With all that you heard last year, many categorize crypto as the riskiest asset class, and honestly, I cannot even blame them. Beyond the volatility and sudden swings, bad actors in the space have driven the crypto space many steps back. While innovations are prevalent if you search hard enough, many steer away after being burnt.

However, web3’s promise to the world remains to create a more decentralized, transparent, and secure internet. It gives users ownership users more control over their data and digital assets. It makes a more equitable and open internet where power is distributed among many instead of concentrated in the hands of a few large corporations or governments.

Today, we go through how to get started in crypto in 2023.

1. Understanding it all

There are many jargons to be privy to, and crypto serves them all to you in a wide variety. From memes to highly advanced tech references, this may take the longest to understand, but it is a learning journey you build along the way.

To accelerate that, however, Coinmarketcap compiled a list of crypto jargon suitable for any who wants to understand the inner lingo between crypto bros and sis.

Beginner resources are everywhere for you to feed your curiosity. My recommendation, though, is to start with Whiteboard Crypto on Youtube. For the longest time, they have been churning out crypto 101s and explainers for you to understand eaan excellent good place to start.

The decentralized nature of crypto communities allows for a more inclusive environment where everyone can participate and contribute regardless of their background or location.

For this very reason, communities are a great way to kick-start your journey in web3. By tapping into these communities, you speak to like-minded individuals and surround yourself with those with decent footing in crypto.

Join our discord channel as we navigate the world of crypto together; you may also find our NFT community channel here if that interests you.

If you love to binge on podcasts, here are a few resources.

I spend 10+ hours a week listening to Podcasts.

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) June 25, 2022

After Twitter, it's my favorite way of keeping up with Crypto.

Here's what's in my rotation:

2. Getting a crypto wallet

You now have a rough sense of building your understanding of the space, but this section will help you actively participate in the space.

A web3 wallet is a digital wallet that allows you to store, manage and interact with digital assets on the blockchain. Think of it like a digital bank account, but instead of keeping your money in a bank, your assets are stored on a decentralized network.

Just like your physical wallet, a web3 wallet has a unique address that can be used to send and receive assets. The main difference is that any central authority does not control a web3 wallet, and a private key secures it.

Note: write down your private key physically, and do not share them openly with anyone. It is yours to keep and yours to lose.

How to get started in #Web3 with @MetaMask

— Manmade (@Manmade_Brand) February 1, 2022

A thread 🧵

Whether or not you have #Crypto yet, you can still set up your digital wallet in preparation.

Step 1: Go to https://t.co/FKP2xMy9JI and download the extension

Step 2: Click Install MetaMask for #Chrome

1/ pic.twitter.com/Nk11tD6bcY

You can use a web3 wallet to interact with decentralized applications (dApps) built on blockchain platforms such as Ethereum. For example, you can use it to make transactions, vote on proposals, or access other decentralized services without a centralized intermediary.

Finally, it’s important to remember that web3 wallets differ from centralized exchanges wallets (Binance, Huobi, Kucoin etc.). In those cases, you don’t have control over your private key and instead trust the exchange or the wallet provider to keep your assets safe.

Last year, one of the most popular centralised exchanges took a massive fall; learn more about the Signs The FTX Crash Was Bound To Happen.

3. Doing your own research

The beauty of ownership comes with a responsibility, which is to DYOR.

The cryptocurrency market is highly volatile and can be unpredictable. By conducting your own research, you can better understand the risks and potential rewards of investing in different types of cryptocurrencies.

HOW TO #DYOR FOR 7 YEAR OLDS 🌝

— DANNY 🧸 (@DannyCrypt) May 17, 2021

“DYOR” translated as “Do Your Own Research” is a common phrase you’ll be seeing under a lot of Crypto tweets but do you know what to Research on?

This thread explains all you need to know before you buy a Coin

Kindly Retweet 🚀📊

Unfortunately, the cryptocurrency space is also known for scams and fraudulent activities. By doing your own research, you can be better equipped to identify and avoid these scams.

Rug pull is a common type of security issue in crypto

— Hacken🇺🇦 (@hackenclub) January 14, 2023

It's a scam that can bring millions of dollars to bad actors

In this thread below, we'll explain what a rug pull is, how it works, and give examples of the most shocking ones

🧵… pic.twitter.com/ieinPdJAwU

Cryptocurrency is a relatively new technology and it is still being developed. You can stay informed about the latest developments and potential uses for blockchain and other crypto-related technologies by doing your own research.

Messari published it’s Crypto theses for 2022 a while ago.

— Covduk (@Cov_duk) July 11, 2022

It’s a 165 page report covering the key trends, predictions & the future of crypto.

