As the crypto industry struggled to recover from the storm of 2022, the fate of centralized exchanges (CEX) remained uncertain. The path forward may not be easy, but it is clear: it’s time to rebuild.

The trust that once existed between investors and these exchanges has been broken, and the road to rebuilding that trust will be long. But as history has shown us, after every storm, there is always an opportunity to rebuild and emerge stronger than before. The challenge is to seize that opportunity and create a new and improved crypto ecosystem prioritising security, transparency, and accountability.

Searching for a reliable and trustworthy centralized exchange can be daunting as the crypto industry evolves. But, an alternative solution that’s been gaining traction in recent years is decentralized exchanges (DEXs).

Did you know that cryptocurrencies can be traded through centralized exchange (CEX) or decentralized exchange (DEX) ? 🧐

— Kaizen 🇷🇪 🇫🇷 (🌱) (@kaizen079) January 11, 2023

In this thread, we will see what are their main differences : 🧵

These platforms offer security and autonomy that centralized exchanges can’t match. However, DEXs are not without their own set of challenges. Liquidity, one of the biggest hurdles for DEXs, remains a significant issue, making it difficult for users to find buyers or sellers for certain assets. The ease of use and accessibility to various tokens on centralized exchanges, on the other hand, is unmatched.

There's only 140K in liquidity left to long on GMX rn pic.twitter.com/CA6HizEm7A

— yk | (stupid , poor ) (@YusoffKim) January 16, 2023

Given transparency is a core pillar crypto has been built on, this article will aim to provide more transparency for those still partaking in an intimate relationship with CEX.

Make sure you are Clean, in the reserves

CryptoQuant was the first I know who published a metric on this. Clean reserve is a metric of the total reserve of an exchange which does not include the exchange’s token.

What is the "Clean Reserve" metric?

— CryptoQuant.com (@cryptoquant_com) December 20, 2022

Why is it significant, particularly in the context of the FTX collapse? 👇 pic.twitter.com/d4yj2LUxMj

One primary reason for the fall between FTX and Alameda was a large portion of their assets, $FTT, was held in reserves.

This came with profound implications, significantly when the price of $FTT fell, and the value of the assets held on FTX/Alameda also took a plunge.

While some exchanges have reasons for holding their native tokens, this metric should not be used entirely to judge an exchange. Instead, it serves as a starting point for investors, giving them a glimpse into the inner workings of the exchange and providing a general idea of how the exchange operates.

I need to know your age and how much money you have – Proof of reserves

FTX wasn’t the first, and certainly isn’t the last.

— Miles Deutscher (@milesdeutscher) November 9, 2022

When Binance introduces proof-of-reserves, this will set the new industry standard for transparency.

We’re about to see who’s swimming naked when the tide goes out.

Anyone can claim they are clean, but proof of reserve will be the documentation. Just like how you can claim your name to be Dumbledore, but on your ID card, you’re Hagrid. You don’t want Hagrid; you want daddy Dumbledore.

Proof of reserves is a powerful tool to help investors separate the wheat from the chaff. This mechanism allows exchanges to prove that they hold the amount of digital currency they claim to have, providing investors with a sense of security and trust.

That’s where proof of reserves comes in; it’s like a background check, helping investors identify the exchanges that are trustworthy and reliable and separate them from those that are not.

When an exchange claims to hold a certain amount of cryptocurrency but cannot provide proof of those holdings, it raises red flags and suspicions of solvency.

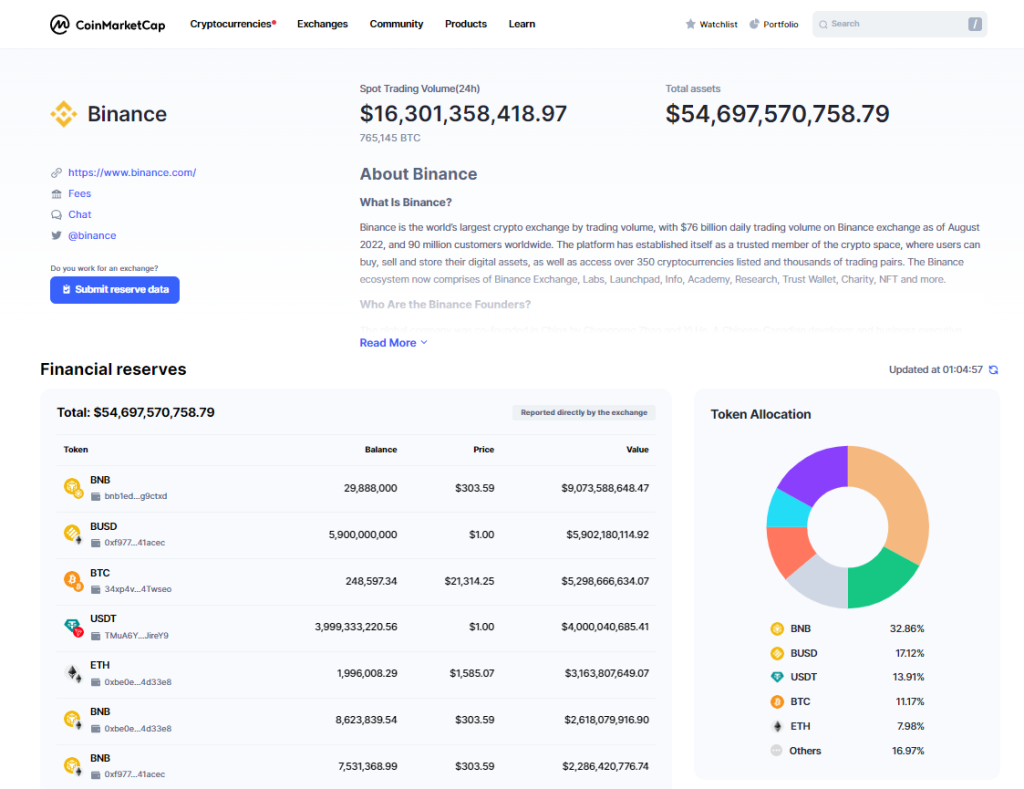

Here’s an example of proof of reserves you can access for free using CoinMarketCap’s new feature. You may also want to use Nansen’s dashboard to track exchange portfolios.

1/ We are working with exchanges to display proof-of-reserves on @nansenportfolio for everyone to track their token holdings and transactions.

— Nansen 🧭 (@nansen_ai) November 11, 2022

Here's the current list of exchange portfolios and we will live update this thread with more, so make sure you are following! 🧵

I need to know if you can sustain my lavish lifestyle – Proof of solvency

Someone approaches to buy you a drink. In the sense of proof of reserves, that person will show you the money in his/her pocket, which will then give you an idea that they will be able to cover the cost of the drinks.

In the proof of solvency, they tell you they have a steady income and maybe even show you their history of CPF contributions. You know they can buy drinks for you for that night and the next couple of weeks.

Proof of reserves is not necessarily a wrong solution, but it doesn’t paint a complete picture of an exchange’s solvency or change the underlying fundamental truths.

According to the CEO of Kraken, Jesse Powell, proof of reserves requires major audits from 3rd parties for more transparency.

1/ I said I was going to be more assertive with calling out problems. This is one of them.

— Jesse Powell (@jespow) November 22, 2022

"Reserves" = assets minus liabilities

"Reserves" != list of wallets

The Proof of Reserves AUDIT requires cryptographic proof of client balances and wallet control.https://t.co/ALcfi7rLUV https://t.co/TawYclk0nT

There was also some drama before the increasing call for proof of reserves across exchanges in the industry.

Twitter user @jconorgrogan highlighted the transfer of 320,000 ETH from Crypto.com’s cold wallet to Gate.io. According to Crypto.com, all its users’ crypto is stored in cold storage with Ledger hardware wallets.

This raised many suspicions, as the transactions done by crypto.com showed how proof of reserves could be easily altered to an individual’s favour.

Anyone know why https://t.co/2vZHyCaKNe would send 320k ETH (82% of their ETH today) to https://t.co/bVgf3bCqwp on October 21? pic.twitter.com/2E1NxX1pJz

— Conor (@jconorgrogan) November 12, 2022

So what can be done? The king of Ethereum had some things to say, bringing up what proof of solvency should look like.

Having a safe CEX: proof of solvency and beyondhttps://t.co/AKEweYZfj2

— vitalik.eth (@VitalikButerin) November 19, 2022

Big thanks to @balajis and staff from @coinbase @binance @krakenfx for discussion!

To summarize, Proof of Solvency is the ability to prove customers’ deposits are equal to X (Proof of Liabilities) whilst proving ownership of private keys of X coin (Proof of Assets).

The exchanges must show the sum of reserves > the sum of liabilities. It would be relatively easy with the Merkle tree of reserves dished out by Vitalik; the hard part comes when exchanges take other paths in deriving their liabilities. Avalanche’s CEO Emin Gun Sirer explains further below.

But there are lines of defense against even this. Creditors could refuse to extend credit to someone who has issued PoLs unless the credits appear in the PoL. Better yet, all corporate actions could flow through a contract that incorporates them into PoRs/PoLs.

— Emin Gün Sirer🔺 (@el33th4xor) November 14, 2022

Getting a hard-on, I mean your hardware on

This is the most straightforward and almost applicable to all scenarios.

It is one, if not the safest, way to store coins. Coin Bureau talks about the five best hardware wallets to use and which is the safest.

If there is anything that the past 2 weeks has taught us, it's the importance of self custody. One of the safest ways to store those coins is with a hardware wallet. Here are my top 5 picks compared side by side. https://t.co/WDc64XtIBP

— Coin Bureau (@coinbureau) June 29, 2022

Alternatively, you can check this thread on how you can keep your funds safe from CEX.

Here’s how to keep your funds safe from CEX if you don’t own a ledger

— Crypto Coach 🐒📈💰 (@WisdomMatic) December 13, 2022

A thread 🧵

Making CEX great again

It will take time for cryptographic proof of reserves, regular independent audits and internal controls to be right. The podcast between Alex Tapscott and Andrea Young below discussed more tips on practising safe CEX. They go deeper to share current-day examples.

If we take a step back, almost every major crypto event was caused by human error. Do Kwon, Alex Mashinsky, Su Zhu and SBF all have that as a common denominator. We all do actually, every human makes mistakes.

Despite central banks’ heavy regulation of traditional banking systems, errors and mistakes can still occur when humans are at the top. Humans who run these systems are prone to making mistakes; even if it is not a common occurrence today, chances are still there.

In the 2008 financial crisis, we saw traditional banks making risky loans and investing in complex financial products, which caused many banks to fail and require government intervention for stabilization. Stabilize the financial system.

If humans can’t be trusted at such a large magnitude, who or what can we turn to?

Also Read: How To Get Started In Crypto (UPDATED 2023)

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief