and sale that can also help you gauge the demand for a project. If the Presale Traded Volume is higher, it indicates a larger movement of funds and demand between buyers.

Flip or HODL?

After going through all the relevant projects, how do we determine whether we should flip or HODL a particular project? Let’s look at the fundamental concept of both options!

When flipping, a buyer wants to enter and exit a project with the intent to achieve short-term gains. In this case, what you want in the project should be overwhelming public support and hype that isn’t too expensive so that you take less risk as well as have a higher chance of achieving higher multiples in gains.

For a flip, a buyer should try their best to ensure whitelist status to guarantee a mint, and for some projects, an even cheaper mint. This will increase your chance of short term projects as buyers who purchase during the actual sale will be buying for higher.

After securing your NFT, if the project has a period of time between the end of the sale and reveal date, this period is where the floor price of the NFT will most likely rise.

As a flipper, you want to leverage the increased hype before the reveal and avoid the increased disappointment after the reveal, hence selling before the reveal is a good way to take profits and minimize risk.

For a long-term hold, a buyer is looking to enter a project and HODL to achieve long term gains as they believe in the project.

In this case, you want a project to have an excellent developing team, roadmap and better fundamentals. For a HODL project, a buyer can afford to wait until after reveal to try and purchase an NFT for lower than mint price.

As they are HODLing long term, the NFT project should most likely be a utility one, hence the rarity of the art is less significant and securing a lower-priced NFT will increase your chance of long term success.

Conclusion

Although a framework will not guarantee 100% success your NFT journey, I believe that it is a good gauge for beginners that do not know where to look in terms of differentiating between good and bad projects.

This framework might also contain factors that experienced NFT flippers might not have come across before.

Featured Image Credit: Chain Debrief

Also Read: Selling Out In Four Minutes: The Story Behind Imaginary Ones’ Successful NFT Drop