I’ve read it all so that you don’t have to.

Here are the takeaways from the top 10 Crypto narratives for 2022.

Regulations for cryptocurrency can vary widely depending on the location, so it’s important to research your country’s legal and regulatory environment before investing.

A Crypto Regulation/Legislation 🧵

— Ben Armstrong (@Bitboy_Crypto) August 5, 2022

I spoke with someone today deep in politics with contacts everywhere.

Here is a thread with what I think are the biggest takeaways from my conservation.

1/22

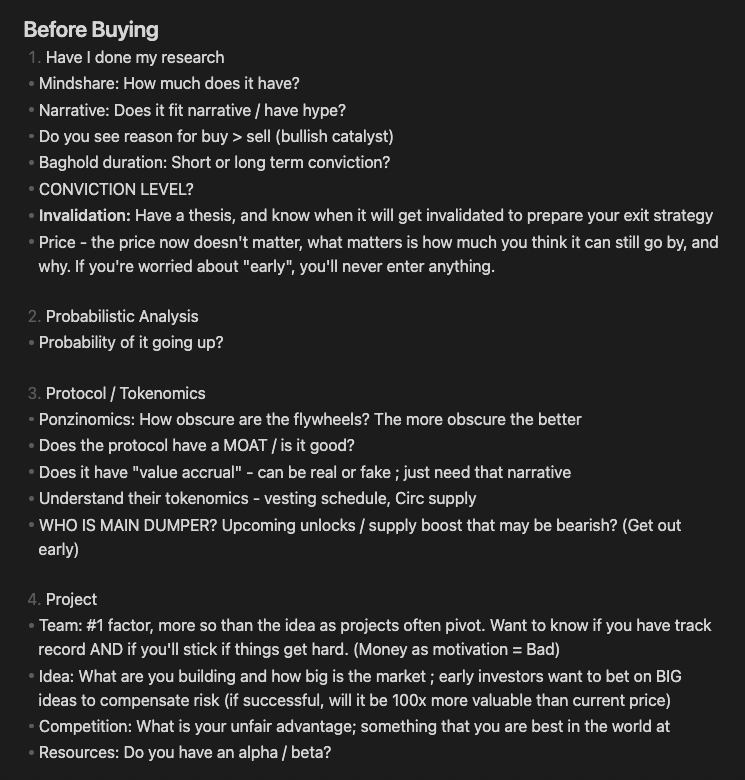

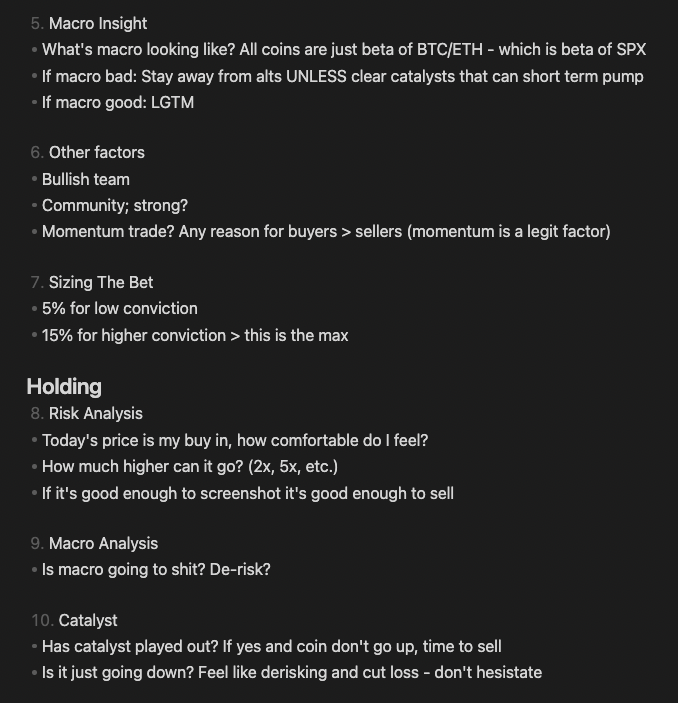

Here’s an alpha checklist.

Find out how to DYOR: How To Do Your Own Due Diligence On Crypto Projects Before Investing

4. Buying some crypto on a DEX or CEX

Between the two, there are certain similarities and stark differences. Before you select which route you would like to take, here is a summary and a comparison.

Regarding control, DEXs are decentralized and not controlled by any single entity, while a single entity controls CEXs. This means that on a DEX, users have more control over their funds and trades.

A raw, glistening ELI5 thread on $SUSHI

— redphone.eth (@redphonecrypto) August 31, 2020

(Alternate title = Sushi chef murders multiple VCs)

To understand Sushi, boy, you must understand uniswap

Uniswap is a decentralized exchange (DEX). You can think of it like a vending machine.

More 👇

DEXs are considered more secure than CEXs as they eliminate the risk of a single point of failure or hack. On a DEX, users hold their own private keys and are responsible for their own security, while on a CEX, the exchange has the users’ private keys and is responsible for their security.

Not your keys, not your #bitcoin 🔐 pic.twitter.com/dz2ygZYex9

— Bitcoin Magazine (@BitcoinMagazine) November 13, 2022

DEXs offer more anonymity than CEXs, as users are not required to provide personal information to use the platform. CEXs, on the other hand, often need users to provide personal details and go through a KYC process.

CEXs generally have more liquidity than DEXs, which can result in better prices and faster trades.

Liquidity is fueling the stock market rally says everyone. What is this liquidity? How does it get created? How does it fuel stocks, commodities? (Thread)

— Kirtan A Shah (@KirtanShahCFP) December 18, 2020

Hit the ‘re-tweet’ and help us educate more investors’ (1/n)

DEXs can be less user-friendly than CEXs, and the trading process can be slightly more complicated. DEXs typically have lower trading volumes, and orders can take longer to fill. CEXs generally have higher trading volumes, and buying and selling are more straightforward.

Centralized exchanges

- Choose a cryptocurrency exchange: There are a variety of cryptocurrency exchanges available, such as Coinbase, Binance, and Kraken. Choose a reputable exchange with good security that supports the type of cryptocurrency you want to buy.

- Create an account: Sign up for an account on your chosen exchange. You will likely need to provide your personal information and verify your identity.

- Add funds: Most exchanges will allow you to add funds to your account using a bank transfer, credit or debit card, or wire transfer. The specifics will vary depending on the exchange you choose.

- Buy cryptocurrency: Once you have funds in your account, you can use them to buy the cryptocurrency of your choice. The process will vary depending on the exchange, but generally, you must navigate to the website’s appropriate section and place an order.

Decentralized exchanges

- Choose a decentralized exchange: There are a variety of decentralized exchanges available, such as Uniswap, Sushiswap, and Kyber Network. Choose an exchange that is reputable, has good liquidity and supports the type of cryptocurrency you want to buy.

- Connect your wallet: To use a decentralized exchange, you will need a wallet that supports the exchange. Examples of wallets that can be used on DEXs are MetaMask, Trust Wallet, and MyEtherWallet.

- Add funds: Once you have connected your wallet, you can add funds by sending cryptocurrency from another wallet or an exchange.

- Place an order: Once you have funds in your wallet, you can use them to place an order on the decentralized exchange. You can either place a buy order or a sell order.

Also read: Top 3 Decentralized Platforms As An Alternative To Trade On Centralized Exchanges

5. Crypto Twitter is where the fun is at

Twitter can be an important tool for crypto investors. It is a great source of news and information about the crypto industry. Many influencers, investors, and industry experts use Twitter to share their thoughts and insights on the latest developments in the crypto market.

1/ Here’s a thread on the top 10 worst accounts to follow crypto trading edition:

— ZachXBT (@zachxbt) December 6, 2021

1) @crypto_banter

2) @crypto_birb

3) @scottmelker

4) @Bitboy_Crypto

5) @thecryptolark

6) @elliotrades

7) @MMCrypto

8) @JRNYcrypto

9) @TheMoonCarl

10) @IvanOnTech

Twitter is a fast-paced platform that gives you early access to news and information about new crypto projects, partnerships, and other developments. It can give you a sense of the general sentiment of the market and help you understand how the community is receiving different events or announcements.

Daily research routine:

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) January 15, 2023

1) Heavy subjects – white papers, mechanics, governance forums

2) Finding my own alpha – on chain tools, DeFi dashboards, protocol discords

3) Others – twitter, newsletters

I need routines or I'd just be refreshing Crypto Twitter all day.

Closing thoughts

In conclusion, getting started in the world of crypto in 2023 involves researching different types of cryptocurrencies and the technology behind them, choosing a secure wallet to store your crypto, buying some crypto through reputable exchanges, using your crypto for purchases or as an investment and staying safe by keeping your private keys and seed phrase secure.

It’s important to remember that the cryptocurrency market is highly volatile, and it’s important to do your own research and invest only what you can afford to lose. Additionally, always be aware of the potential risks and volatility of the market. With these steps in mind, you can take your first steps into crypto in 2023.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief