Ever wish you could take a 5x short on an NFT? Or ever thought about hedging against your NFT because its floor price is tumbling lower? nftperp may have just solved your concern.

Also Read: Sudoswap: The Next Generation NFT Marketplace With No Royalties

NFTs Have Come A Long Way

Let’s start with how NFTs have evolved.

NFTs have cemented their space in Web3.0, with some riding the cycles into blue-chip status.

Despite current market conditions, their popularity does not seem to extirpate. A lot of collections offer benefits to members of their community, thus incentivizing investors to hold onto them.

But what if you want to own one, but feeling invariably discombobulated about the declining prices? Up till now, there hasn’t been a solution for hedging this downside risk.

Hedging Your JPEGs

Well, not anymore. nftperp is launching an NFT futures DEX on Arbitrum One, where you can trade contracts on popular collections.

It’s a great way to have delta neutral exposure to NFTs that could grant you access to airdrops, minting privileges, or real world events.

The best part of it all is that you will not have to own the underlying NFT to buy contracts on it. This allow degenerates like you and I to bet our life savings for fun yet again only to get liquidated.

However, with only a maximum of 5x leverage, I guess it will take some time before our accounts get decimated again unless the market swings 20% against us instantly.

Understanding nftperp

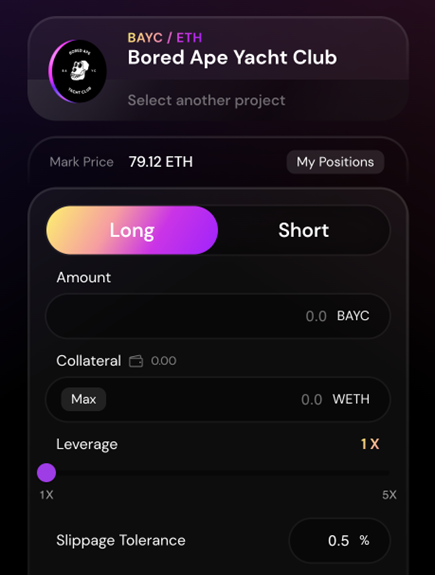

nftperp is an open-source DeFi software created for all Web 3.0 users. Their core product is a decentralized exchange to long or short blue chip NFT projects such as BAYC, CryptoPunks and more.

What is NFTperp? 🤔

— nftperp.xyz (@nftperp) August 18, 2022

NFTperp is a perpetual futures exchange for NFTs that tracks the floor price of NFT collections!

Have you tried our testnet Anon?

Try out our protocol below ⬇️ https://t.co/EforcKnWNm

With nftperp, you can:

- Trade blue-chip NFTs with any amount of collateral using perpetual futures contracts

- Long or short NFTs

- Trade with up to 5x leverage

nftperp is built on vAMM (virtual automated market maker) originally designed by Perpetual Protocol.

TLDR on vAMM:

- No liquidity provider is needed

- No orderbook

- One trader’s gain is another trader’s loss

If you would like to know more about how vAMM works exactly, click here. Do note that the mechanism used is very technical and it requires advanced knowledge in the space to understand it.

The Problem With NFT Markets

There are two main issues currently:

- Presently, there is no way to short NFTs. NFT traders can only buy low and hope to sell high eventually. At the same time, ape holders do not have a way to hedge their position.

- Blue chip NFTs like BAYC and CryptoPunks are far too expensive for the retail community to get involved in.

With these two problems, the market is actually missing out on a ton of speculative trading volume that is not yet captured.

The answer to this? A perpetual futures exchange for NFTs that tracks the floor price of NFT collections.

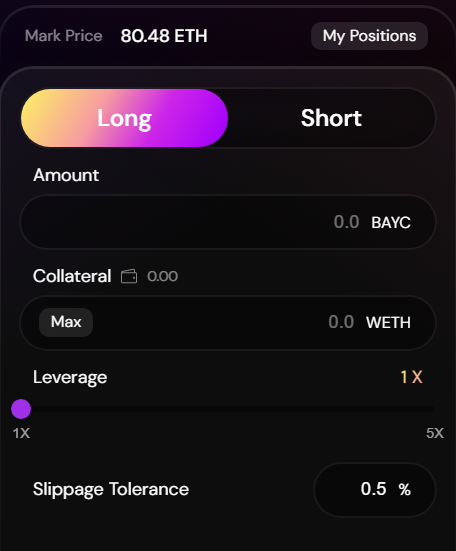

Traders now have the ability to go long or short on the floor price of projects such as BAYC with any amount in $ETH.

Putting The Picture Together

For instance, Bob owns an ape with a floor price of 100 $ETH. He wants to lower his downside risk but he does not want to sell his precious ape. He found out about nftperp and opened a 100 $ETH short position on the exchange.

If the floor price of BAYC drops to 90 $ETH, his ape is now worth the value of 90 $ETH. However, Bob also has a profit of 10 $ETH from his short position that he took.

Instead of losing 10 $ETH due to a decrease in the floor price, Bob hedged his position with no value lost.

Let’s say the opposite happened. If the floor price of BAYC increased to 110 $ETH, Bob would have a loss of 10 $ETH on his short position but his ape is now worth 10 $ETH more than before. Like the aforementioned, Bob hedged his position with no value lost too.

On the other hand, let’s say Charlie is a Web 3.0 newbie and has been priced out from blue chip NFTs like BAYC due to the high barrier of entry. With nftperp, he can long BAYC with as little as USD $5 equivalent in $ETH, and even has the option to leverage should he deem fit.

However, traders should know that there is a funding rate associated with trades, which should be factored into profit and loss calculations.

Conclusion

If you like what you’ve heard so far, feel free to check their demo product over here. They have an exciting roadmap ahead so you’ll definitely want to pay close attention to what the team does in the near future.

I think there is real demand for NFT borrow/lend

— Sisyphus (@0xSisyphus) August 25, 2022

nftfi has like 2,000 loans a month, $15mm a month, and ATH volume in ETH denom in July. no token (https://t.co/q5aGXTuZPi)

benddao is collapsing because of bad risk management but got a ton of both borrow and lend (30k ETH) prior

NFTs have been in free-fall following the Azuki Elementals mint. Here's how I profited from this by shorting #BAYC on 5x leverage using NFT Perp platforms @nftperp and @Tribe3Official. pic.twitter.com/ANcFKkLDwO

— Taiki Maeda (@TaikiMaeda2) July 3, 2023

Overall, I think this offers a great opportunity to retail investors who would like to trade NFTs. Instead of purely flipping where one is required to buy low and sell higher than what their purchase price is to make a profit, nftperp allows one to profit no matter an increase or decrease in the NFT’s floor price as long as you’re on the right side of things.

Through this way, those who are unable to afford a BAYC can now “own” it fractionally through a contract.

Furthermore, it seems that the protocol will be launching a token in the near future, which may be airdropped to those participating in the testnet.

Also Read: Ape Now And Pay Later; Buy Your Favorite NFTs With Teller

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief